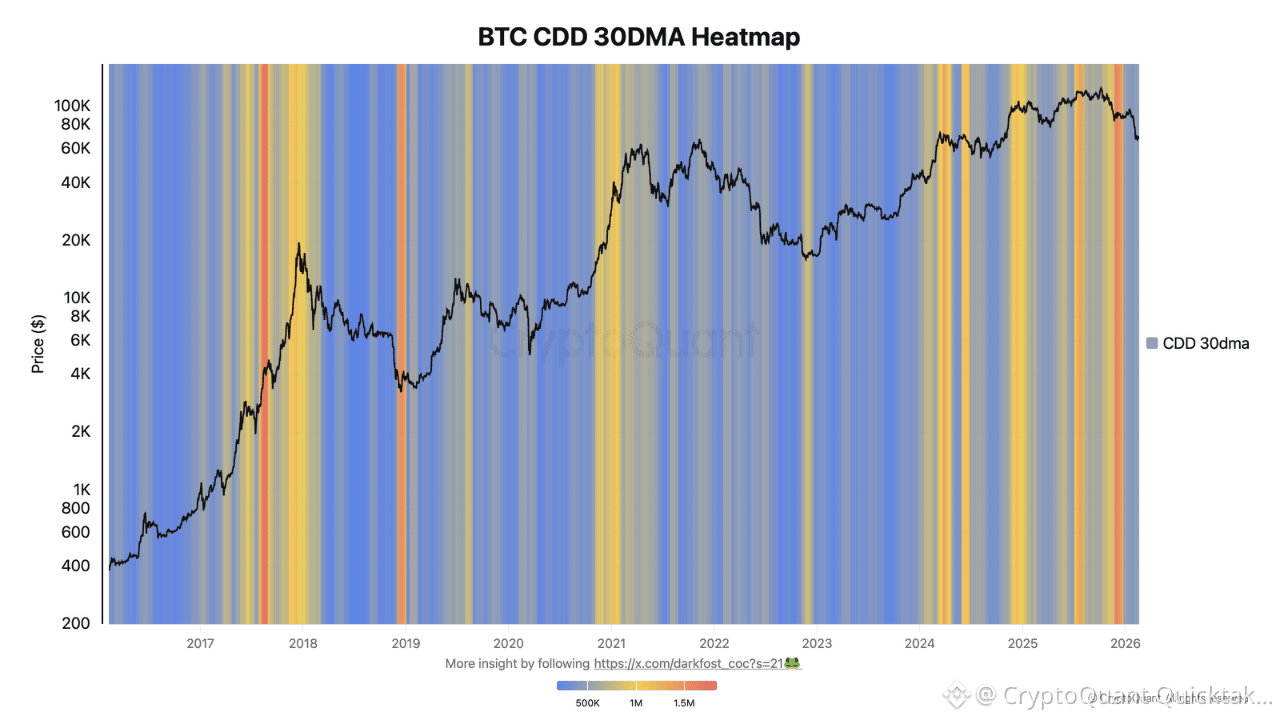

Long Term Holders have been particularly active throughout this cycle, as highlighted by the CDD (Coin Days Destroyed) heatmap.

CDD is an indicator that measures the number of holding days accumulated by a BTC each time an UTXO is spent. When displayed as a heatmap, this metric provides a clear and immediate overview of LTHs activity.

When compared to previous market cycles, it becomes apparent that this cycle stands out as the one in which LTHs have been the most active.

This activity has also tended to intensify around market tops, suggesting that their significant selling pressure likely played a role in marking these local peaks.

That said, it is important to note that this cycle has also introduced additional sources of noise that may have contributed to increased LTH activity without necessarily being tied to outright selling pressure. Several major entities have conducted UTXO consolidation transactions, including Coinbase and Fidelity Investments.

Furthermore, the emergence of Ordinals and Bitcoin inscriptions has prompted some long standing holders to migrate from legacy addresses toward SegWit (P2WPKH = bc1q...) or Taproot (P2TR = bc1p...) formats, which may also have impacted CDD readings.

Finally, the arrival of institutional capital and new market participants has significantly improved overall market liquidity, allowing Long Term Holders to distribute larger amounts of BTC than in previous cycles.

Written by Darkfost