Most blockchains force a trade-off: you either get full transparency, where everyone can see everything, or full privacy, where nobody can verify what's happening. Dusk tries to walk a third path. It tries to make ownership private while keeping rules auditable. That balance explains why it has gained attention in late 2025 and early 2026, but most certainly from financial institutions that need both confidentiality and regulatory clarity.

Having watched markets cycle through privacy hype, regulatory crackdowns, and institutional hesitation, Dusk intrigues me in that it does not pretend the rules aren't there-but builds privacy around them. After nearly six years in development, Dusk flipped the switch on its mainnet in January 2026, touting what's described as "auditable privacy." Simplified: transactions and ownership remain hidden from the public, while regulators and otherwise authorized parties could verify compliance if necessary.

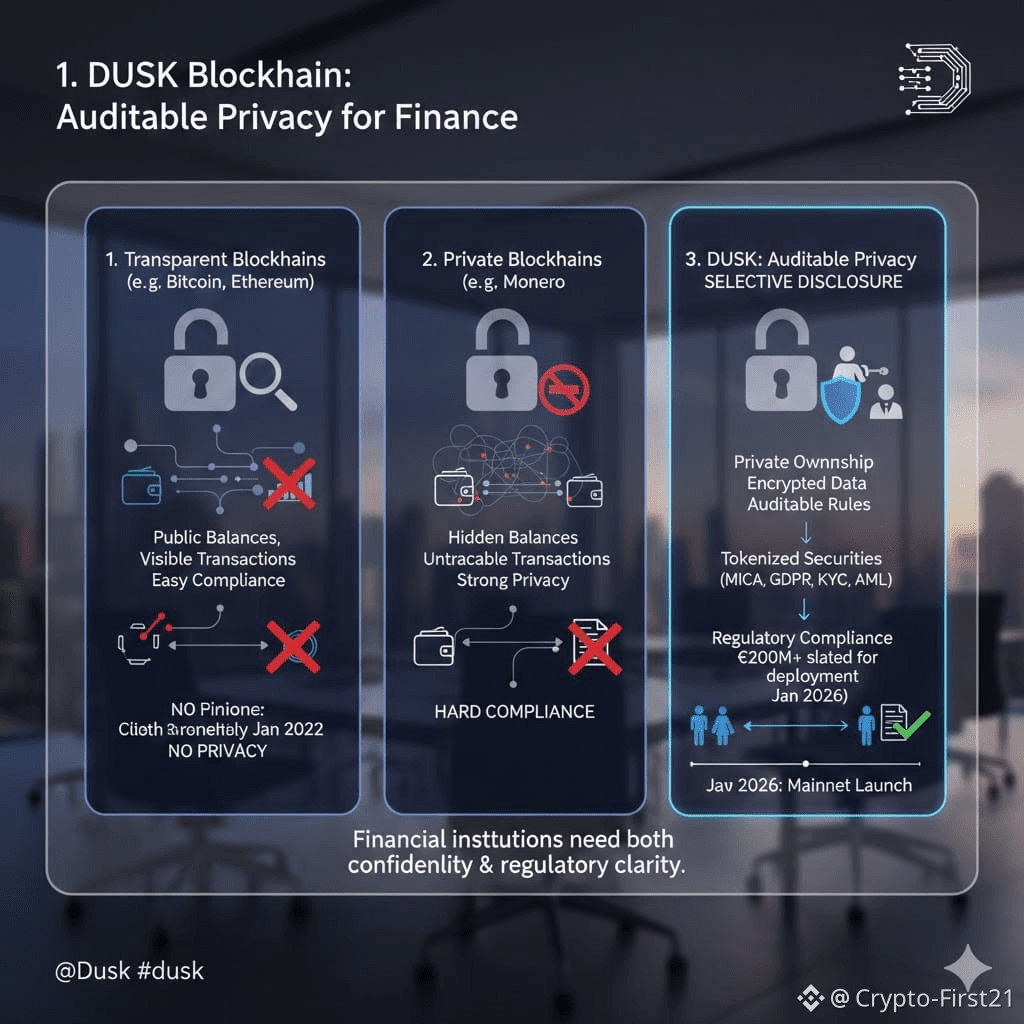

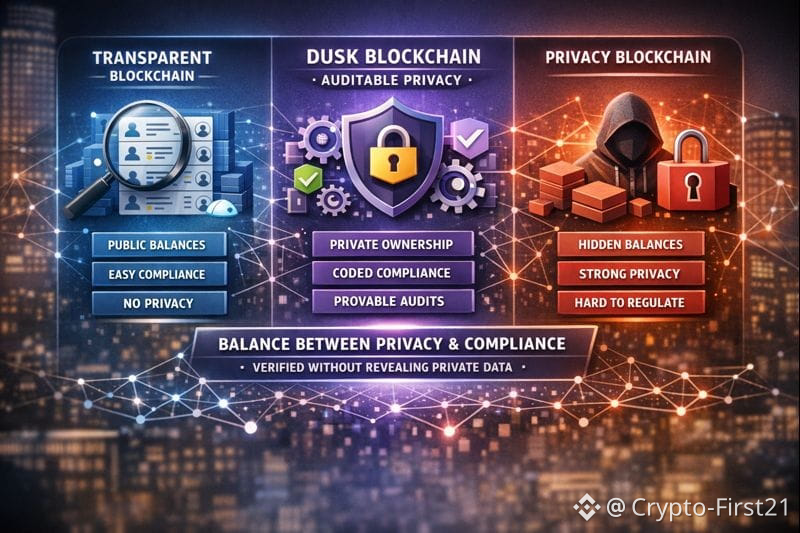

To see why, it's useful to consider how, in regular blockchains like Bitcoin or Ethereum, balances, transactional amount, and wallet history are publicly visible. While visibility can be useful for establishing trust, it also means that anyone and everyone can see sensitive information. When companies have publicly visible shares or publicly traded financial activity, anyone can see exactly what they are doing in real-time. This level of visibility, of course, is not acceptable in regular finance.

Traditionally, the kind of thing we call “privacy coins” has taken the reverse path. Not only do we fail to authenticate some information, we fail to authenticate most. This, of course, protects users, but it causes major issues in regulated markets. Banks, stock exchanges, asset-issuing companies, and the like cannot function on platforms on which they cannot verify their own observance of laws such as KYC, anti-money-laundering laws, and securities laws. And it's here

Dusk leverages zero-knowledge proofs, which are cryptographic means that allow a party to prove the veracity of something without disclosing the underlying data. This would be like proving you are above 18 years old without showing your date of birth. In Dusk, this notion extends to ownership, identity, and transaction rules: you can prove a transfer followed regulatory requirements without disclosing who you are or how much you transferred.

The most tangible example is the work DUSK does in tokenized securities. In cooperation with regulated platforms around Europe, DUSK hosts the actual financial assets directly on its blockchain. By early 2026, over €200 million in tokenized securities were slated for deployment with licensed exchanges. These assets do require strict compliance: investors are required to meet eligibility rules, trades must be in accordance with jurisdictional laws, and regulators must have the ability to audit records. DUSK enables all of this while still keeping individual balances and transaction histories private from the public.

What makes this possible is selective disclosure. Data is encrypted by default. Only authorized parties-regulators or auditors-can decrypt or verify specific parts when this is legally required. Everybody else sees only the cryptographic proofs that the rules were followed. This maintains confidentiality, without breaking trust.

In November 2025, Dusk launched the Hedger Alpha system for confidential transactions on test networks. This let users privately send assets while maintaining cryptographic audit trails. That may sound technical, but the implication is simple: financial activity can finally be private without becoming invisible.

To put things in perspective, let's compare three common blockchain models. On fully transparent chains like Ethereum, ownership is public, compliance is easy, but privacy is almost nonexistent. On full privacy-first chains like Monero, ownership is hidden, privacy strong, but regulatory compliance is extremely hard. Dusk wishes to sit in the middle: ownership is private, compliance rules are executed in code, and audits are possible through cryptographic proofs. This is where real-world finance actually operates.

What makes that suddenly trend so is the regulation. Not only has the MiCA regime in Europe and the DLP been activated, which is requiring financial institutions to seek blockchain-type settlement systems, but the GDPR regarding the proper handling of data cannot have financial information publicly available. You need a solution that meets all the necessary and correct regulation, and Dusk is one of the few blockchains designed for the new world verses an adapted world.

Another reason is the increasing demand for tokenization of real-world assets, wherein investment analysts project that the market for tokenized securities, bonds, and funds could reach $10 trillion by 2030. But this is going to happen only if institutions trust this infrastructure. As of January 2026, the futures open interests on Dusk were at nearly $48 million on a single day, indicating an increasing market focus on this cryptocurrency trading infrastructure. As usual, various price movements are temporary, but the increasing open interests indicate that market players are gradually understanding the underlying tale of this price movement.

From a personal point of view, I see that the most obvious thing is a shift in wording. Just a few years ago, we were all about anonymity and censorship resistance. Now we are all about compliant privacy. That is hard. That is hard cryptographically, hard protocol-wise, and hard-to-achieve. That is well reflected by Dusk’s six-year development.

There’s also the philosophical aspect. Real ownership implies being in control without being exposed. It implies being able to own up, prove your property, operate as you wish, and still operate under rules, without being exposed to the world or informing them of your entire life. And on this, Dusk gets us much nearer than most other systems I’m aware of.

Progress has been steady, not flashy. Mainnet was launched last January 2026, making confidential smart contracts possible. Integrations with data oracles and cross-chain bridges are in the pipeline for the first half of 2026, while regulated exchanges are slowly adding tokenized assets to their lists. There are no instant gratification achievements when it comes to infrastructure, though. The point here is the live building blocks are now out.

Of course, challenges remain. Cryptographic systems are complex, regulatory interpretations change, and adoption takes time. The direction, though, is clear. Financial institutions aren't asking anymore if blockchain can be compliant; rather, they're asking which infrastructure will let them operate privately while staying within the guidelines.

That brings us back to that question of confidential ownership with auditable rules. It sounds very abstract, yet it describes something very, very real. It means holding shares, bonds, or digital assets without public exposure, while proving to regulators that everything is above board. It means businesses operate competitively without spilling their strategic beans. It means individuals can keep their financial privacy without stepping outside the rule of law.

In markets, the biggest changes usually occur quietly, in plumbing and infrastructure. Retail traders chase narratives; institutions chase reliability. Dusk's approach falls squarely into that second category. Whether it becomes dominant or not, it speaks to where blockchain design is going: not toward absolute transparency or absolute opacity, but toward selective, programmatic trust. And in a digitizing, regulating financial world, that may prove to be the most valuable feature of all.