This study combines three metrics: Binance Exchange Inflow, Liquidity USD (MAG-XRP), and Liquidity XRP (MAG-XRP). Together, they help explain how exchange supply and on-chain liquidity conditions have historically aligned with major XRP price movements.

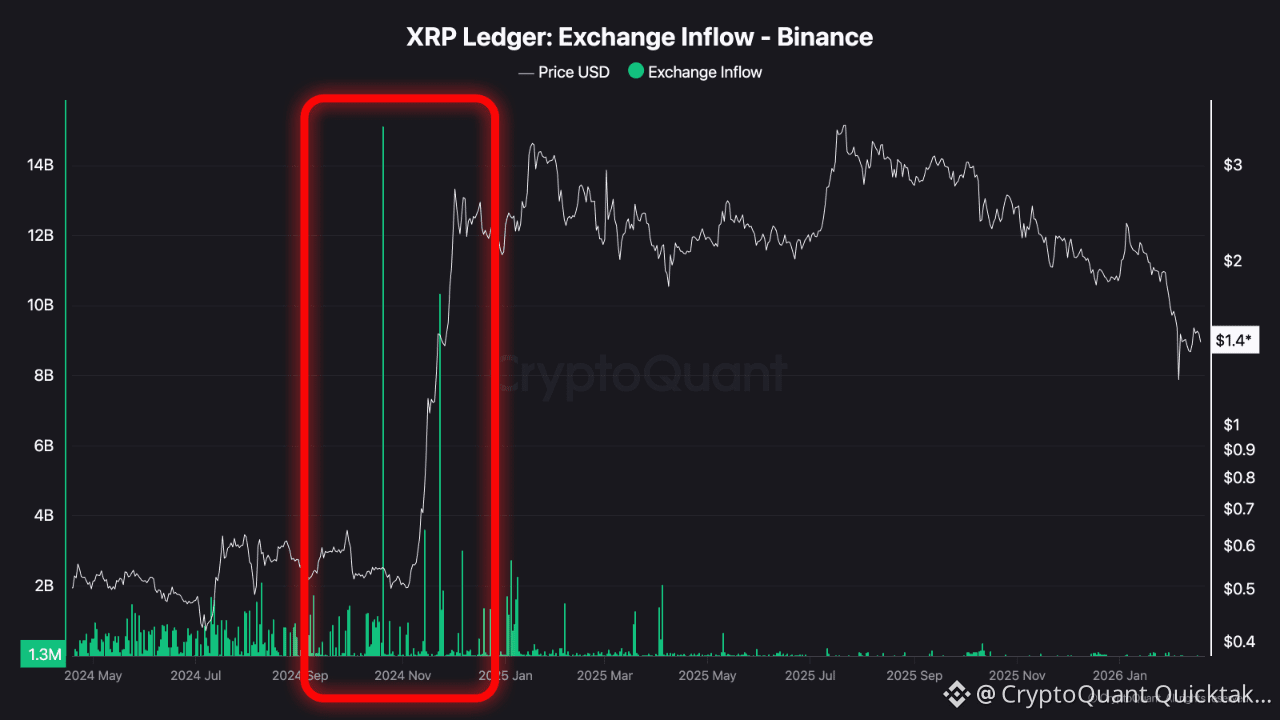

Exchange Inflow on Binance shows a sharp spike during the highlighted period before the strong rally. Large inflows typically indicate tokens moving to exchanges, which can signal potential sell pressure. However, inflows do not always translate into immediate selling. In this case, the spike coincided with rising volatility and preceded a major price expansion.

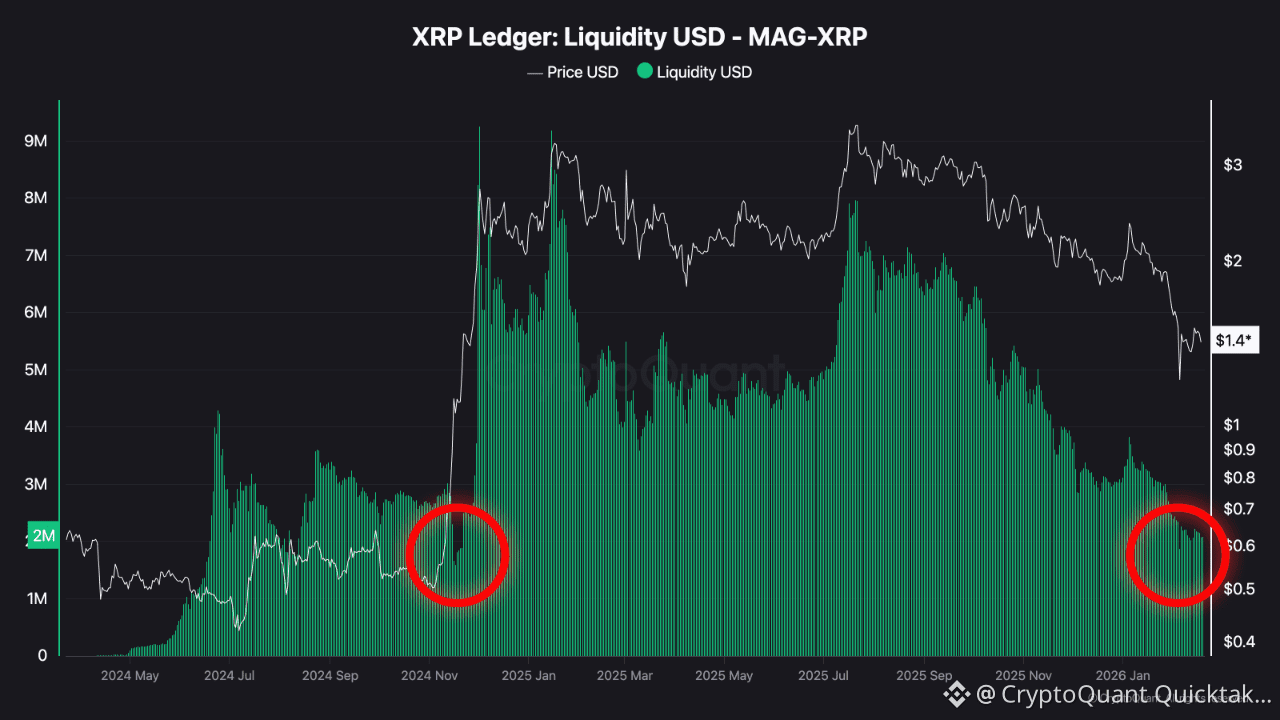

Liquidity USD measures the capital depth supporting XRP markets. During the rally phase, USD liquidity expanded significantly, allowing price to sustain upward momentum. Recently, USD liquidity has been declining, suggesting thinner market depth compared to the expansion phase. Lower depth often increases volatility sensitivity.

Liquidity XRP reflects token-side availability. Before the breakout, XRP liquidity compressed noticeably, indicating reduced active supply. That compression phase aligned with the start of the strong upward move. Currently, XRP liquidity is trending lower again, resembling earlier pre-expansion conditions.

Historically in this chart, a combination of exchange inflow spikes and liquidity compression preceded volatility expansion. Rising USD liquidity supported sustained moves, while declining liquidity increased fragility.

At present, exchange inflows remain moderate, but both USD and XRP liquidity are contracting. This suggests a thinner market structure where price reactions may become sharper.

These metrics provide structural context but should not be used in isolation. Combine them with derivatives positioning, funding trends, and broader market structure before forming directional conclusions.

Written by The Alchemist 9