Most people still think that blockchain competes on scalability. In 2026, that seems quaint. It’s not innovation or scalability that’s important anymore—it’s execution: How well does a network move actual value? How well does a network handle a high volume split? XPL is right in the middle of this upheaval, and what’s been happening in its prices is only a small part of this larger narrative.

The concept of an execution layer is simple. It is the part of the blockchain that actually gets the transactions done, the smart contracts, and then gets the results back. In the old systems, this was an integrated network, where the execution, the settlement, the storage, and the consensus were layered one on top of the other. This was fine when the blockchains were small in number.

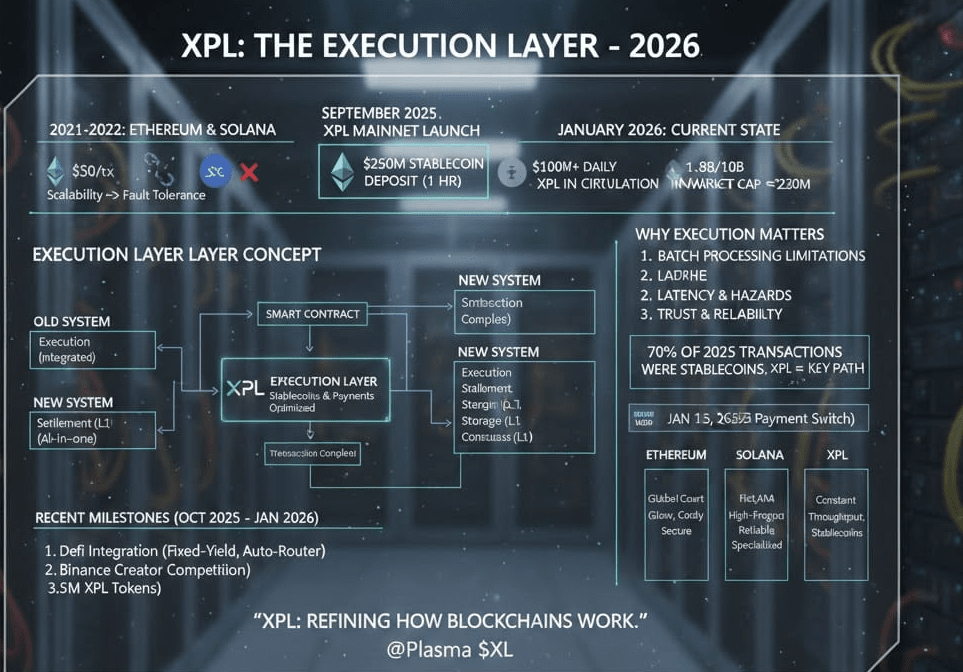

Ethereum illustrated this problem in 2021 and 2022. Behind every spike in NFT minting and DeFi liquidations, fees busted through the $50 barrier on a per-transaction basis. Solana moved in the other direction, prioritizing raw transactions, and its frequent crashes in the first year encouraged us to understand the trade-off between raw performance and sufficient fault tolerance, especially in a safety-critical area such as our code runs in.

To the best of history in the BlockChain industry, when the mainnet of XPL was launched in September of the year 2025, the initial one-hour stablecoin deposit was $250 million. The one data point speaks more than any slogan can speak in terms of checking the capability of the Execution Layer for a large-scale money transfer, which was successfully tested by the end-users of the first kind of mainnet in the world.

Why is this execution a problem? In other words, what makes it so difficult to move value reliably in a decentralized network? The standard blockchain model is a batch processor, and their transactions are done in batches, or “blocks” that must be propagated and validated on dozens or hundreds of machines. Each additional step increases latencies, and each and every detour brings with it a whole line of potential hazards. Layer one execution protocols attempt a refactoring of this whole process in order to facilitate smooth and trust-free execution..

One of the main focuses of XPL is the execution of stablecoins. This may seem like a very specific task for a blockchain network. However, the reality is that right now, stablecoins are the dominant players when it comes to actual blockchain transactions. It is no secret that more than 70 percent of all transactions that were processed through the blockchain network in 2025 were stablecoin transactions. This matters, because the numbers mentioned above are actual economy values. A layer of execution only actually matters if the people using the layer trust it

One such example is the integration of the cross-chain liquidity system called USDT0 that belongs to the company called Tether. USDT0, as of January 15, 2026, processed more than $63 billion in transaction volume across 18 interconnected blockchain networks, and XPL was identified as one of the main execution paths. What this means is XPL is more than just theory – it’s actually facilitating the flow of substantial amounts of capital throughout the crypto space.

As of January 22, 2026, XPL processes over $100 million in daily trading volume, with roughly 1.8 billion tokens circulating out of a total 10 billion supply. That gives it a real-time market capitalization near $230 million. These numbers are important because they show real economic activity. Execution layers only matter if people trust them with money.

What makes execution layers different today compared to a few years ago is specialization. Instead of trying to serve every possible use case, newer networks design their execution engines around specific workloads. XPL does this for stablecoins and payments. Other chains may target gaming, NFTs, or AI computation. This division of labor is starting to look more like traditional financial infrastructure, where different systems handle clearing, settlement, custody, and compliance separately.

In understanding the positioning of XPL, a brief discussion of Ethereum and Solana, two other familiar blockchain networks, is in order. While Ethereum is committed to achieving the highest level of decentralization and an unshakeable level of security, the underlying transaction processing layer is only able to process 15-20 transactions in a second. Solana focuses purely on achieving the highest transaction processing speeds, claiming a processing rate of thousands of transactions in a second, but functioning only with the most specialized equipment and in highly optimized ways.

So, Ethereum is basically a global courts system: slow, costly, but incredibly secure. Solana is more like a high-frequency trader: fast but tough to work with. XPL is more like a global payment switch: built for constant throughput, rather than to enable all possible smart contract experiments.

The reason why there is a recent interest in XPL is not because of hype but because progress is being made. In October 2025, mainstream DeFi protocols started incorporating their work right into its execution layer and implemented fixed-yield tactics and stablecoin routing in an auto-router. Then in January 2026, a multi-week XPL creator competition was started by Binance, handing out 3.5 million tokens and bringing in a whole new level of users and transaction activity.

Another, even more subtle, reason that traders care is related to unlock schedules of tokens. About 88.8 million XPL tokens, or 0.9 percent of total supply, will unlock on January 25, 2026. Such events in regular markets are known to cause market volatility. However, in execution value projects, unlock events further validate demand for the underlying network. This helps execution value accrue if transaction volumes increase at a faster rate.

Personally, it has been a humbling experience to observe how execution layers have developed during the last ten years. There was a promise of payments happening in an instant and happening worldwide. In truth, payments took minutes, and the cost was high. Today, for the first time, we find ourselves on the cusp of a new era, with the possibility of transactions becoming almost invisible, like in traditional finance but without its middlemen, and XPL is a step in that direction.

One question keeps coming up: does execution alone create long-term value? The answer depends on whether usage becomes habitual. Payments networks succeed when people stop thinking about them. Visa did not win because it was exciting. It won because it worked every time. Execution layers in crypto must reach that same level of boring reliability.

As someone who has been following execution layers, it has been an eye-opening process the last ten years. Bitcoin's initial vision was for zero-conf, global payments. In practice, there were minute waits and considerable charges. Now, for the first time, we're able to look at a system that provides transfers almost inconceivably close to instantaneous, as if it's traditional finance, but without an intermediary system; systems like XPL, which is a result of learning from the school of hard knocks.

Execution layers are where crypto meets reality. They turn ideas into transactions, and transactions into trust. XPL is not redefining what blockchains are. It is refining how they work.