I’m going to explain Vanar the way it actually feels when you look past slogans.

Most Layer-1 chains are built like a public scoreboard: everything visible, everything measurable, and everything aimed at impressing other technical people. Vanar feels like it’s built like a backstage crew. The audience never sees the cables, the timing cues, the rehearsals, or the panic fixes. They only feel one thing: the show ran smoothly. That is the real adoption game. Normal users don’t want to study wallets and gas. They want an app that works, saves their progress, remembers what they did, and doesn’t punish them for being new.

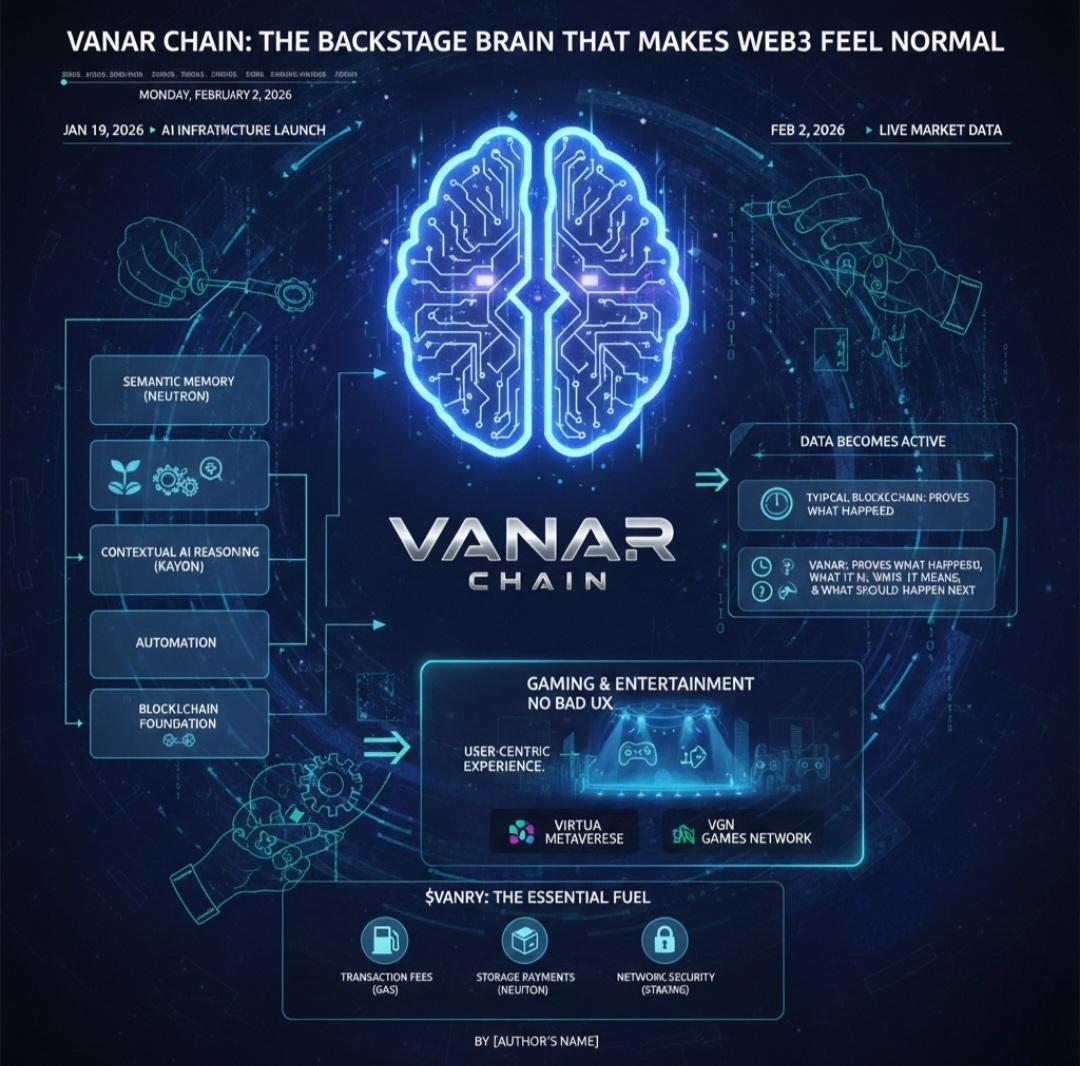

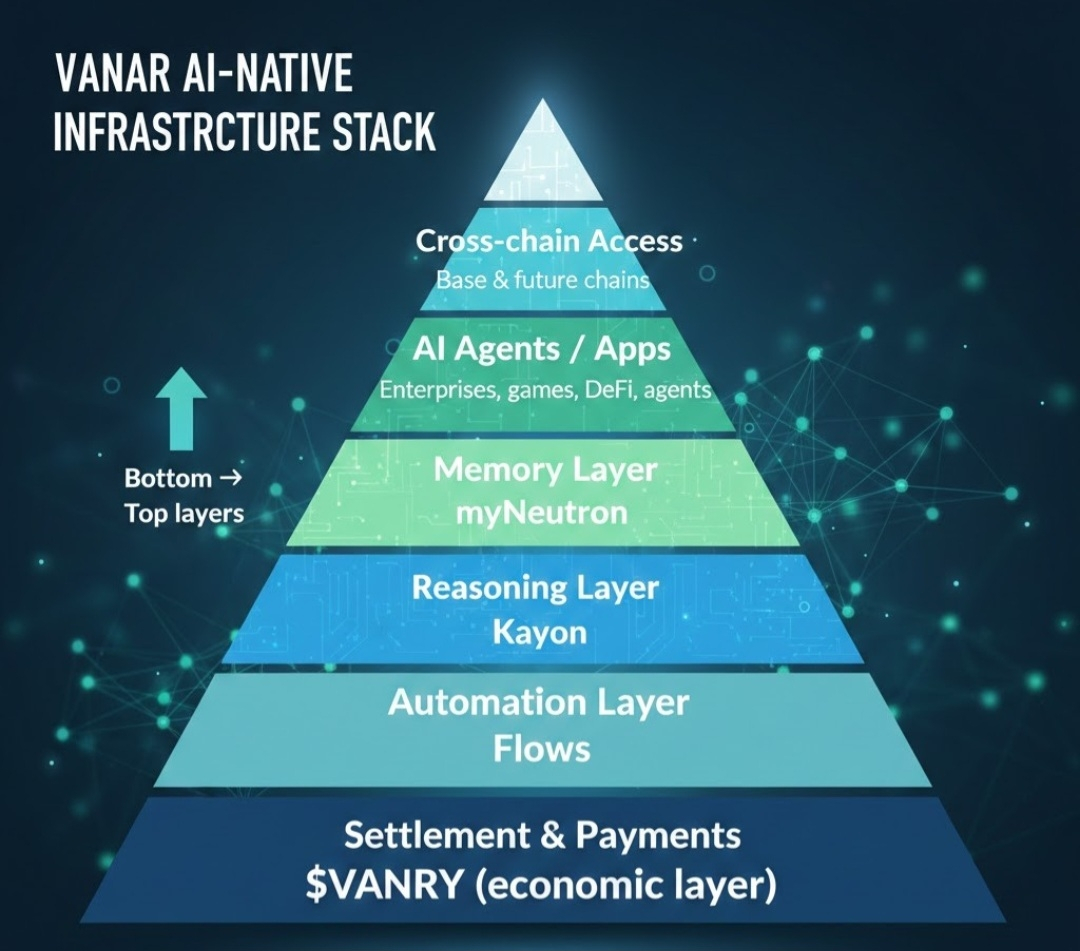

Vanar’s core idea is simple but ambitious: don’t just run transactions—make the chain capable of handling meaning, memory, and decision-making as part of the base experience. On Vanar’s own site, they frame this as a five-layer stack where the blockchain is the foundation, and higher layers add semantic memory (Neutron) and contextual AI reasoning (Kayon), with automation and industry application layers planned above that.

That “stack” framing matters because it tells you what Vanar is really trying to sell to builders: not only blockspace, but a more complete toolkit for applications that need to store real information and act on it.

Here’s the best way to understand the difference:

A typical blockchain is great at proving what happened.

Vanar is trying to be good at proving what happened, what it means, and what should happen next—without the application relying on a messy pile of off-chain services.

Neutron is presented as the piece that turns raw files into compact, verifiable “Seeds” that can live on-chain and be searched or used as logic inputs—Vanar even describes a compression example (like 25MB into 50KB) to illustrate the goal: store real-world data in a form that remains useful, not just referenced by a dead link.

Kayon is described as the reasoning layer—built to let applications query and interpret those Seeds (and other datasets) in plain language and turn the result into actions and workflows, including compliance-style checks.

Whether you love the “AI chain” narrative or hate it, this is the practical tension Vanar is trying to solve: most blockchains can execute simple conditions, but struggle with rich data and context. Vanar’s pitch is that data can become active, not passive.

Now let’s talk about why games and entertainment are not a side-quest here.

When a team has real exposure to games, entertainment, and brands, they learn something the hard way: users don’t negotiate. In a game, if onboarding is confusing, people leave. If a screen takes too long, people quit. If the experience breaks flow, they uninstall. That’s why Vanar keeps orbiting “mainstream verticals” like gaming and metaverse experiences—those environments punish bad UX immediately.

This is where ecosystem products matter. Vanar is often linked publicly with Virtua Metaverse and the VGN games network as examples of real consumer-facing experiences being built around the chain.

And there’s a more direct signal in a recent official update from Virtua: they described a migration path where existing NFTs would be mirrored/airdropped onto Vanar as upgraded assets (framed as “Neutron NFTs”), which is basically the ecosystem saying, “We’re not just partnering—we’re moving state onto this chain.”

This matters because it turns Vanar from an idea into a place where users might actually arrive for a reason other than speculation.

So where does $VANRY fit, without fluff?

A token becomes “real” when it turns into a habit. The best utility is the kind that quietly repeats every day.

From Vanar’s documentation, $VANRY is positioned as the native token used for transaction fees (gas) and staking to support network security.

From Vanar’s own Neutron product page, $VANRY is also framed as a way to pay for storage with a stated benefit (for example, saving on blockchain storage costs when paying in $VANRY).

And the staking platform exists as a dedicated product endpoint, reinforcing that staking isn’t just a concept—it’s packaged as a core user action.

This is the token logic that actually makes sense to me:

If Neutron-style storage becomes something teams use repeatedly (documents, media, proofs, invoices, records), then VANRY starts behaving like “fuel” in a way you can measure.

If Kayon-style reasoning becomes something builders integrate into apps and workflows, then VANRY demand can become usage-linked instead of attention-linked.

That’s the dividing line between a token that needs constant excitement… and a token that earns relevance because people are doing real work on-chain.

You also asked for “recent updates,” so let’s keep it grounded and date-specific.

In the last couple of weeks (January 2026), multiple public write-ups and trackers highlight Vanar pushing hard on the “AI-native infrastructure” positioning, including references to an AI infrastructure launch date (January 19, 2026) and a broader emphasis that the intelligence layer is becoming the product focus.

Very recently (published February 1, 2026), a community post also reinforced the same theme—Vanar being framed as more than a basic L1 and leaning into an ecosystem that blends gaming, metaverse, AI, and brand solutions.

And as of today (February 2, 2026), market data pages show $VANRY’s live price/volume snapshot and circulating/max supply figures—useful mostly as a reality check that the token is actively traded and tracked at scale (even when sentiment swings).

My personal interpretation is this: Vanar is trying to win the next cycle by making blockchain feel less like a “ledger you visit” and more like an operating layer that quietly upgrades the experience of the apps built on it. The chain part is only the beginning. The bet is that storage (Neutron) + reasoning (Kayon) + automation (coming layers) can reduce the amount of off-chain glue developers normally need, and that reduction in complexity is what finally makes Web3 feel approachable to normal people.