When people talk about , the conversation often starts and ends with trading. That view is understandable, but it is also incomplete. Binance today operates less like a single product and more like a layered financial ecosystem — one that reflects how crypto is gradually maturing.

What stands out is not speed or noise, but structure.

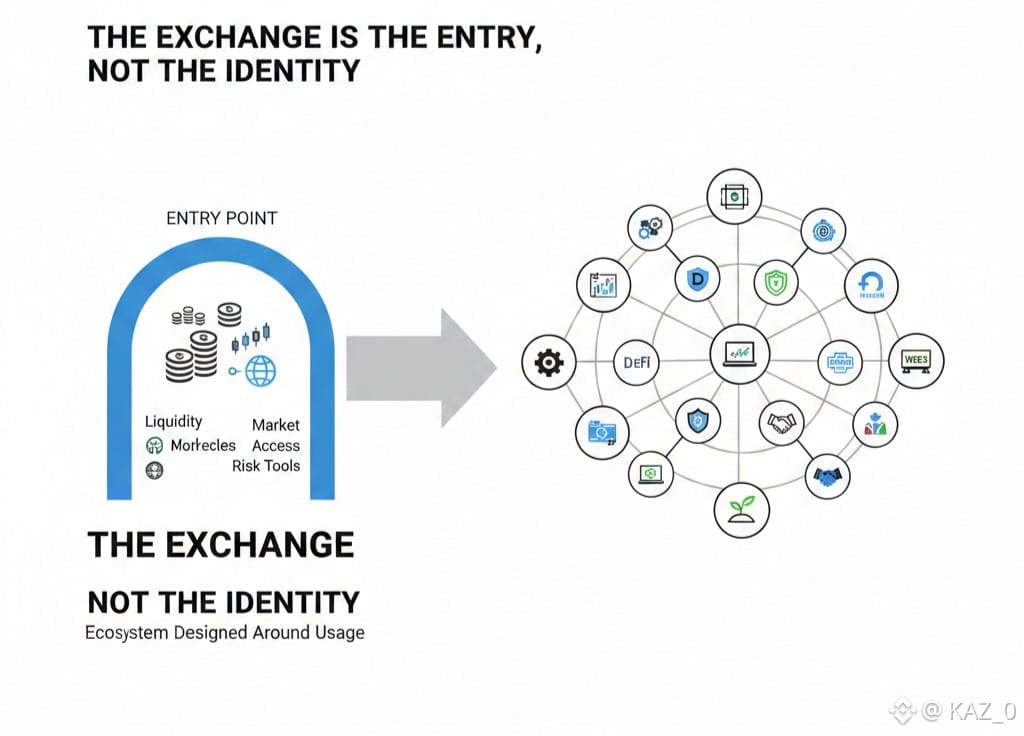

The Exchange Is the Entry, Not the Identity

The centralized exchange remains the most visible part of Binance. It provides liquidity, market access, and risk tools that both retail users and institutions rely on. In volatile markets, this role becomes even more important.

But the exchange is no longer the full story. Binance has treated it as a foundation — a place where users enter the ecosystem — rather than the final destination. That distinction matters. Platforms that depend only on volume often struggle when cycles turn. Ecosystems designed around usage tend to endure.

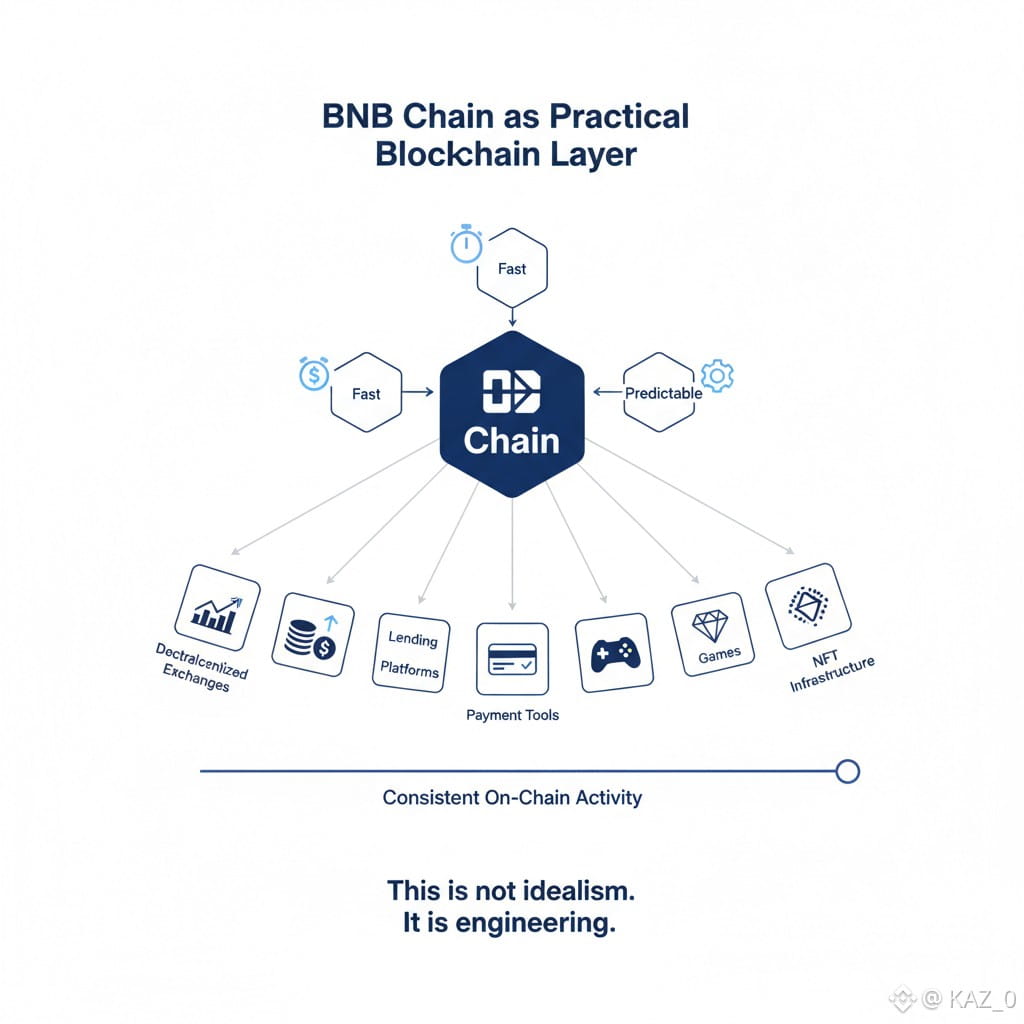

BNB Chain as a Practical Blockchain Layer

BNB Chain is often discussed in technical terms, but its real value is practical. It was built to be fast, affordable, and predictable — qualities that developers and users actually need.

Instead of chasing experimentation for its own sake, BNB Chain focuses on enabling applications that people use daily: decentralized exchanges, lending platforms, payment tools, games, and NFT infrastructure. The result is consistent on-chain activity driven by demand rather than short-lived incentives.

This is not idealism. It is engineering.

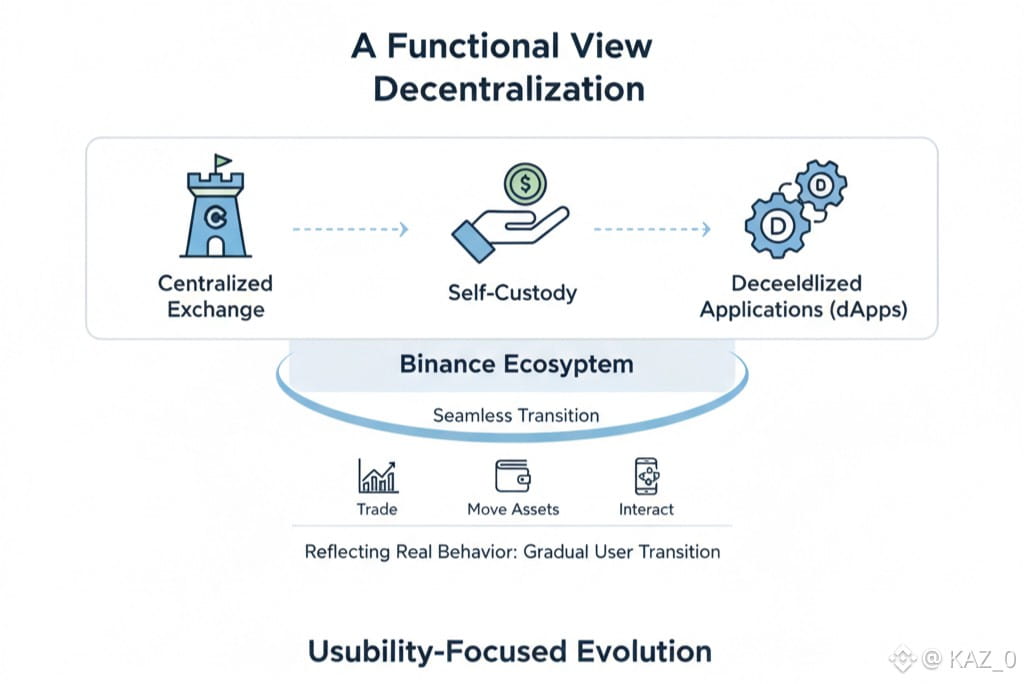

A Functional View of Decentralization

One of the more mature aspects of the Binance ecosystem is how it treats decentralization. Rather than framing it as a binary choice, Binance integrates it as a layer.

Users can trade on a centralized exchange, move assets to self-custody, and interact with decentralized applications — all within the same environment. This reflects real behavior. Most users do not switch worlds overnight. They transition gradually, as trust and understanding grow.

By accommodating this reality, the ecosystem avoids forcing ideology where usability is still evolving.

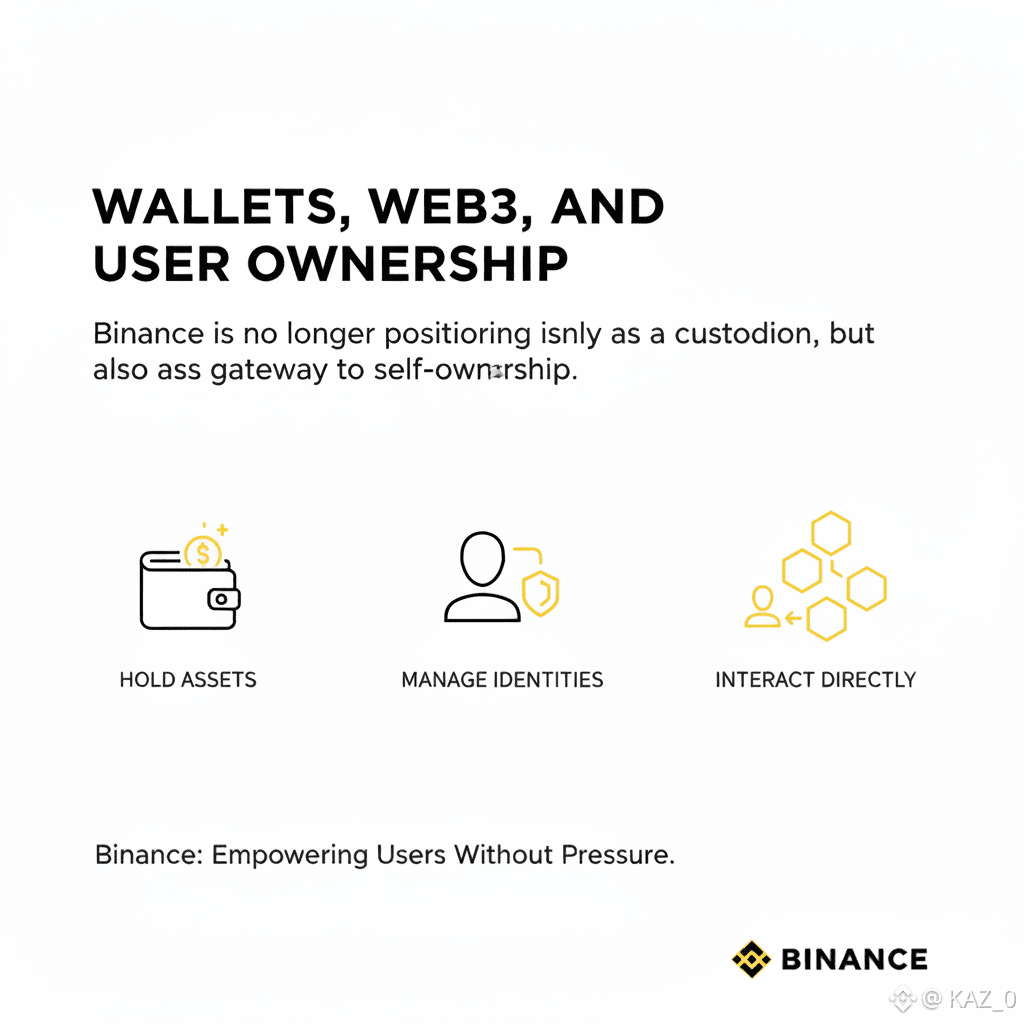

Wallets, Web3, and User Ownership

The expansion into Web3 wallets and on-chain access signals a long-term shift. Binance is no longer positioning itself only as a custodian, but also as a gateway to self-ownership.

This matters. Over time, ecosystems that empower users to hold assets, manage identities, and interact directly with protocols tend to create deeper engagement. Binance’s approach here is measured — offering tools without pressure — which aligns with how adoption actually happens.

Payments and Quiet Utility

While much of crypto discussion focuses on innovation, Binance Pay operates in a quieter space: utility. Payments, transfers, and merchant tools are not glamorous, but they solve real problems.

Cross-border value movement, in particular, remains inefficient in traditional systems. By addressing this gap, Binance is building relevance beyond speculation. These tools may not dominate headlines, but they are likely to matter when market sentiment cools.

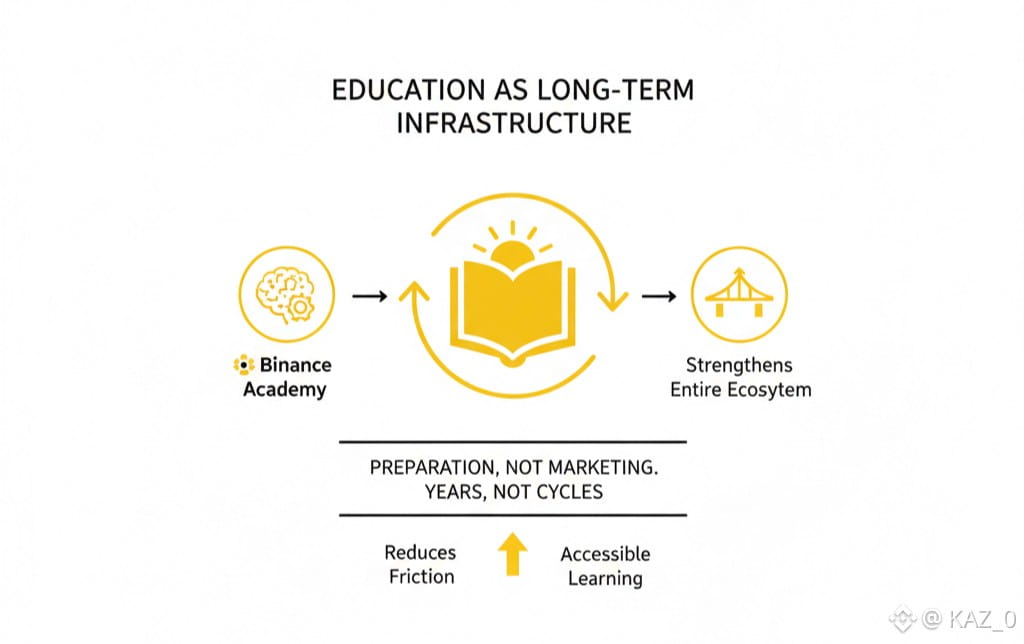

Education as Long-Term Infrastructure

Another understated pillar is education. Binance Academy does not drive volume, yet it strengthens the entire ecosystem. In an industry where complexity often discourages participation, accessible learning reduces friction.

Education is not marketing. It is preparation.

Ecosystems that invest here usually think in years, not cycles.

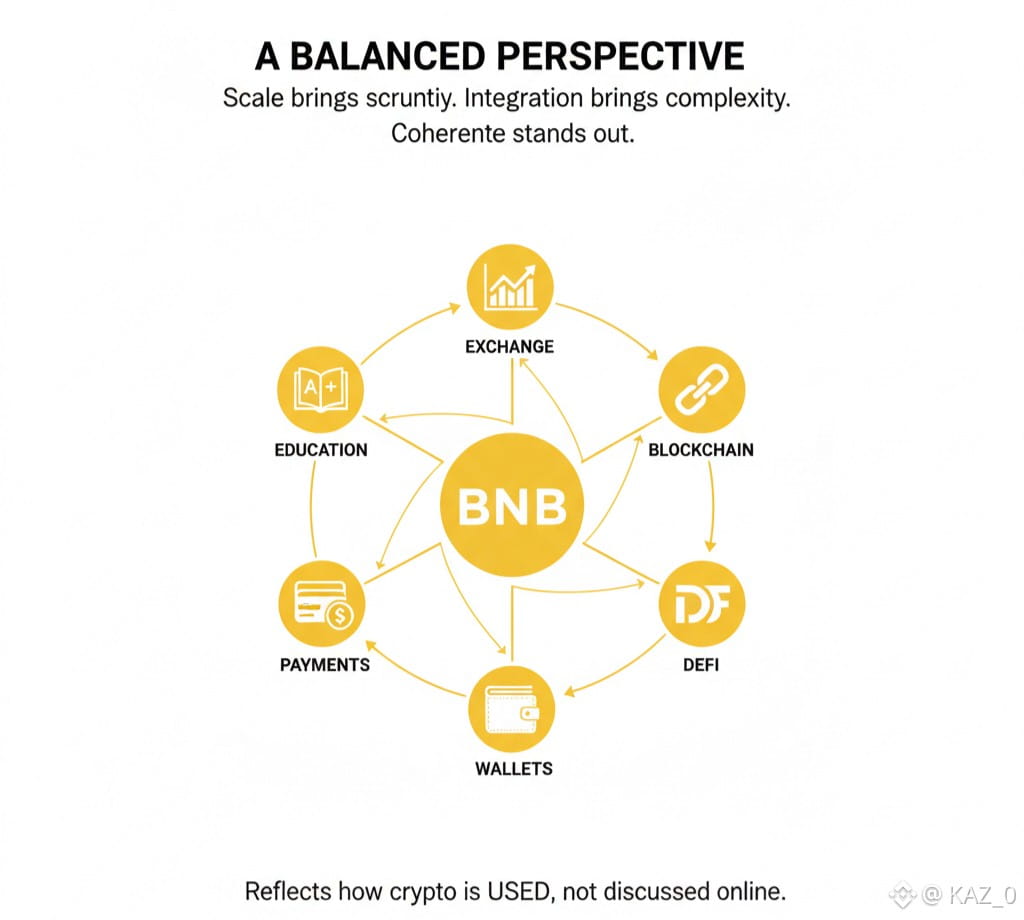

A Balanced Perspective

The Binance ecosystem is not without challenges, and acknowledging that is part of a mature view. Scale brings scrutiny, and integration brings complexity. But what stands out is coherence. Each layer — exchange, blockchain, DeFi, wallets, payments, education — reinforces the others.

This is not accidental. It reflects a clear understanding of how crypto is actually used, not how it is discussed online.

Closing Thought

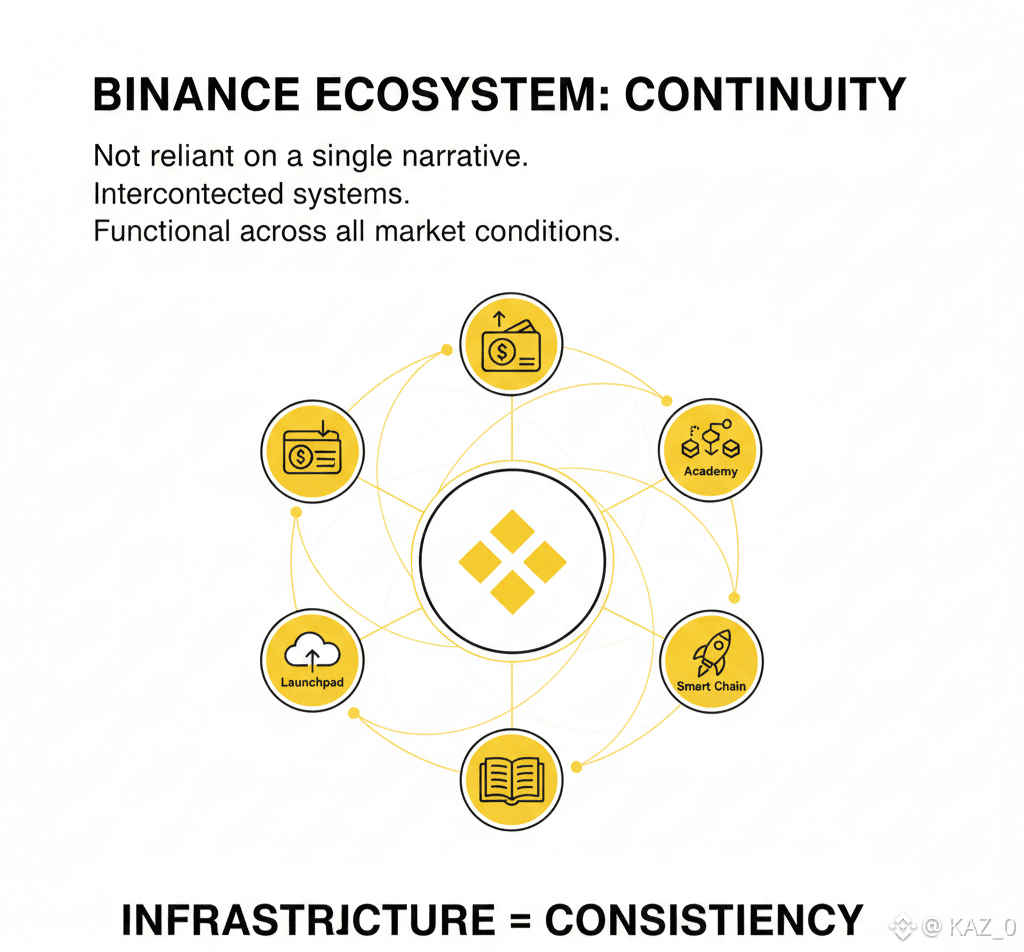

In a market known for extremes, the Binance ecosystem represents something quieter: continuity. It does not rely on a single narrative or trend. Instead, it builds interconnected systems that remain functional across conditions.

Over time, markets reward what works consistently.

And consistency, more than noise, is what defines infrastructure.

#Binance #ecosystem #WhoIsNextFedChair #cryptouniverseofficial #KAZ_0