In-depth data, including all metric breakdowns and visual trend analysis, is available in the full infographic. The information below is an executive summary of the on-chain panorama.

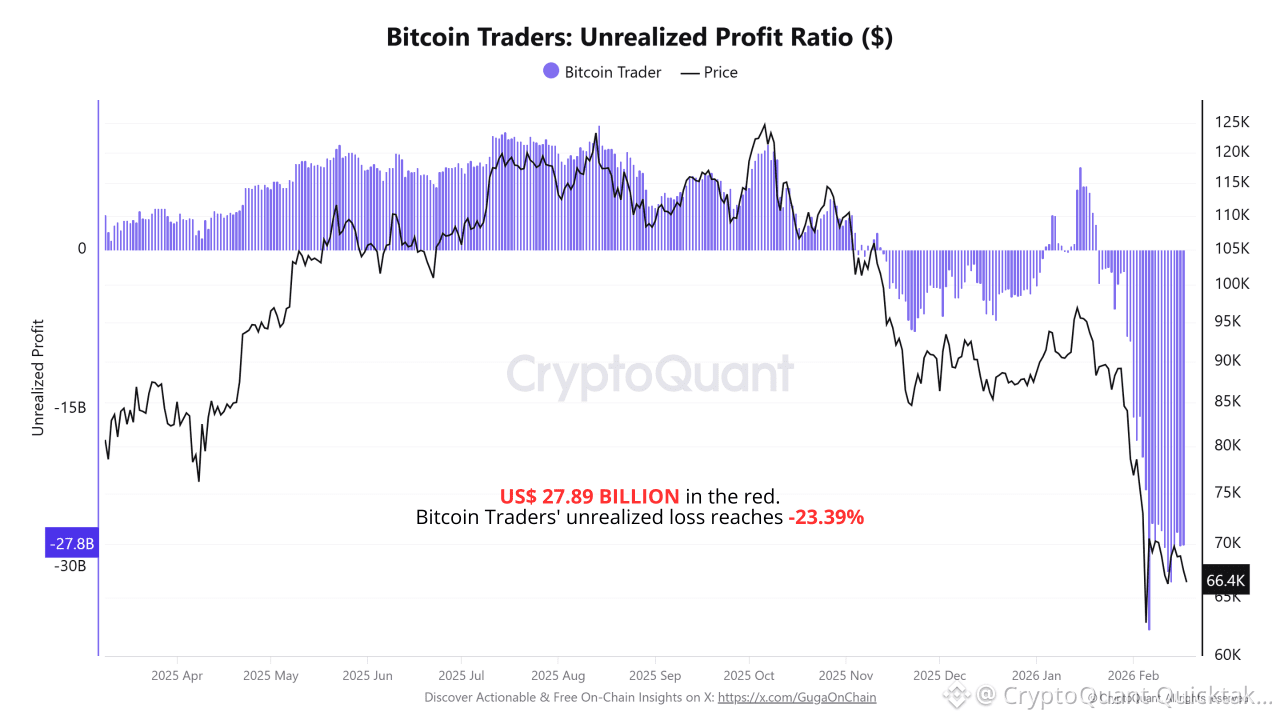

No different from the giants trading Bitcoin via ETFs and CME futures in the US — who have already lost $8.5 billion since October and seen exposure plunge by two-thirds since the 2024 peak — Bitcoin Traders with a specific profile are also enduring historic losses. These are addresses with UTXO age between 1 and 3 months, balances from 10 to 10,000 BTC, that reject CEXs and miners, preferring self-custody in hard wallets. The result? An unrealized loss of $27.89 billion, or -23.39%. Just like the American institutional market, which trades at a persistent discount on Coinbase, this group faces the same selling pressure that knocked Bitcoin down more than 40%.

Even with the 3 pillars from the previous analysis — Accumulators (demand of 371.9K BTC), Retail (+6,384 BTC in 30 days) and Miners (MPI of -1.11) — sustaining the price between $66K and $70K and preventing an immediate collapse, the macroeconomic scenario indicates it is still too early for the bear market to end. The protection from these agents merely delays the inevitable: Bitcoin's encounter with deeper levels.

WHERE BTC MAY FIND BOTTOM

◾ Immediate Support → $60,000 – Region concentrating the highest trading volume from the first half of 2024.

◾ Realized Price → $54,800 – The last major on-chain defense. It's the average cost basis of all holders.

◾ Extreme Scenario → $42,000 – Levels not seen since February 2024.

THE BARE TRUTH

Loss has no class. Whether on Wall Street's glass-floored trading floors or in the solitude of a hard wallet, the entire market is hostage to the same bloodbath. ETFs and on-chain addresses share the same red. The recovery? It depends on price reaction at the levels above.

Written by GugaOnChain