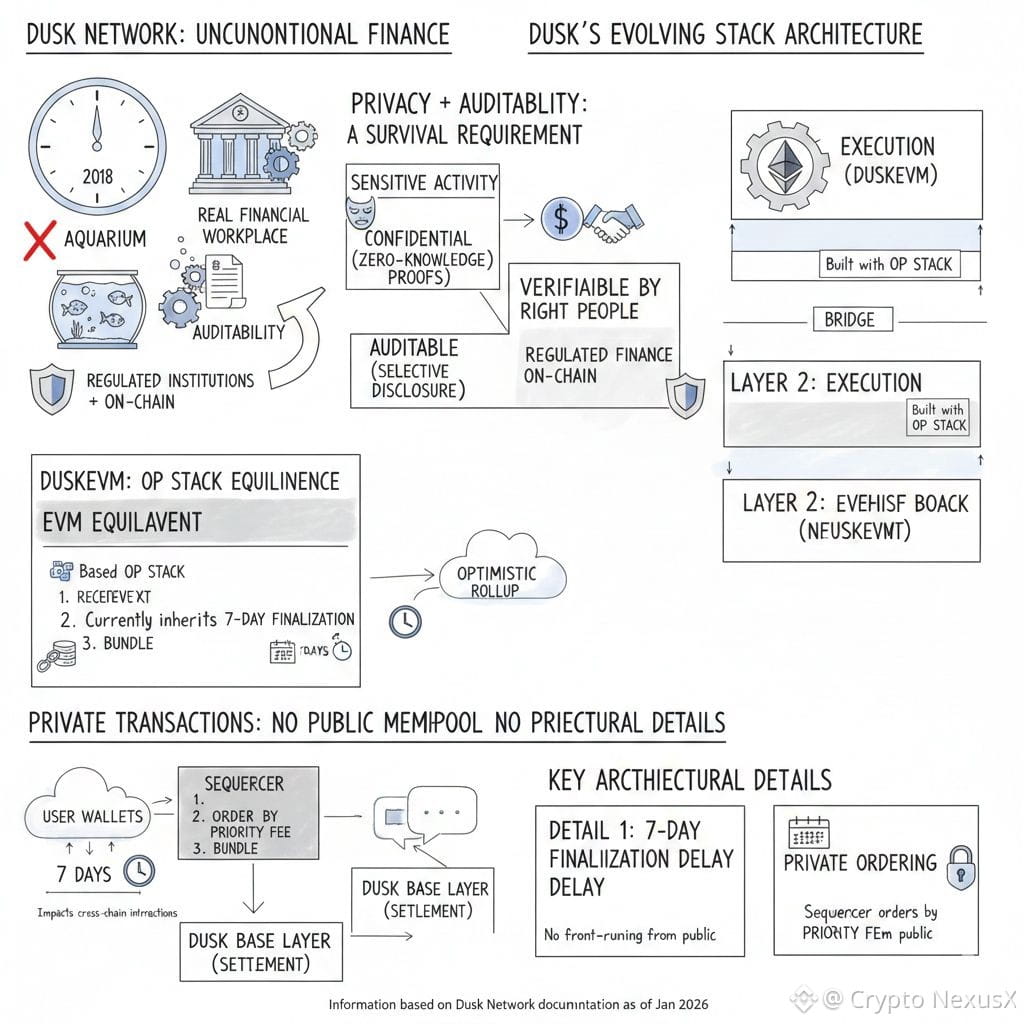

I have a soft spot for projects that are willing to be a little “unfashionable” in crypto, and Dusk fits that description. Since 2018 it has been building toward a version of blockchain finance that looks less like an aquarium and more like a real financial workplace: sensitive activity can stay confidential, but the right people can still verify what needs to be verified. That privacy plus auditability combination is not a vibe choice. It is a survival requirement if you want regulated institutions to do anything meaningful on chain.

What makes Dusk interesting to me right now is that it is no longer trying to squeeze everything into one execution model. It is turning into a stack with clear separation between what settles and what executes. In Dusk’s own documentation, DuskEVM is framed as an EVM equivalent environment built with the OP Stack, while the base layer is used for settlement and data availability. The docs also spell out two details that are easy to miss but shape everything you build on top: DuskEVM currently inherits a 7 day finalization period from the OP Stack, and it does not have a public mempool because transactions are only visible to the sequencer and ordered by priority fee.

Those are not “developer footnotes.” They change the texture of the market you can safely run. A long finalization window pushes you toward designs that assume reversibility and delayed certainty. A sequencer visible mempool is a very different world from the public mempool norms that people associate with Ethereum. You can argue it reduces certain front running dynamics, but you also have to accept that ordering power and transparency become governance questions, not just technical ones. The important part is that Dusk is explicit about the tradeoffs instead of pretending there are none.

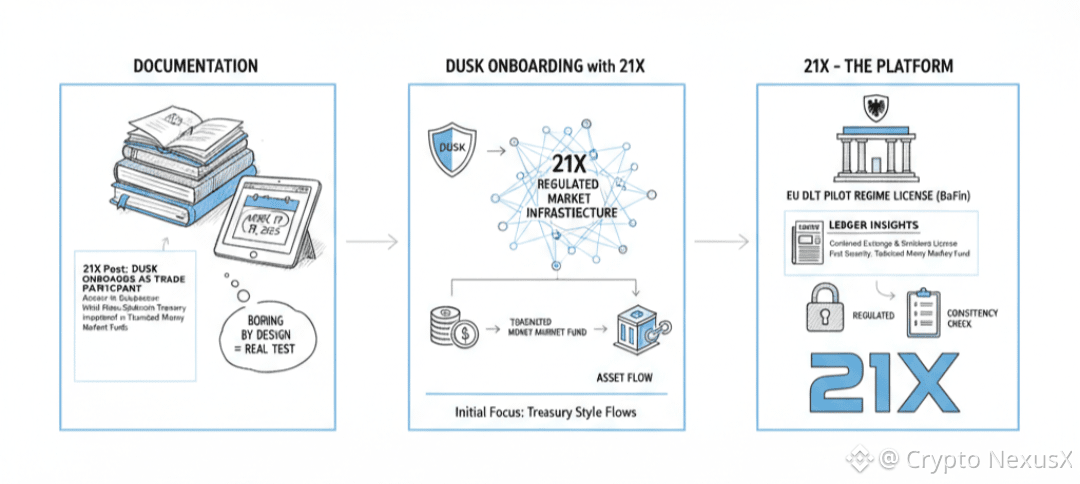

Now layer that technical posture into something concrete: Dusk onboarding as a trade participant with 21X.

According to 21X’s April 17, 2025 post, Dusk onboarded with 21X as a trade participant at launch, gaining access to 21X’s regulated market infrastructure. The initial focus is described in very specific terms: opening 21X’s platform to Dusk’s asset flow starting with stablecoin treasury investment in tokenized money market funds. That detail matters because it is not the usual crypto habit of starting with the most speculative use case available. Treasury style flows are boring by design, which is exactly why they are a good test of whether a regulated tokenization venue is real or just a concept.

The other reason the 21X angle matters is that 21X is not just another “RWA platform” saying the right words. Independent coverage from Ledger Insights describes 21X receiving a combined exchange and settlement license under the EU DLT Pilot Regime, granted by BaFin, and notes that the first security would likely be a tokenized money market fund. That lines up closely with the focus described in the Dusk onboarding post, which is a nice consistency check.

If you want the most formal confirmation, ESMA’s report on the DLT Pilot Regime states that 21X AG was authorised as a DLT TSS on December 3, 2024, and notes the system has been in operation since May 21, 2025. It also describes the setup as a fully integrated platform for trading, clearing, and settlement, and explicitly mentions Polygon PoS as the public permissionless chain used, with permissioned access enforced via whitelisting. A separate legal analysis from Bird and Bird similarly describes 21X receiving the first German DLT TSS license under the DLT Pilot Regime and also mentions Polygon as the processing chain.

So when I look at Dusk becoming a launch trade participant on 21X, I do not read it as a trophy logo. I read it as Dusk trying to plug into the kind of regulated venue where the boring constraints are non optional: who is allowed to trade, how access is controlled, how settlement and reporting actually work, and how you explain all of that to supervisors without hand waving.

There is also an awkward question hiding in plain sight, and it is the kind of question serious infrastructure has to answer: if ESMA describes 21X’s current DLT TSS as operating on Polygon PoS, what does it mean for Dusk to be a trade participant and to open the platform to Dusk’s asset flow. My interpretation is that “trade participant” is a role inside the regulated venue, not necessarily a claim that Dusk is the underlying ledger for 21X’s trading and settlement today. It could be about how assets, liquidity, and treasury flows sourced from the Dusk ecosystem access 21X’s regulated rails. The press release language points more in that direction, especially with the money market fund treasury investment example.

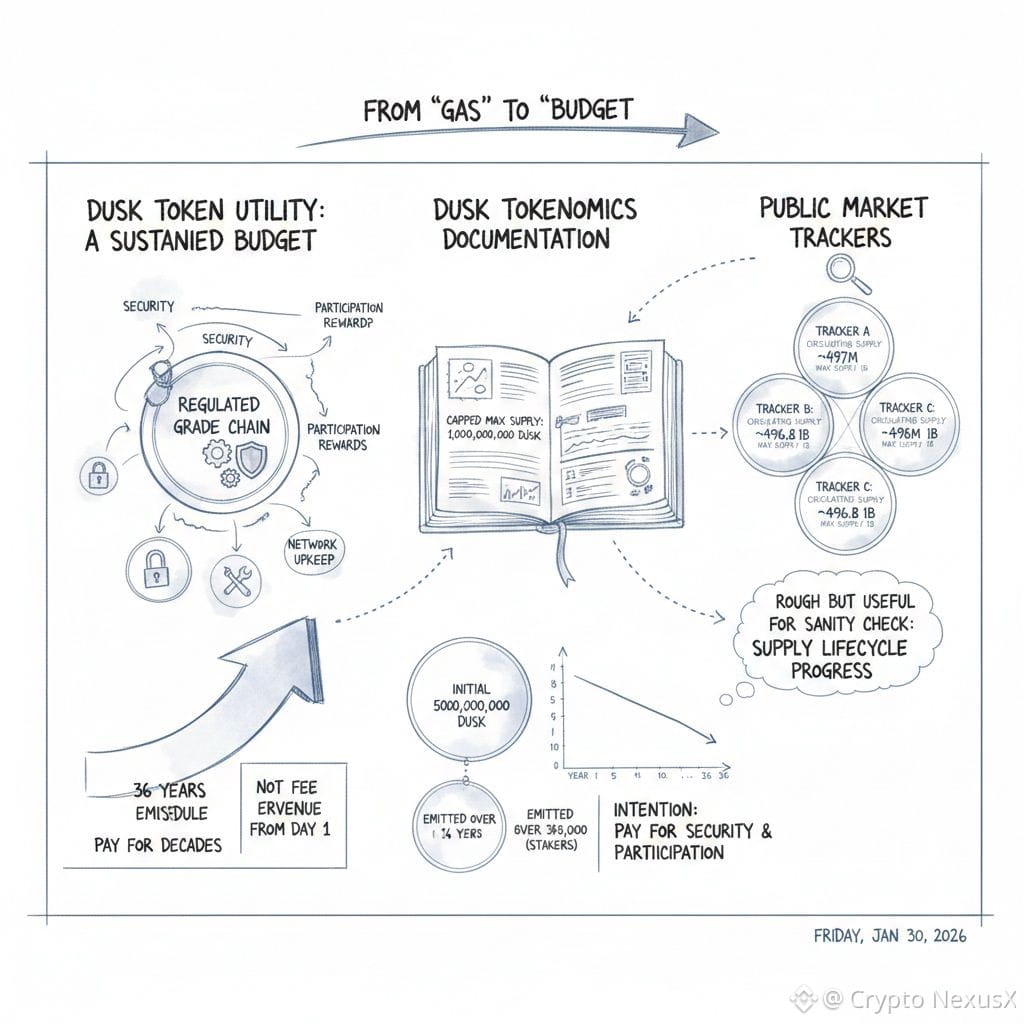

Zooming out, this is where DUSK token utility starts to look less like “gas” and more like the ongoing budget that keeps a regulated grade chain alive. Dusk’s tokenomics documentation lays out a capped maximum supply of 1,000,000,000 DUSK, combining a 500,000,000 initial supply and 500,000,000 emitted over 36 years to reward stakers, following a long emission schedule. You can debate whether emissions are good or bad, but the intention is clear: the network is designed to pay for security and participation for decades, not to pretend fee revenue will magically do that from day one.

On the “what is happening in the market right now” side, public market trackers commonly show circulating supply around the 497 million range and the same 1 billion max supply figure. I treat those as rough, because different trackers disagree at times, but they are still useful for sanity checking how far along the supply lifecycle the asset appears to be.

Where I land after putting all this together is pretty simple. Dusk is trying to be the kind of chain that regulated finance can actually use without forcing everyone to conduct business in public. The recent 21X trade participant onboarding is meaningful not because it sounds prestigious, but because the starting use case is the kind that tends to surface real operational truth: tokenized money market fund exposure, stablecoin treasury management, regulated access controls, and a venue that is explicitly licensed under the EU DLT Pilot Regime.

The main risk is also clear. DuskEVM’s current finality model and sequencer centered transaction visibility are constraints that will shape what products are practical at scale. If Dusk moves toward faster finality and strengthens transparency around sequencing guarantees, that is when the “regulated plus privacy” thesis starts to feel less like a good story and more like a durable advantage.