When I started looking deeper into stablecoins over the past year. I noticed something that felt obvious in hindsight but rarely gets discussed properly. Stablecoins have already won. With a market size now exceeding $150 billion and annual transaction volumes crossing tens of trillions of dollars. They are no longer an experiment or a niche trading tool. They are becoming a global settlement layer in their own right. Yet almost all of this activity still runs on blockchains that were never designed specifically for payments. Based on my research that mismatch between use case and infrastructure is one of the biggest hidden bottlenecks in crypto today and it is exactly the problem Plasma is trying to solve.

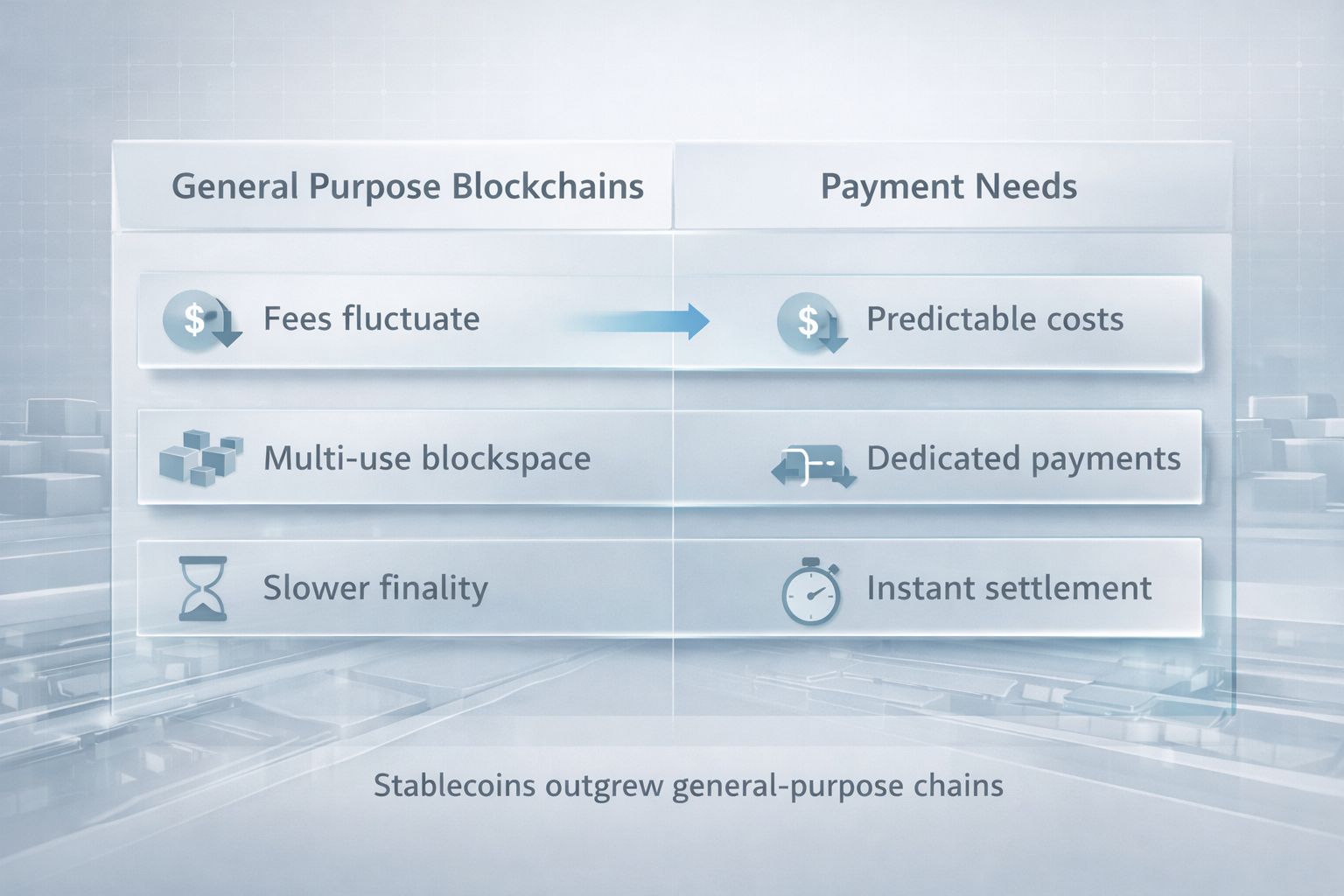

Most Layer 1 blockchains treat stablecoins as passengers rather than the engine. Ethereum, for example remains the dominant settlement layer for USDC and a significant portion of USDT flows but it was built to support everything from NFTs to DeFi to DAOs. When network usage spikes fees rise finality becomes uncertain for everyday users and payments stop feeling like payments. TRON took a different route by optimizing for cheap transfers and it now processes the majority of USDT transactions globally. What surprised me, however is that even TRON is still a general purpose chain first with trade offs in decentralization and long term neutrality that institutions quietly worry about.

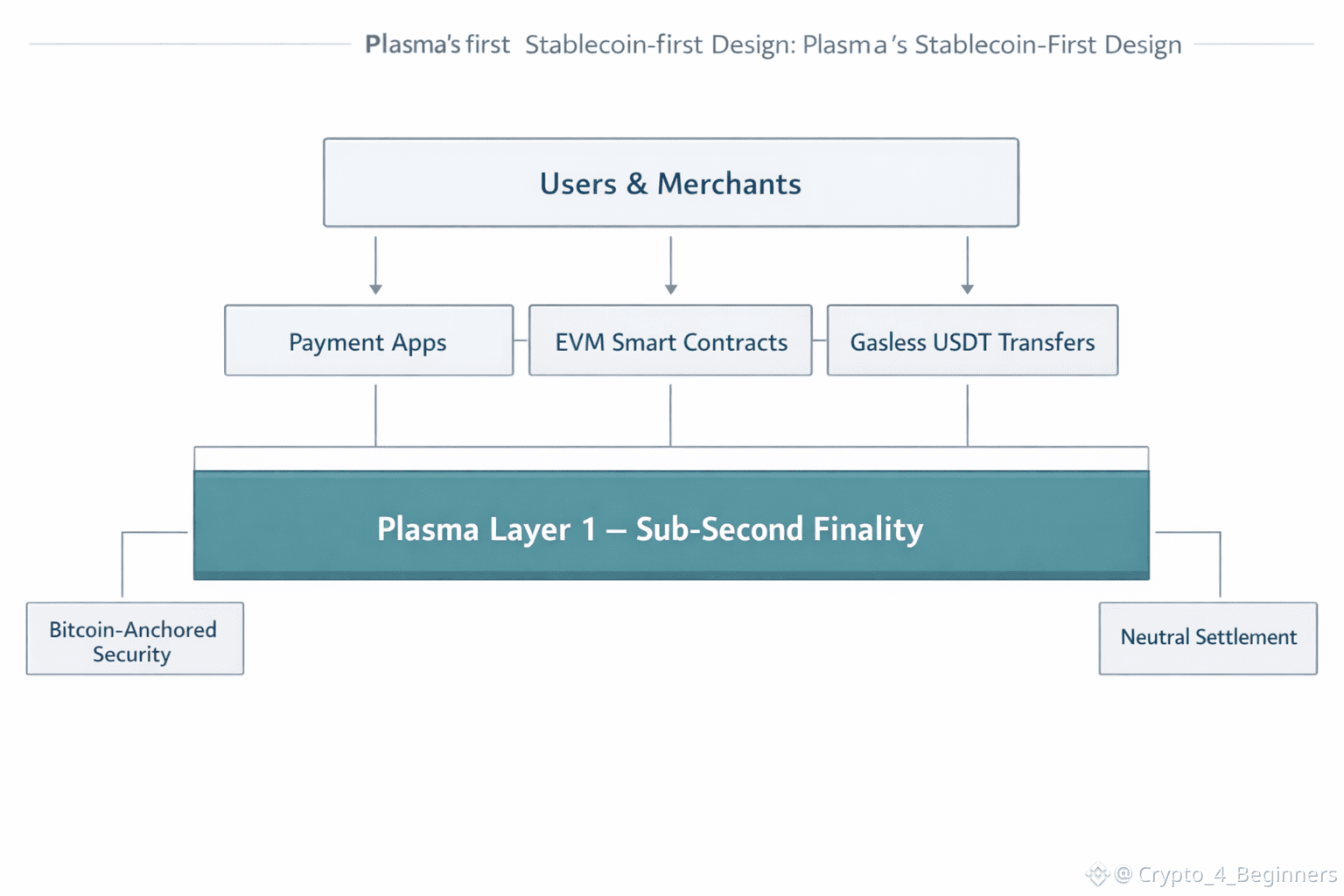

Plasma enters this picture with a very different thesis. Instead of asking how stablecoins can fit into an existing blockchain design it asks what a blockchain would look like if stablecoin settlement were the primary objective from day one. Everything about Plasma's architecture flows from that question. It is a Layer 1 built around stablecoin first gas gasless USDT transfers and sub second finality while still remaining fully EVM compatible through Reth. That combination is rare and in my assessment strategically important.

One data point that often gets overlooked is how stablecoins are actually used outside crypto native circles. According to public payments research cross border transfers through traditional rails still cost between 5% and 7% on average and can take multiple days to settle. At the same time stablecoins already move value across borders in minutes often for cents but even "cents" matter at scale especially in high adoption markets where stablecoins are used for remittances, payroll and merchant settlement. Plasma gasless USDT transfers directly address that friction by removing the need for users to hold or manage a separate gas token just to move dollars.

From a developer perspective Plasma full EVM compatibility is another detail that matters more than marketing narratives suggest. I have seen too many payment focused chains struggle because they require developers to learn new tooling or adapt to unfamiliar execution environments. Plasma avoids that trap. Solidity contracts, existing wallets and familiar infrastructure can be deployed without friction. The difference is that once deployed those applications benefit from PlasmaBFT consensus which delivers sub second finality. For payments finality is not a luxury feature. It is the difference between confidence and hesitation.

What really caught my attention, though is Plasma's approach to security and neutrality. Bitcoin anchored security is not a buzzword here. In a world where stablecoin settlement increasingly involves institutions, payment processors and regulated entities neutrality and censorship resistance become non negotiable. Bitcoin stands out as the most politically neutral and battle-tested base layer in crypto. Plasma wants to tap into that reputation by anchoring itself to Bitcoin hoping it will help when institutions start weighing long term settlement challenges.

Now look at Plasma next to something like Circles USDC setup. Circles put together a strong network for issuing and redeeming USDC all closely tied to banks and compliance systems. Still Circle does not really play the same role as a decentralized blockchain infrastructure provider. It relies on existing chains to move USDC. Plasma complements rather than competes with that model by offering a settlement layer where stablecoins can move efficiently without sacrificing decentralization or composability. In my view that makes Plasma more of a neutral highway than a toll road controlled by any single issuer.

Retail adoption is another angle where Plasma's design choices start to make sense. In regions with high stablecoin usage such as parts of Latin America, Africa and Southeast Asia users care far more about reliability and simplicity than about speculative upside. They want money to arrive quickly predictably and without hidden costs. Gasless transfers and a stablecoin first approach make things simpler for everyone. Users don't need to understand blockspace auctions or fluctuating fees. They just send dollars.

Institutional use cases follow naturally from the same design. Think about payment processors on-chain payroll or managing a treasury. They all need payments to settle on time and in a way you can track. With sub second finality you get almost instant reconciliation. That's a game changer. Plus since it works with the EVM you can build in rules for compliance, reporting or automation right from the start.

From what I have seen Plasma actually hits a sweet spot most other chains just talk about making things easy enough for regular people to use but still offering the kind of reliability big institutions need. Not many pull that off.

Of course no thesis is without challenge. People really do hesitate when it comes to switching. Ethereum and TRON already have a tight grip and those network effects are tough to break. Getting people and developers to move their stablecoins is not just about building something faster or cheaper. It's about proving day after day that the new thing actually works and keeps working and then there is the whole regulatory mess. Sure stablecoins are more accepted now but the rules keep shifting. Any chain focused on settlement has to keep one eye on compliance always ready for the next change.

Plus the competitions heating up. General purpose Layer 1 are racing to improve finality and lower fees and Layer 2 solutions continue to mature. The question Plasma must answer is whether specialization can outperform generalization in the long run. Based on my research I believe the answer depends on scale. Stablecoin volumes keep climbing and honestly. It's getting impossible to ignore how much we need settlement infrastructure that is actually built for the job.

Here is what grabs me about Plasma is it does not pretend to be a one size fits all solution. It sticks to what it does best. It does not chase DeFi hype cycles or narrative driven use cases. Instead it focuses on the most "boring" part of finance is moving money efficiently. History shows that boring infrastructure often captures the most durable value. TCP/IP did not win because it was exciting it won because it worked.

In that sense Plasma feels less like a speculative Layer 1 and more like a bet on where crypto is quietly heading. Stablecoins are becoming the default interface between crypto and the real economy. If that trend continues blockchains purpose built for stablecoin settlement may end up being more important than chains optimized for everything else.

Based on my assessment Plasma chain and PLASMA are positioning themselves at exactly that inflection point. Will Plasma end up leading as a settlement layer? That is going to come down to how well the team executes the partnerships they build and whether people really trust them but the core idea just feels right. As crypto moves past the experimental stage and starts handling real money. We will need infrastructure thatis up to the task. That is probably where the next big wave of adoption comes from.