Plasma is working toward a future where usability of stablecoin applications it is no longer the feeling of a workaround atop crypto infrastructure, but rather like natural payment systems that people can expect to feel confident about. At the beginning, the project makes a distinct positioning: it is not a Layer 1 with stablecoins as a secondary functionality that has to be added to an otherwise generic chain, but rather a chain built on the very concept of stablecoins as the key use-case. All its architecture, road map, and messaging are all based on that one decision.

Plasma, on a high level, retains what already works with the builders in re-evaluating what has not worked with the users. The chain is not only EVM compatible, but developers do not need any more familiar tools, libraries, or workflows and learn a completely new environment. That in itself reduces the barrier to adoption. But Compatibility is a mere beginning of Plasma. It is based on the actual flow of value after an application is put into reality with users actually transmitting dollars rather than tokens to speculate. It is aimed at rapidity of finality, limited friction and reduced points of failure between intent and settlement.

The real distinction of Plasma is what occurs on the outside of the EVM. The project records a stablecoin-native layer, which directly solves the greatest crypto-payment pain, which is gas. To a majority of users, the need to have a separate gas token in order to transfer stablecoins is cumbersome and might be too costly and unwarranted. Plasma addresses this by a protocol-controlled paymaster and relayer flow which allows basic sends of gasless USDT transfers. Notably, this sponsorship does not entail open-ended sponsorship. It is purposefully limited, restricted, and centered on immediate transfers, and provisions made to curb abuse. Such a balance between usability and control is the main theme of the philosophy of Plasma.

In addition to gasless transfers, stuck coins Plasma also records support of paying network fees in stablecoins using custom gas token mechanics. This is a bare-faced effort of breaking the psychological and functioning wall that makes stablecoins feel like ordinary money. Onboarding becomes much easier when users are able to send dollars without acquiring another asset. In the case of payment apps, that simplicity is multiplied with a smaller number of failed transactions, better UX, and increased conversion rates.

The theory-practice shift was marked by the official release of the mainnet beta of Plasma and the release of its native token, called XPL, planned to be released in September 25, 2025. When first launched, Plasma stated about 2 billion dollars of stablecoins on the network are in circulation, with deployments by DeFi partners to offer instant liquidity and utility. Regardless of whether one is payment-oriented, settlement-oriented, or programmable finance, such initiation activity implies that Plasma does not play in a vacuum. It is attempting to fulfill actual demand on the first day.

Even the token system is presented in an open document. Mainnet beta initial credit supply is pegged at 10 billion XPL. TheLockup period of the US public sale participants is 12 months, it is completely unlocked in July 282026. The transparency of timing is important. It enables those involved to rationally consider supply workings, instead of making educated suppositions, and helps solidify the greater trend of Plasma accomplishing infrastructure as predictable and not a mystery.

The reason the approach of Why Plasma is relevant is made clear when considering the current use of the stablecoins. Stablecoins are already transferring value in the world in a very huge scale, but the practice remains like crypto. Transfers are slow, fees unpredictable and user flows are fragile. Plasma is explicitly attempting to bring the usage of stablecoin nearer to the expectations of conventional payments but maintain the openness and programmability of blockchain systems. When that is successful, not only will it result in a better chain, but it will also mean a better basis of payroll, merchant payments, remittances, and internal business settlements.

This focus is supported by the roadmap. The documentation of Plasma signifies that it has a coverage of a wider range of stablecoins in the long run, which will implement more than just the initial flows of USDT without compromising safety and control. A specific area of focus is the optional module of confidential payments which is rather remarkable to study. It is specifically oriented to such use cases as payroll and business settlements, when full transparency can be a significant liability not an asset. Plasma is attempting to introduce a pragmatic ethos by marketing confidentiality as a choice, not compulsory, and the costly emphasis on auditability as a necessity and the inexpensive emphasis on privacy as a necessity.

Later-stage mechanisms also include the actors of validator decentralization and staking. This is the sequencing that is deliberate. Plasma has shown that its first concern is the stability of the operations and reliability of the payment, and then it proceeds with expansion of the participation and governance. It is more of a mentality with rollouts of traditional infrastructure rather than the speculative crypto rollouts. Test the rails, see that they work, and widen the rails.

Plasma has a strong focus on movement as opposed to lock-in, as viewed through an exit and mobility angle. In the messaging of the chain, the assumption has always been that the capital will not be stagnant, it has to move. Plasmascan and the documentation team validate the notion of a payments chain that should be utilized on the daily basis. To any spectator who observes the supply movements the unlocking of the purchase of the US public sale on July 28, 2026, is as solid a commit as it can be, not an open-ended one.

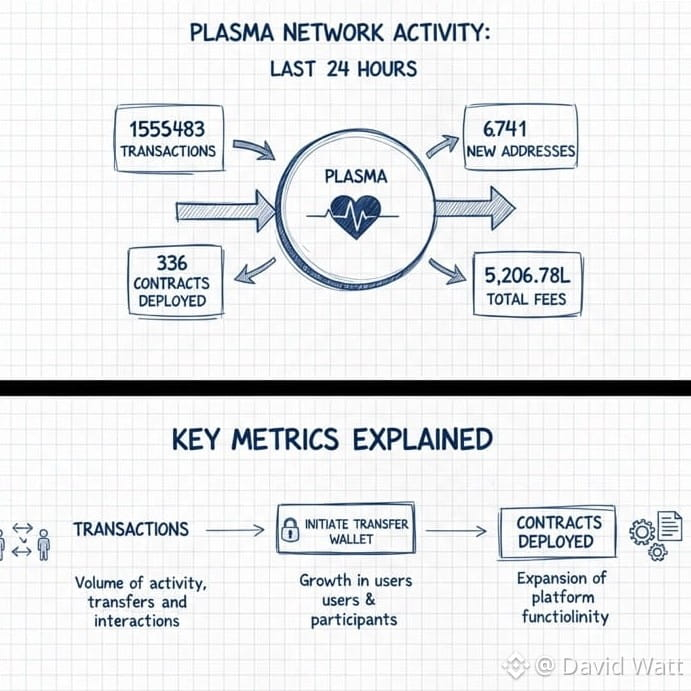

Onchain information comes in recently to add a layer of the story. The explorer demonstrates over 155,000 transactions by the end of the past 24 hours, almost 4,800 new addresses, 236 contracts deployed, and slightly more than 5,200 XPL as the transaction fees paid during the last 24 hours. All these are numbers of not hype cycles, but heartbeat. They demonstrate a network that is being practiced, trialed and finally embedded into actual workflows.

Finally, Plasma is not pursuing loud dominance. It is seeking silent relevance in terms of usability. Plasma enables the base layer to implement stablecoin transfers in an effortless way and ensure finality is always fast, thereby eliminating the necessity for application teams to fix UX and fee issues downstream. Provided the chain persists in shipping meticulously and ageing without breaching these guarantees, it stands a viable probability of becoming a settlement layer, which payments teams can rely on. It is in an environment where novelty is probably the order of the day that Plasma can find itself at the center of its greatest strength with its bet on normality.