Ethereum’s Role Beyond Price Speculation

Despite increasing competition and shifting market cycles, Ethereum remains one of the most important infrastructures in crypto in 2026. While short-term price action often dominates discussion, Ethereum’s relevance is rooted less in speculation and more in its role as a global execution and settlement layer for decentralized applications.

Network Effect and Ecosystem Dominance

Ethereum continues to host a significant share of decentralized finance, stablecoin issuance, NFT infrastructure, and on-chain governance. Even as alternative networks grow, many applications still anchor liquidity, security, and final settlement to Ethereum. This network effect has been built over years of developer adoption and capital concentration, making it difficult to replicate through speed or low fees alone.

Technical and Market Structure Evolution

From a technical and market structure perspective, Ethereum has matured into a structurally resilient asset. Price cycles now reflect clearer phases of expansion, consolidation, and re-accumulation rather than erratic speculation. Extended sideways ranges, declining volatility phases, and well-defined support and resistance zones have become more common. These characteristics suggest a market increasingly driven by positioning, capital rotation, and longer-term participants rather than purely retail momentum.

Economic Model and Protocol Maturity

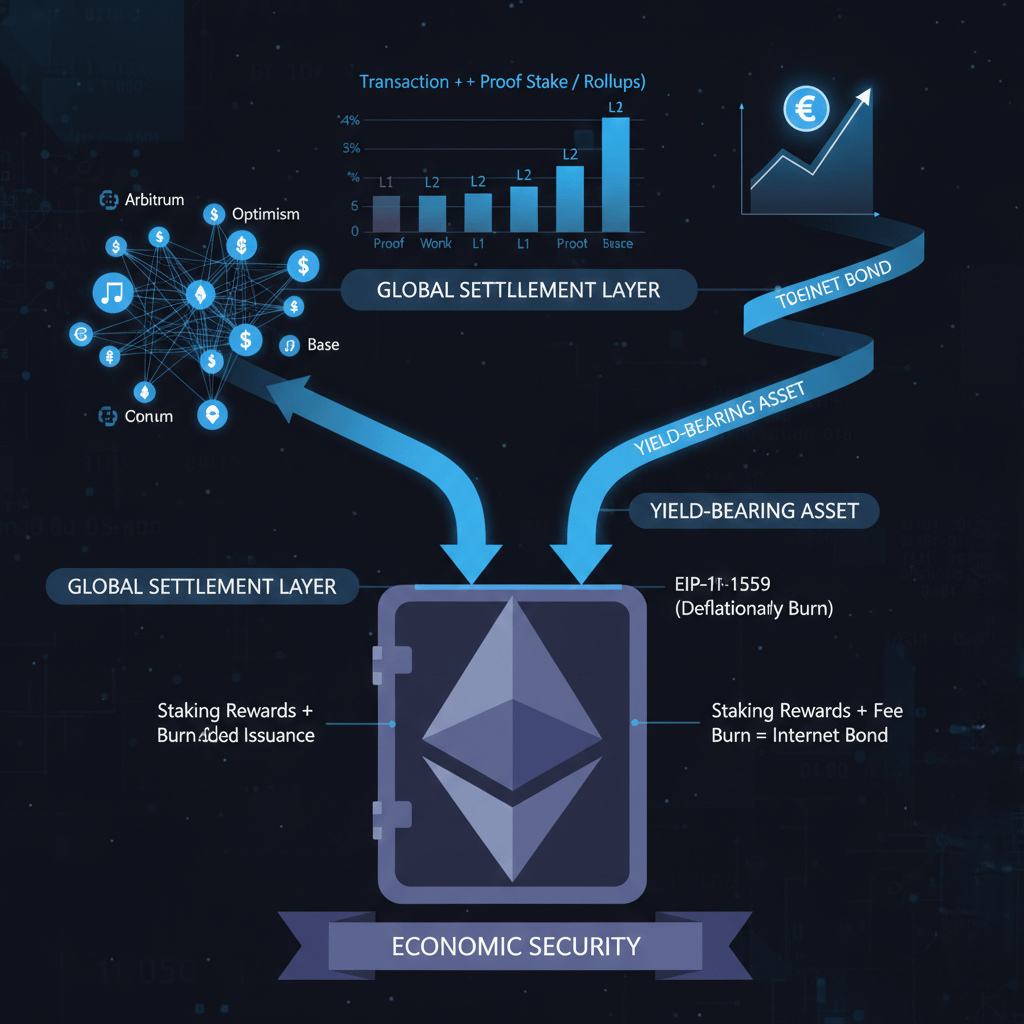

Ethereum’s transition to proof of stake reshaped its economic structure. Network security is maintained by validators with capital at risk, aligning incentives toward long-term stability. Reduced issuance and evolving fee dynamics have shifted ETH toward a yield-bearing infrastructure asset rather than a purely transactional token. At the same time, Layer 2 networks have absorbed transaction volume, allowing Ethereum’s base layer to prioritize security and settlement rather than throughput.

Institutional Adoption and Market Depth

Institutionally, Ethereum’s role has expanded beyond crypto-native use cases. ETH is increasingly viewed as programmable financial infrastructure, supporting tokenized assets, stablecoin settlement, and cross-border value transfer. This institutional participation has added depth to Ethereum’s market structure, improving liquidity while dampening extreme volatility over time.

Conclusion

Ethereum still matters because it is not just a blockchain or a token. It is infrastructure. And in markets, infrastructure tends to outlast hype cycles, trend shifts, and short-term narratives.