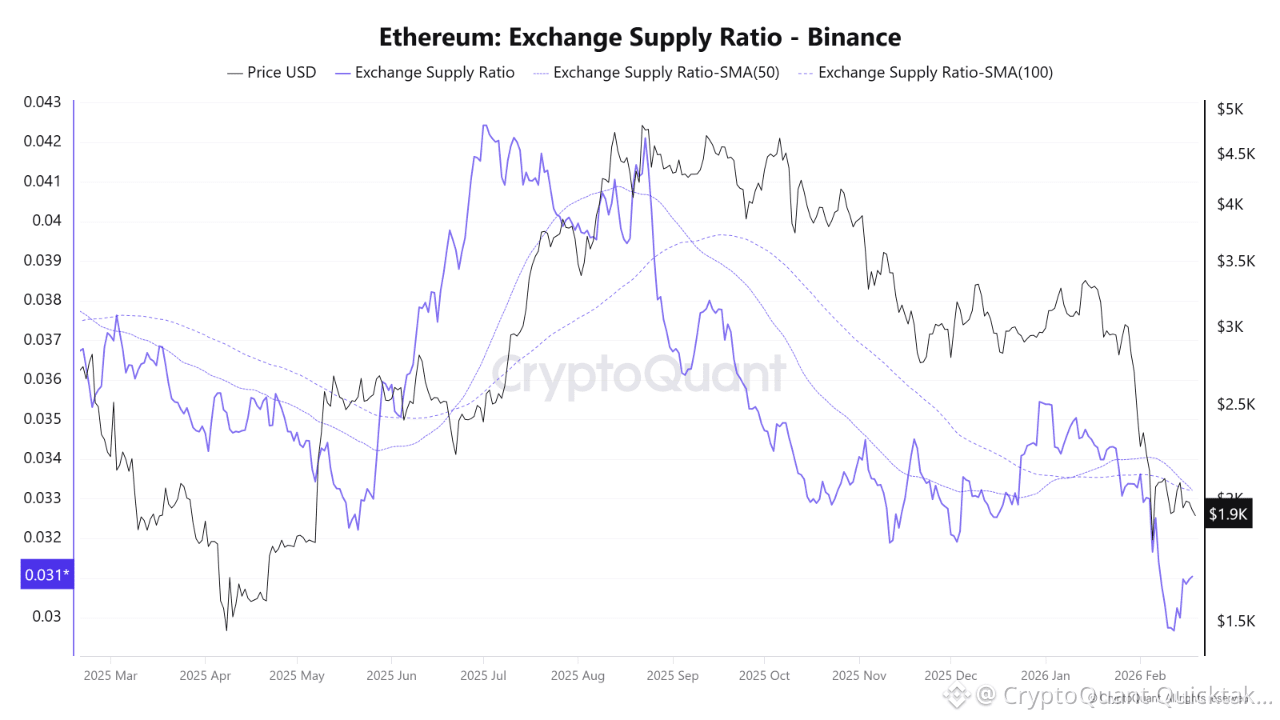

The chart shows that the Exchange Supply Ratio (Binance) is clearly declining. In other words, the amount of ETH held on Binance is decreasing. Under normal conditions, this would be interpreted as reduced selling pressure. However, the fact that price is falling during the same period reveals how weak demand actually is.

A declining exchange balance alone is not inherently bullish. If no new capital is entering the market or worse, if existing demand is shrinking reduced supply cannot push prices higher. Liquidity is weak and buyers are not aggressive. There is no strong spot demand willing to move the price upward.

When supply drops but price continues to fall, the issue is not “fewer coins available for sale,” but rather a lack of buyers.

If the exchange supply ratio is decreasing while price trends downward, the selling pressure is likely coming from perpetual short positions and funding related dynamics. Aggressive activity in derivatives markets can suppress price even if spot supply is declining.

ETH leaving exchanges may also be moving to staking or changing hands through OTC deals. Therefore, assuming that withdrawn ETH will not be sold is not necessarily accurate.

The SMA(50) and SMA(100) are both sloping downward. Even as the ratio declines, momentum fails to recover. This proves that in a weak trend, positive on-chain data alone cannot lift price. First the trend must reverse only then can supply metrics support a sustained move higher.

If demand does not strengthen, low supply by itself will not trigger a rally. However, if short positions accumulate aggressively, the probability of a sudden short squeeze increases.

A falling supply ratio could amplify upside moves if a breakout occurs, but until then, the structure suggests that in this bearish season, there are simply not enough buyers to support a sustained upward move.

Written by PelinayPA