The tape essentially provides a response to the question, "Why is a stablecoin settlement chain even getting attention when every chain claims it can do payments?" if you're currently considering about Plasma. After reaching an early top at $1.68 back in late September 2025, $XPL has been trading around the $0.12 handle with real liquidity behind it, roughly ~$90M in 24-hour volume, and a ~$200M+ market size depending on the tracker. That isn't drowsy, forgotten alternative conduct. The market is actively repricing what "stablecoin-first" would be worth in the event that adoption occurs where it matters.

The rails that people really use are called stablecoins.

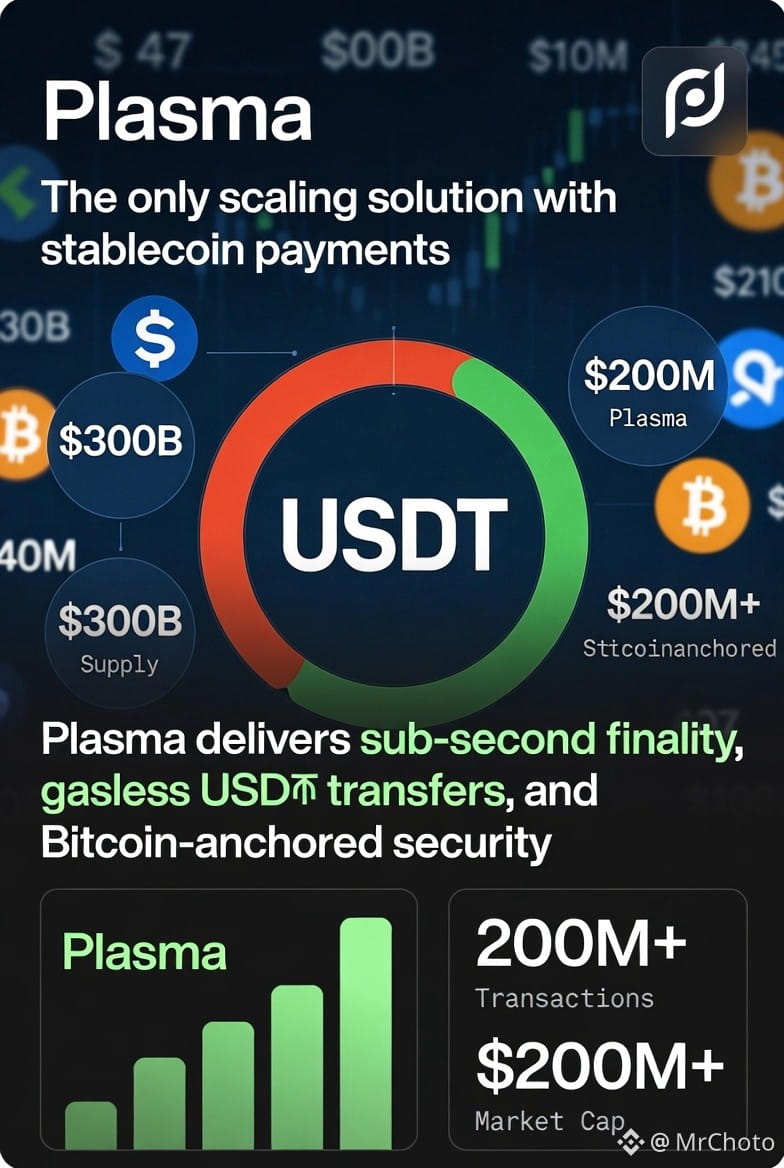

Here's the deal now. Instead of being the settlement layer discussed on podcasts, stablecoins have subtly evolved into the one that people really utilize. In early 2026, the total stablecoin supply is in the low $300 billion level, and depending on the snapshot you're looking at, USDT alone is in the high $180 billion range. This focus is important since it reveals the location of the payment "gravity" and indicates that the competition is real. You are in competition with the default rails that people currently use to route size, not with feelings.

Eliminate Gas Friction and Make Finality Feel Like Cash with Plasma's Wedge

What is Plasma's real advantage in a very competitive on-chain settlement market? In the abstract, it's not "we're faster." The two obstacles that prevent stablecoin payments at scale—the requirement for a separate gas token and the need to wait long enough for finality so that the recipient views the transfer as a promise rather than cash—are specifically being addressed by Plasma. The design decisions are rather obvious: sub-second finality through its PlasmaBFT consensus, stablecoin-first gas where fees may be paid in USD₮ (and even BTC via auto-swap), and zero-fee USD₮ transfers. It then attempts to use Bitcoin-anchored security as a shortcut for credibility, essentially stating that "we want the settlement assurances to rhyme with the most conservative base layer."

The "Metro Card" Issue: Extra Asset Hops Are Disliked by Payment Users

Consider it this way. The majority of establishments require you to purchase a metro card before you can board the train, but they claim it's okay since the card is "part of the economy." Users of payments detest that. Forcing an additional asset hop is friction if the product is dollars moving, and friction leads to churn. Plasma is attempting to make the "metro card" undetectable in the typical scenario through gasless USDT transfers. Then, stablecoin-first gas serves as a backup for any situation that isn't typical, allowing developers to continue creating legitimate apps without immediately compelling customers to pay the native-token tax. If that UX loop is mastered by Plasma

Competitive Reality: It's Not Theory, It's Incumbent Flow

Because everyone can see the same potential, competition becomes intense at this point. has long been the mainstay of USDT transfers as it is affordable, reliable, and "good enough" for a substantial portion of flows. Additionally, L2s benefit from low-cost high-throughput chains such pitch speed and cost for consumer-like payments, as well as composability and dissemination. Thus, Plasma is unable to claim that "payments are big." "Why would flows move here instead of staying where they already clear?" must be addressed. A combination of cost, finality, and operational simplicity that is much superior for the particular task of stablecoin settlement is the only plausible solution.

What Really Counts: "Pending Anxiety," Confirmation UX, and Failure Rates

Stablecoin settlement isn't only "TPS," but also failure rates, reorg anxiety, confirmation UX, and how frequently you have a user do an additional step. This is what I'm keeping an eye on and what the market generally overlooks early on. Sub-second finality is the distinction between a merchant treating monies as received and pending; it is not a Twitter flex. Gasless transfers are customer acquisition, not charity. Additionally, EVM compatibility is a way to shorten the integration time for payment apps and wallets that already have tried-and-true codepaths, not a checkbox. In essence, Plasma is stating, "We'll take the most popular stablecoin actions and make them feel like sending a message, not like using a chain."

Risks: Distribution, Value Capture, and the Regulatory Spotlight

However, you shouldn't ignore the dangers since they are precisely where "stablecoin-first" might backfire. First, you are subtly obscuring the value capture of native tokens if you make the default path gasless and stablecoin-denominated. Although it's not a given, that may work if XPL is primarily a security asset and the chain gains enough significance for people to want to stake and manage it. Second, distribution is crucial. Your superior design is meaningless if big wallets and payment front ends don't route to you. Third, any chain that focuses on stablecoins is subject to stricter regulations. As soon as you become significant, banks, regulators, and issuers are discussing how stablecoins affect deposits in order to accelerate that trend.

Bull Case: Compound after winning a tiny piece of a huge pie

What bull case, then, is genuinely marketable rather than merely optimistic? A tiny piece of a huge pie is being captured by plasma in a way that compounds. You don't need Plasma to change the world if the total quantity of stablecoins is about $300 billion and USDT remains the dominant currency. Exchange-to-exchange transactions, merchant payment processors, remittance corridors, and wallet-to-wallet consumer transfers are some of the high-frequency categories for which it must develop into a significant settlement venue. The chain gets sticky when millions of transfers are made every day with constant finality and low failure rates. App teams develop on top of it after it becomes sticky, not because the technology is better, but because the money is already there.

Bear Case: Incentive-Driven Activity Diminishes + Incumbents React

The bear case is also simple. The incumbents reply. All fees are compressed. UX enhances current rails. As @Plasma struggles to demonstrate its security approach under actual demand, the "stablecoin-first" difference becomes commonplace. Alternatively, you may encounter the traditional early-L1 issue: activity appears, but it is motivated by incentives and diminishes when advertising or emissions stop. In that case, $XPL trades similarly to the majority of new L1 tokens, with spikes during announcements followed by a gradual decline as the market seeks evidence of on-chain usage.

Track Settlement Reality: The Only Important Filter

From here, my filter is straightforward. Track the settlement reality instead of overanalyzing the narrative. The percentage of transfers that are actual end-user payments compared to exchange churn, the number and amount of daily stablecoin transfers on #Plasma , the median confirmation and finality UX in key wallets, and whether development engagement results in deployed payment solutions rather than demos. Plasma has a good chance of becoming a default rail for some flows if those lines continue to rise as the larger stablecoin market continues to grow. If they don't, it's just another token attempting to outsell rails that are already functional. $XPL