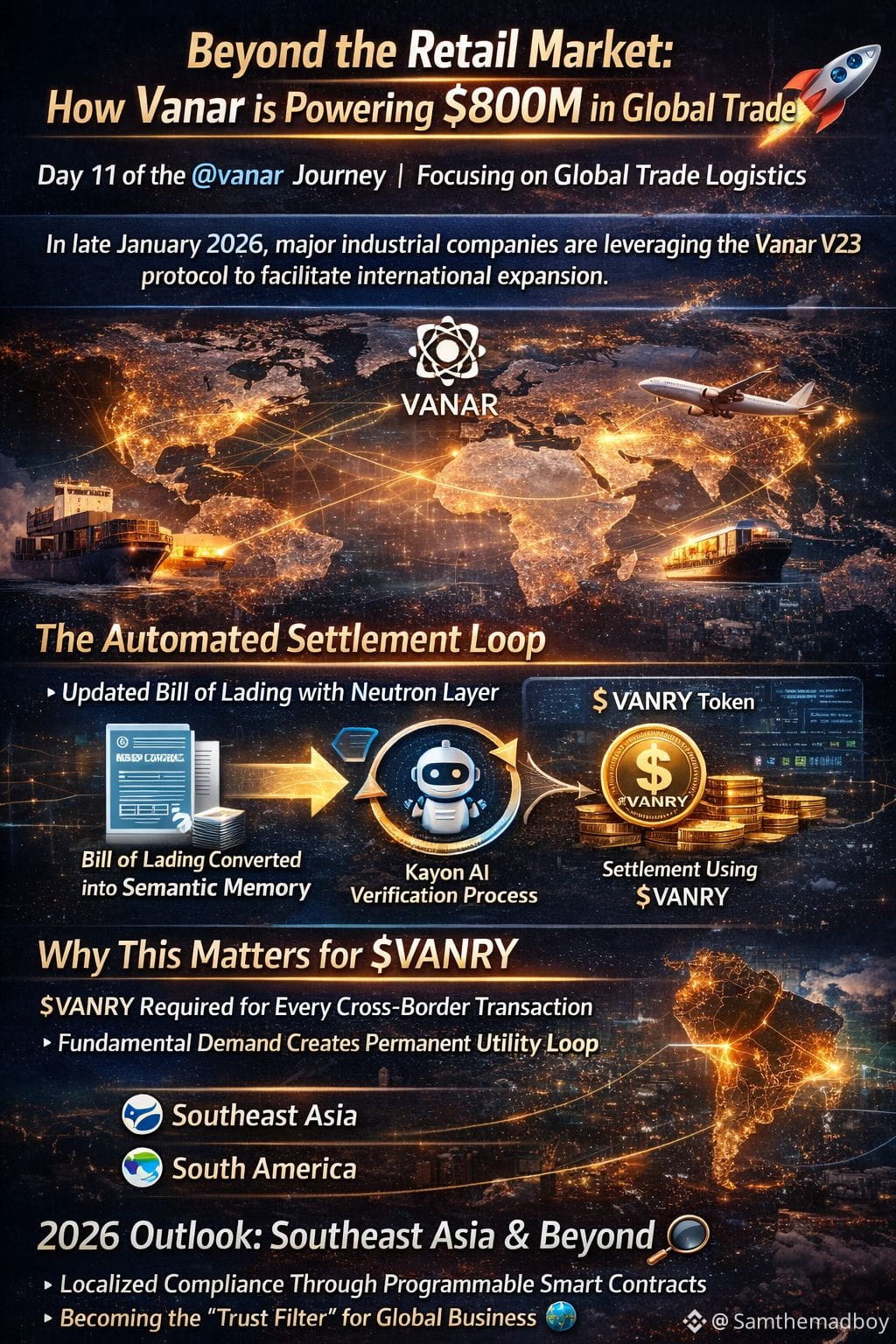

As we enter Day 11 of the @vanar journey, the focus has shifted from decentralized gaming to a much larger arena: Global Trade Logistics. In late January 2026, we are seeing the "Going Abroad" trend where major industrial companies are using the Vanar V23 protocol to facilitate international expansion.

The Automated Settlement Loop

The breakthrough this month is the cross-layer event response system. In traditional shipping, a "Bill of Lading" can take days to verify. On the Vanar Chain, the Neutron layer converts these documents into "semantic memory"—essentially digital versions that the Kayon AI engine can read and verify instantly. This has allowed for a cumulative trade volume exceeding $800 million this month alone.

Why this matters for $VANRY

Every one of these cross-border transactions requires $VANRY for gas and settlement triggers. Unlike speculative trading, this is fundamental demand. When a new energy vehicle company tokenizes a shipping fleet on-chain, it creates a permanent, high-volume utility loop for the token.

2026 Outlook: Southeast Asia & Beyond

The roadmap for the rest of Q1 2026 shows @vanar expanding this model into Southeast Asia and South America. By meeting localized compliance needs through programmable smart contracts, Vanar is becoming the "trust filter" for global business. 🌍

#altcoins #Web3 #BinanceSquareFamily #Write2Earn