Preface

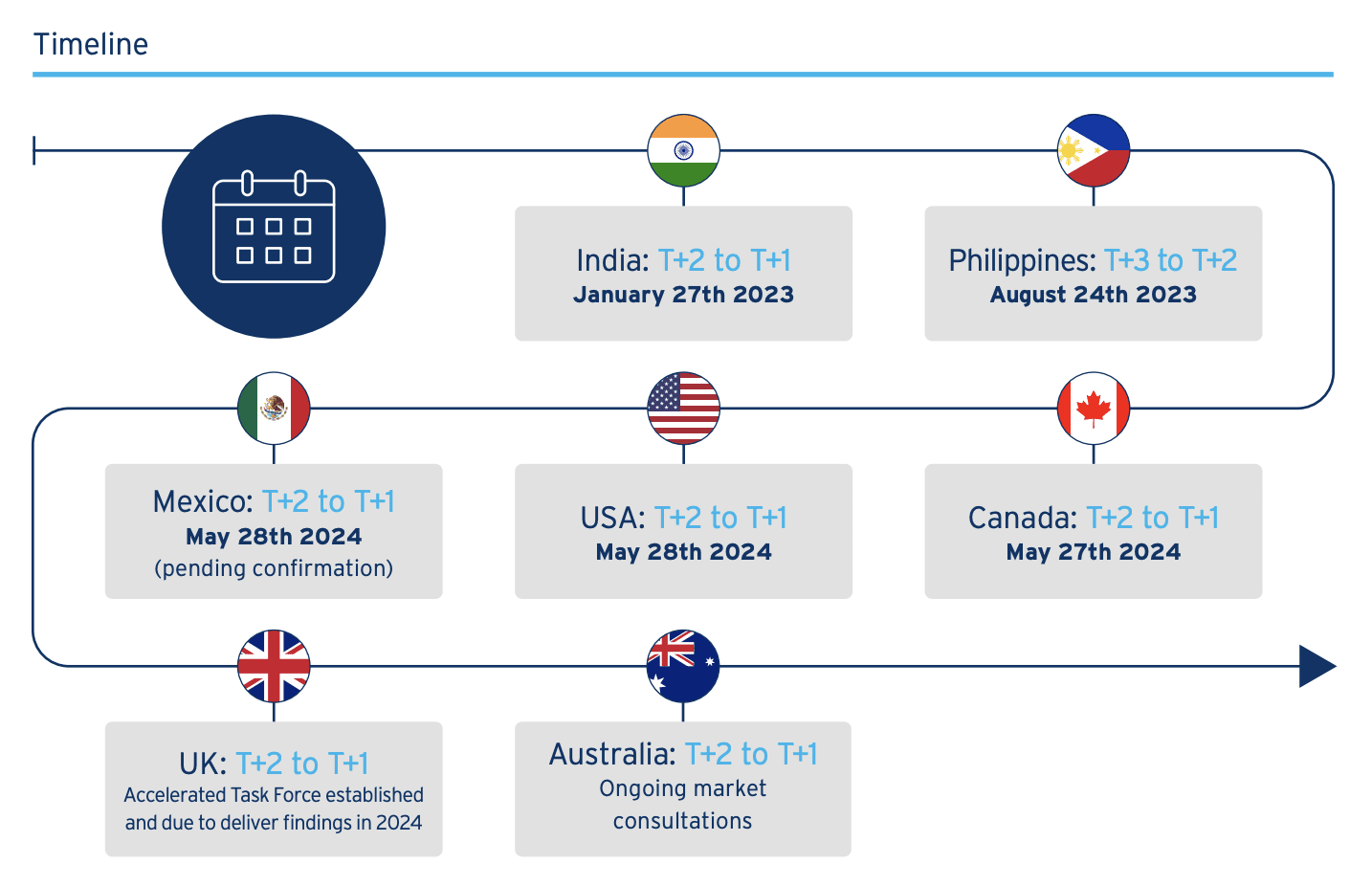

Citibank's latest research report "Securities Services Evolution 2023 - Disruption and transformation in financial market infrastructures" highlights India's newly launched T+1 settlement, which ensures that transaction settlement is completed within 24 hours.

As major economies such as the United States and Canada transition to T+1, Citi investigated the impact of DLT, CBDC and stablecoins on this transition.

I have condensed the 41-page report into the key highlights below for everyone to read.

executive Summary

The report looks forward to the industry's start in 2021, transformation in 2022, and core strategies in 2023. The industry not only plans to shorten the settlement cycle of the capital market, but also foresees the trend of other settlements, the adoption of digital currencies and atomic settlements in the next five years, and companies are fully preparing for the war.

FMI Agenda

FMIs face the twin challenges of transforming settlements and digital assets, as well as renewing legacy infrastructure. Strategies vary across regions: Latin America is witnessing major mergers, European liquidations are suspect, Asia and Latin America focus on digitalization, and North America and Europe focus on shared platforms. As the settlement cycle accelerates, FMI operations will become increasingly complex in the future. Transformation and management away from traditional construction became the theme.

Settlement transformation

89% of the respondents believe that settlement will advance to T+0 or T+1 within five years, symbolizing a major change. The United States and Canada are moving towards T+1, bringing cross-industry impacts: Europe and Asia are facing financial pressure, while North America is facing regulatory and liquidity challenges.

As the market transforms, industry standards will be upgraded. From the experience of T+1 in India, the key to success lies in customer engagement, automation enhancement and strategic planning, especially instant messaging and just-in-time inventory management. However, T+1 may cause the risk of global settlement being out of sync, affecting every transaction link.

DLT and digital assets

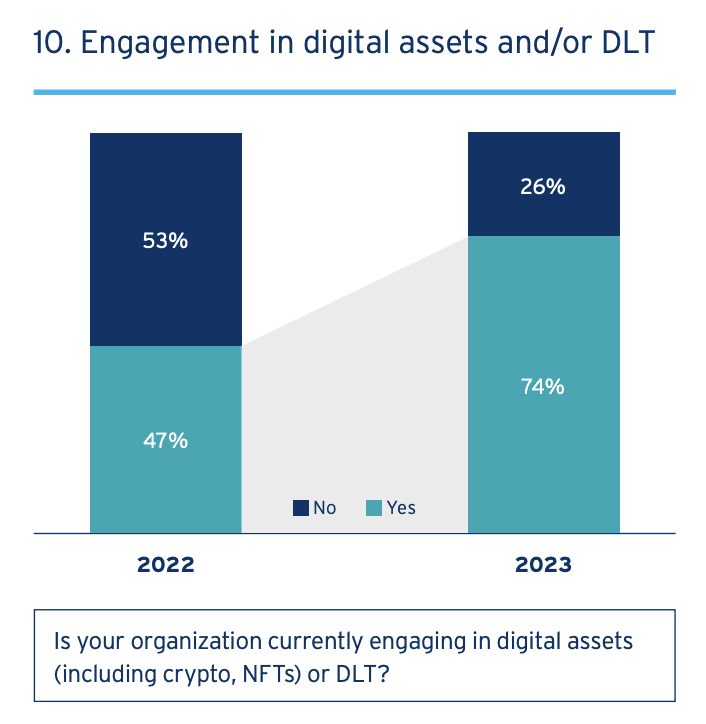

In 2023, 74% of respondents will participate in DLT and digital assets, showing that the trend of DLT continues unabated. Despite negative headlines, digital asset activity in Eurasia increased. The industry expects DLT to increase operational choice and flexibility.

Within five years, CBDC and business mechanisms are expected to be widespread. Organizations and technologies are changing, and regulation is increasing. The key to the future development of DLT lies in attracting buyers and optimizing industrial processes.

Research methods

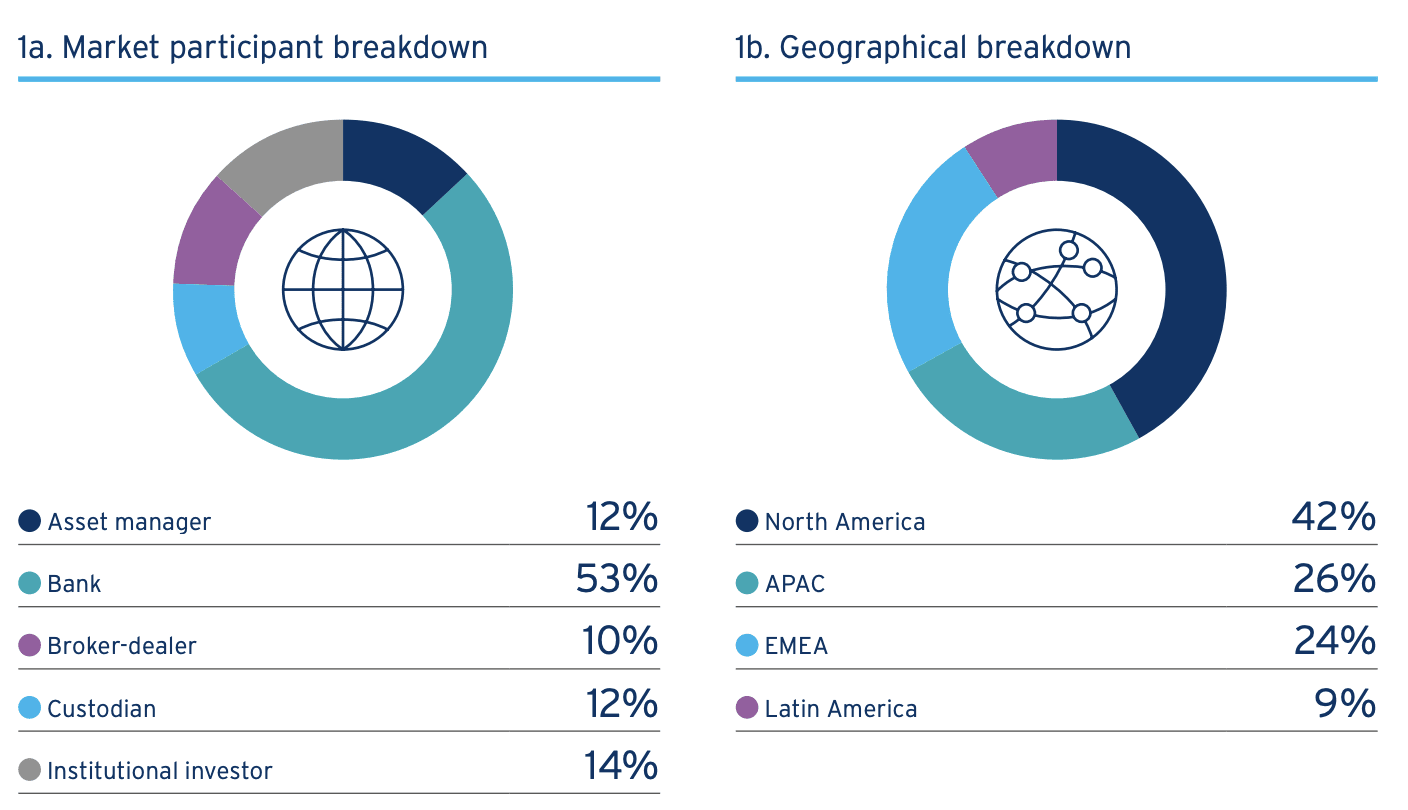

To gain insight into securities settlement trends in Asia Pacific, Europe, North America and Latin America, this report integrates qualitative and quantitative data.

For the quantitative part, Citi Securities Services, in partnership with ValueExchange, conducted a survey of 483 global experts in May 2023, covering FMIs, custodians and more.

For the qualitative part, 12 FMIs and industry insiders were interviewed from June to July 2023 to gain an in-depth understanding of the professional views of exchanges, financial technology and other industries.

What’s driving the financial market infrastructure (FMI) agenda today

The Changing Role of Central Securities Depositories (CSDs)

The role of CSD has transformed over the past decade. Although things like blockchain and T+1 settlement are easy to implement at the CSD level, actual market adoption faces challenges.

CSD has become an ecosystem manager, driving market progress and innovation. This represents a change to CSD’s business model and increases interaction with global regulations.

Accelerating settlements high on agenda

Global attention on accelerated settlement (T+1) is increasing, with 24% of market participants identifying it as having the greatest impact on business.

Mexico, with half of its transactions related to foreign investment, is expected to implement T+1 in 2024 in parallel with the United States. India has implemented T+1, North America has followed, and other markets will follow. Accelerated settlement goes beyond simple FMI or settlement issues, and emphasizes overall cooperation and cross-time zone considerations among participants.

Replace FMI legacy technology

The CSD business is facing the challenge of balancing the advancement of innovation and the transformation of legacy technologies. 14% of the world’s post-trade systems are aging, but updating them is fraught with difficulties.

Although legacy systems hinder innovation, many organizations have been slow to change because of their reliability. The market is looking for transformation paths to avoid interference and maintain trust.

Digitalization: the new role of FMI

In 2023, the market will focus on digital assets and the innovative role of FMIs will evolve. In the early stage, it focused on the transformation of specific assets, but there is an existing need to integrate the liquidity of various asset pools.

FMIs provide regulated shared platforms that adapt to this change, unlike past DLT models. The current CSD opens up a new direction for digital assets.

Shareholder governance and engagement

The role of CSDs is changing towards connecting issuers and investors more transparently. The existing structure cannot meet the needs of rapid shareholder voting. As investors become more actively involved in company management, pressure on the intermediary market increases.

New technology platforms like Proxymity emerged, but brought uncertainty to publisher relationships. This promotes diversity in operating models, which may dilute the ability to respond to investor needs.

The Tradeoff: Enterprise Action Automation

In global securities trading, the automation of corporate actions cannot be ignored. Many countries such as Australia, India and Switzerland have achieved 80% progress in this industry. Global investors want to see cross-market standardization and promote unification of asset services.

But reform also faces challenges, ranging from local specificities to the inertia of existing processes. CSDs continue to push for automation, ensuring it is on the agenda. Euronext Securities Oslo emphasizes the importance of standardization in order to attract foreign investment.

latin america's single market

What happened?

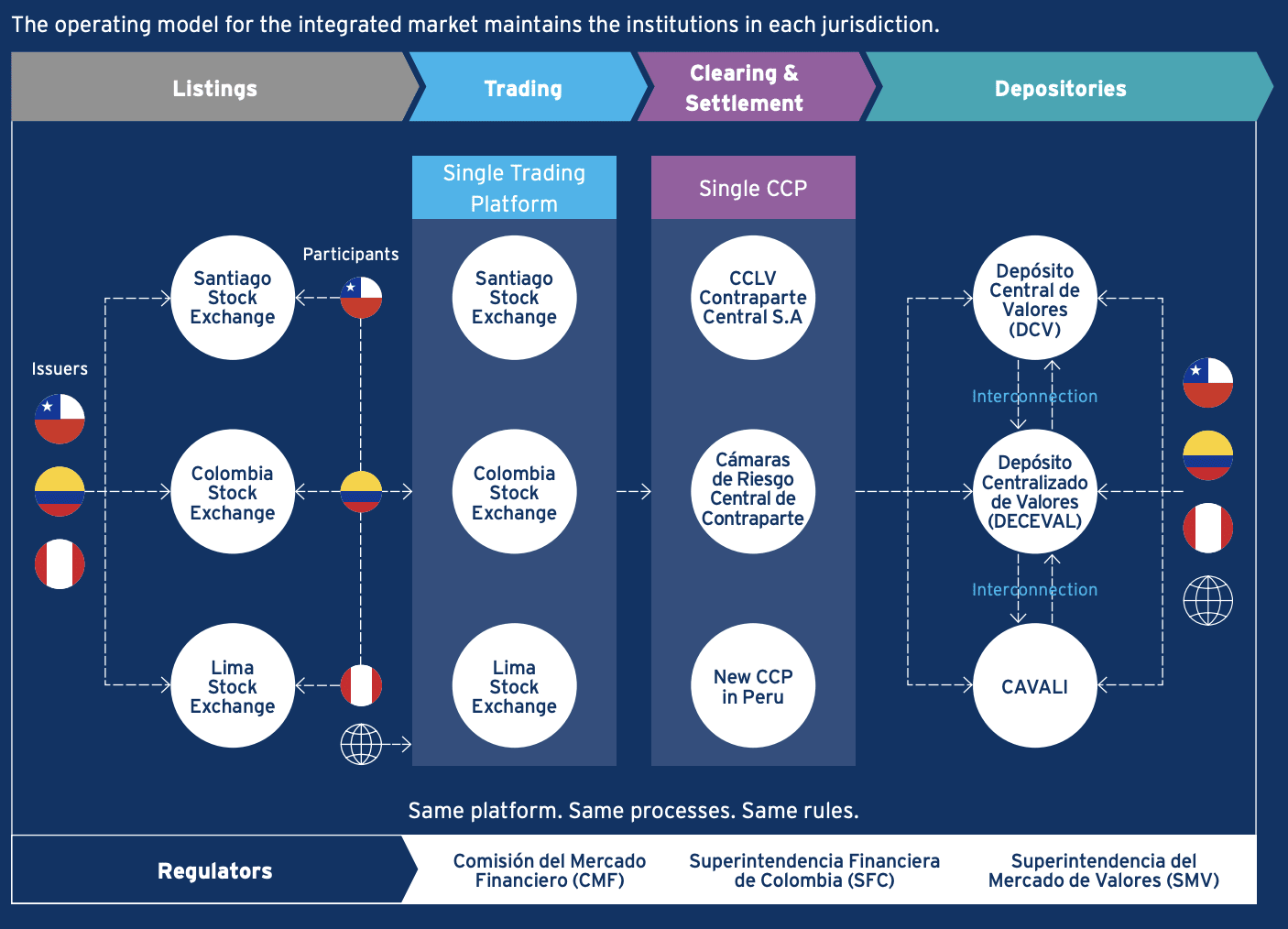

In 2024, the three major stock markets of Colombia, Chile, and Peru will be merged into one trading platform, which is a huge progress in FMI cooperation. Brother and Zhi each account for 40%, and Secret accounts for 20%.

This move integrates three markets in Latin America and improves the "investability" of assets. The issuer can be listed in one country, but the shares are traded in three places and are subject to unified regulations.

What has been done so far?

Since 2018, the stock markets of the three countries have made progress, establishing shareholding companies and achieving issuer recognition and settlement interoperability. But the real challenge lies in post-trade integration, specifically the integration of clearing and settlement. Juan Pablo Córdoba of the Colombian Stock Exchange believes that the integration of clearing and settlement is more challenging than the integration of trading.

create new opportunities

This integration initially benefits stocks, but may expand to other assets in the future, such as listed derivatives. Cordoba warned that fixed income may take time because most are OTC transactions and trading habits vary from country to country. The new trading group will bring opportunities to participants such as streamlining market processes, introducing common standards to increase automation, and potentially leveraging stablecoins for foreign exchange management.

Integrated market operating model

Change across multiple markets is never easy. Existing account structures in Colombia and Peru (but not Chile) make account standardization difficult to achieve.

In addition, the willingness of global investors to adjust is also key. The smaller market size relative to Brazil or the United States may result in investors being reluctant to adapt quickly to new changes. Finally, global initiatives such as accelerated settlements may bring about the need for more structural changes at a time when stability is needed.

Impact on global investors

This development brings benefits to investors, mainly enhancing liquidity and investment efficiency. The three major markets will provide a standardized user experience and use the same matching engine and rules.

Through a single settlement platform, investors can unify data connections and bank relationships, eliminating differences among depository institutions. The increase in liquidity will attract more market participants, driving a continued virtuous cycle.

Liquidation mergers in Europe

what's going on?

Since MiFID I in 2007, competition for clearing European trades has shifted, with clearing costs falling from €1 to a few cents.

After Euronext Clearing entered major European markets, it launched a "preferred clearing" model to influence companies' clearing choices. If the parties to the transaction fail to reach an agreement, the liquidation will default to Euronext and then be handled by Monte Titoli. This change may affect economies of scale.

What does this mean for market participants?

"The choice of a preferred liquidation model is an illusion."

The scale of Euronext Clearing means that participants only face two markets, improving efficiency. But it also brings challenges of choice, cost and risk. Choosing the wrong clearing house can lead to reduced efficiency and increased costs. There are few cross-border transactions in T2S and there may be risks in increasing the settlement volume. With the impact of the Central Securities Depository Regulation (CSDR), adding pressure seems inappropriate at this time.

What happens next?

Jeff King (Citi) said: “The dice have been thrown, but it remains to be seen how market participants will react to this model. Liquidation appears to be the path of least resistance.”

The outlook for these risks remains unclear. While the cost-saving opportunities for market participants appear to be slim, Euronext Clearing will be the preferred route if no other option is available.

Settlement transformation

Billing Transformation Today: Where Are We Now?

Over the past decade, global settlement needs have increased. In 2014, China took the lead in implementing T+0 settlement, and subsequently, major markets shortened it from T+3 to T+2.

In 2024, the United States and Canada will adopt T+1 settlement, bringing new settlement risks and changes. This big step not only affects the settlement process, but also forces other markets to follow suit, creating a domino effect.

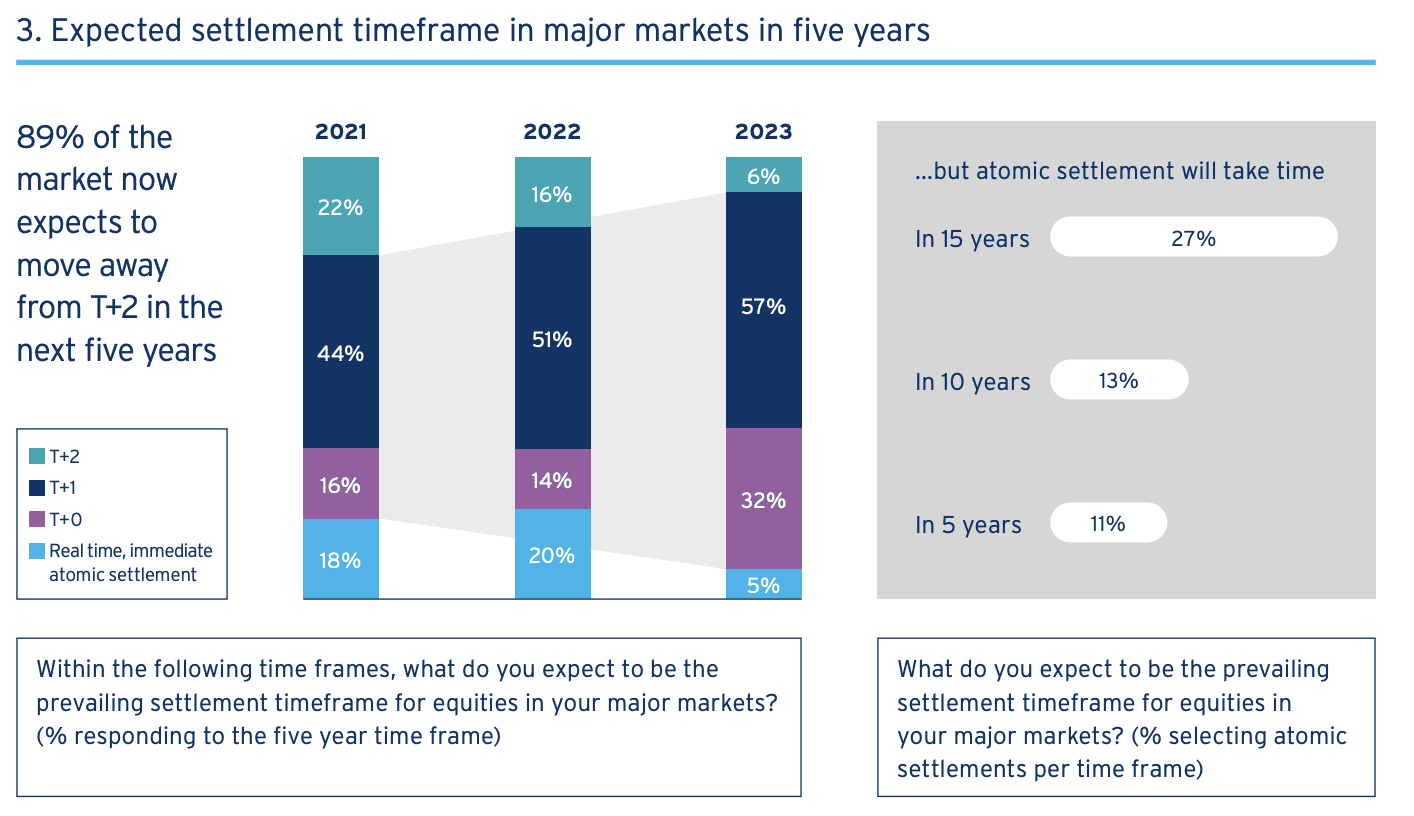

Expedited Settlement - Always Available

The settlement process is changing rapidly. As of 2021, 89% of market participants expect T+1 or T+0 settlement within five years. 27% believe instant settlement will dominate major markets within 15 years. Although instant settlement still requires time and resources, the direction is clear.

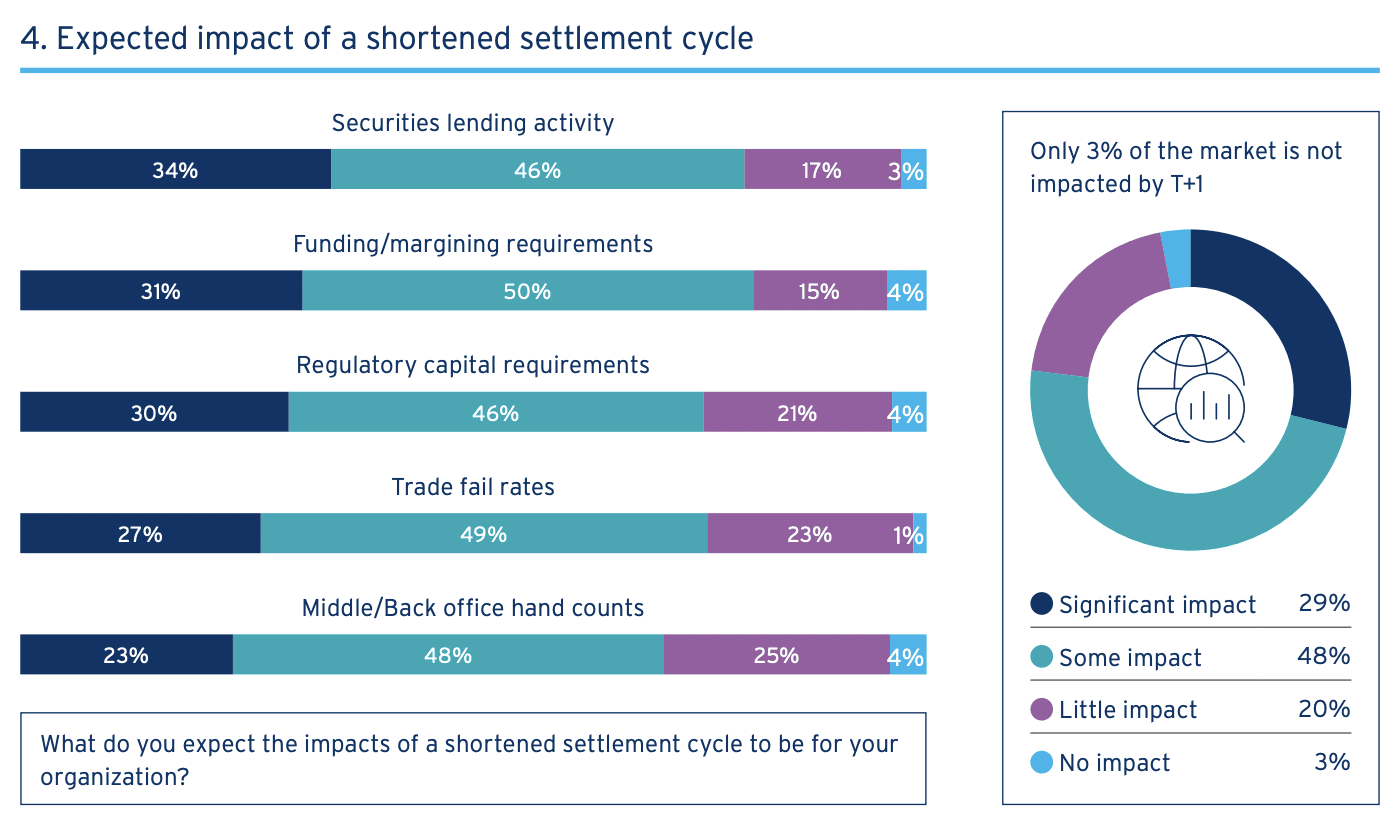

Accelerated settlement – no one is immune

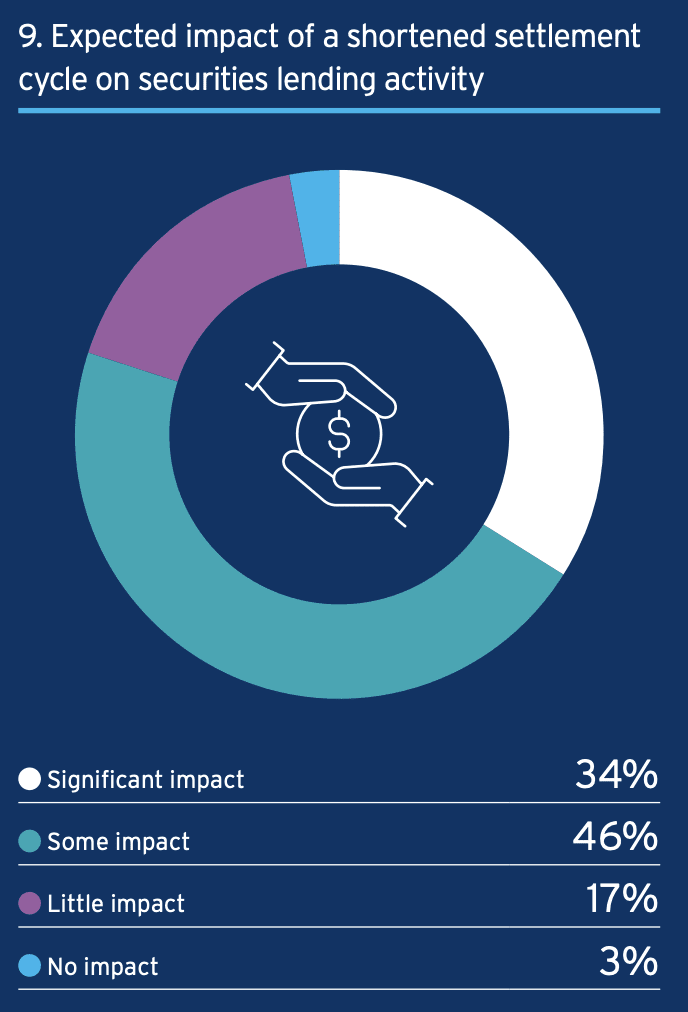

T+1 settlement has a huge impact on 77% of businesses, especially brokers and custodians. This affects the entire transaction process, from account opening to fund management. With the implementation of T+1, the transaction failure rate is expected to increase. Funding and bond requirements will also be restructured to the benefit of custodians. Securities lending faces challenges, but effective optimization will create opportunities.

Accelerating settlement is a matter of funding

In recent years, the funding portion of the transaction has been seen as a big obstacle to shortening the settlement cycle. Currency liquidity management in China and India has added many costs. Issues of funding complexity extend beyond simple securities transfers. Most firms consider cash clearing to be a critical step toward T+1, especially given the time frame and funding liquidity differences of FX trading.

It's about your identity...

Under the T+1 settlement in the United States, large brokerages pursue immediate efficiency, while small companies need to reset their business models. Large U.S. and Canadian brokerages have adjusted and are working hard to synchronize customer networks. Smaller players face new SEC rules requiring electronic trade confirmations and faster automation.

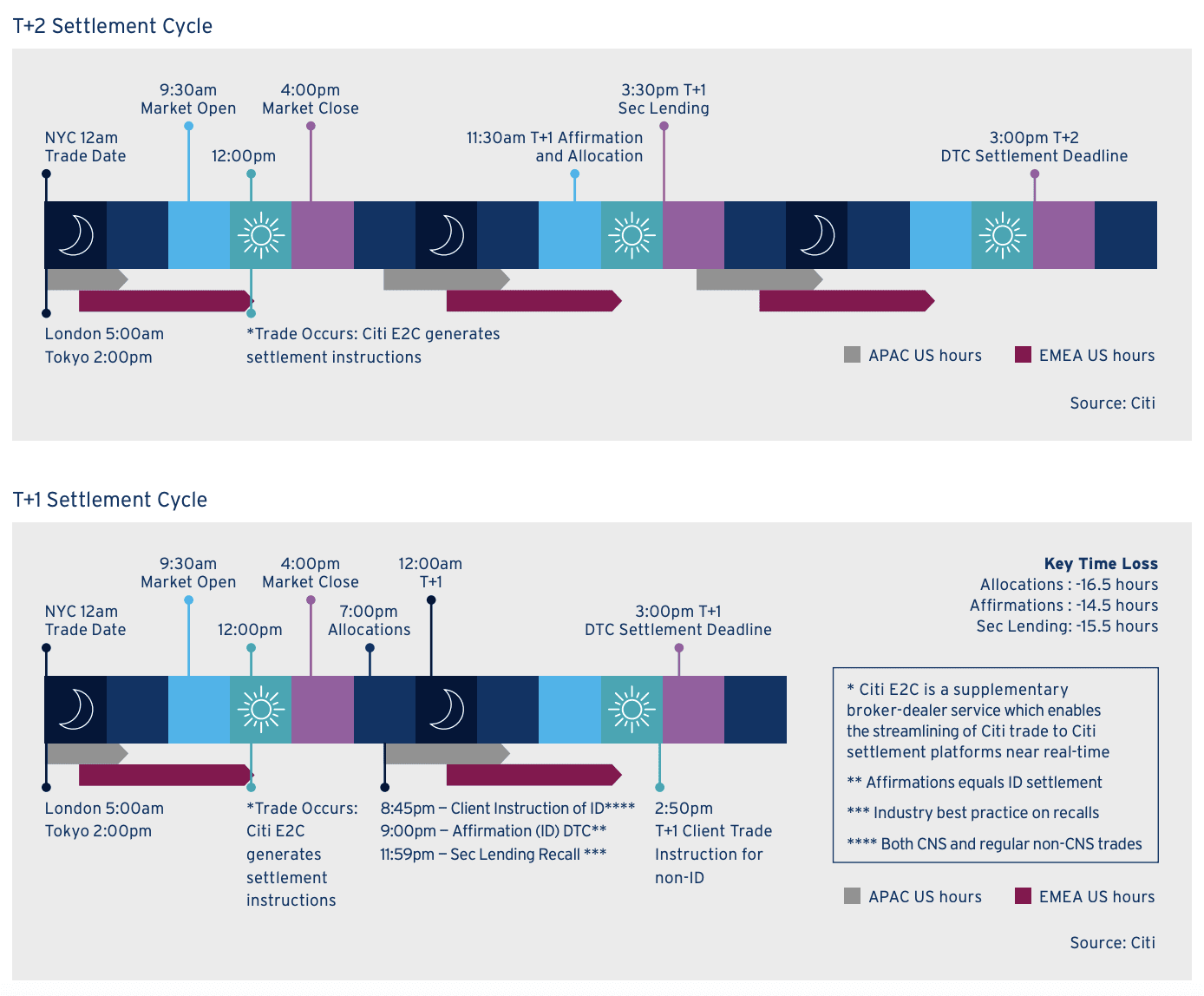

...and your location

Moving to T+1 settlement, time zones pose huge challenges for foreign investors. The T+1 reform in the United States and Canada forces European companies to expand operations until the early morning. The European Finance Association said transaction processing times have been significantly reduced.

Local regulations, such as UCITS V and ERISA, exacerbate the difficulty of adjustment. To adapt, many companies are evaluating their operating models and seeking innovation. Foreign capital plays a central role in the market, and its unique needs cannot be ignored.

The T+1 Journey: Building a New Target Model for Accelerated Settlement

T+1 settlement is becoming a global trend. A consolidation strategy is key to reducing long-term costs. Key steps include: optimizing customer communications, upgrading internal technology platforms and adjusting staff location strategies.

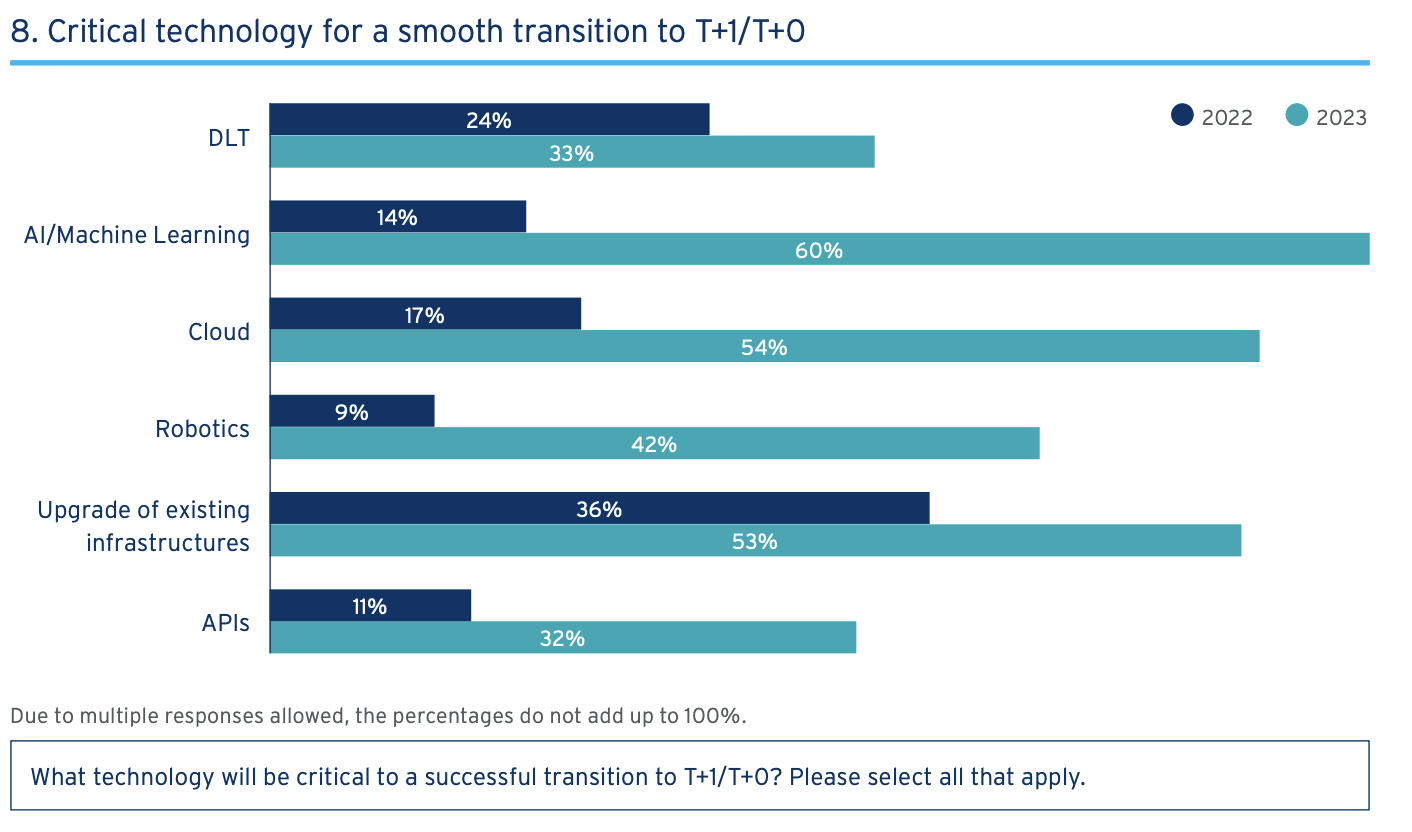

AI and RPA technologies are increasingly important in this transition. As settlement times shorten, companies are adjusting their workforce to accommodate different time zones. A successful T+1 transformation requires a balance of technology and human resources.

What happens if I do nothing?

In the face of T+1 settlement, foreign investors regard it as a choice but not an obligation. But failure to comply carries risks: in China and India, uncompleted transactions result in fines; in the United States, unconfirmed transactions bring additional fees and brokerage risks. The risks of inaction are clear and global.

What will happen in the future?

Facing T+1, this is an ecosystem game, and participants need to work together to ensure preparation. The United States, Canada, and Mexico are about to conduct tests to ensure that institutions and investors are properly prepared.

T+1 preparation will be the minimum standard. At the same time, multiple markets, such as the UK and Australia, are also discussing accelerating settlement and providing exchange opportunities for global experts.

T+1 and Securities Lending

T+1 and Securities Lending: What’s the Connection?

The move to T+1 has had a huge impact on securities lending, with 80% of companies in this industry being significantly impacted. In the worst-case scenario, uncertainty about the movement of securities could prompt asset owners and brokers to reduce their loanable inventories, leading to a significant reduction in market liquidity. But the best-case scenario is that institutions with immediate inventory certainty may turn T+1 into a major business opportunity.

What are the potential challenges?

After the United States and Canada switched to T+1, the domestic lending market in the United States was under less pressure, but the offshore market faced challenges due to manual operations. Asset owners are guaranteed by agent borrowers but may borrow less in higher-risk industries. Brokers’ recovery processes are at risk of errors and delays. Under the T+1 system, the timing of recycling is crucial. Hedge funds may deny repossession requests due to low penalties.

What potential solutions and opportunities are there?

Facing the challenge of T+1, companies with just-in-time inventory will benefit. Moving to an instant system could increase borrowing and lending. Manage risks in real time to avoid excessive storage and increase loanable stocks. Effective customer authorization management and low settlement risk allow companies to provide "failure coverage" solutions to reduce transaction risks.

What’s in store for the future?

The securities lending market is highly interconnected and it is difficult to succeed alone. For immediate processing, the core platform must be adopted in a timely manner around the world, especially the United States' transition to T+1. The industry focus is on the impact of T+1 transformation, and notification, communication and settlement standards will be clarified. The goal is to increase market liquidity.

DLT and digital assets

DLT and digital asset participation continues to grow

DLT and smart contracts are changing the post-transaction world. Although there are cases of DLT failure, attention is still high. In 2023, 74% of companies participating in DLT increased from 47% in 2022.

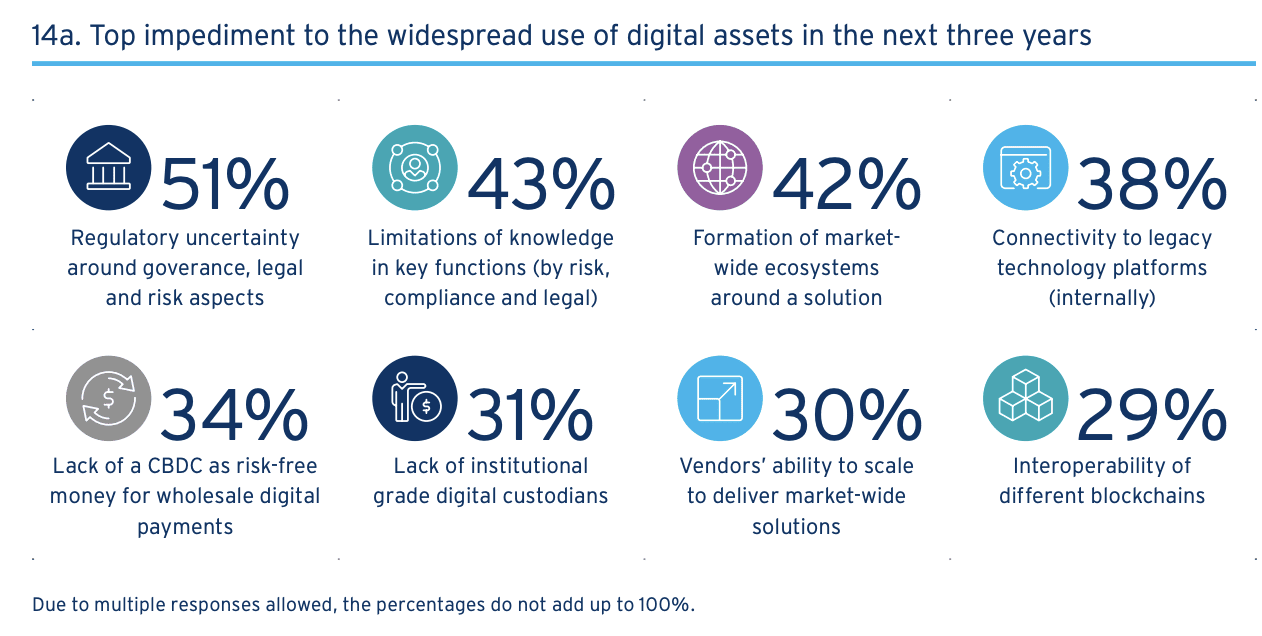

Asia and Latin America focus on liquidity, Europe seeks sound regulation, and North America benefits from tokenization. The key to success is not just technology, but the people and processes that implement it.

Digitalization: operating at two maturity levels

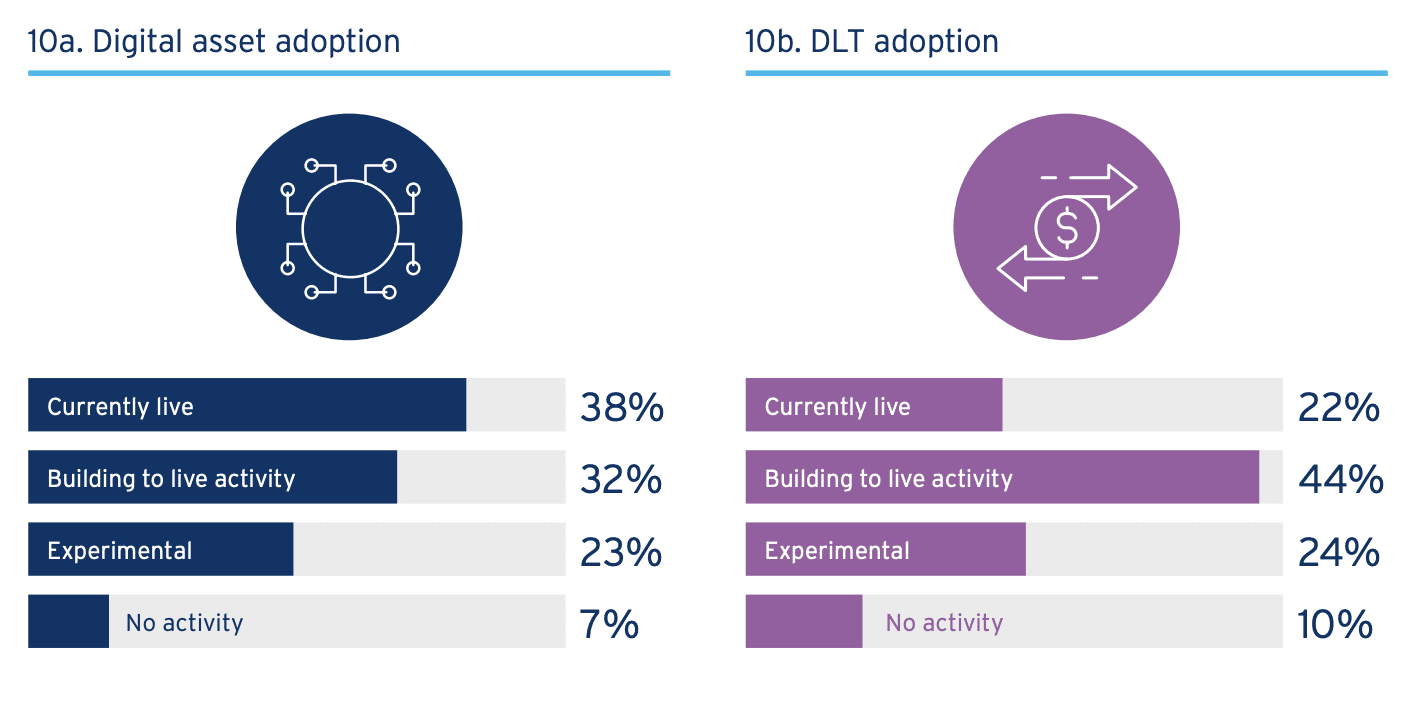

The past year has seen a shift in the progress of digital asset development and DLT projects. While 38% of respondents have launched cryptocurrency services, its momentum in the U.S. has slowed.

Regulators in Europe, Asia and the Middle East are advancing relevant regulations. DLT and tokenization are showing their value in industries such as bonds and securities financing, and the application of DLT is becoming more and more mature, especially in improving transparency and reducing investment risks.

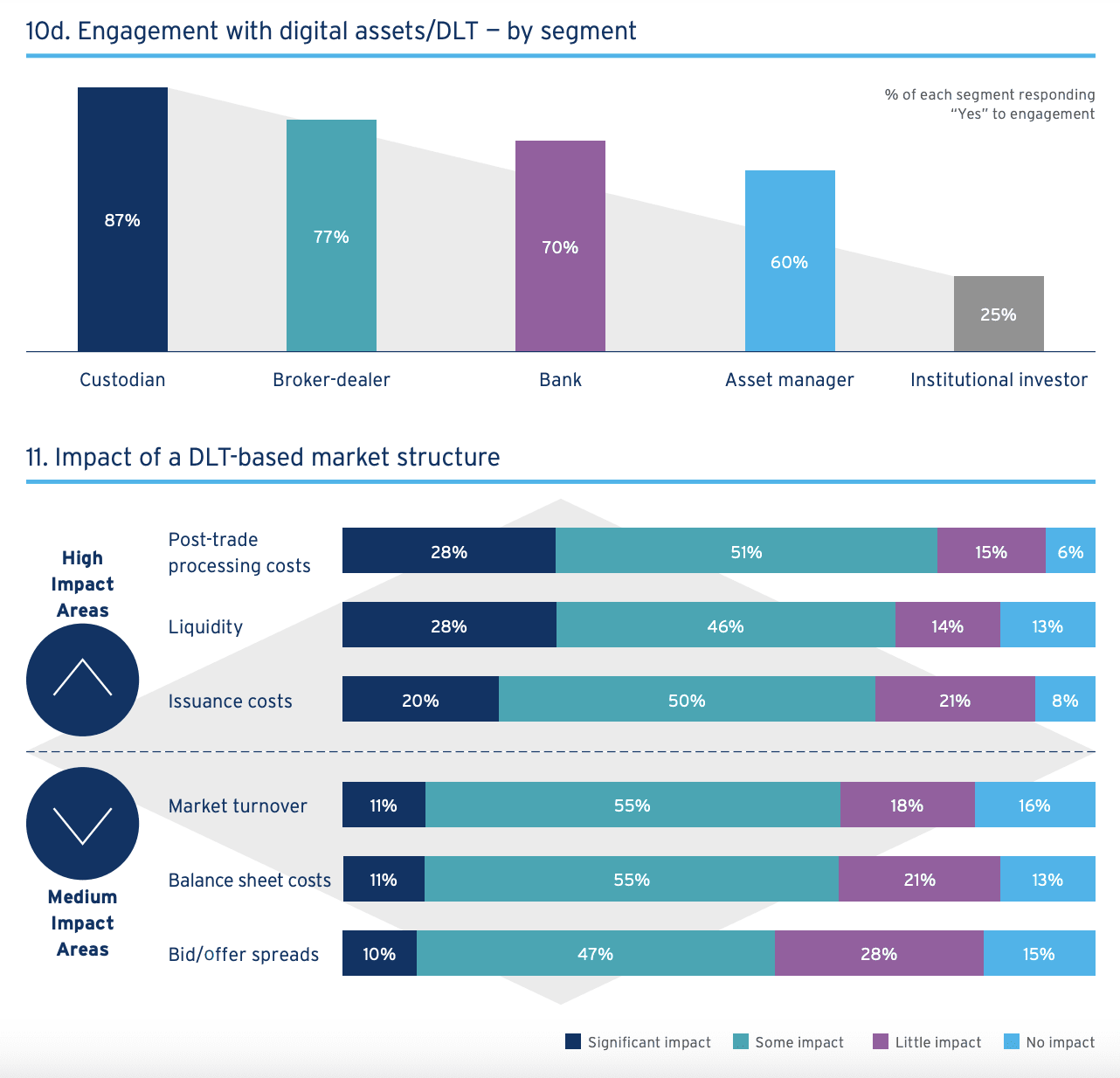

Using DLT Today: Is DLT Still a Banker’s Game?

87% of custodians are invested in DLT and digital asset projects, but only 25% of asset owners are equally active. The current focus is on improving operational efficiency and reducing costs.

But the true value of DLT—such as changing the fundamental value and liquidity of securities—has yet to be fully explored. When DLT begins to significantly impact investment portfolios, such as through tighter spreads or deeper market liquidity, project returns will increase significantly.

DLT as an enabler – not a destination

DLT and tokenization allow us to escape the technical limitations of market structures and provide greater freedom for every transaction. Although there are doubts about real-time settlement, DLT brings options to companies, and real-time settlement may become a competitive advantage. Asset division also increases liquidity. For example, the Hong Kong Monetary Authority's "Genesis Plan" shortens settlement time and improves distribution efficiency.

Tokenization, digital issuance or smart contracts?

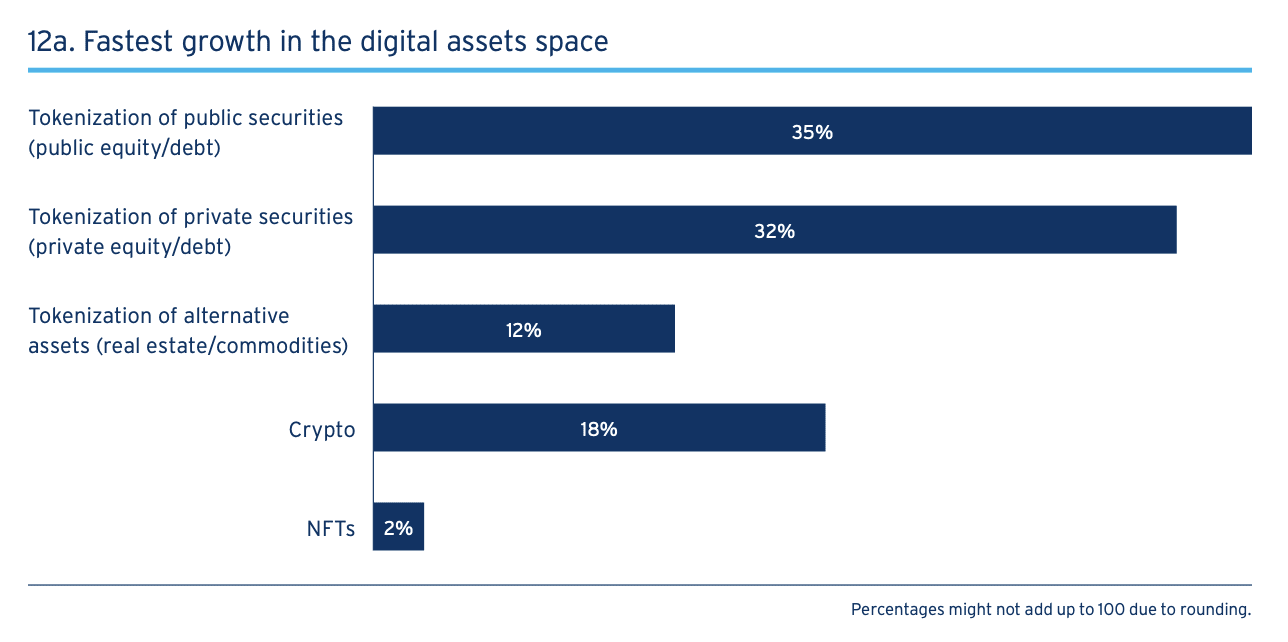

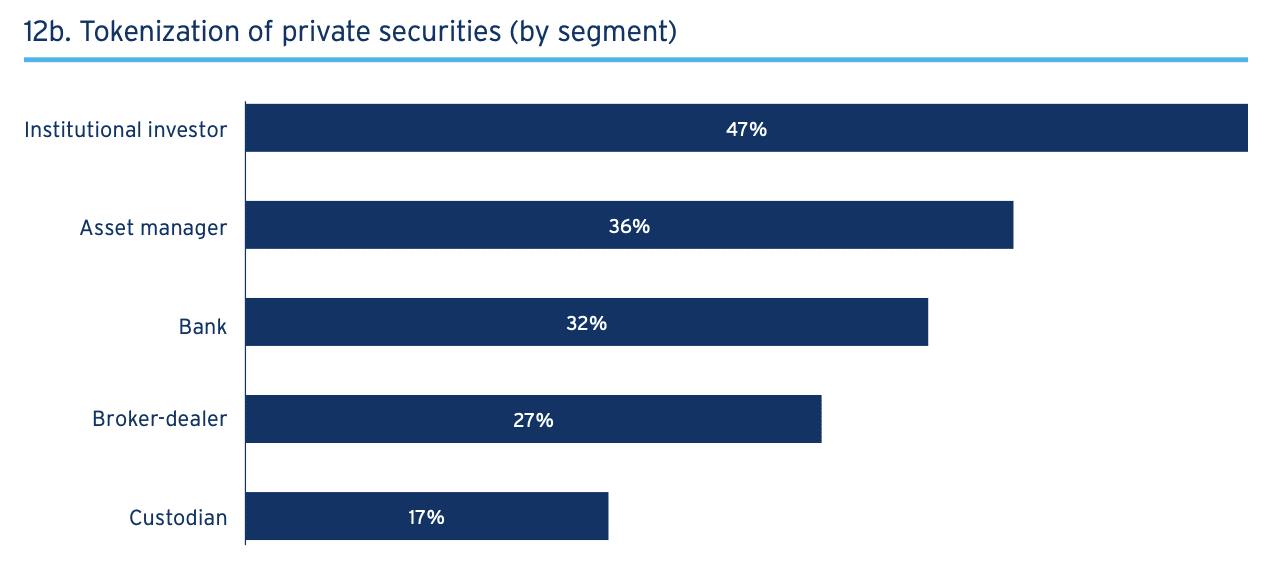

79% of respondents believe tokenization is a core growth direction. Sellers favor listed stocks and bonds, while institutional investors focus on the private equity industry to increase liquidity and transparency. Smart contracts have become an important development, enabling automation outside of the blockchain, such as HKEX Synapse and SGX’s DLT projects.

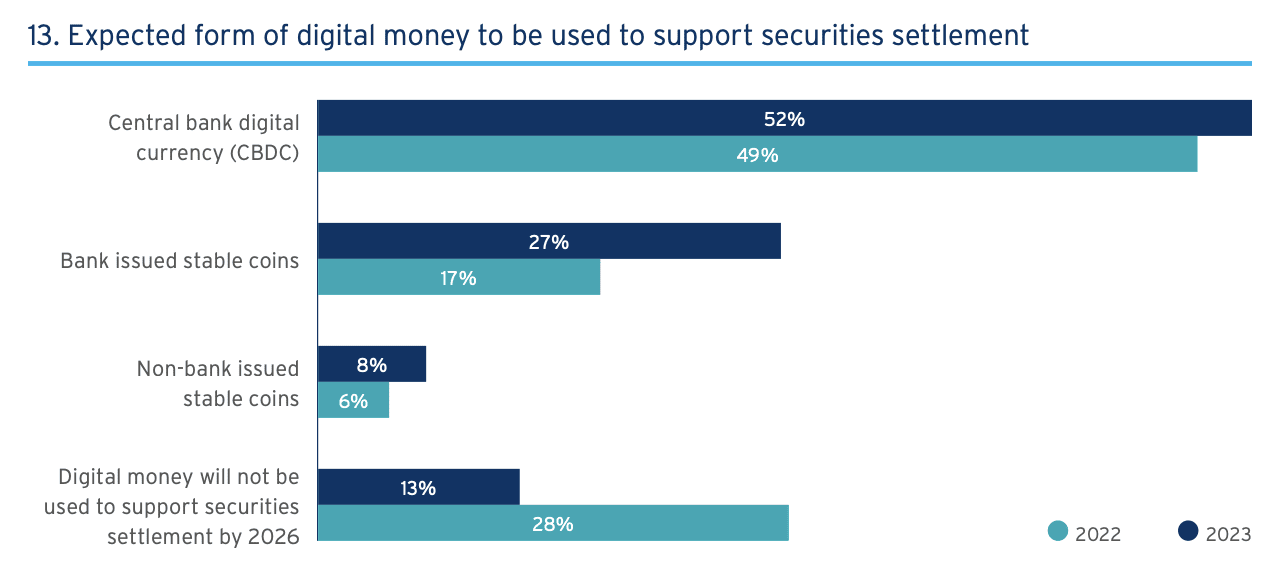

Financial support: Digital cash is coming quickly

Digital currency is mature, with 87% expected to be feasible by 2026. CBDC is the focus, and most are expected to make progress within three years, and practical experience has been gained from global pilot projects. 52% of the respondents expect CBDC to be launched within 3 years to solve the problem of blockchain transfer. About one-third favor the solution, and 27% expect to use bank stablecoins within 3 years, an increase of 10% from last year. The company is committed to providing investor transparency, liquidity and regulatory acceptance, building a scalable tokenized deposit base.

The digital journey: Best practices are emerging

Digital assets and DLT are rapidly shaping the industry, and guidelines are based on success and failure:

Clearly define the business and whether DLT is needed to solve the problem.

Establish an ecosystem and coordinate with business cases.

Regulation and internal risk work together to solve the problem.

Leverage technology partners to expand impact.

Address legacy burdens and connect digital platforms to core infrastructure.

Scalability partner.

Reinvent processes to realize the benefits of DLT and digital assets. These points help overcome challenges and enable effective use of DLT.

in conclusion

Financial market infrastructure and market participants are rapidly driving practical and collaborative changes to address settlement, asset servicing and digital challenges, breaking away from the structures of a decade ago. Over the next five years, settlement cycles will be shorter, DLT will become operational, fund flows will be digitized, and core banking systems will be revamped. In this wave of change, companies need to make smart choices, and the entire industry will jointly face and manage challenges from an ecosystem perspective.

References

花旗銀行《Securities Services Evolution 2023 - Disruption and transformation in financial market infrastructures》

https://www.citibank.com/mss/docs/Citi_Securities_Services_Evolution_2023.pdf

Further reading

The financial contradiction brought about by the US dollar to CBDC is the financial revolution or the tragedy of privacy

https://soaringcrowz.substack.com/p/afpi-cbdc

The intersection of regulation and innovation: How the SEC and BIS are shaping the future of cryptocurrency

https://soaringcrowz.substack.com/p/sec-bis-crypto

Unexpected country of crypto, Vietnam ranks first in cryptocurrency adoption rate in the world

https://soaringcrowz.substack.com/p/vietnam-crypto