I’ve been thinking about Dusk the way I think about the parts of finance most people never see. Not the trading floor, not the apps, but the back hallways where real decisions get made and real risk gets managed. Those hallways are quiet for a reason. If every position, every counterparty relationship, and every settlement intent were broadcast in public, the system would be unusable. At the same time, those hallways still have locks, logs, and people who can inspect what happened when something goes wrong.

That’s the mental model that makes Dusk click for me. It is trying to be confidential by default while still being inspectable when it needs to be. Not secrecy for its own sake, and not performative transparency either. More like a controlled environment where privacy is normal and proof is available on demand.

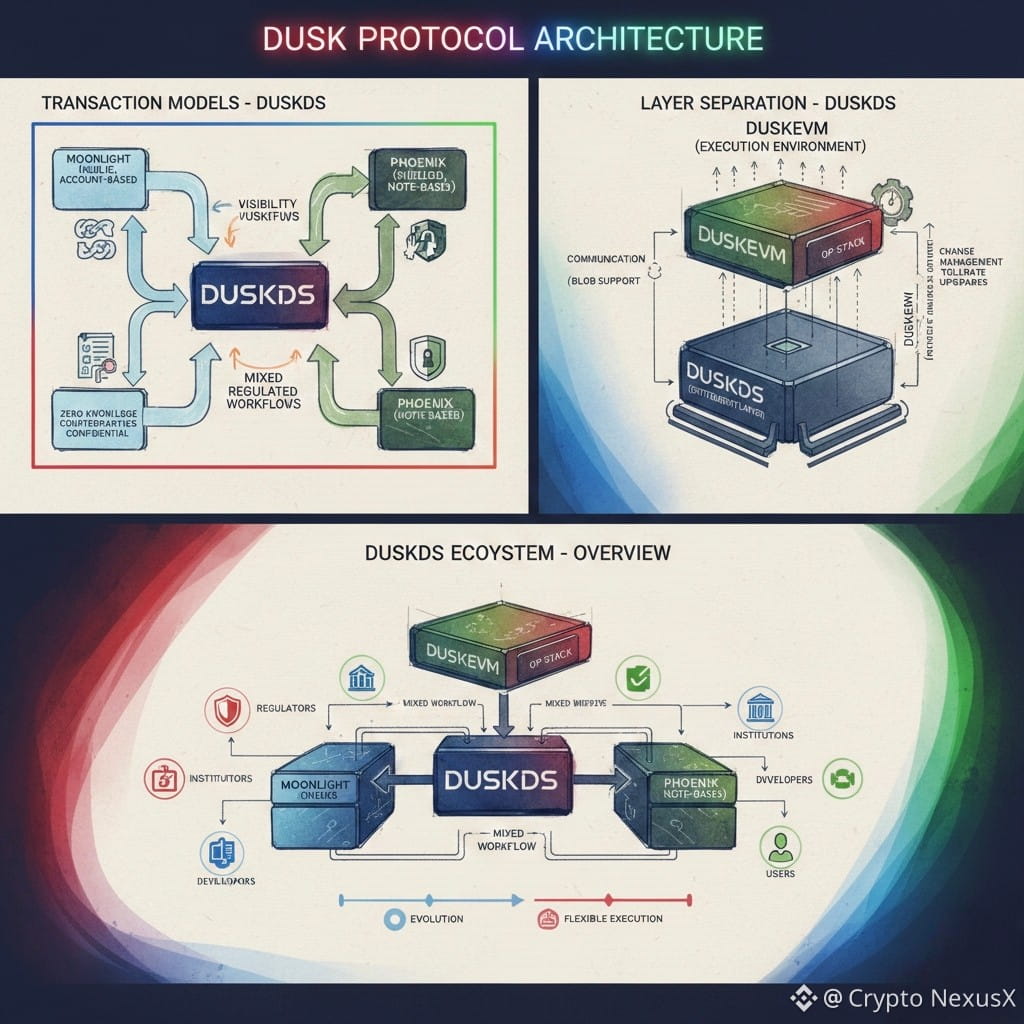

This shows up in a very concrete way in DuskDS. It supports two native transaction models living side by side. Moonlight is public and account based, the kind of thing you want when visibility is useful. Phoenix is shielded and note based using zero knowledge proofs, the kind of thing you want when amounts and counterparties should not be exposed to the world. That pairing matters because most regulated workflows are not purely private or purely public. They are mixed. Some things must remain confidential, and some things must be reportable. Dusk is designed around that reality rather than fighting it.

There’s also a quiet practicality in the way Dusk separates its base layer from execution environments. DuskEVM is positioned as EVM equivalent execution built on the OP Stack with blob support in mind, while the settlement layer remains DuskDS. This kind of separation is usually marketed as modularity, but for regulated infrastructure it is also about change management. Institutions tolerate upgrades when the core guarantees stay stable. Having a settlement layer with its own rules and a separate execution layer is closer to how mature financial systems evolve.

One detail from the DuskEVM documentation stuck with me because it reveals how the team thinks about market structure. DuskEVM does not have a public mempool. The sequencer sees the mempool and orders transactions by priority fee. That is not just an engineering choice. A public mempool is basically a global broadcast of intent. It tells everyone what you are about to do, which is entertaining in retail environments and often unacceptable in institutional ones. Removing the public broadcast reduces certain kinds of information leakage, but it also concentrates power and makes fairness and audit trails more important. The interesting part is not pretending there is no tradeoff. The interesting part is whether the chain ends up providing the tooling and evidentiary trails that let serious users evaluate ordering and execution quality.

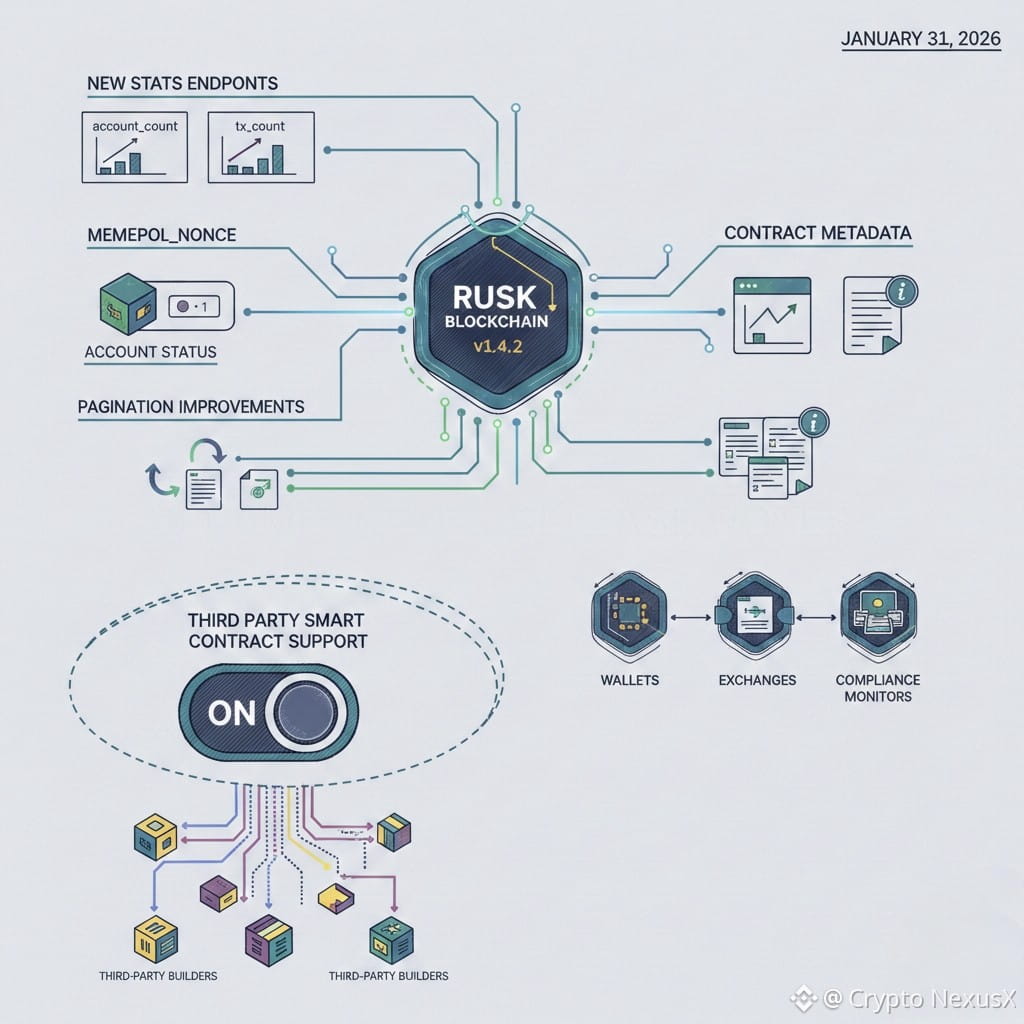

When I look for recent progress, I tend to trust boring changes more than shiny ones. In late 2025, the Rusk releases started adding exactly the kinds of things that make a chain easier to integrate and easier to measure. New stats endpoints like account_count and tx_count, a mempool_nonce in account status, pagination improvements, and contract metadata endpoints are not flashy. They are the kinds of upgrades that wallet teams, exchange teams, indexers, and compliance monitors actually need. I see those as signals that the project is trying to become legible to outsiders, which is what infrastructure has to do if it wants to be used.

Another release note from December 2025 is even more ecosystem shaping in a quiet way. Rusk v1.4.2 describes fully enabling third party smart contract support. That is the kind of switch that determines whether a chain stays a curated garden or becomes an actual ecosystem. Once third parties can deploy without special handling, the chain stops being just a concept and starts being a place other builders can bet on.

There is also a nuance around finality that is worth handling carefully. The DuskEVM docs mention inheriting a seven day finalization period from the OP Stack, while future upgrades aim for one block finality. In OP Stack systems, people often confuse the seven day window with what everyday users experience as transaction finality, because the longer window is commonly tied to dispute windows and withdrawal guarantees in cross domain contexts. The reason this matters for Dusk is not academic. If the target audience includes regulated settlement and issuance workflows, risk teams will ask which kind of finality they are dealing with and what the operational implications are. When that story is explained clearly, the chain becomes easier to model. When it is vague, adoption slows.

On token utility, I find it useful to stop thinking about DUSK as an abstract asset and start thinking of it as a permit plus fuel. On the base layer, staking has explicit mechanics like a minimum stake of 1,000 DUSK and a maturity delay before rewards begin. On the execution side, DUSK is also positioned as the native token for DuskEVM gas, with fees reflecting both L2 execution and L1 data availability costs published back to DuskDS. This dual role ties usage and security together, which can align incentives, but it also means network activity and validator economics are more coupled than in systems where gas and staking are separated.

If you want something tangible, you can also look at the token’s footprint across EVM environments. Etherscan shows the ERC 20 DUSK contract with roughly 19.6k holders, and BscScan shows the BSC representation with around 13k holders. That distribution is not just trivia. It tells you where liquidity and familiarity still live, which affects bridging gravity and how easily new users can move into the native environment over time.

The easiest way to summarize my impression is this. Dusk is not trying to win by being the loudest chain in the room. It is trying to win by being the chain that lets regulated finance exist on chain without making every participant naked in public, and without asking auditors to trust a black box. The reason I take it seriously is not any single feature. It is the coherence between the privacy model, the selective disclosure posture, the execution architecture, and the recent work that makes the system more measurable and more integrable.

If I were watching what matters next, I would look for real examples of selective disclosure workflows that stand up to external scrutiny, clearer explanations of finality semantics that a risk committee could model, and evidence that third party contract deployment stays boring in the best way, meaning stable tooling, predictable indexing, and integrations that do not require heroics.