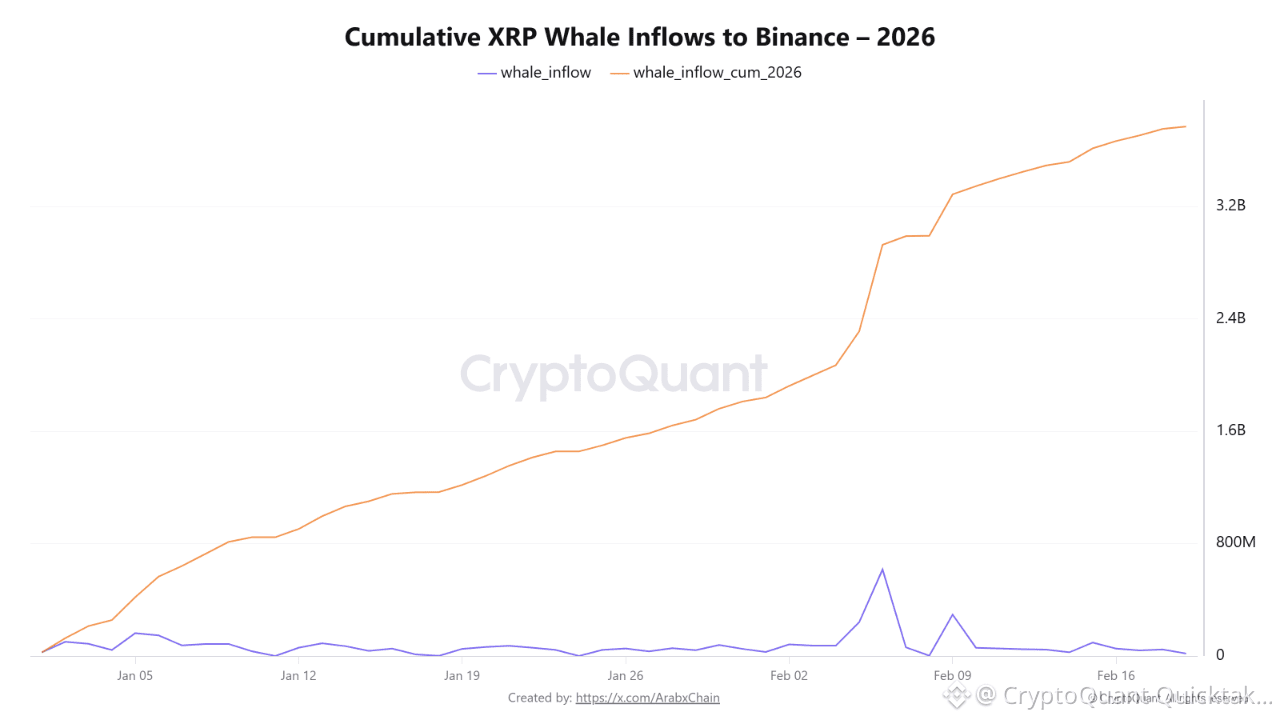

The cumulative flow chart for XRP whales into the Binance platform during 2026 shows a clear increase in the volume of coins deposited by large wallets, reaching approximately 3.8 billion XRP. This behavior carries significant implications regarding the nature of the current market phase and the expectations of major market participants.

Since the beginning of January 2026, the cumulative curve has been gradually and steadily rising, reflecting a continuous influx of large amounts of XRP into the platform. This pattern does not appear random or driven by short-term spikes; rather, it shows a series of successive increases, indicating that whales are undertaking systematic transfers of large balances instead of isolated, individual movements. This type of behavior is usually interpreted as a potential preparation for redistributing liquidity or capitalizing on anticipated price movements.

What stands out in the chart is the clear acceleration in the pace of increase during the first half of February, with the cumulative value rising at a faster rate compared to January. This acceleration suggests a growing appetite among whales to move their assets to exchanges, which may be linked to expectations of higher price volatility or an approaching market decision point. Historically, increased whale flows to exchanges have coincided with periods of either short-term price corrections or repositioning ahead of a new trend.

With cumulative flows reaching levels exceeding several billion XRP, the amount of liquidity theoretically available for sale is arguably greater than before. However, this does not necessarily imply direct selling pressure, as some of these flows may be used for other purposes, such as providing liquidity for trading pairs or transferring assets between internal exchange portfolios.

Written by Arab Chain