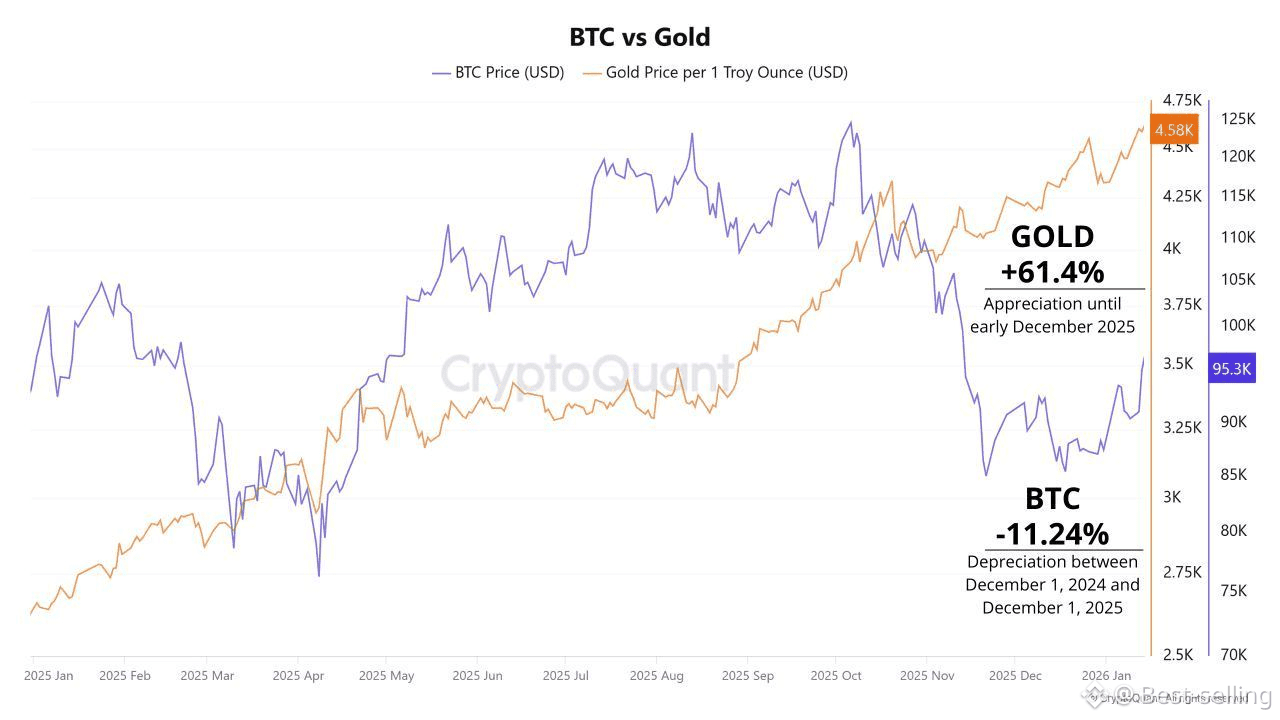

While $BTC has chopped below $100K, gold ripped +61%, its biggest annual move since the late 1970s. #Bitcoin? Down ~11% over the same window.

That’s not a rejection of Bitcoin, that’s just risk management.

@Cellula Re-poster #dusk $DUSK

With a cautious Fed, sticky inflation, and geopolitical noise, institutions parked capital in the cleanest hedge first. Gold did its job. Fast.

You can even see it on-chain. Tokenized gold flows are concentrated in $PAXG and $XAUT, now dominating most of the tokenized commodity space. That’s where capital went while it waited.

This isn’t structural, it’s just tactical.

Institutions didn’t rotate out of Bitcoin forever. They rotated ahead of clarity. When the risk-off bid fades and macro pressure eases, that capital doesn’t stay in gold.

It looks for asymmetry. Gold is where capital hides, and Bitcoin is where it goes when it wants upside.

This divergence feels less like the end of a cycle and more like the setup before rotation back.