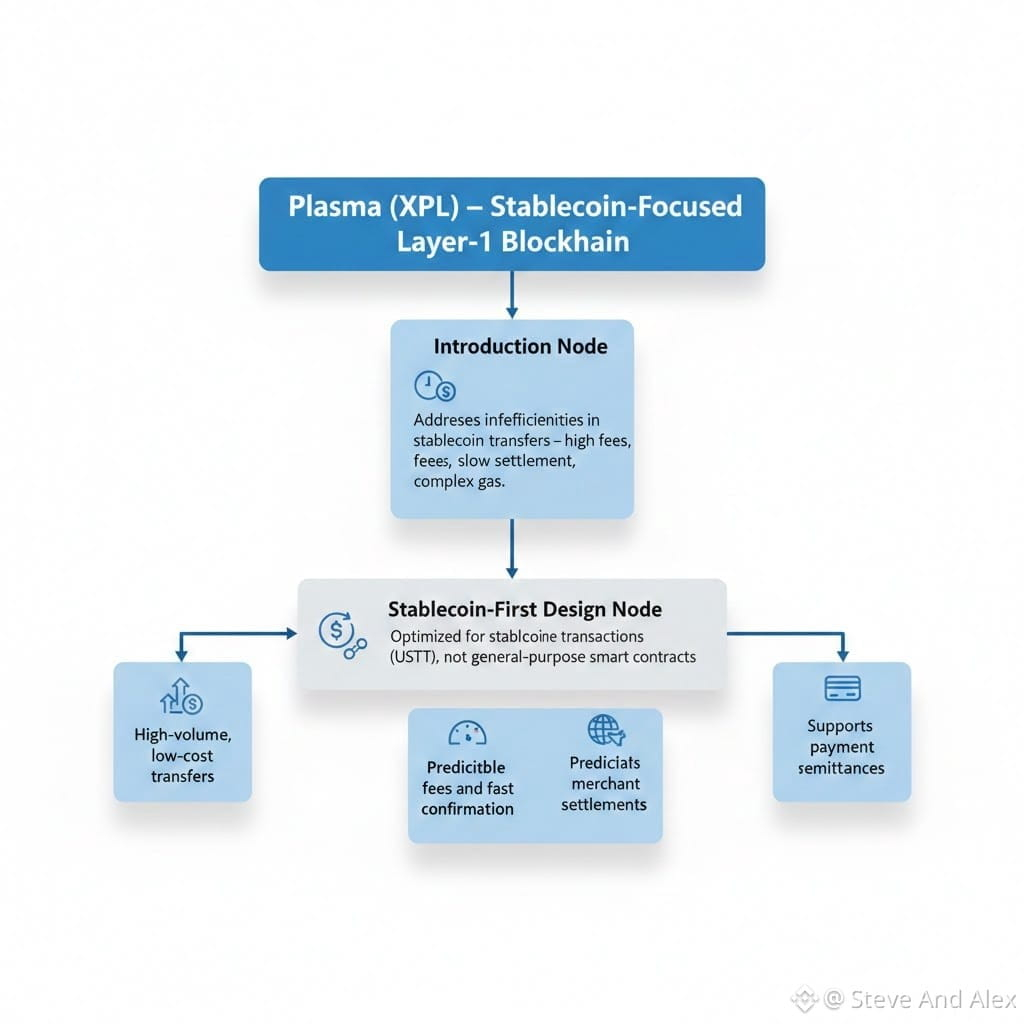

Introduction:

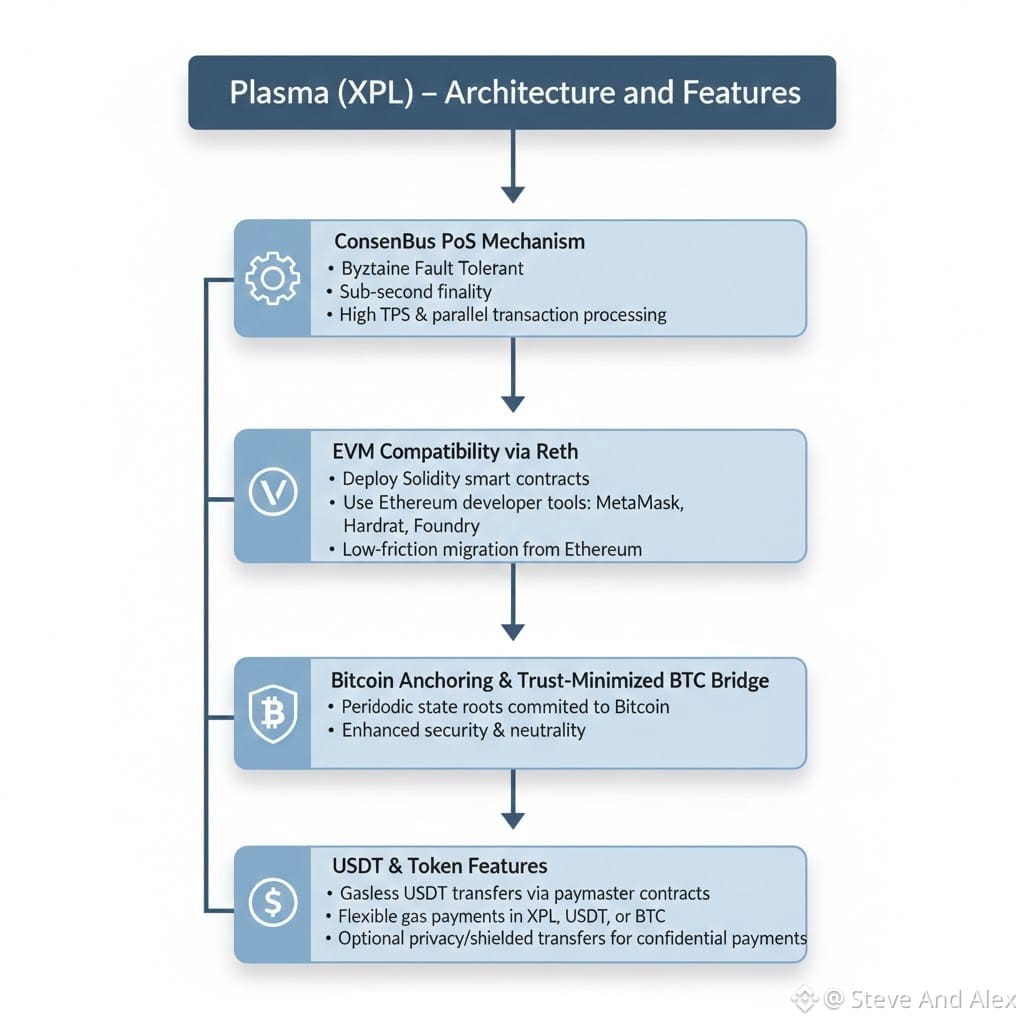

In late 2025, the Plasma XPL blockchain emerged as one of the most significant Layer-1 launches in the cryptocurrency ecosystem, primarily due to its stablecoin-centric design and innovative tokenomics. Since the launch of XPL, the market and analyst community have closely watched how the token’s allocation, vesting schedule, and ecosystem incentives are structured — as these factors play a defining role in long-term adoption, network security, and sustainable growth.

This article provides an up-to-date examination of XPL’s token model and funding strategy based on the most recent developments from exchange listings, public sales, market capitalisation milestones, and ecosystem funding mechanisms.

XPL Token Launch and Initial Market Response:

The native token of the Plasma blockchain, XPL, debuted with a significant market presence. On its launch day, XPL achieved a multi-billion dollar market capitalisation, crossing over $2.4 billion soon after mainnet beta and exchange listings, particularly on major platforms such as Binance and OKX.

This initial market valuation reflected strong demand from both retail and institutional participants, driven by the anticipation of Plasma’s stablecoin-optimized blockchain. Within the first hours of trading, XPL’s price action suggested high liquidity and active market participation, factors that strongly influence early ecosystem dynamics.

Public Sale and Initial Distribution:

Before listing on exchanges, Plasma conducted a public sale of XPL tokens, which was significantly oversubscribed. The public sale was reported to have drawn demand exceeding 7 times its available allocation in minutes, with large stablecoin commitments from whales and institutional participants during the deposit campaign.

This engagement not only demonstrated strong community interest but also contributed materially to initial liquidity and token circulation. Public sales serve as both a distribution mechanism and a tool to decentralise early token ownership, which can reduce concentration risk and support broader ecosystem participation.

Exchange Listings and Strategic Accessibility:

A crucial step in XPL’s ecosystem rollout was securing listings on several major exchanges. The token was listed on leading platforms, including Binance and OKX, on the same day as the mainnet launch, which significantly increased global accessibility for traders and holders.

Exchange listings are important to any new blockchain token for several reasons:

Liquidity Provision: Listings on major exchanges typically improve trading volume and depth, which helps reduce slippage and supports price discovery.

Wider Reach: Users can interact with XPL through familiar interfaces and trading pairs (e.g., XPL/USDT), broadening the potential holder base.

Support for Ecosystem Incentives: Exchange pairs and promotions often enable additional incentive mechanisms like staking, launch pools, and yield programmes.

In the context of Plasma’s token allocation, exchange support plays a role in determining how tokens move from vesting schedules into active circulation while maintaining orderly market conditions.

Token Allocation: Design and Strategic Purpose:

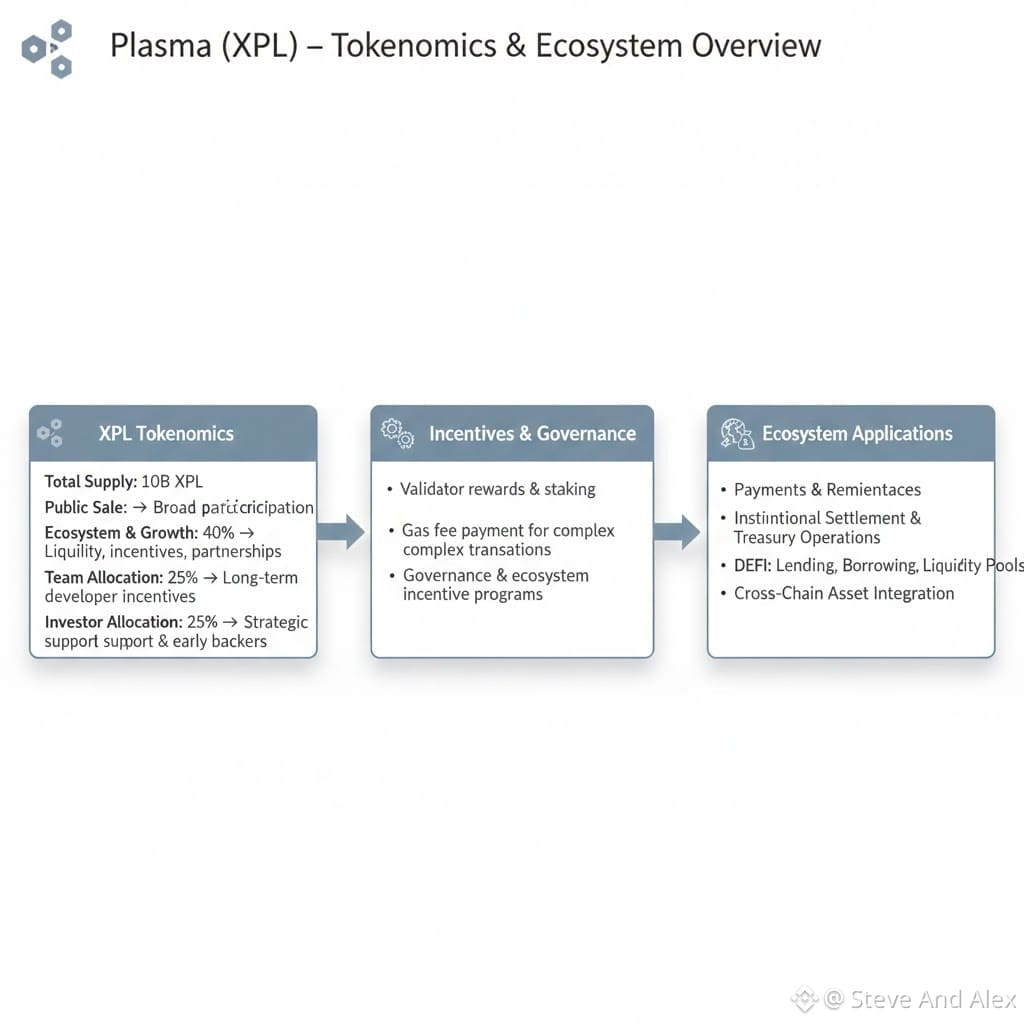

Although Plasma’s whitepaper and official tokenomics documentation outline a 10 billion XPL total supply, it is the allocation strategy and unlock schedule that define how this supply influences ecosystem growth and sustainability.

While detailed vesting information was published separately by project documentation, recent market analysis and reports indicate the following major categories of XPL allocation:

Public Sale (10% of total supply): Designed to enable broad participation and early decentralisation through deposit campaigns and retail access. Ecosystem & Growth (40%): A significant portion reserved to fund liquidity, partnerships, incentive programmes, and strategic initiatives that support network expansion.Team Allocation (25%): Set aside for core developers, contributors, and long-term incentives. This amount is typically subject to vesting schedules to align team incentives with long-term success.

Investor Allocation (25%): Reserved for early backers and strategic investors that supported the project before launch. This distribution model aims to balance early decentralisation, growth funding, and long-term alignment between project contributors and ecosystem stakeholders.

Ecosystem Funding and Gradual Unlocks:

Recent analyses of XPL’s token mechanics show that tokens allocated for ecosystem growth are not released all at once. Specifically, a portion of the ecosystem allocation (e.g., 8%) was unlocked at mainnet beta to facilitate initial liquidity and incentive programmes, while the remainder is subject to a controlled monthly unlock over the next three years. This staged release is an intentional design choice to ensure that:

Liquidity incentives can be maintained over time without causing sudden supply shocks.

Partnerships and integration programmes have a funding runway that sustains them beyond launch hype.

DeFi incentives can be deployed strategically to attract users and protocols to the Plasma network.

Such phased vesting and unlock schedules are standard within professional token economic models and serve to stabilise markets while aligning incentives for growth.

Airdrop and Community Incentives:

In addition to allocation and vesting, Plasma’s ecosystem funding strategy includes targeted airdrop and engagement campaigns. For example, early participation incentives were made available via specific exchange programmes, where participants earned XPL through yield products and savings programmes.

These mechanisms serve several purposes:

Reward early community support.

Encourage users to explore network functionality.

Build momentum in specialised user segments such as stablecoin holders or DeFi participants.

By incorporating community incentives into its broader allocation strategy, Plasma enhances engagement without relying solely on standard unlock and vesting schedules.

Market Performance and Narrative Context:

Beyond purely technical token distribution, the market reception post-launch offers valuable context. XPL’s listing and initial price action — including rapid valuation and significant trading volume — reflect how allocation strategy and ecosystem awareness translate into real market behaviour.

Reports showed XPL reaching multi-billion-dollar market capitalisations shortly after trading began. This market response is an important indicator of investor and user confidence following the implementation of Plasma’s funding model.

Conclusion:

Plasma’s approach to token allocation and ecosystem funding represents a well-structured attempt to balance early adoption, long-term incentives, market stability, and community participation. By allocating a substantial share of XPL to ecosystem growth, structuring vesting and unlock schedules, and supporting engagement through external programmes, Plasma aims to ensure sustained development beyond the mainnet debut.

While the path from launch to mature ecosystem remains long, these initial moves in allocation and funding design provide a transparent foundation for future expansion across stablecoin payments, liquidity incentives, and network utility.