One pattern repeats in every crypto cycle: when the market slows down, most people stop paying attention. Volume drops, timelines get quieter, and narratives lose momentum. But the networks that keep running during these periods are often the ones that matter later.

One pattern repeats in every crypto cycle: when the market slows down, most people stop paying attention. Volume drops, timelines get quieter, and narratives lose momentum. But the networks that keep running during these periods are often the ones that matter later.

That’s one of the reasons I keep watching @Plasma .

Not because of short-term excitement, but because of how the project is positioning itself. Plasma isn’t trying to compete for attention in every category. The focus on payments and stablecoin-driven activity suggests a strategy built around steady demand, not speculative bursts.

Not because of short-term excitement, but because of how the project is positioning itself. Plasma isn’t trying to compete for attention in every category. The focus on payments and stablecoin-driven activity suggests a strategy built around steady demand, not speculative bursts.

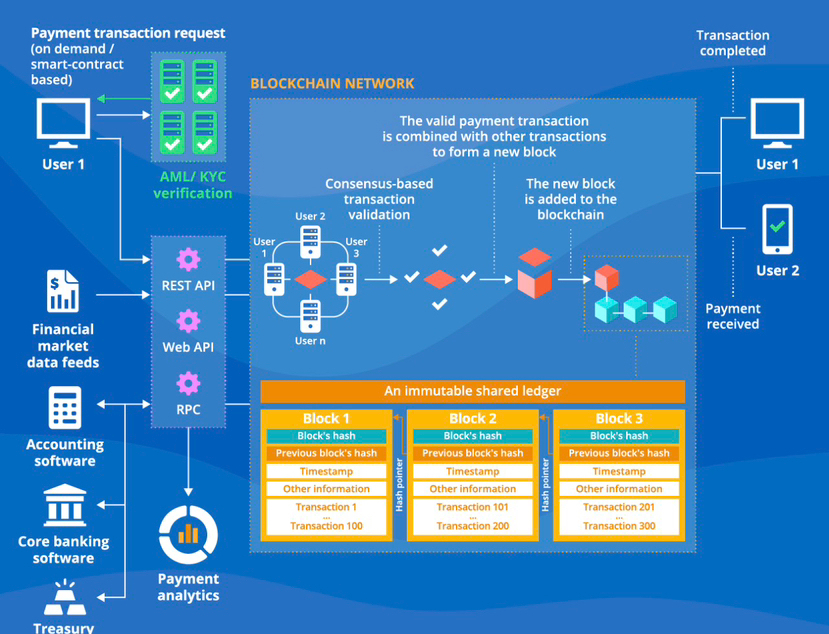

What’s interesting about payment-oriented infrastructure is that usage behaves differently. Trading volume can disappear overnight. Incentivized liquidity can vanish in weeks. But real value transfer tends to be persistent. Businesses, traders, and users still need to move funds regardless of market direction.

That’s why consistency becomes such an important metric. Not spikes, not sudden growth—just the ability to process transactions reliably, day after day.

For $XPL , this kind of environment is actually constructive. When markets are quiet, speculative narratives fade, and what remains is utility. If network activity keeps building, even slowly, the long-term value proposition becomes clearer over time.

Crypto often rewards patience in ways that aren’t obvious in the moment.

The loudest phases of the market attract attention, but the quiet phases often build the foundations.

And sometimes, by the time the noise returns, the groundwork has already been laid.