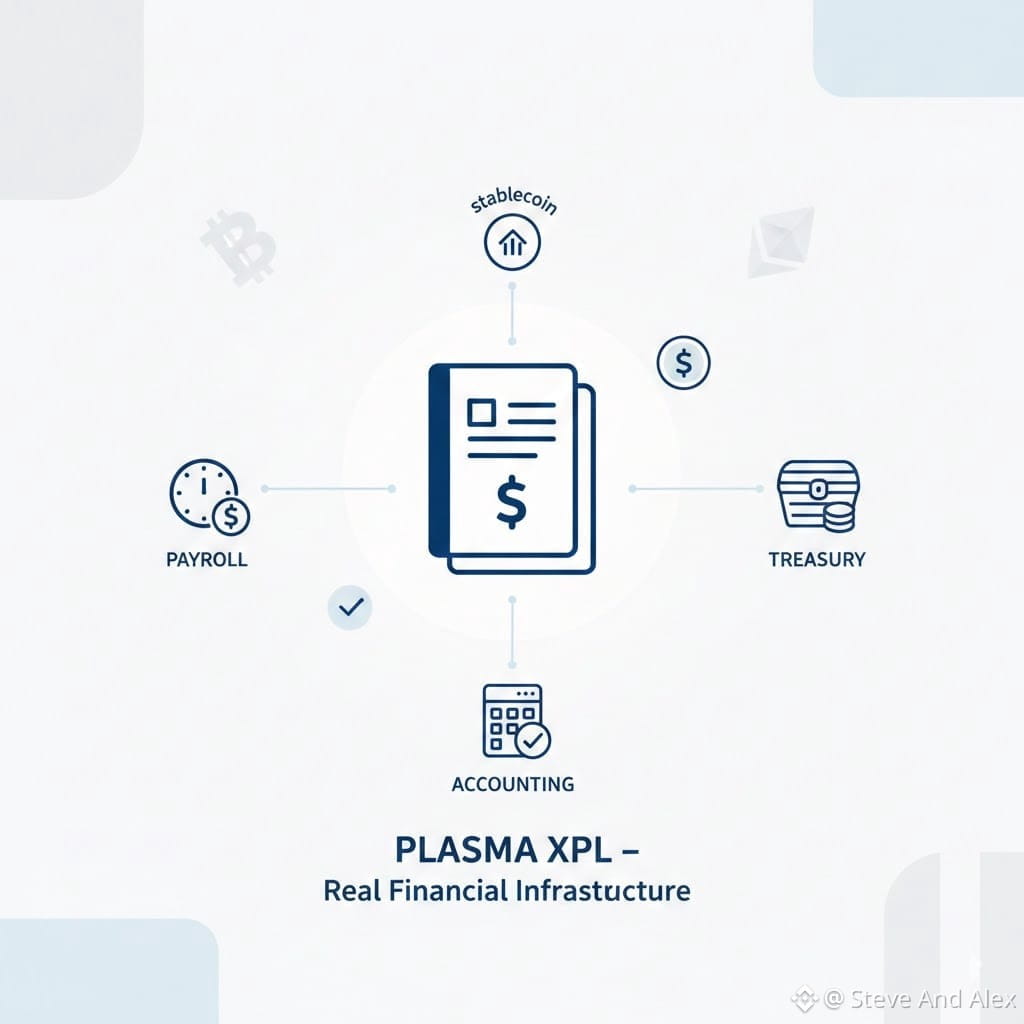

In the crowded world of crypto, everyone talks about hype and flashy prices,, but very few projects focus on real financial infrastructure. PLASMA XPL (XPL) is exactly that; a project that aims to turn blockchain technology into something that can be used daily for accounting,, treasury, and payroll management. While many chains are chasing TVL or daily transaction counts,, XPL focuses on measurable, predictable flows of value. That’s a big difference because it makes the network usable,, not just for speculation, but for actual finance.

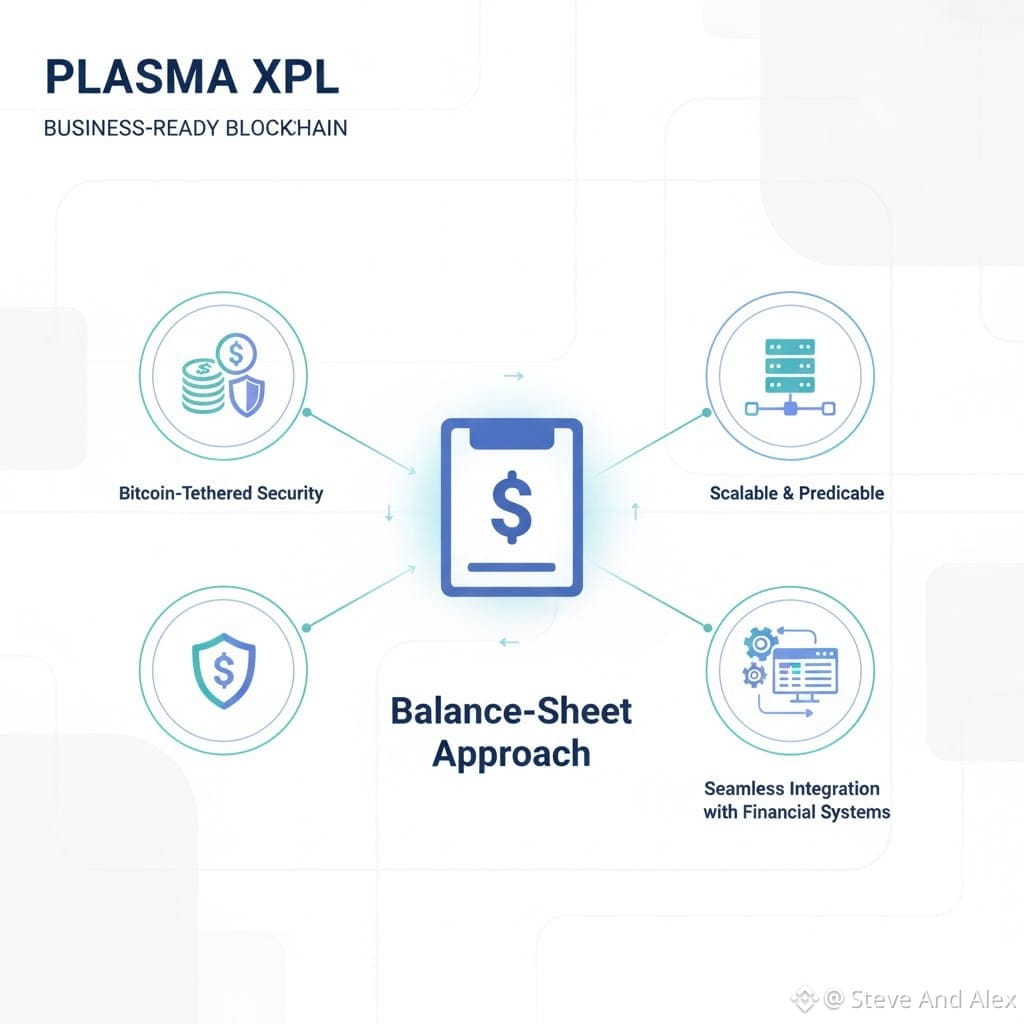

One of the key points of XPL is its balance-sheet approach. Instead of just recording random transactions, XPL integrates stablecoins, accounting, and treasury flows in a Bitcoin-tethered security layer,, which reduces risk and costs dramatically. Imagine transferring money without worrying about massive fees or unexpected volatility; that’s what XPL is building quietly and steadily.

Scalability is another area where XPL shines; many crypto projects promise fast transactions but fail to deliver under real-world loads. XPL,, by design, keeps costs fixed and predictable while ensuring high throughput. It means whether you are sending $100 or $1 million,, the network behaves consistently. No hidden fees,, no unpredictable gas spikes, just smooth operations.

The architecture of XPL allows it to be integrated with existing financial systems,, like payroll or treasury software. That makes it not only a blockchain but a bridge between traditional finance and crypto. Companies can adopt XPL without massive overhauls,, because it works alongside the systems they already use.

Another crucial point is security. Many projects claim security but rely on untested mechanisms or constant patching; XPL uses a Bitcoin-tethered model which leverages the security of one of the most battle-tested blockchains in the world. That means,, the financial data is as secure as money itself, making it appealing to corporates and institutional users.

Community adoption is also growing steadily. Unlike hype-driven coins, XPL does not rely solely on influencers or viral campaigns. Instead, it emphasizes education, transparency, and usability. The project releases detailed guides, workflow examples,, and treasury case studies, which help users understand exactly how XPL can improve financial operations,, not just make a quick buck.

Developers, entrepreneurs, and even traditional accountants are starting to see the benefits of XPL. By using predictable flows and stable costs, they can model cashflows more accurately, run simulations,, and plan budgets with confidence. It turns crypto from a high-risk gamble into a practical tool that integrates with day-to-day finance.

The use of stablecoins within XPL is particularly important. While other chains rely heavily on native tokens that fluctuate wildly in value,, XPL focuses on stablecoin transfers that maintain purchasing power. That allows businesses to adopt blockchain technology without worrying about sudden value swings,, which can disrupt payroll, accounting, or treasury management.

Another thing worth noting is transaction transparency. Each transaction is visible on the blockchain,, but privacy is maintained at the business level. That means auditors or regulators can verify flows without exposing sensitive business data. This dual approach,, transparency and privacy,, is rare in crypto projects and gives XPL a competitive advantage.

PLASMA XPL also supports future integrations. Smart contracts, API endpoints, and modular architecture mean that the platform can expand as financial technology evolves. Companies can automate treasury flows,, integrate accounting systems, or even experiment with cross-chain operations without disrupting existing processes.

Now, if we talk about adoption strategies,, XPL is methodical. Unlike coins that pump-and-dump, XPL focuses on long-term growth. Educational campaigns,, partnerships with fintech firms, and clear documentation help onboard serious users who value stability over hype. This approach might not make headlines daily,, but it builds a solid foundation for years to come.

Another interesting aspect is predictable fees. While Ethereum or Binance Smart Chain can suddenly spike fees during congestion,, XPL maintains fixed costs. That predictability allows companies to budget accurately,, plan payroll, and execute large transactions without risk. In crypto, predictability is undervalued,, but it’s exactly what businesses need.

The treasury model is another strong pillar of XPL. By integrating payroll, accounting, and treasury flows,, businesses can reduce overhead and minimize human error. This is not speculation; this is practical blockchain adoption that actually saves money, time,, and resources.

Furthermore, the team behind XPL is surprisingly low-profile. They focus on building rather than hype,, meaning updates, code releases, and ecosystem improvements are consistent and high-quality. Unlike projects that promise the moon and deliver little,, XPL quietly improves the financial infrastructure layer of crypto day by day.

In conclusion,, XPL is not trying to be the flashiest coin on the market; it’s aiming for utility, predictability, and usability. From predictable fees,, to Bitcoin-tethered security, stablecoin transfers, and financial workflow integration,, it’s building something tangible. For anyone looking to adopt crypto for real business use rather than speculation,, XPL offers a compelling path forward.

The market may chase hype, but a silent revolution is happening with XPL. Companies, developers, and accountants are slowly adopting it,, realizing that blockchain doesn’t need to be risky to be transformative.

If you want to understand crypto beyond price charts,, XPL is the project to watch. It might not trend on Twitter today,, but in a few years, it could redefine how businesses interact with blockchain technology,, turning promises into real-world solutions.