Most discussions surrounding cryptocurrency and blockchain continue to center upon price, hype, and speed. Nevertheless, every two or three years, a level-change revolution takes place, but outside the mainstream eye. One example is Dusk, which has revolutionized how best to separate asset visibility and logic, and this is revolutionizing how best to combine regulated finance and on-chain privacy.

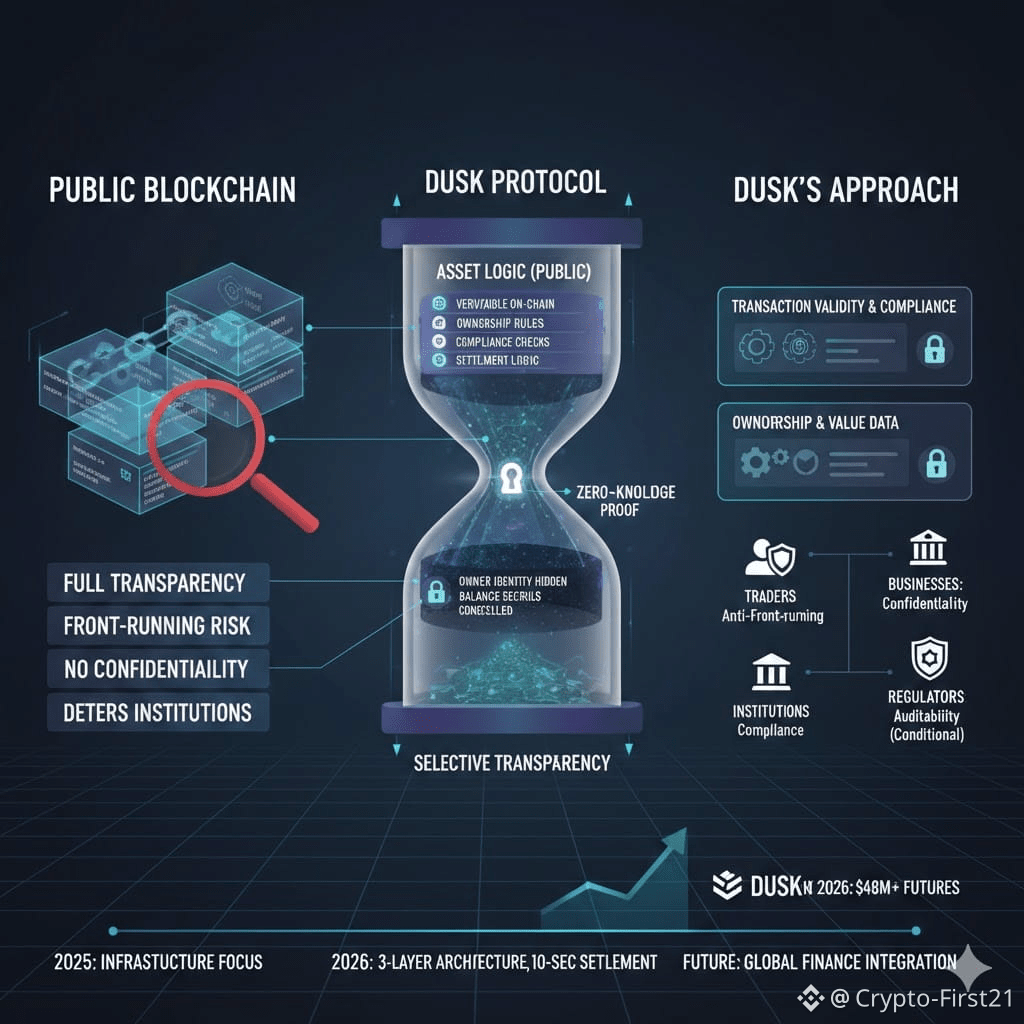

However, if you’re familiar with the market long enough, you know that as transparency, while arguably cryptos' ultimate strength, becoming their ultimate weakness lies in how transparency, particularly with regard to earlier versions of blockchains, makes everything transparent, ie, visible, to all. Thus, “transparency helped build trust in what otherwise would be seen as a trustless world, but it's also created some structural issues: front running of large traders, deterring institutions, deterring businesses from exposing balance sheets to public networks, or regulators demanding more compliance, less transparency.”

Dusk takes a different approach for its architecture. In this approach, Dusk doesn’t consider privacy an add-on, instead, it gives it first-class treatment within assets. The basic idea behind Dusk is as follows: asset logic, i.e., asset ownership, compliance, and settlement, needs to be verifiable on-chain, and visibility, i.e., asset owners and their balances, needs to be hidden.

In practice, Dusk is able to validate and lock in all sorts of transactions without ever revealing what is going on. This is accomplished utilizing something called zero-knowledge proofs, which allow the user of Dusk to confirm that rules are being followed without ever being forced to reveal what is going on. The analogy given for this is being able to prove that you are of legal age for an establishment without ever being forced to reveal your birthdate. This is obviously minor, but for finance, it is literally all or nothing.

This concept is becoming increasingly popular, particularly due to its alignment with the current and future financial necessities. DUSK briefly entered the list of the four biggest cryptocurrencies based on the daily trading volume for the reason of privacy. Around January 2026, futures were marked by an increased volume of close to 48 million dollars. These developments were not for the sake of hype. There was a significant sense of understanding surrounding the regulated infrastructure of the next market cycle.

Price action, of course, only provides one side of the overall picture, though. The underlying reality is simply that of institutional participation. For that matter, banks, registrars, and everyone else of that ilk rarely desire radical transparency of any kind. They desire accountability, yes, but they desire that without sacrifice of confidentiality, and blockchains, especially those of a public persuasion, simply could not provide that to them, whereas they can with Dusk thanks to the layers that we've defined upon our platforms.

To make clear why this matters, it's helpful to think about the way most blockchains treat assets as compared to the way Dusk treats its own.

With regular public blockchains, the transfer of assets shows the sender, the receiver, and the amount transferred. Anyone can correlate all activities, identify whale movements, detect trading patterns, and see the cash flow of businesses. On the other hand, on privacy-focused blockchain networks, everything happens under the radar, helping criminals while harming authorities.

In between are the dual concepts of dusk. Transaction validity and rules for compliance are both visible and enforceable. Data regarding ownership and the value of the transaction are kept secret unless there are legal indications to the contrary. This degree of selectivity in terms of visibility makes the operations of the financial instruments possible without the sacrifice of confidentiality.

And that's exactly that middle ground that real-world finance inhabits. Settlement rules are public, clearing mechanics are transparent, but individual balances or trades are not. Dusk is simply rebuilding that as a decentralized environment.

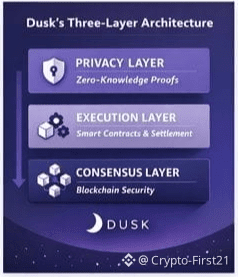

As of early 2026, Dusk rolled out a modular three-layer architecture, splitting the consensus, execution, and privacy layers apart, enabling the development of confidential smart contracts that can process regulatory rules without leaking sensitive data. Additionally, the network settles in under 10 seconds, benchmarking this mainstream performance bracket, addressing one of the main gripes of mainstream finance − how long transactions can take to settle.

From a trader's point of view, these architectural developments are not new. You see this same progression in financial infrastructure before. The structure changed first. The liquidity came later. Last, but certainly not least, came the entire financial marketplace.

What’s particularly interesting is how the process of actual world asset tokenization maps into this. Tokenized bonds, securities, and funds have stringent compliance needs. Data on ownership should not be entirely publicly known. Settlement rules should not be entirely transparent. Auditability must exist without the entirety of the information being disclosed. The separation that exists within Dusk’s design between asset logic and visibility allows compliant securities to natively exist on-chain without violating legal or information flows.

Since late 2025, Dusk has focused significantly on establishing infrastructure for institutional finance, as opposed to speculation, which most consumers focus on. This consists of data integration, smart contract toolsets, as well as compliance-focused(tokenization) toolsets, which never seem to make it onto trends on social media, but that's exactly what's needed to be viable over long periods of time.

One of the most misconstrued ideals related to the concept of privacy in the world of crypto has been that privacy, for one party, was the equivalent of secrecy with regards to the regulator. Institutional money movements, for example, rely heavily on selective transparence; that is, select parties are required to have certain pieces of data revealed under certain laws, and the public shouldn’t have any insight. This, once again, mirrors the design with regards to dusk.

From whence I come, having built bridges between different market cycles, I have learned that narratives around infrastructure move slowly, then suddenly. That means that oracles, stablecoins, custody, and scaling solutions all followed that pattern. There was the slow build, followed by a sudden explosive relevance to things that could simply no longer be ignored.

So it appears the infrastructure for privacy is converting to this type of phase, not necessarily explosively, and certainly not dramatically. Rather, it's growing and advancing step by step. In the background, there are pilots underway within the enterprise, there are back end integrations, and there are upgrades to the architecture. There are certainly discussions about the regulations, and by the time interest and excitement build to the degree necessary to make it apparent to

Another influence on the growing interest in the space can be seen within the capital rotation dynamics experienced within the overall privacy space. As traders sought newer opportunities within the space through projects aligned to regulatory efficacy, rotations through the older options, such as DUSK, experienced appreciable boosts in their trading volumes, to the tune of several hundred percent rises on a daily basis. This can be seen as an acknowledgement of the market's understanding of efficacy in reaching the wider institutional stage without the need for anonymity.

Still, the speculation is secondary. The deeper story is in architectural evolution. Separation of asset logic from visibility may turn out to be the default design principle of future financial blockchains. It solves a fundamental conflict that so far has dogged crypto's possible role in global finance: how to remain transparent and decentralized while shielding participants from unwanted exposure.

This might mean, for ordinary users, that decentralized exchanges will no longer broadcast intent for large trades. For businesses, it is payroll systems, treasury management, and settlement layers that leak nothing of their internal flows. For institutions, this finally opens the door to regulated instruments being issued and traded without blowing their cover on confidentiality.

What stands out most is the incentive alignment: Traders want protection from front-running. Businesses want confidentiality. Institutions want compliance. Regulators want auditability. The architecture leading up to Dusk addresses all four without forcing trade-offs that break the system.

In markets, the largest changes usually appear quietly. They don't come in flashing headlines or overnight dominance. They first appear in backend upgrades, enterprise experiments, and protocol design papers. It's always later that they surface in liquidity flows and valuation.

One of those changes, the way Dusk abstracts asset logic from visibility, can be thought of as being as significant as such changes, even though it may not be represented as prominently on trend charts on a weekly basis. It’s structural-level changes to the ways in which finance can be done on a blockchain.

And it’s worth saying, in terms of changes happening long-term, something that addresses actual issues will remain long after something has been “popular.”