@Plasma takes a sharp turn away from the traditional belief that security only exists when every participant validates every action. Instead, it introduces a model where execution can move freely, rapidly, and at scale, while authority remains firmly anchored to the root blockchain. This separation is not a compromise. It is a calculated structural evolution that allows blockchains to function more like real financial systems, where enforcement exists without constant supervision.

In a Plasma system, the root blockchain no longer acts as a busy marketplace processing every trade, transfer, and computation. It becomes a court of final settlement. Transactions occur continuously inside Plasma chains, where balances shift, contracts execute, and economic activity flows without touching the base layer. The root chain only becomes active when participants need to enforce rights, resolve disputes, or exit positions. This design dramatically reduces congestion while preserving the ultimate power of enforcement.

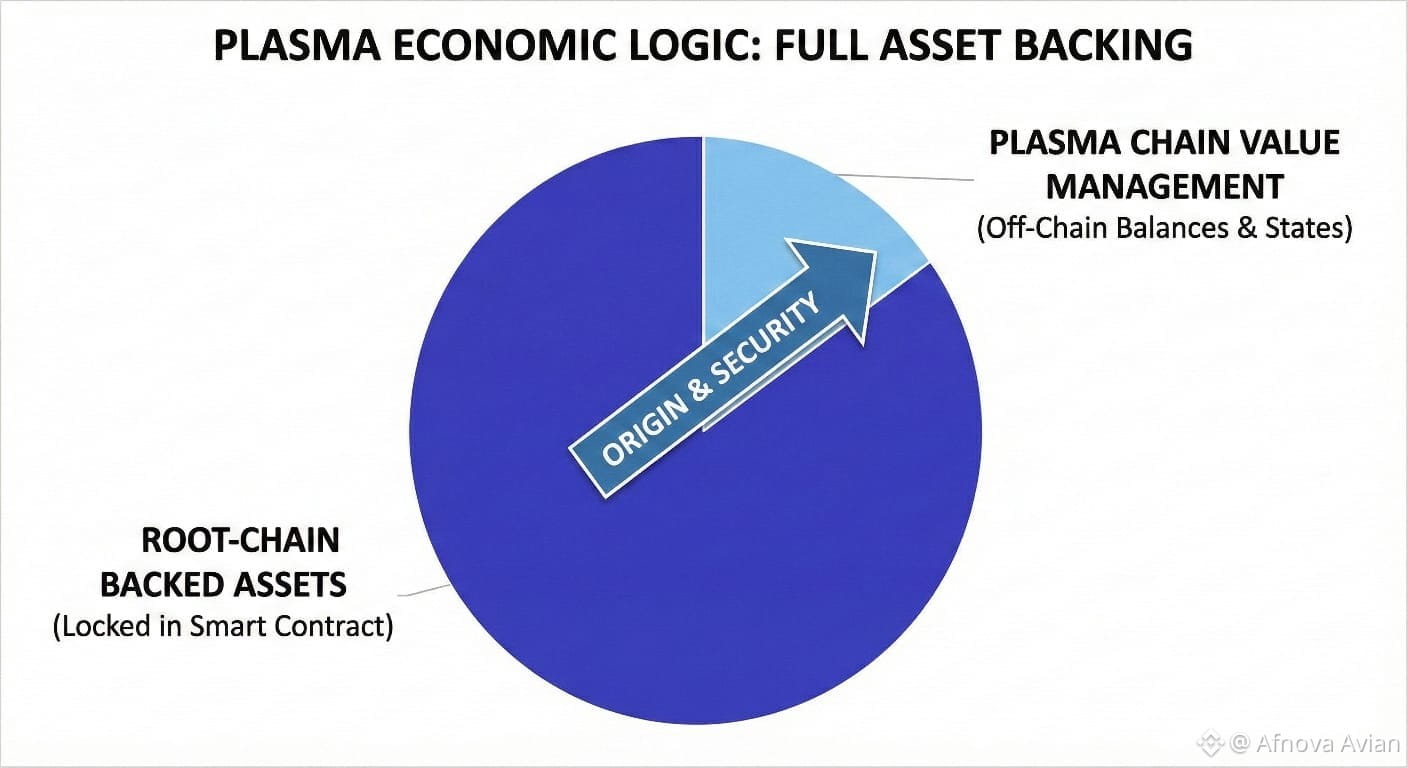

The economic logic behind this structure is critical. Plasma chains are not independent ecosystems printing value out of thin air. All value inside a Plasma chain originates from assets locked on the root blockchain. When a user deposits funds, those assets are secured in a smart contract at the base layer. The Plasma chain merely manages ownership and state transitions for those assets. This ensures that every balance inside the Plasma environment is fully backed, transparent in principle, and redeemable through cryptographic proof.

From a trading perspective, this creates a powerful environment. Markets require speed, depth, and efficiency. Plasma allows large volumes of trades to occur without the friction of on-chain settlement for every action. Traders can move positions, rebalance exposure, and interact with complex contract logic while knowing that their funds remain anchored to a secure base layer. The risk profile shifts away from execution latency and fee volatility toward monitoring and enforcement, which is a far more manageable tradeoff.

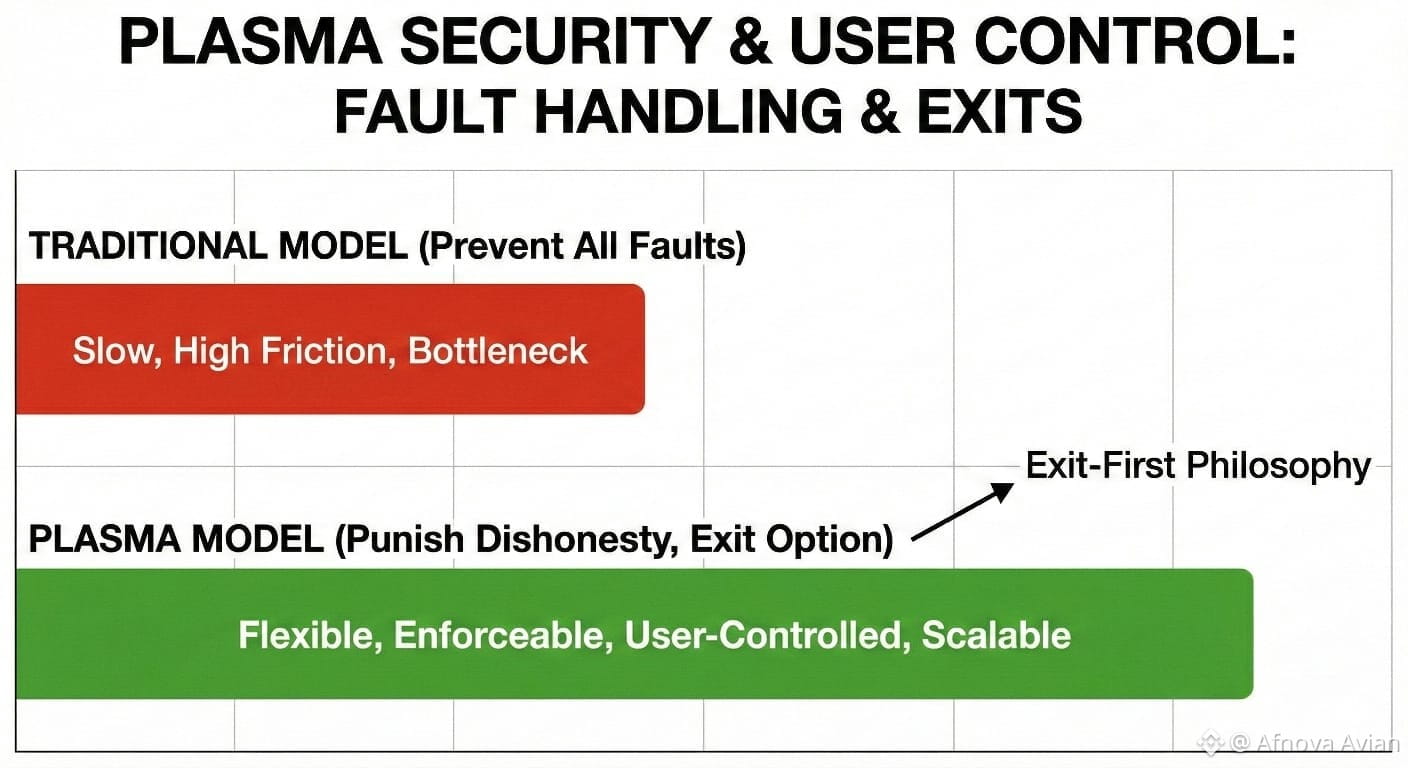

A key strength of Plasma lies in how it handles incorrect behavior. Instead of preventing every possible fault upfront, Plasma assumes honest behavior by default and relies on penalties to correct deviations. If a Plasma operator attempts to include an invalid state transition, anyone who has access to the relevant data can submit a proof showing the inconsistency. Once proven, the invalid state is reversed and the dishonest actor is penalized economically. This threat of loss discourages manipulation without slowing down normal operation.

This approach mirrors how financial markets operate under regulation. Trades are not individually pre-approved by regulators. Instead, systems operate freely within defined rules, and violations are punished when detected. Plasma applies this same logic at a protocol level, using cryptography and smart contracts instead of legal frameworks. The result is a system that is both flexible and enforceable.

Another important dimension of Plasma is its handling of participants. Users do not need to register or be explicitly listed on the root blockchain to interact with Plasma chains. New participants can receive funds, interact with contracts, and become economically active without creating immediate on-chain footprints. This dramatically lowers entry barriers and allows Plasma systems to grow organically, supporting large user bases without overwhelming the base layer.

At the same time, Plasma does not remove responsibility from participants. Users who hold value inside a Plasma chain are expected to monitor that chain at reasonable intervals. This monitoring requirement is not constant and does not involve validating every action. Instead, it focuses on ensuring data availability and detecting abnormal behavior. If a user detects that information is being withheld or that the system is no longer behaving reliably, they retain the right to exit.

The exit mechanism is central to Plasma’s trust model. Participants are never locked into a Plasma chain indefinitely. If confidence breaks down, users can initiate withdrawals back to the root blockchain. These withdrawals are governed by predefined rules and time delays, allowing disputes to surface and incorrect claims to be challenged. This exit-first philosophy ensures that power ultimately rests with users rather than operators.

By shifting execution off-chain and reserving enforcement for exceptional cases, Plasma creates a system that aligns with how markets naturally function. Liquidity flows where friction is lowest, but accountability remains non-negotiable. The root blockchain does not need to see every transaction to guarantee security. It only needs the ability to enforce correctness when it matters.

This balance between freedom and control is what gives Plasma its strategic edge. It does not attempt to eliminate risk entirely, which is impossible in any market system. Instead, it manages risk through structure, incentives, and clear exit paths. In doing so, Plasma transforms the blockchain from a bottleneck into a foundation capable of supporting global-scale decentralized activity.