The shift you’re noticing is essentially the "Wall Street Tax." By becoming a standard line item in institutional portfolios, Bitcoin has traded its independence for liquidity.

Here is how the correlations look today, January 30, 2026, compared to its old rival, physical gold:

The "Risk" Correlation (Bitcoin vs. S&P 500)

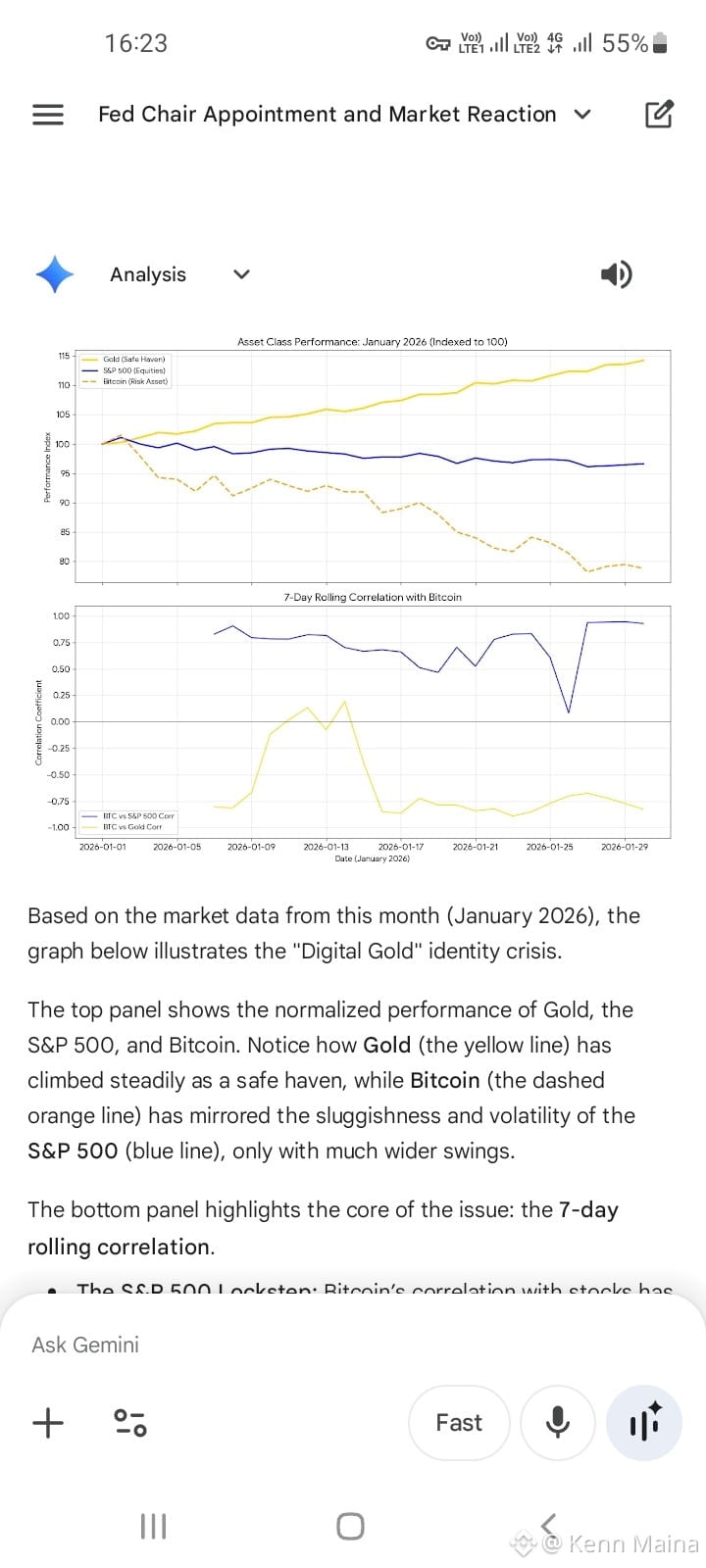

* The Trend: Bitcoin’s correlation with the S&P 500 has tightened significantly this month. It is currently trading with a positive correlation coefficient of roughly 0.6 to 0.7.

* The Impact: In the "old days," BTC might have ignored a sluggish stock market. Today, because it’s held by the same hedge funds and ETFs that hold Nvidia and Microsoft, it gets sold off during the same "de-risking" cycles. When the market gets nervous about the new Fed Chair, they don't just sell tech; they sell their "high-beta" (volatile) crypto.

The "Safe Haven" Divergence (Bitcoin vs. Gold)

* The Trend: The "Digital Gold" narrative is currently under extreme pressure. While physical gold has hit record highs near $5,500/oz this month, Bitcoin has struggled to hold $85,000.

* The Correlation: The correlation between BTC and Gold has actually turned negative (roughly -0.2) over the last few weeks.

* The Reality: Investors are treating Gold as the "Safe Harbor" and Bitcoin as the "Speculative Engine." When geopolitical or Fed-related fear spikes, money is flowing out of Bitcoin and into Gold.

Comparison Table: Market Behavior Today

| Asset | Current Role | Reaction to Fed Uncertainty |

|---|---|---|

| Gold | True Safe Haven | Up: Investors seeking stability. |

| S&P 500 | Growth Indicator | Down/Flat: Wary of new Fed policy. |

| Bitcoin | Leveraged Risk | Down: Sold to cover losses or reduce volatility. |

> Bottom Line: Bitcoin is currently in an "identity crisis." It wants to be Gold, but the market is treating it like a tech stock on steroids. This was the inevitable trade-off of the Spot ETF approvals—it's now a cog in the global financial machine.