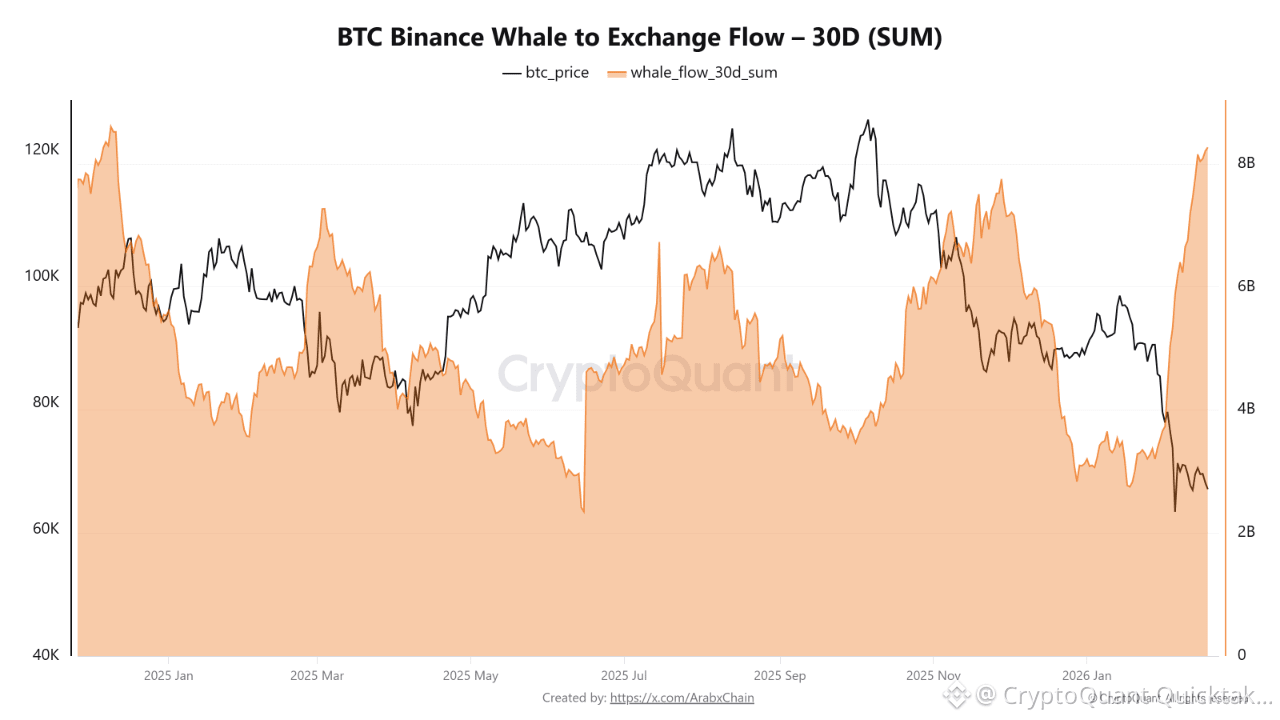

Data shows a significant surge in whale inflows to the Binance platform, reflecting a clear shift in the behavior of major Bitcoin holders. The 30-day average of whale inflows to the platform has reached approximately $8.3 billion, the highest level recorded since 2024, giving this development particular significance in terms of its market implications.

This rapid increase in the 30-day average of whale inflows is often interpreted as a potential predisposition to sell or reallocate positions, especially when it coincides with a decline or relative weakness in price action. Meanwhile, the data shows that Bitcoin was trading near $66,400 at the time of this reading, significantly below its previous highs, suggesting that potential selling pressure may be a contributing factor to this weak price performance.

From another perspective, the 30-day moving average of whale flows reaching its highest level since 2024 does not necessarily signify an outright sell-off. It could also reflect strategic moves to manage liquidity, shift assets for use in derivatives, or repositioning in anticipation of larger future moves. However, historically, significant jumps in this average tend to coincide with periods of increased volatility or transitional phases in market structure.

It is also noteworthy that this surge followed a period of relatively stable whale flows, reinforcing the hypothesis of a shift in major investor sentiment. If these flows continue to rise, we may see an increase in the supply available for sale on exchanges, a factor that could put downward pressure on prices in the short term. Conversely, if the flows begin to decline again, it could signal the end of the distribution phase and the beginning of a gradual return of confidence.

Written by Arab Chain