Plasma is often described through speed or zero fees, but that framing misses what it is actually trying to solve. The system is built around a more structural question: how digital dollars move once they leave speculative environments and enter real financial rails. Most blockchains optimize for on-chain activity. Plasma optimizes for settlement that institutions are already required to use.

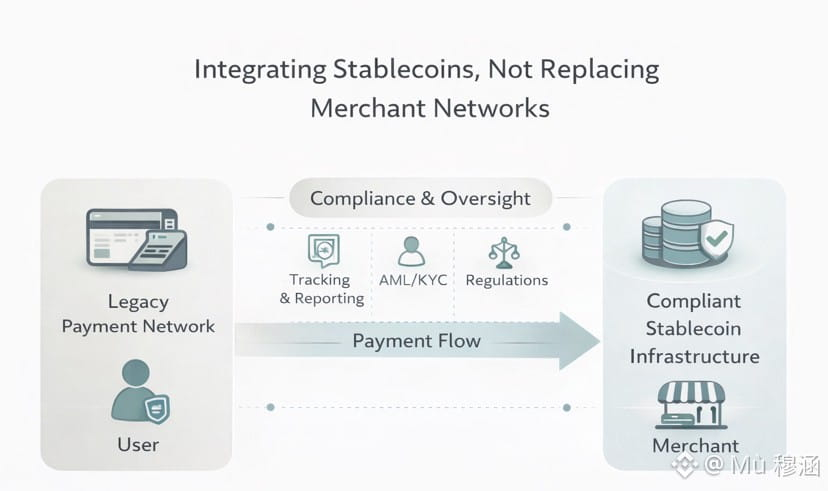

A large portion of stablecoin demand does not come from traders. It comes from businesses, treasury desks, custodians, and payment networks that operate under audit requirements, reporting rules, and jurisdictional compliance. These actors do not see regulation as optional, and they cannot adopt infrastructure that treats compliance as an external problem. Plasma’s design reflects this reality. It treats compliance tooling, monitoring, and reporting as part of the base layer rather than something bolted on later.

This choice is strategic, not ideological. Plasma is not attempting to compete in a permanent confrontation with regulators. It is positioning itself as infrastructure that can be integrated into existing financial workflows without forcing banks or payment processors to change how they already operate. If that alignment works, the potential scale of usage is fundamentally different from consumer-only chains.

The same logic appears in how Plasma approaches payments. Instead of asking users and merchants to adopt new crypto-native systems, Plasma routes stablecoin spending through existing merchant networks. The end result is simple: users spend digital dollars where they already shop, and merchants do not need new hardware, new software, or new settlement logic. The blockchain complexity is abstracted away, not emphasized.

This reframes a long-standing issue with stablecoins. Holding digital dollars has been easy for years. Spending them in everyday contexts has not. Plasma treats off-chain acceptance as a requirement, not a compromise. In that sense, it inverts the usual assumption that money must remain fully on-chain to be legitimate. For money to be widely used, it has to function across both environments.

XPL fits into this model as infrastructure capital rather than a speculative asset. Its role is to secure the network, incentivize validators, and support long-term operational stability. The intent is not for XPL to behave like a volatile instrument, but to resemble the way capital functions inside traditional payment systems: present, necessary, and generally unremarkable in day-to-day use.

That distinction matters. Financial systems scale when participants trust stability, not price swings. Plasma’s messaging around XPL consistently frames it as something banks and developers rely on, not something users are expected to trade actively. The network’s success does not depend on short-term market behavior, but on whether it becomes useful infrastructure for settlement and liquidity.

Plasma also reflects a broader shift toward stablechain-focused design. Rather than supporting every possible application category, it concentrates on money movement itself: transfers, settlement, institutional flows, and programmability tied directly to payments. The objective is not experimentation for its own sake, but reliability at scale.

Interoperability follows the same pattern. Instead of locking liquidity behind rigid bridges, Plasma connects into shared liquidity environments that allow funds to move based on intent rather than chain-specific mechanics. This reduces fragmentation and lowers the operational cost of moving stablecoins across networks without introducing unnecessary complexity.

What emerges is a system that treats adherence as leverage rather than friction. Regulation, auditability, and integration with existing financial rails are not framed as constraints. They are treated as the conditions required for real adoption. Plasma is not trying to redefine money in theory. It is trying to make digital money behave predictably in practice.

If it succeeds, the outcome is not dramatic price action or rapid speculation. It is quieter than that. Stablecoins begin to move like money already does: across borders, through institutions, and into daily economic activity, without users needing to think about the infrastructure underneath.