Here’s a **detailed analysis of why the STX (Stacks) price has recently *pumped*** — useful for your Binance **Square post**, written in a clear, data-driven format:

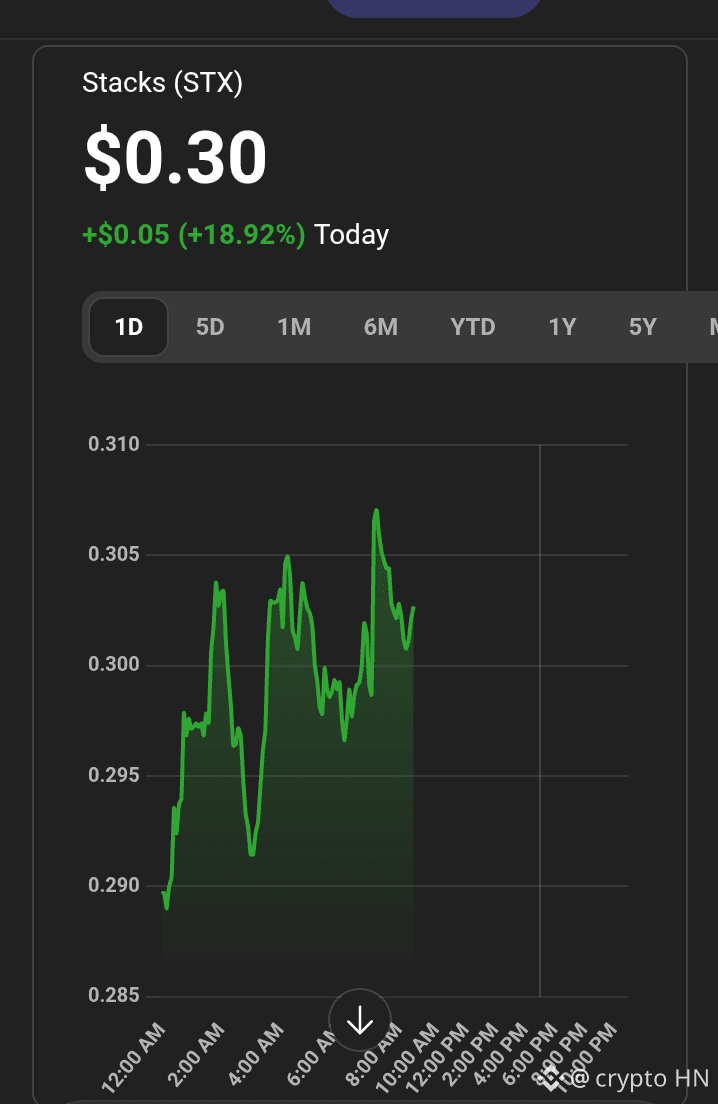

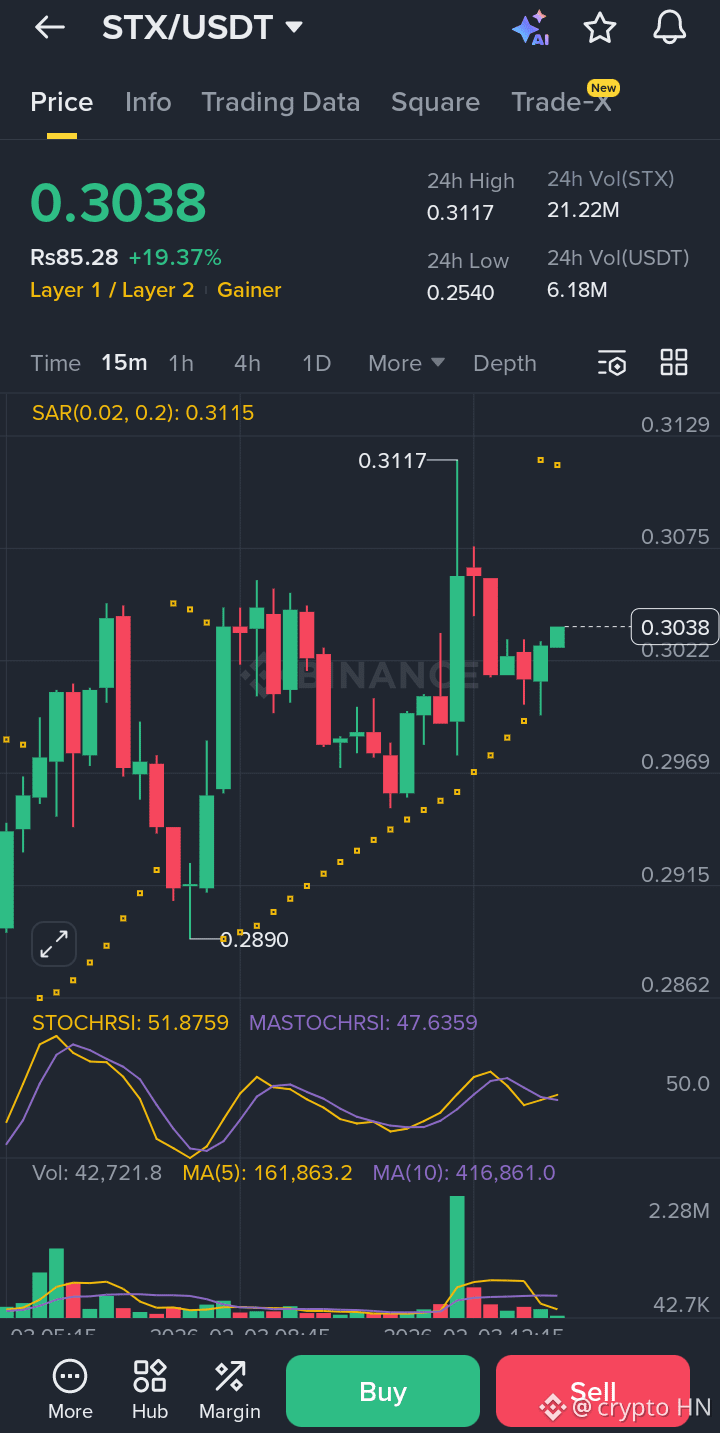

## Stock market information for Stacks (STX)

* Stacks is a crypto in the CRYPTO market.

* The price is 0.302689 USD currently with a change of 0.05 USD (0.19%) from the previous close.

* The intraday high is 0.307836 USD and the intraday low is 0.25436 USD.

## 🧠 **1. Broad Market Context**

$STX isn’t moving in isolation — **crypto markets are showing renewed strength overall**, with Bitcoin and major altcoins recovering after recent dips, which tends to lift correlated assets like STX. ([Coin Gabbar][1])

**Why this matters:**

* Altcoins often follow **Bitcoin’s momentum** — when BTC stabilizes or rallies, speculative money rotates into higher-beta plays like STX.

* Market sentiment improves, boosting trading activity and volume in many smaller tokens.

---

## 🚀 **2. On-Chain & Market Signals (Technical Drivers)**

Strong technical data is supporting the rally:

### 📈 Rising Trading Volume & Open Interest

Recent on-chain data shows **a surge in trading volume** and **exchange open interest for STX**, indicating *new capital entering the market* rather than short-covering. This is a classic bullish signal. ([FXStreet][2])

> **Volume jumped** dramatically — one of the highest levels this year.

**Why it matters:**

* High volume with price up = buy pressure.

* Rising open interest signals fresh positions, not just profit taking.

### 📊 Technical Breakouts & Momentum

* STX **broke above key trendlines and EMAs**, signalling a bullish trend shift. ([FXStreet][2])

* RSI and MACD patterns still showing room for continuation. ([FXStreet][2])

This means short-term traders see the breakout as *trend confirmation* and are adding positions.

---

## 🛠 **3. Fundamental Catalysts (Long-Term Drivers)**

### 🧾 Institutional & Product Adoption

Recent developments are strengthening STX’s real-world utility and capital access:

**🔹 21Shares ASTX ETP launch:**

A regulated investment product that lets institutions get STX exposure with automatic Bitcoin staking rewards — lowering barriers for big money. ([CoinMarketCap][3])

**🔹 WalletConnect integration:**

Expands stacking participation to **45M+ wallet users**, increasing network demand. ([CoinMarketCap][3])

**🔹 Yield and DeFi strategy discussions:**

Institutional panels highlight new yield products and risk frameworks — building confidence. ([CoinMarketCap][3])

---

## 🔗 **4. Bitcoin Ecosystem Synergy**

STX is uniquely tied to Bitcoin’s ecosystem through **Proof of Transfer (PoX) and Bitcoin-earned stacking rewards**.

* As BTC strength returns, *investors seek Bitcoin-aligned altcoins* like STX — especially since stacking gives BTC rewards.

* Historical analysis shows STX strongly correlates with Bitcoin price action. ([AMBCrypto][4])

So when **BTC gains or stabilizes**, STX often follows — sometimes with higher leverage.

---

## 📌 **5. Narrative & Sentiment Drivers**

Several key narratives are helping sentiment:

### 🔹 Altcoin rotation

When Bitcoin dominance stabilizes or dips, capital often flows into promising altcoins — including STX. ([Decrypt][5])

### 🔹 Dip accumulation

Many traders see recent lows as support zones and are *buying the dip*, which accelerates price rebounds once volume increases. ([Coinpedia Fintech News][6])

### 🔹 Ecosystem growth

Work on **sBTC, USDC integration, Clarity upgrades, and cross-chain utility** improves long-term use cases — a bullish narrative for holders. ([CoinMarketCap][3])

---

## ⚠️ **6. Risks & Bearish Considerations**

It’s important to balance the bullish case with risks:

* Some analysts still see the broader trend as bearish below long-term MAs. ([Traders Union][7])

* Price remains capped under major resistance levels. ([Coinpedia Fintech News][6])

* Long-term adoption still needs active DeFi use and TVL growth.

---

## 📊 **Summary — Key Reasons STX Pumped**

| Driver | Influence |

| ---------------------------------------------- | --------- |

| **BTC recovery & broader market strength** | ⭐⭐⭐⭐ |

| **High trading volume + open interest growth** | ⭐⭐⭐⭐ |

| **Technical breakouts (EMA, trendlines)** | ⭐⭐⭐ |

| **Institutional products & integrations** | ⭐⭐⭐ |

| **Narrative & stacking demand** | ⭐⭐⭐ |

**Bottom line:** STX’s pump is a *mix of macro crypto strength, fresh technical upside, and expanding fundamental adoption*. Investors respond to multi-layer signals — not just one.

---

If you want, I can **turn this into a tweet thread or Binance Square post format with hashtags and emojis**!

[1]: https://www.coingabbar.com/en/crypto-currency-news/overall-crypto-market-update-feb-3-btc-eth-up-today?utm_source=chatgpt.com "Crypto Market Today Rebounds As BTC Hits $79K, ETH Gain 1.6%"

[2]: https://www.fxstreet.com/cryptocurrencies/news/stacks-price-forecast-stx-soars-20-as-btc-surpasses-88-000-202504220424?utm_source=chatgpt.com "Here is why STX is rallying"

[3]: https://coinmarketcap.com/cmc-ai/stacks/latest-updates/?utm_source=chatgpt.com "Latest Stacks News - (STX) Future Outlook, Trends & Market Insights"

[4]: https://ambcrypto.com/stx-and-bitcoin-a-0-86-correlation-signals-big-moves-4-rally-next/?utm_source=chatgpt.com "STX and Bitcoin: A 0.86 correlation signals big moves – $4 rally next?"

[5]: https://decrypt.co/337245/altcoin-season-alts-soaring-bitcoin-ethereum-price-analysis?utm_source=chatgpt.com "Altcoin Season? These Coins Are Soaring as Bitcoin and Ethereum Take a Breather"

[6]: https://coinpedia.org/price-analysis/why-stacks-price-is-rising-today-factors-that-could-support-a-move-toward-0-50?utm_source=chatgpt.com "Why Stacks Price Is Rising Today: Factors That Could Support a Move Toward $0.50"

[7]: https://tradersunion.com/news/cryptocurrency-new

s/show/1378200-stacks-surges-10-52percent-today/?utm_source=chatgpt.com "Stacks price jumps — what’s behind today’s move"

#StaySafeCryptoCommunity #GoldSilverRebound #StrategyBTCPurchase I#USPPIJump #PreciousMetalsTurbulence