There is a very specific kind of anxiety that comes with sending money when you really need it to arrive. It sits in the chest like a held breath. You press “send,” and then you wait. You refresh. You wonder if you typed something wrong. You imagine explanations you might have to give if it doesn’t go through. For people who live comfortably inside fast banks and forgiving systems, this feeling is easy to forget. For everyone else, it is routine. Plasma exists in that emotional space — not as a flashy invention, but as a response to a feeling people have carried for far too long.

Money is supposed to be boring. When it works, nobody talks about it. When it doesn’t, it dominates lives. Yet so much of blockchain infrastructure has been built as if money were a side effect rather than the point. Users are asked to understand gas, tokens, chains, delays, and confirmations — layers of abstraction piled on top of something as basic as “I need to send value to another human being right now.” Plasma feels like it begins with a different question, one that sounds less technical and more personal: what does it feel like to trust a payment?

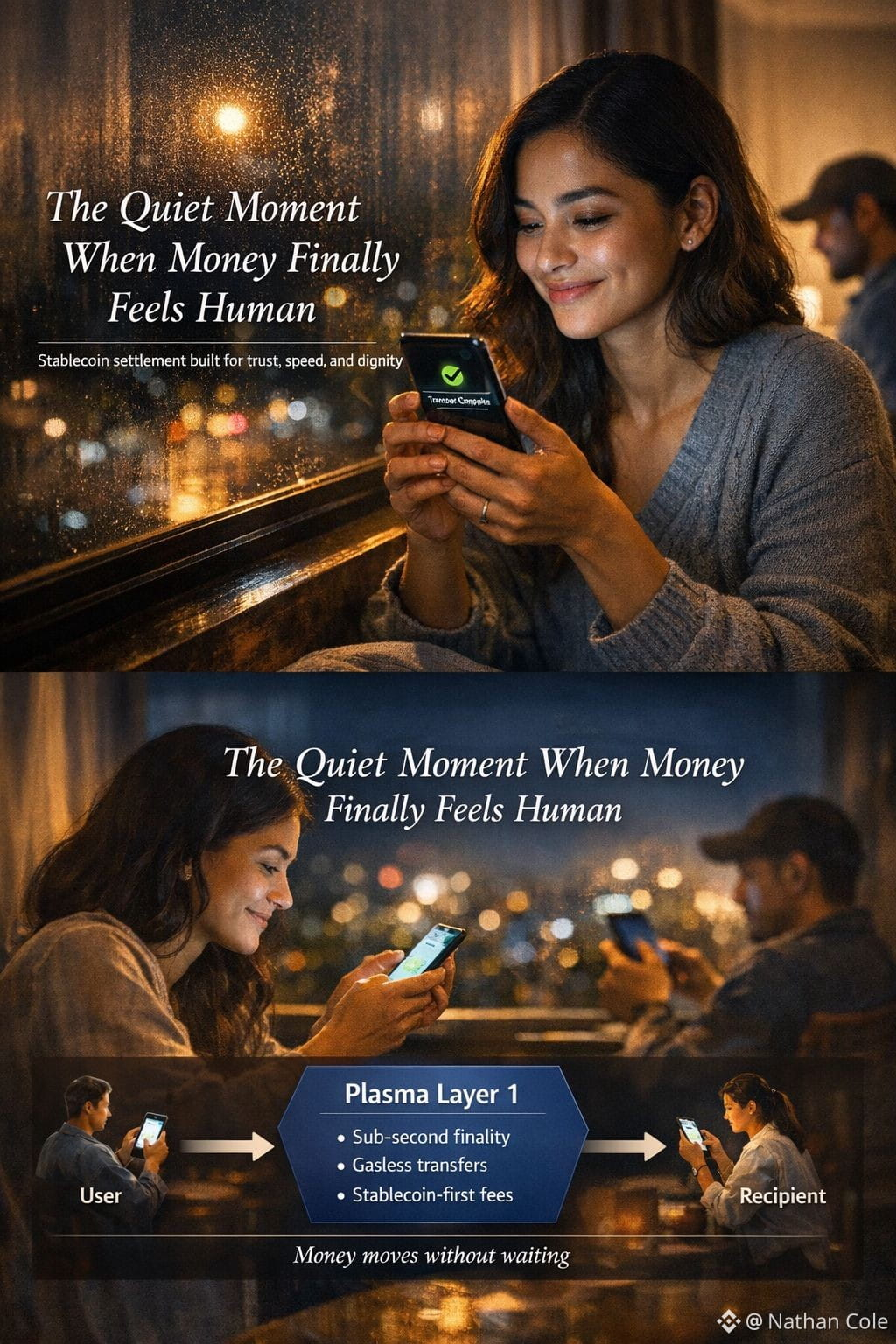

The answer is not found in whitepapers alone. It is found in moments. A mother sending rent late at night. A merchant deciding whether to release goods. A worker waiting on a payment that determines whether tomorrow feels stable or fragile. Plasma’s design choices — gasless USDT transfers, stablecoin-first fees, sub-second finality — are not impressive because they are clever. They are impressive because they remove pauses. They remove doubt. They remove the tiny humiliations that accumulate when systems make people feel small or confused for trying to move their own money.

There is something deeply human about refusing to make users buy a volatile token just to move a stable one. That requirement, common elsewhere, quietly tells people that the system is not for them unless they adapt to it. Plasma reverses that relationship. It adapts to how people already think about value. Dollars feel like dollars. Sending them feels like sending, not like negotiating with a machine. That subtle respect for mental simplicity is an emotional design choice, even if it wears the clothing of infrastructure.

Under the surface, the machinery is serious, almost austere. Full EVM compatibility is not about trend-following; it is about continuity. It means builders don’t have to abandon what they know to participate. It means existing tools, habits, and instincts still apply. The choice of a high-performance execution environment and a fast, final consensus system is not about winning speed contests. It is about shortening the distance between intention and certainty. The faster money becomes final, the faster fear dissolves.

Finality changes behavior. When people trust that a transaction is truly done, they move on. They stop hovering over screens. They stop second-guessing. That psychological release is rarely discussed in crypto, but it is everything in payments. Plasma seems to understand that settlement is not a number on a dashboard; it is a moment when tension resolves.

Even the decision to anchor security to Bitcoin carries an emotional undertone. It is a nod to permanence, to something widely regarded as hard to coerce and harder to erase. In a world where financial systems often bend under pressure, anchoring to something stubborn is a way of saying: this ledger should not change just because someone powerful wishes it to. It is not romantic decentralization. It is pragmatic reassurance.

What makes Plasma resonate is not that it tries to be everything. It doesn’t. It chooses. It chooses stablecoins. It chooses payments. It chooses the unglamorous work of reliability. In doing so, it quietly aligns two very different worlds. On one side are everyday users in places where stablecoins are not experiments but lifelines. On the other are institutions that care deeply about guarantees, audits, and deterministic outcomes. Plasma speaks to both without changing its tone, because at the core, both want the same thing: money that behaves predictably.

Of course there are risks. Specialization always carries them. Complexity hides in relayers and paymasters. Governance choices matter. Anchors add dependencies. But these risks feel acknowledged rather than ignored. They are the risks of someone who knows what they are building and why, not someone chasing novelty for its own sake.

What lingers after thinking about Plasma is not excitement in the usual crypto sense. It is something quieter. A sense of relief. The idea that one day, sending stablecoins might feel as ordinary as handing someone cash, without the mental overhead, without the background fear. That success would look invisible. People would stop talking about the chain. They would simply trust it.

In a space obsessed with being seen, Plasma seems content to disappear into usefulness. And maybe that is the most emotional promise of all: a future where money moves without drama, without friction, without asking people to be brave just to participate.