🧠 Short Intro

Pendle (PENDLE) is the native token of Pendle Finance, a decentralized finance (DeFi) protocol that lets users tokenize and trade future yield — meaning you can break apart future interest or rewards from an asset and trade or hedge those returns onchain.

📌 What Pendle Does

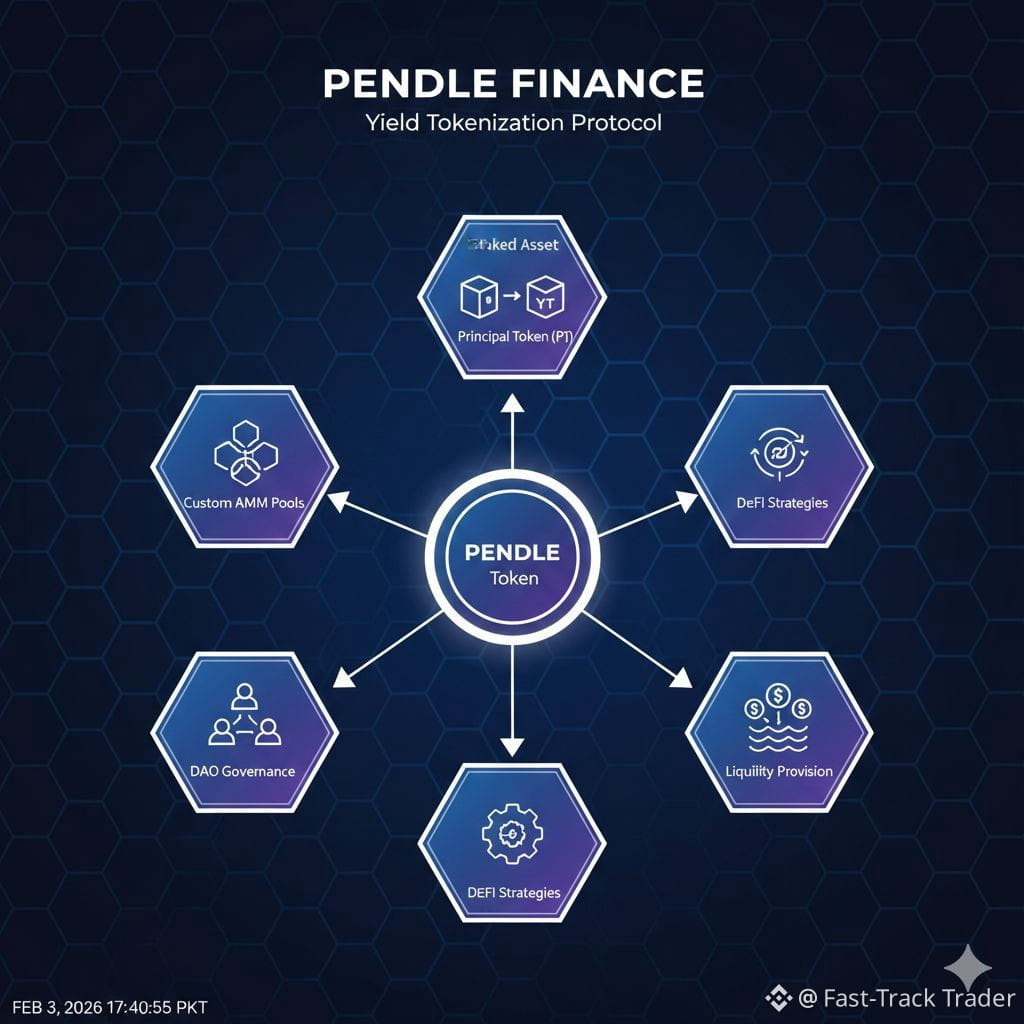

Pendle Finance introduces a new way to manage returns in DeFi by separating a yield‑bearing asset into two parts:

• Principal Token (PT) — represents the original asset value redeemable later.

• Yield Token (YT) — represents the future earnings (interest or yield) of that asset.

Users can trade these separately on Pendle’s custom Automated Market Maker (AMM), creating markets for fixed yield and variable yield strategies.

PENDLE token is the core utility and governance token of the protocol. Holders use it to:

• Govern the system and vote on key protocol decisions.

• Stake for rewards through models like vePENDLE or its newer sPENDLE liquid staking variant.

• Participate in liquidity incentives and share in protocol revenue.

Pendle operates across multiple major blockchain networks including Ethereum, Arbitrum, BNB Chain, Optimism, and others, making it widely accessible in DeFi.

📚 How Pendle Works (Simple Explanation)

📌 Yield Tokenization: You deposit a yield‑bearing asset (like a liquid staking derivative). The protocol wraps it into a standardized format then splits it into a PT and YT.

📌 Trading Yield: Traders can buy or sell future yield independently of the principal — allowing strategies like locking in a fixed return or speculating on yield changes.

📌 Special AMM: Pendle’s marketplace is optimized to handle assets whose value changes over time (because future yields diminish as maturity approaches).

In 2026, Pendle began shifting from a long‑term locked vePENDLE governance model toward a more liquid staking model (sPENDLE) with shorter unstaking periods and revenue buybacks to distribute to stakers, making incentives more accessible.

📊 Why PENDLE Matters

• Brings advanced yield tools to DeFi: Users can manage and trade future income streams rather than waiting for rewards to accrue.

• Supports hedging and risk management: Traders can tailor exposure to yield rates — a step toward sophisticated financial products onchain.

• Governance & revenue share: Token holders influence protocol direction and may earn rewards from fees and buybacks through newer staking models.

• Cross‑chain presence: Pendle’s architecture spans multiple networks, helping spread liquidity and adoption across DeFi ecosystems.

• Strong TVL growth: Pendle’s decentralized yield markets have attracted billions in total value locked as the ecosystem evolved.

⭐ Key Takeaways

• Pendle is a DeFi protocol that lets you tokenize and trade future yield, splitting assets into principal and yield tokens.

• PENDLE token is used for governance, incentives, liquidity rewards, and revenue sharing.

• The system’s custom AMM and yield token mechanics create new financial opportunities in decentralized markets.

• Recent upgrades like sPENDLE aim to improve staking flexibility and reward distribution.

• Pendle plays a growing role in DeFi’s evolving yield landscape — not just pure speculation.

#Pendle #PENDLE #DeFi #YieldTokenization #Blockchain $PENDLE