$DOT isn’t trying to be the fastest or the loudest Layer 1.

Its long-term bet is different: many specialized blockchains secured together, instead of one chain doing everything.

In a market crowded with general-purpose networks, DOT represents a modular vision — where apps get their own chains without sacrificing security.

🔍 What Is Polkadot (DOT)?

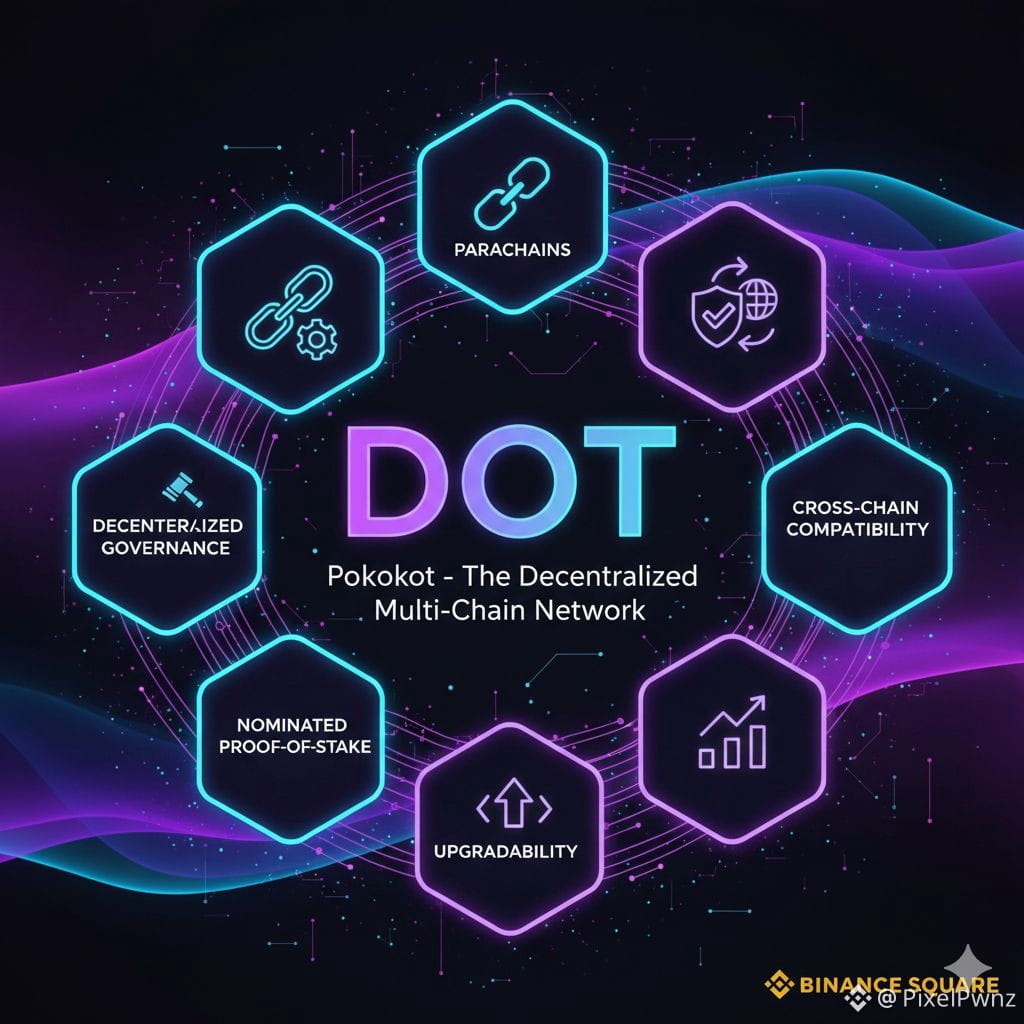

Polkadot is a multi-chain network designed around:

Shared security

Interoperability by default

Application-specific blockchains (parachains)

Instead of forcing all apps onto one chain, Polkadot allows projects to launch custom blockchains that connect to a central relay chain. DOT is used for:

Network security (staking)

Governance

Ecosystem participation

The idea is simple: optimize per use case, not per trend.

📊 Outlook Ranges (Scenario-Based)

ScenarioMarket DirectionConditionsBullishStructural recoveryAppchain growth, ecosystem tractionNeutralSideways movementStable usage, slow adoptionBearishContinued lagWeak demand, capital rotation away

These scenarios reflect sentiment paths, not price targets.

🔑 Key Drivers for DOT

🏗️ 1) Appchain (Parachain) Strategy

Polkadot focuses on depth, not simplicity. Parachains allow:

Tailored performance

Independent upgrades

Use-case-specific optimization

As crypto matures, this design may appeal more to serious builders than one-size-fits-all chains.

🛡️ 2) Shared Security Model

New chains don’t need to bootstrap validators from scratch. By connecting to Polkadot, they inherit network security — lowering barriers for:

Startups

Enterprise-style use cases

Long-term infrastructure projects

Security-sharing remains one of Polkadot’s strongest differentiators.

🔄 3) Flexible Governance & Upgrades

Polkadot emphasizes on-chain governance, allowing:

Faster protocol upgrades

Reduced reliance on hard forks

Community-driven evolution

This adaptability helps the network evolve without disruption.

🌱 4) Ecosystem Repositioning

DOT may benefit when the market rotates away from:

Short-term narratives

Meme-driven speculation

Toward:

Infrastructure

Developer-centric platforms

Long-term scalability plays

⚠️ Risks & Challenges

🧠 1) Complexity Barrier

Polkadot’s design is powerful — but complex. This can:

Slow onboarding

Confuse retail users

Limit immediate adoption

Ease of use matters in competitive markets.

📉 2) Ecosystem Visibility

Despite strong tech, Polkadot often struggles with:

Low social momentum

Limited retail excitement

Underwhelming headline growth

Perception remains a hurdle.

🔁 3) Appchain Competition

Other ecosystems now offer:

Rollups

Modular stacks

Appchain-like solutions

Polkadot must continuously prove why its model is superior.

🌍 4) Market Timing Risk

DOT performs best when markets value infrastructure and builders. In pure hype cycles, it tends to lag trend-focused assets.

📌 Quick Summary

Polkadot (DOT) is a long-game project. Its success depends less on viral narratives and more on whether app-specific blockchains become the dominant crypto architecture.

AspectSnapshotCore FocusAppchains & shared securityStrengthModular scalabilityWeaknessComplexity & visibilityAudienceBuilders & infrastructureRisk LevelMedium

📜 Disclaimer

This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and risky. Always do your own research (DYOR).

📊 Market View: Bearish

While Polkadot’s technology is strong, current market sentiment favors simpler, narrative-driven platforms. Until ecosystem traction and visibility improve, DOT may continue to underperform relative to trend-leading sectors.