I used to think privacy on-chain was for people who wanted to disappear. Then I realized most people don’t want to disappear. They just don’t want their entire financial history to be a public diary.

That is the strange part of modern blockchains. They are honest, but they are also loud. Every transfer leaves a trail that never fades. Sometimes that is good. Sometimes it is unnecessary. Not because something is wrong, but because some things should not be permanently visible to everyone.

This is why Dusk’s direction feels different. Dusk is building privacy in a way that still respects the world institutions live in. It is not trying to remove accountability. It is trying to reduce exposure. Private to the public, but auditable when required.

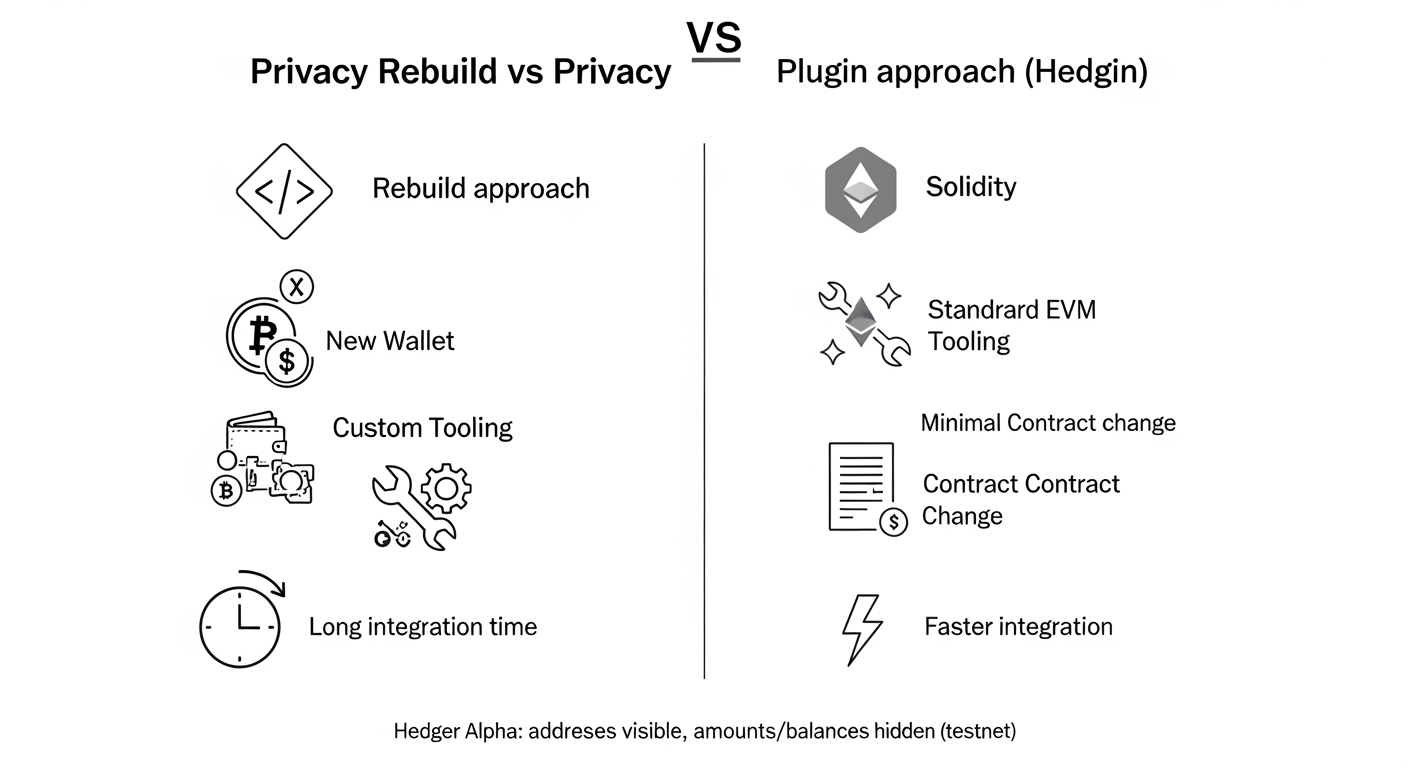

The key idea is that privacy should not require a new lifestyle. In many privacy systems, developers have to rebuild everything. They learn new languages. They rewrite contract logic. They hire specialists just to do one feature. That friction slows adoption, even when the technology is strong.

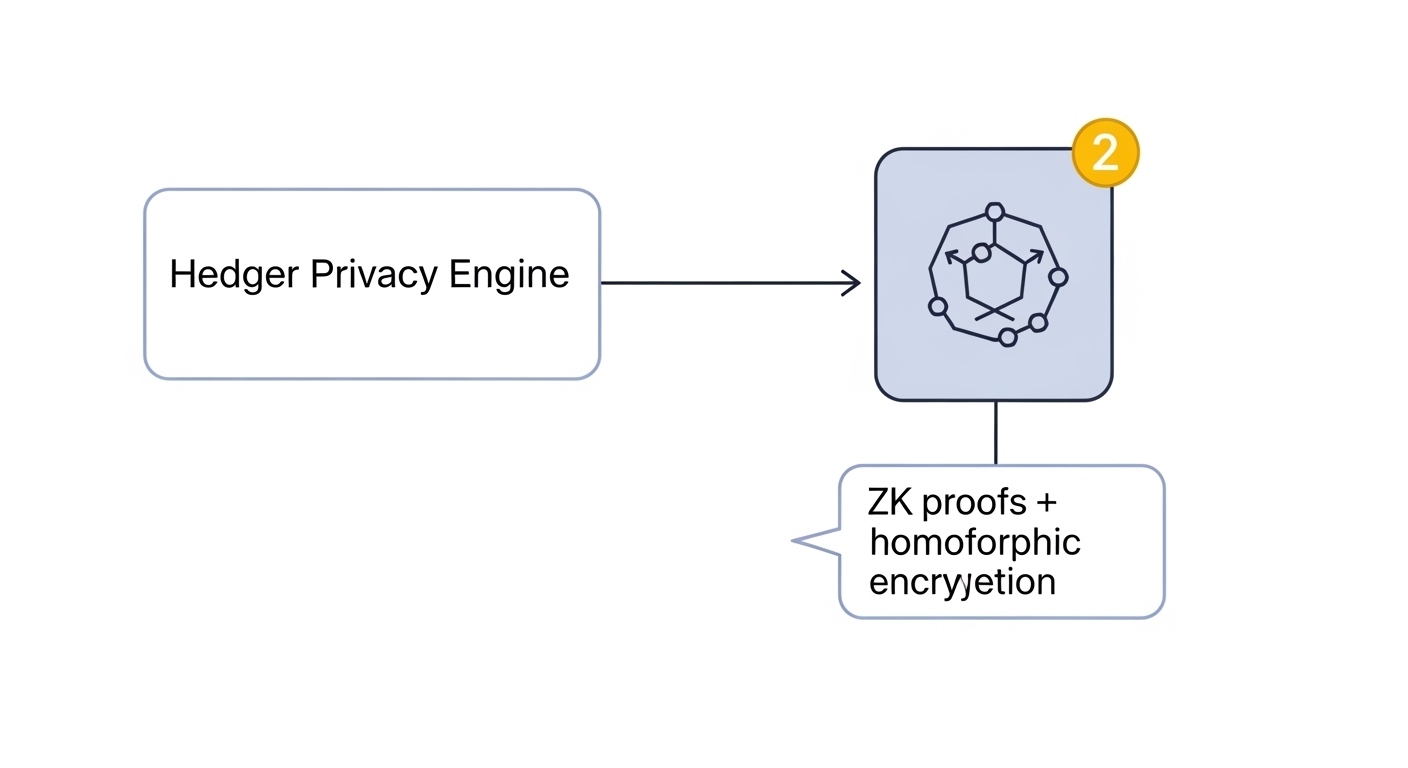

Dusk is trying a more practical path through Hedger. Hedger is a privacy engine designed for the EVM execution layer. The EVM is the Ethereum Virtual Machine, where Solidity smart contracts run. Solidity is the language most DeFi developers already know. So the promise is simple: keep the familiar toolchain, and add confidentiality as a module.

Hedger Alpha is now live for public testing on Sepolia testnet. That matters because it turns philosophy into something you can touch. You can create a Hedger wallet, shield test ETH, send confidential transfers, and unshield back to a normal EVM address. The privacy boundary is also clear in this phase: sender and receiver remain visible on-chain, but amounts and balances are hidden.

This is not full anonymity. It is a “cover” for the sensitive parts. And for finance, that can be the point. Trading intent is sensitive. Portfolio size is sensitive. Even the simple act of paying someone can reveal patterns that outsiders can exploit.

Now connect that to the real target: tokenized finance.

Real-world assets and regulated products cannot live in a world where every balance is public. But they also cannot live in a world where nothing can be audited. Institutions don’t want secrecy. They want controlled visibility. They want to protect users and market structure, while still being able to prove compliance when required.

This is where Dusk’s “privacy as a switch” becomes meaningful. It doesn’t force developers to abandon the EVM. It doesn’t force teams to rebuild everything. It aims to let existing DeFi ideas move into a finance-ready environment without turning privacy into a research project.

If the next wave of on-chain markets includes regulated assets, the winners won’t be the chains that shout the loudest. They will be the chains that feel normal to build on, and safe to operate on. In that world, privacy is not a rebellion. It is a setting.

Dusk is trying to make that setting practical.