90% STRC / 10% MSTR

STRC locks in a fat, tax-deferred coupon. Keeps monthly bills paid without selling stock.

$900k in STRC + 11% dividend = $99k/yr straight into your account.

10% MSTR is 1.25x levered exposure to a 30% BTC CAGR.

This grows far faster than inflation, letting you peel off a sliver each year to keep purchasing power intact.

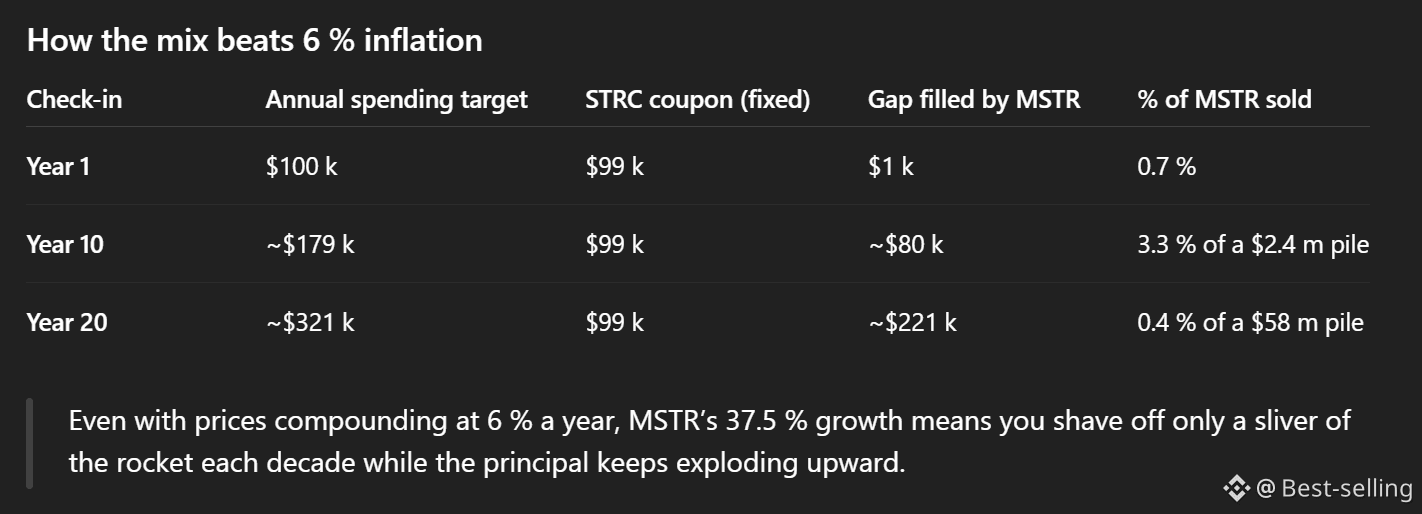

$100k in MSTR growing 37.5%/yr means your $100k doubles every 26 months if untouched.

STRC’s 11 % coupon covers nearly the entire first-year lifestyle, so bills get paid without touching volatile assets.

A modest 10% slice in MSTR compounds fast enough to outrun 6 % inflation many times over, giving you a deep well to tap for rising expenses.

Capping MSTR at 10% keeps portfolio swings mild while preserving exponential upside.

More cautious? Go 95 / 5. Feeling bolder? Try 80 / 20.

The framework stays the same, only the growth buffer size changes