Greg had a problem most people would kill to have: he was sitting on 50 Bitcoin, and it was boring him to death.

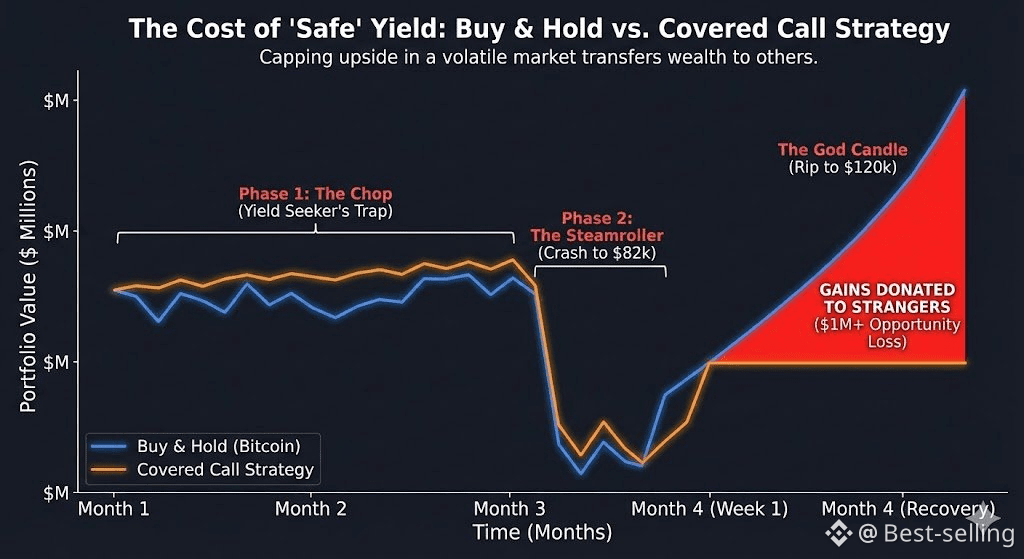

skor three months, price had been stuck in a narrow channel between $92,000 and $98,000. While the rest of crypto chased meme coins and DeFi yields, Greg’s portfolio, worth nearly $4.7 million, was effectively dead money.

Then he saw the strategy that promised to fix it.

“Generate ~15–18% annualized yield on your Bitcoin,” the newsletter read. “Low risk. No leverage. Just selling upside you probably won’t need.”

It was called the Covered Call Strategy.

The pitch was seductive: you hold your Bitcoin. You sell a contract giving someone else the right to buy it at $100,000 next month. In exchange, they pay you cash today.

Greg ran the numbers. Selling calls would net him roughly $70,000 per month. Nearly $840,000 a year. Just for waiting.

“It’s like collecting rent on a house,” he told his friends. “I’m getting paid to hold.”

He didn’t realize he had just agreed to pick up nickels in front of a steamroller.

The Hidden Cost: Selling Your Convexity (Upside)

What the newsletter didn’t explain was Bitcoin’s first principle: Positive Upside (or convexity for nerds).

Bitcoin is asymmetric by design. It can go down 100%, but it can go up 1,000%, 10,000%, or more. You tolerate volatility because the right tail pays for everything.

By selling call options, Greg surgically removed that right tail.

Upside: Capped at $100,000

Downside: Fully intact

He engineered Negative upside (Convexity). The “yield” wasn’t income. It was an insurance premium. Greg had become the volatility seller in a market that exists to punish volatility sellers.

The Trap: The Hedge (Gamma) Flip ($93,640)

The trap sprang on a Tuesday morning. Greg’s dashboard flashed a warning he didn’t fully understand:

Gamma Flip: $93,640

This was the structural line in the sand for dealers.

Above $93,640: Dealers are "Long Gamma" and buy dips.

Below $93,640: Dealers flip "Short Gamma" and sell into weakness.

That morning, adverse regulatory headlines hit. Bitcoin slipped to $93,100. Once price crossed $93,640, the stabilizers vanished.

$93,100 became $91,000. $91,000 became $86,000. $86,000 became $82,000.

In six hours, Greg watched roughly $600,000 of mark-to-market value evaporate.

“At least I have the premium,” he thought.

He had collected $70,000 for the month. But the “safe yield” was a two-inch airbag in a 100-mph crash.

The Second Steamroller: The Recovery

The true tragedy of covered calls isn’t the drawdown. It’s the recovery.

Two weeks later, the panic proved temporary. Bitcoin didn’t just bounce it ripped. $85,000. $95,000. $105,000. $120,000.

This was the moment Greg had waited years for. The God Candle.

But he didn’t really own 50 Bitcoin anymore. He had sold the right to buy his coins at $100,000. When price hit $120,000, the calls were exercised.

Market Price: $120,000

Greg’s Exit Price: $100,000

Opportunity Transferred: $1,000,000

Greg kept his $70,000 premium. The call buyer kept the upside and the Lamborghini.

The Lesson

Greg learned too late that Yield is not Income. Yield is Risk in disguise.

Selling covered calls on Bitcoin is a bet that nothing interesting will happen. Bitcoin exists precisely because interesting things happen.

Greg is still in the market, but he no longer sells calls. In an asset engineered for exponential moves, capping your upside for a monthly paycheck is the most expensive mistake you can make.

He stopped trying to be a landlord collecting rent, and went back to being an owner building wealth.