In-depth data, including all metric breakdowns and visual trend analysis, is available in the full infographic. The information below is an executive summary of the on-chain panorama.

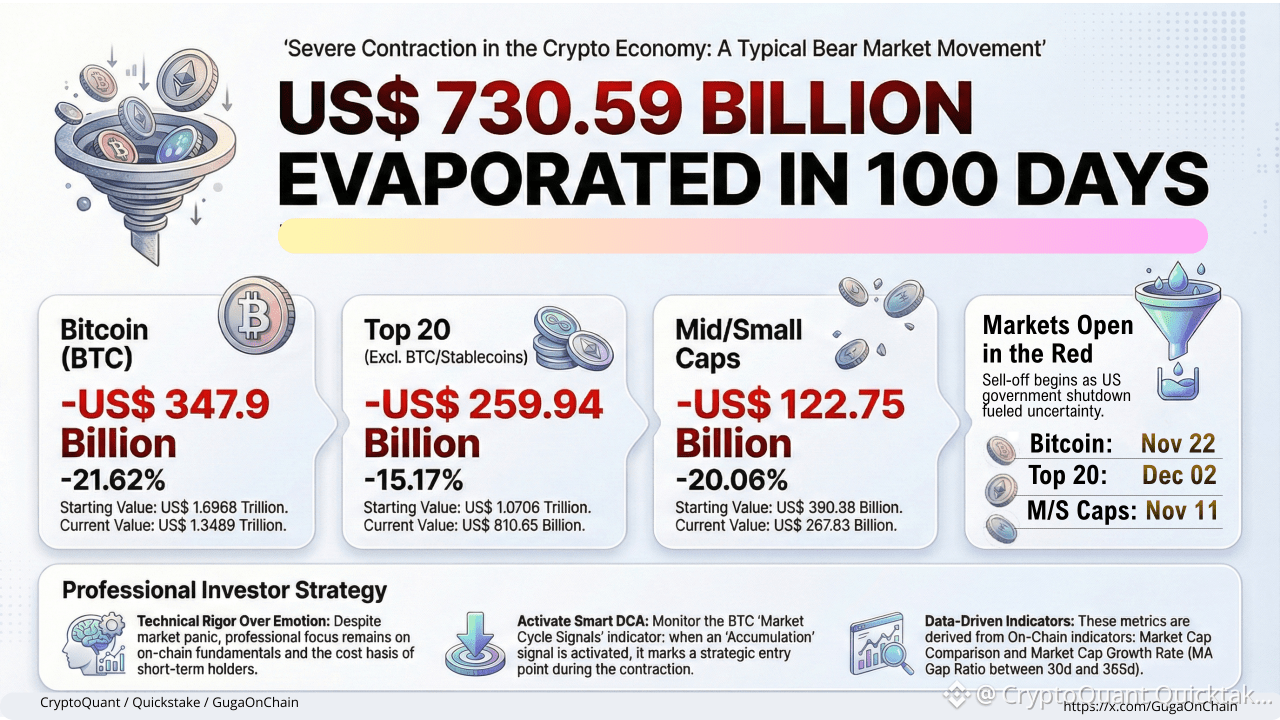

In just 100 days, the cryptocurrency market has erased more than $730 billion in value. What we are witnessing is an unprecedented short-term capital exodus, deepening the contraction of the crypto economy. Bitcoin alone, the ecosystem’s leading asset, is down $347.9 billion, while mid and small-cap altcoins are plunging at an even faster pace. More than a simple correction, the numbers reveal a true investor exodus in a classic risk-off move.

CONTRACTION METRICS – BILLIONS EVAPORATED

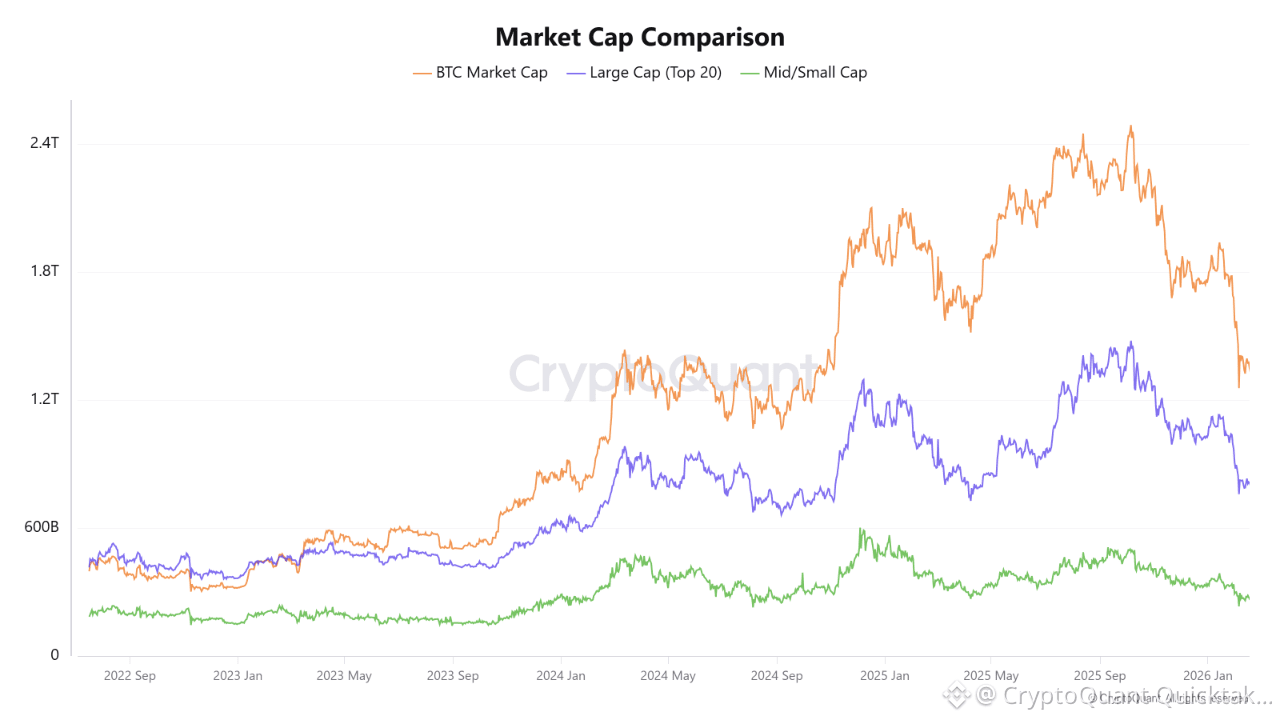

Through on-chain indicators—Market Cap Comparison and Market Cap Growth Rate (MA Gap Ratio between 30d and 365d)—the metrics that expose the crypto economy’s contraction were extracted:

◾ Bitcoin – Leads in nominal losses

→ From $1.6968 trillion (11/22), when it started trading in the red, to $1.3489 trillion today.

→ Difference: -$347.9 billion (decline of 21.62%).

◾ Top 20 (Excluding BTC and Stablecoins) – The elite group of largest cryptos suffered a major blow.

→ From $1.0706 trillion (12/02), when it started trading in the red, to $810.65 billion.

→ Difference: -$259.94 billion (drop of 15.17%).

◾ Mid/Small Caps – The most vulnerable segment was hit hardest proportionally.

→ From $390.38 billion (12/11), when it started trading in the red, to $267.63 billion.

→ Difference: -$122.75 billion (plunge of 20.06%).

◾ Total Drain – With the economy in sharp contraction, $730.59 billion exited the market over this 100-day period.

CONCLUSION

Despite the panic, professional investors should focus on on-chain fundamentals. The cost basis of short-term holders will be crucial. Monitoring BTC Market Cycle Signals for the Accumulation trigger is strategic for Smart DCA amid the contraction. In this phase, technical discipline must prevail over emotion.

Written by GugaOnChain