The precious metals market is currently experiencing its most volatile week since the 1980s. After reaching astronomical lifetime highs in late January, both Gold and Silver have entered a "liquidity wipeout" phase that has left traders on edge.

📉 The Flash Crash Breakdown

On Friday, January 31, the market witnessed a "black swan" event. Gold recorded its steepest one-day decline in over a decade, while Silver saw an unprecedented plunge of nearly 30% in a single session.

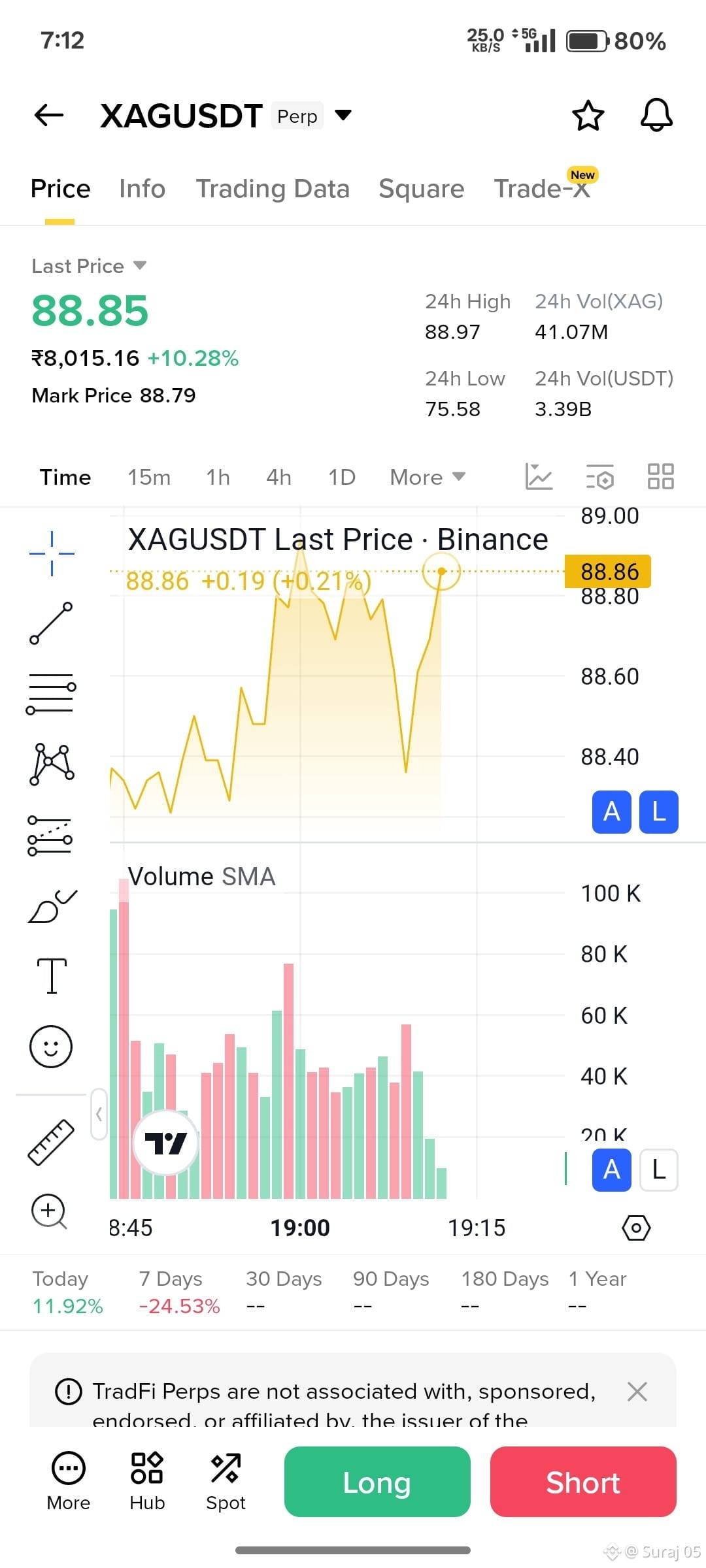

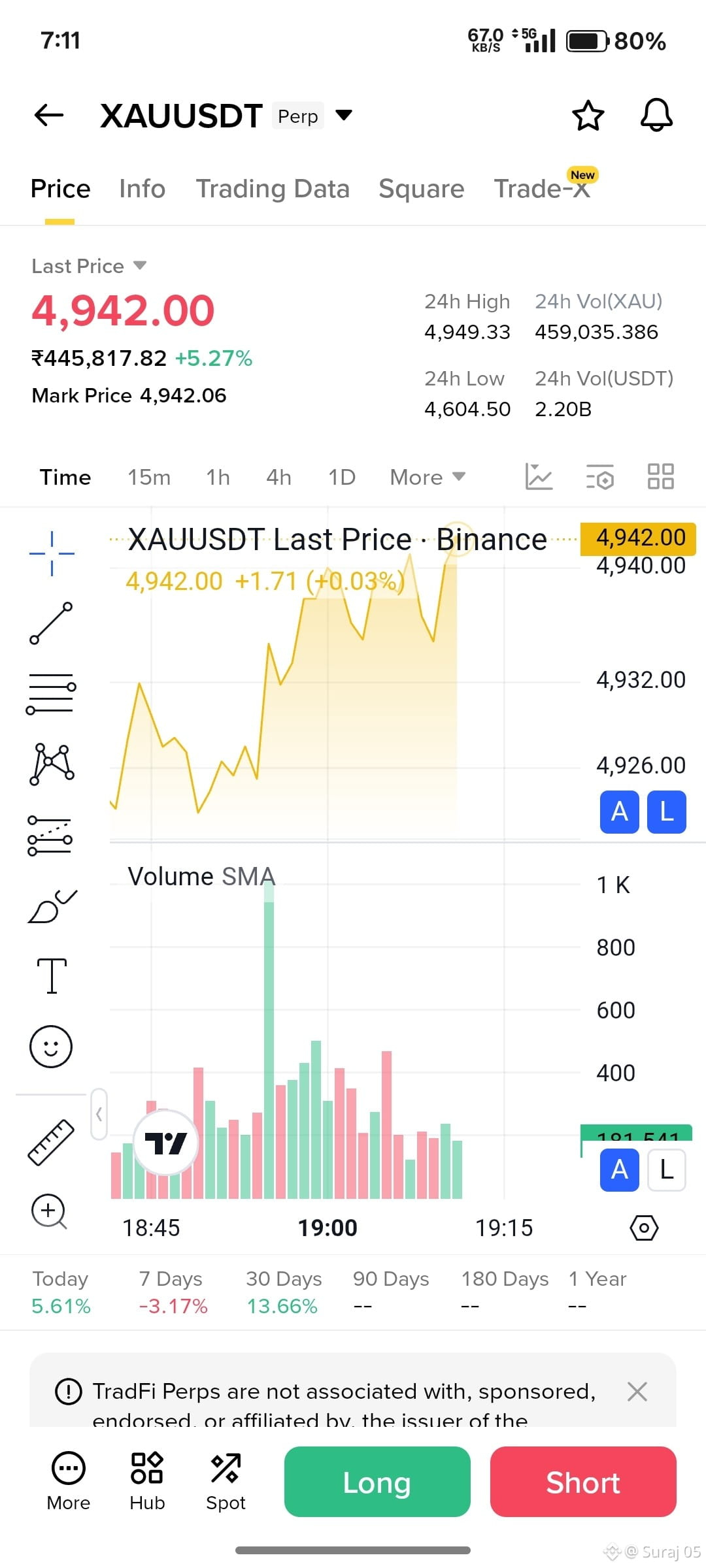

As of today, February 3, 2026, the dust is still settling:

Gold (MCX): Trading near ₹1,53,160 per 10g, down from its peak of over ₹1.80 lakh.

Silver (MCX): Hovering around ₹2,80,000 per kg, a massive correction from the ₹4.20 lakh mark reached just days ago.

Global Spot Gold: Hovering near $4,780/oz, struggling against a strengthening US Dollar.

🔍 Why is this happening?

Experts point to a "perfect storm" of three major factors:

CME Margin Hikes: Major international exchanges (CME Group) hiked trading margins for Gold (up to 8.8%) and Silver (up to 16.5%), forcing over-leveraged traders to dump positions instantly.

The "Warsh" Effect: The nomination of Kevin Warsh as the next Fed Chair has fueled expectations of a hawkish "higher-for-longer" interest rate policy, boosting the USD and crushing non-yielding assets like Gold.

Post-Budget Profit Taking: In India, the Union Budget 2026 acted as a "sell-the-news" event, triggering massive profit-booking from institutional investors.

🚀 Opportunity or Trap?

While the short-term trend looks bearish due to technical damage, many analysts believe the "fundamentals remain intact." Geopolitical tensions (US-Iran and China-Taiwan) and the launch of the US "Project Vault" mineral stockpile could provide a floor for prices.

For crypto-native investors on Binance, the correlation between "Digital Gold" (BTC) and "Physical Gold" is being watched closely as capital rotates during this volatility.

#GoldPrice #SilverCrash #MarketUpdate #BullionNews #Investing2026