Same price level, completely different derivatives market — and that gap is exactly what makes the current data worth reading carefully.

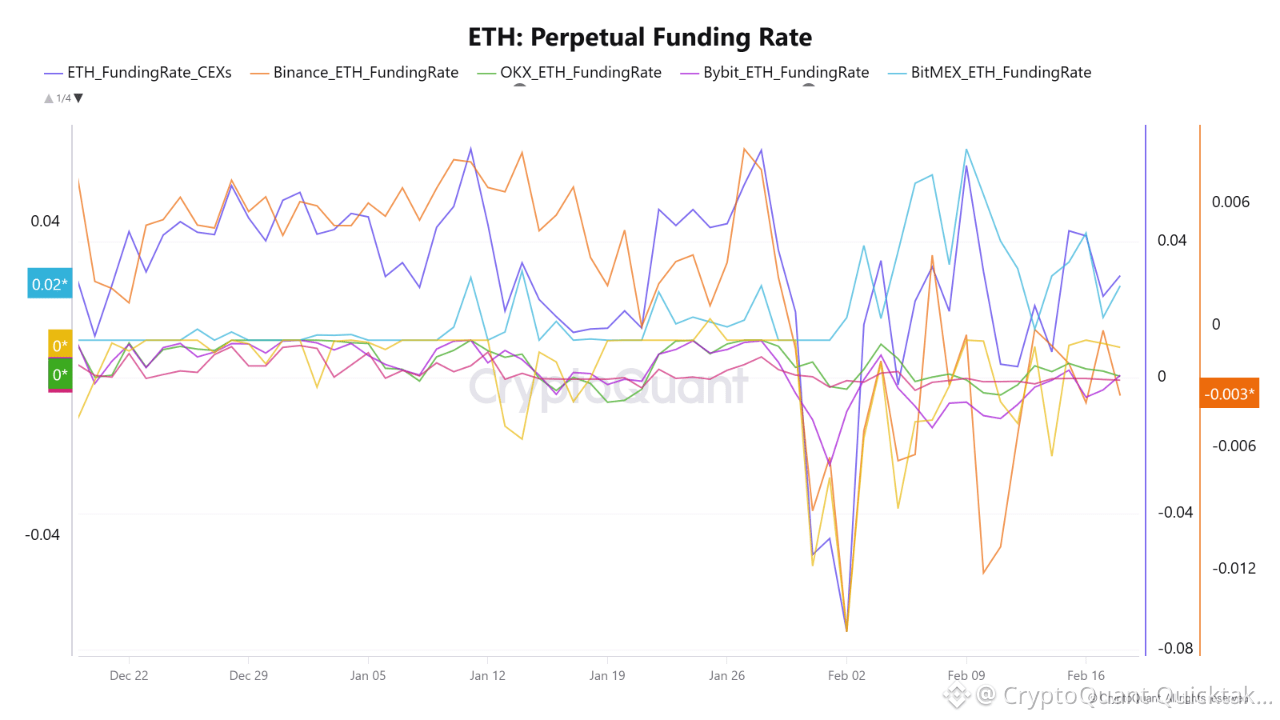

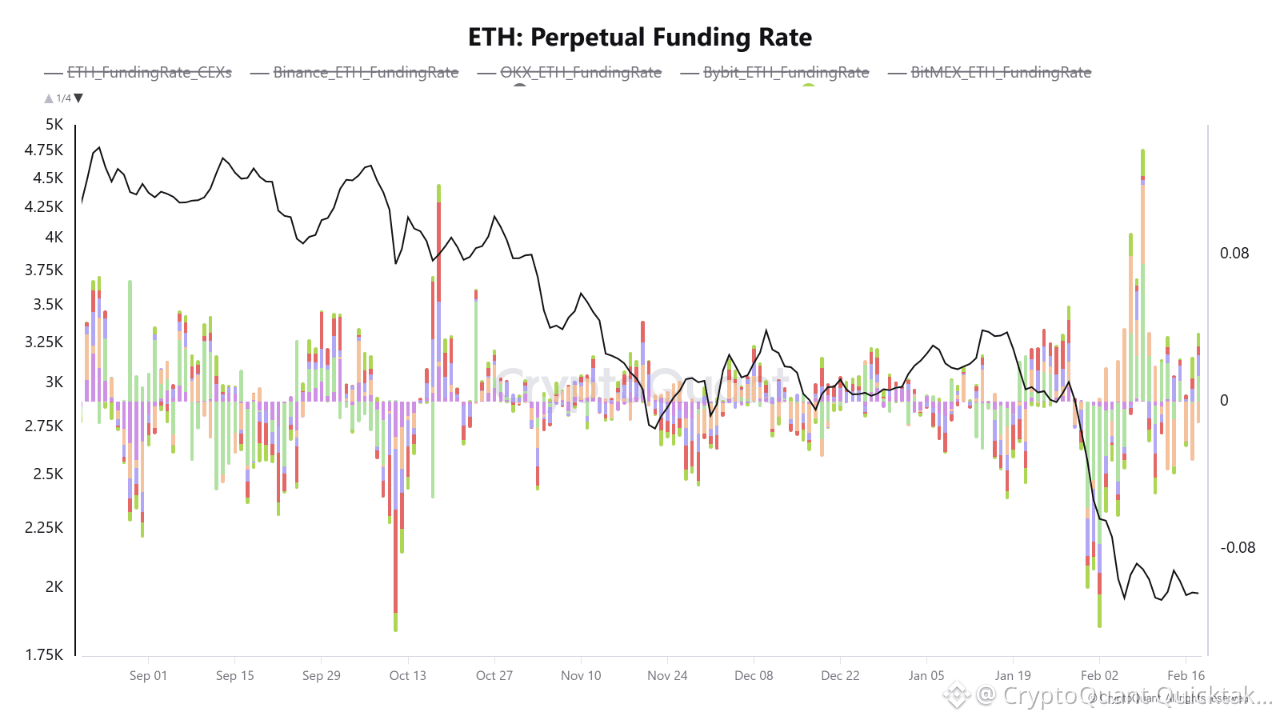

In October 2024, ETH was trading around $2,400–$2,600. The aggregate funding rate across major CEXs was running between 0.055% and 0.097%. Every exchange was aligned — Binance, OKX, Bybit all positive, longs stacked, risk appetite wide open. Today, ETH sits near those same prices at $1,981, but the funding landscape has structurally flipped. The aggregate has collapsed to just +0.030%, and Binance is printing negative at -0.0034%, meaning shorts are now paying longs.

That inversion is the cycle signal. When price revisits a prior level but derivatives sentiment has reversed, it means the trader base was conditioned by everything in between — a run toward $3,300 and then a 40% drawdown in under six weeks. That doesn't invite the same crowd back at the same prices.

The divergence across exchanges deepens the read. OKX sits at near-zero +0.00076%, Bybit at +0.00104%, Deribit slightly negative. These platforms are neutral. Binance's negative funding isn't just directionally different — it's been persistent for two weeks, reaching as deep as -0.012% on individual sessions, while peers drift sideways.

When the dominant exchange leads negative while others lag, it typically reflects a slow structural repricing of risk rather than peak fear. Peak fear tends to snap back quickly. This doesn't. The cycle indicator here stays bearish until Binance's funding rate converges back toward neutral — and that hasn't happened yet.

Written by Crazzyblockk