The professional poker player turned blockchain founder understands something fundamental about building revolutionary technology that most Silicon Valley entrepreneurs miss entirely. Making correct decisions under uncertainty doesn’t guarantee immediate success but creates statistical advantage over time that eventually compounds into transformative outcomes. Paul Faecks spent years training his mind to separate process from results where single hand outcomes matter far less than consistent application of optimal strategy across thousands of hands. This mental framework from competitive poker translated directly to crypto entrepreneurship where volatility and randomness create noise obscuring whether strategic decisions were actually sound.

The February afternoon in London when Plasma opened deposits for their pre-ICO campaign tested every ounce of that psychological training. Watching one billion dollars flood into smart contracts within ninety seconds sounds like entrepreneur’s dream scenario but for Faecks it represented most terrifying moment of his professional career. I’m describing legitimate paranoia about everything that could possibly malfunction because crypto history overflows with projects losing hundreds of millions through front-end exploits, smart contract vulnerabilities, or simple configuration errors that slip past multiple audits and code reviews. At exactly 1:58 PM he wasn’t celebrating impending success but rather scanning monitoring dashboards with cortisol spiking through his system worried about catastrophic failure in final seconds before deposit window closed.

The Institutional Bureaucracy That Drove Founder Back To Crypto’s Wild Side

The path to founding Plasma involved detour through traditional institutional crypto infrastructure that taught valuable lessons about what not to build. After graduating from Technical University of Munich and spending time at Deribit exchange contributing to derivatives market analysis, Faecks cofounded Alloy in August 2021 targeting institutional digital asset operations. The business-to-business infrastructure company promised to merge cryptocurrency capabilities with enterprise-grade compliance and operational standards that large financial institutions require before adopting new technologies. The vision made sense on paper where banks and asset managers desperately wanted crypto exposure but couldn’t accept consumer-grade tools lacking proper controls.

The reality involved endless compliance procedures where legal departments scrutinized every technical decision creating procurement delays stretching months for implementations that could technically complete within days. Corporate politics meant that technical merit mattered less than navigating internal stakeholder dynamics where various departments competed for influence over strategic technology decisions. The acquisition of Alloy eventually materialized delivering what Faecks described as fine but not incredible outcome that provided liquidity without creating transformative success story worth building toward for years. They’re representing thousands of founders who discover that serving enterprise customers often means accepting their broken processes rather than innovating new approaches that challenge institutional assumptions.

The institutional bureaucracy experience crystallized understanding that crypto’s actual value proposition involves permissionless innovation where builders create solutions without requiring corporate approval cycles. If it becomes that blockchain projects optimize for institutional comfort they inevitably recreate same friction-filled systems that decentralized technology should make obsolete. The frustration with corporate red tape pushed Faecks back toward crypto’s experimental edge where teams can ship products rapidly testing assumptions against real market feedback rather than theoretical compliance frameworks. This philosophical orientation toward speed and experimentation rather than consensus and committee approval would define Plasma’s entire development approach.

The Egalitarian Airdrop That Defied Crypto’s Wealth Concentration Norms

The September 25 2025 mainnet launch included airdrop decision that contradicted decades of crypto distribution precedent. Plasma allocated 25 million XPL tokens worth approximately 25 million dollars at launch prices to everyone who participated in pre-deposit campaign regardless of how much capital they committed. Someone depositing minimum ten cents received identical 9,304 XPL tokens valued around 8,390 dollars as whale who locked ten thousand dollars into same smart contract. This equal distribution approach directly challenged crypto’s typical model where token allocations scale proportionally with investment size creating predictable outcomes where wealthy participants capture disproportionate share of upside.

The community reaction demonstrated how accustomed crypto became to wealth-weighted systems. Multiple participants openly discussed exploiting the equal distribution by depositing small amounts across hundreds of different wallet addresses effectively generating millions of dollars in token allocations from minimal capital outlay. The gaming of system was expected and likely priced into Plasma’s decision making where team understood that flat distribution would attract both genuine small participants and sophisticated actors maximizing token capture. We’re seeing calculated trade-off where benefits of generating massive goodwill among retail investors and creating viral social media momentum outweighed costs of whales gaming multiple wallet allocation strategies.

The timing of equal airdrop hitting exactly as markets showed signs of renewed enthusiasm created self-reinforcing cycle. Half of all eligible participants claimed their tokens within three hours of mainnet going live according to Plasma’s own data demonstrating genuine engagement rather than passive farming. The immediate liquidity injection combined with emotional high of retail participants seeing substantial dollar values materialize in their wallets generated authentic excitement difficult to manufacture through traditional marketing campaigns. The airdrop design prioritized community trust and engagement over extracting maximum value from wealthiest participants representing philosophical bet that broad-based support matters more than concentrated capital from few large holders.

The Team Composition Controversy And Blast’s Shadow

The weeks following XPL’s launch saw token price decline over 43 percent from initial peaks sparking rumors and speculation about team backgrounds and insider selling. Social media allegations claimed that developers behind controversial projects Blast and Blur had migrated to Plasma bringing baggage from those tokens which had declined approximately ninety percent from their respective highs. The association with failed or struggling projects created fear uncertainty and doubt among XPL holders worried they were being used as exit liquidity for team members cashing out after disappointing prior ventures.

Faecks addressed accusations directly through public statement clarifying facts versus circulating misinformation. Of Plasma’s approximately fifty person team only three individuals had previously worked at Blast or Blur representing six percent of total headcount rather than wholesale team migration implied by rumors. The broader team composition included veterans from Google, Facebook, Square, Temasek, Goldman Sachs, and payment processor Nuvei bringing diverse technical and financial expertise to stablecoin infrastructure challenges. Adam Jacobs serving as Global Head of Payments previously worked at major crypto venues and traditional payment companies giving Plasma operational knowledge bridging both worlds.

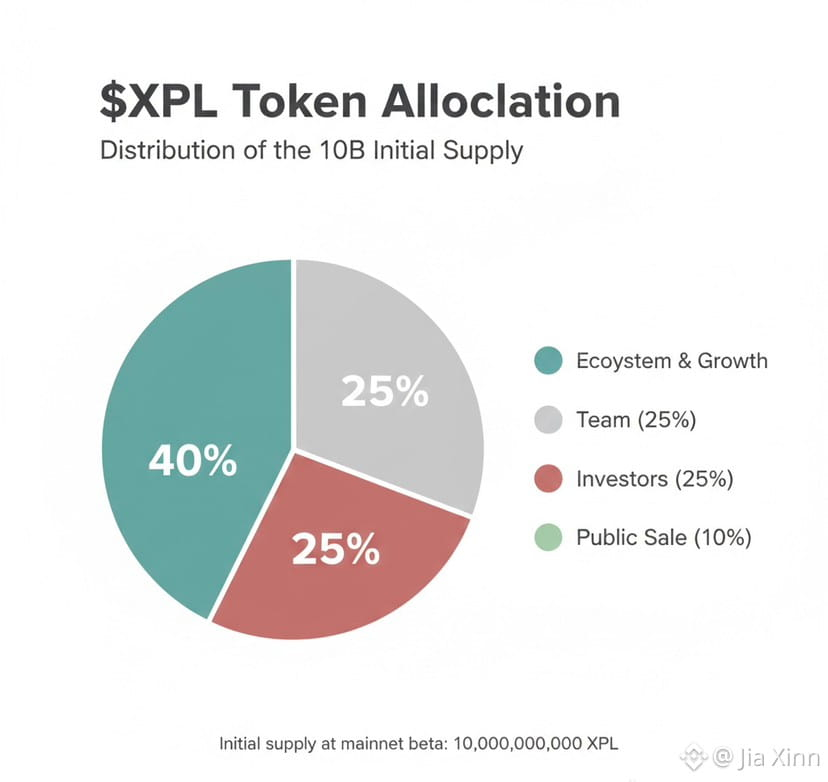

The three year token lock with one year cliff for all team members and investors represented concrete commitment signal distinguishing Plasma from projects where insiders dump holdings shortly after launch. The vesting schedule meant that neither team nor early backers could access any XPL tokens until September 2026 at earliest with remaining two thirds unlocking gradually over following two years until September 2028. This structure removed fears about sudden supply shocks from team selling while aligning long-term incentives where team’s financial success depends entirely on Plasma achieving sustained adoption rather than generating short-term price pumps before exiting positions.

The clarification about no communication or relationship with market maker Wintermute addressed separate speculation about price manipulation. Some observers noted trading patterns suggesting large coordinated buying or selling activity hypothetically linked to professional market makers engaging in strategies beyond basic liquidity provision. Faecks stated plainly that Plasma had not engaged Wintermute’s services and possessed same public information about their XPL holdings as any other market participant. The transparent communication approach contrasted with many crypto projects that ignore controversies hoping negative attention fades naturally without direct engagement potentially amplifying criticism.

The Trillion Dollar Ambition Competing Against Established Giants

The vision Faecks articulates centers on winning global stablecoin settlement positioning Plasma as default transport layer where dollar-denominated value moves between parties. The addressable market involves recapturing transaction flow currently happening across Ethereum, Tron, Solana, and other chains where hundreds of billions of dollars in stablecoin value transfers daily. Tron alone generates over two billion dollars in annual fee revenue primarily from USDT transactions demonstrating that stablecoin movement represents substantial business opportunity distinct from speculative trading or DeFi protocols.

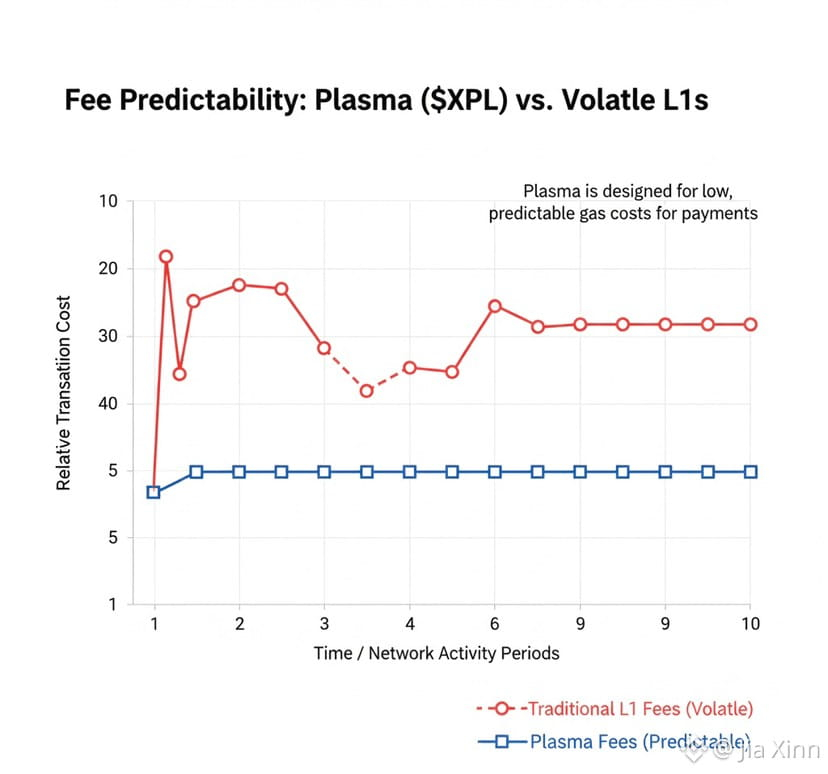

The competitive landscape involves entrenched incumbents and well-funded newcomers all targeting same stablecoin settlement opportunity. Ethereum hosts over 166 billion dollars in stablecoin supply benefiting from first-mover advantage and deepest DeFi ecosystem but suffers from variable gas fees and network congestion during peak demand periods. Tron dominates actual payment usage through consistent low-cost transactions and strong adoption in emerging markets where people use USDT as practical dollar substitute. Circle recently launched Arc blockchain creating dedicated infrastructure for USDC issuance and settlement backed by company managing second-largest stablecoin by market capitalization. Stripe acquired Bridge and announced Tempo payments infrastructure leveraging their existing merchant relationships and distribution advantages.

The speculative possibility of technology giants like Google entering stablecoin infrastructure represents existential threat that dwarfs competition from other crypto projects. If Google decided to integrate stablecoin payments directly into existing products leveraging billions of users across Gmail, Android, YouTube and other properties they could achieve mainstream adoption overnight that niche crypto platforms require years to build gradually. The same applies to Apple, Meta, or Amazon where existing user bases and distribution channels provide insurmountable advantages over standalone blockchain projects fighting for attention and adoption.

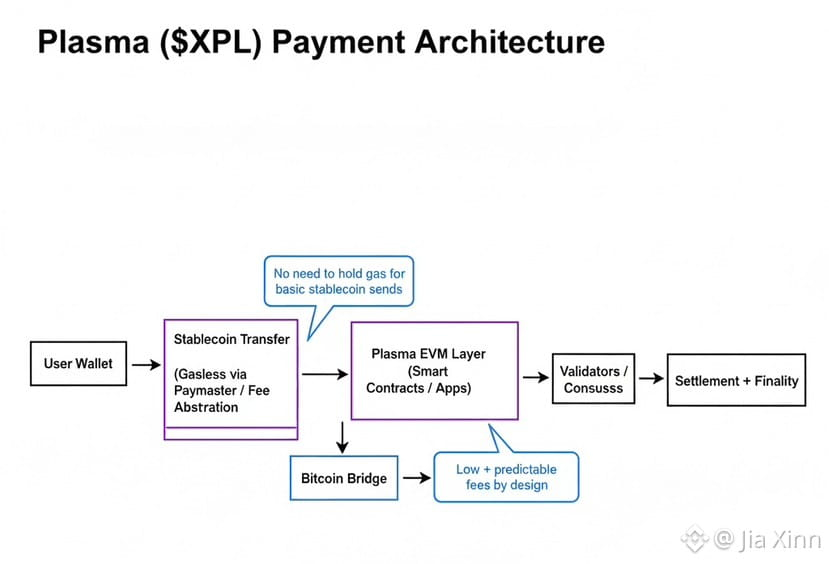

Plasma’s counter to established competition involves purpose-built infrastructure optimized specifically for stablecoin transactions rather than general-purpose blockchain attempting to serve multiple use cases simultaneously. The zero-fee USDT transfers for simple transactions eliminates friction point that prevents mainstream adoption where normal people won’t prepay for gas fees before sending money. The EVM compatibility means developers can deploy existing Ethereum applications without rewriting code from scratch lowering barriers to ecosystem expansion. The backing from Tether through both corporate investment and CEO Paolo Ardoino’s personal participation creates strategic relationship potentially influencing where USDT issuer directs users through wallet integrations and exchange partnerships.

Contemplating Whether Poker Mindset Translates To Infrastructure Endurance

Looking several years forward the test involves whether Plasma can sustain momentum converting initial launch enthusiasm into durable competitive position within stablecoin infrastructure landscape. The equal airdrop and community-first approach generated goodwill and viral attention but those assets depreciate quickly if not reinforced through continuous product improvement and growing genuine usage. The token vesting schedule protects against immediate dumping but creates predictable unlock events starting September 2026 that will test whether demand from actual utility can absorb increasing supply.

The team composition spanning traditional finance, payment processing, and crypto-native experience suggests capability to execute across multiple dimensions required for success. The poker-trained founder comfortable with uncertainty and statistical thinking rather than deterministic predictions may prove advantage when navigating inevitable setbacks and market volatility. The willingness to address controversies directly rather than hiding behind corporate communication platitudes demonstrates confidence in underlying project merit beyond mere marketing narratives.

But capability and confidence don’t guarantee success in markets where timing, luck, and external factors beyond team’s control often determine outcomes regardless of execution quality. If Tether faces regulatory challenges that constrain USDT growth or usage Plasma suffers collateral damage as chain primarily optimized for that specific stablecoin. If established payment networks like Visa or Mastercard successfully integrate blockchain settlement capabilities leveraging existing merchant relationships and brand trust they eliminate Plasma’s value proposition by making dedicated stablecoin chain unnecessary. If user behavior demonstrates that people actually prefer centralized payment apps over decentralized infrastructure due to customer support, fraud protection, and familiar interfaces then entire thesis about blockchain-based payment rails becomes questionable.

The professional poker player turned founder understands that making optimal decisions doesn’t guarantee favorable outcomes but remains the only reliable strategy over sufficient iterations. Plasma represents calculated risk where strategic advantages around Tether relationship, technical architecture, and community approach create better odds than random chance but still face substantial uncertainty about ultimate results. We’re seeing whether applying poker thinking to infrastructure building produces different outcomes than typical Silicon Valley patterns alternating between unbridled optimism and premature defeat. The answer won’t emerge from single quarter’s performance but rather from years of consistent execution where statistical edges compound or fail to materialize revealing whether the bet was actually as well-calculated as it appeared.