This is not just gas, but the security budget.

In most of the blockchains the token is primarily used to pay transaction fees. DUSK is different. Its first job is security. To hold DUSK, validators risk putting their real economic resources in jeopardy to ensure that the network remains honest and online. Had the token not actually served a purpose in security, the chain would have simply been a software with no serious security.

The fact that mainnet is live and tokens can be moved over to native DUSK is important. It implies that security is no longer a concept. The token is in fact being used to execute consensus, charge fees and make real transactions. That is where a blockchain ceases to be an experiment, and begins to behave more like actual financial infrastructure. In the absence of such a move, decentralization will remain largely a promise rather than a reality imposed.

The fact that mainnet is live and tokens can be moved over to native DUSK is important. It implies that security is no longer a concept. The token is in fact being used to execute consensus, charge fees and make real transactions. That is where a blockchain ceases to be an experiment, and begins to behave more like actual financial infrastructure. In the absence of such a move, decentralization will remain largely a promise rather than a reality imposed.

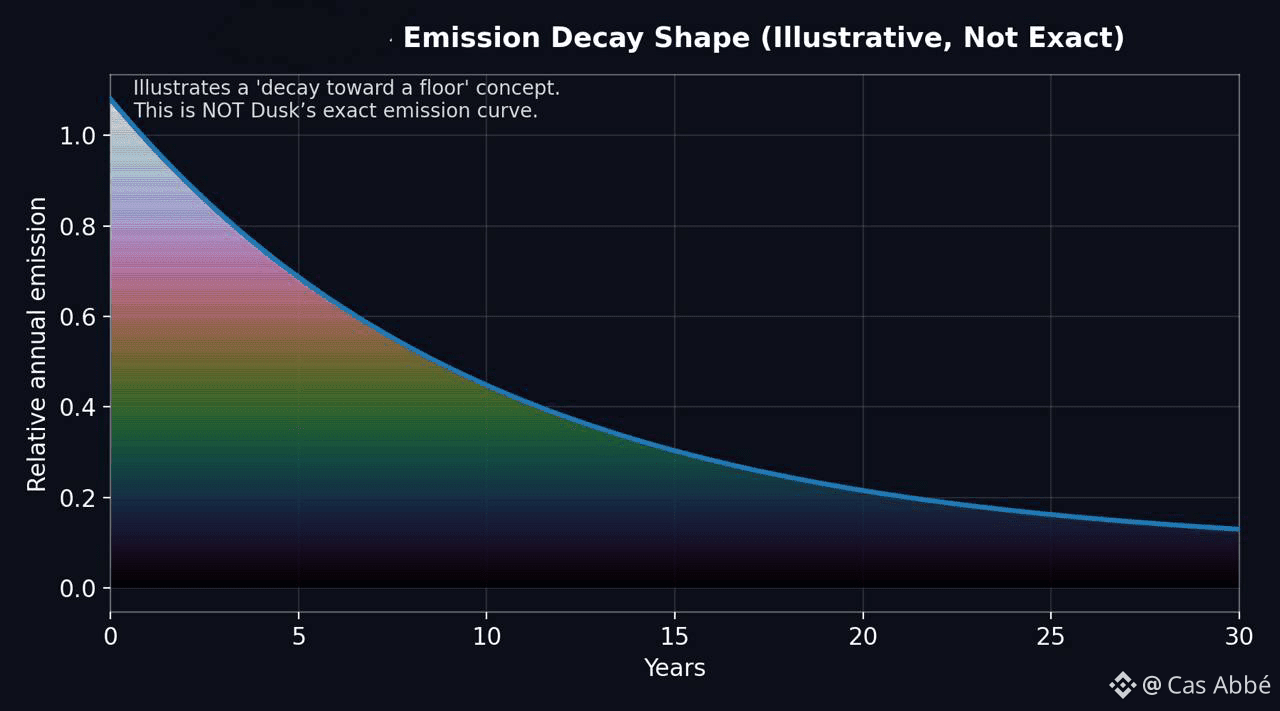

Emissions: a long runway, modelled like a regulated decay.

The same issue is with all Proof-of-Stake networks: until you pay validators enough money to maintain the network, you do not want to have the network inflate indefinitely, slowly ruining the value of the token. The emission design of Dusk attempts to strike the balance between the two sides.

In the beginning, increased emissions will facilitate the attraction of validators and decentralize the stake. Emissions depreciate over time implying that the number of new tokens in the system decreases with time. This drives the network to be more dependent on actual usage and charges, rather than unceasing inflation. Put simply: short-term gains are guaranteed, long-term worth is cushioned. This is aimed at not having a token that senses that it is continually bleeding money just to be alive.

Rewards are not given to a single individual and are divided among positions.

Other blockchains reward the block producers to a large extent. Dusk awards rewards on various positions and committees. This is important, since it is not only in case blocks come to a halt that real financial systems fail--they also fail in case validation, finality, or coordination becomes impossible.

Dusk is attempting to lock out the whole process not only block production by paying several parts of the system. This economically motivates validators to be concerned with correctness, uptime and long term behaviour, not with speed. It is a costlier design, yet it is more akin to actual serious financial infrastructure.

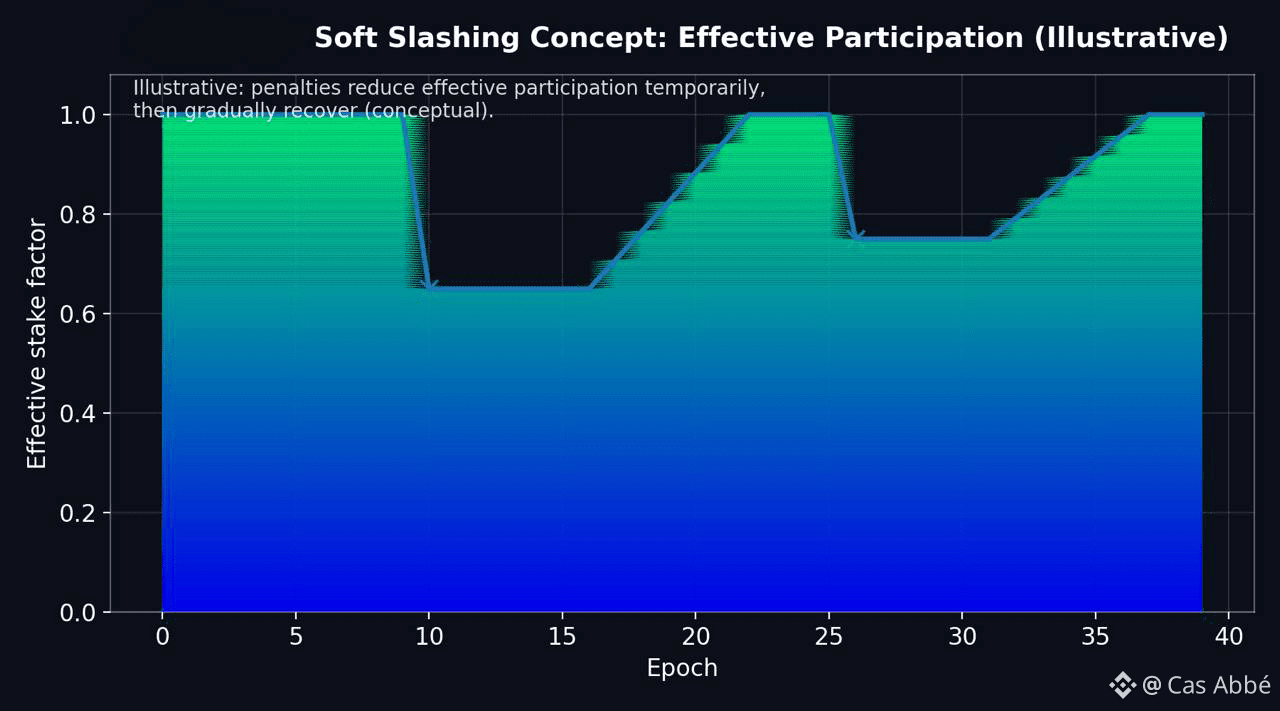

The very narrow philosophy of security is soft slashing.

Dusk does not burn a validator stake immediately, but through soft slashing. This implies bad behavior or unavailability may result in temporary punishment of rewards or few participation by some epochs.

The reasoning is easy, punish bad behavior but do not make honest mistakes into financial catastrophes. This motivates operators to remain credible and at the same time ensure that staking is made available to professional but careful participants. This is important in a regulated or institutional setting - no-one wants an infrastructure in which a single technical failure would irreversibly damage capital.

Tradeoffs: less hard deterrence can accompany less hard penalties.

Soft slashing is not perfect. When the punishment is not severe enough, some validators may tolerate down times, as they may count as good especially when the performance is low. That is the risk aspect of the design.

The resisting force is repetition. Recurring punishment diminishes subsequent reward and choice opportunities gradually rendering untrustworthy validators unprofitable. There is the actual test, which is the behavioral one: is the system inclined to long-run reliability or is it permitting of sloppy behavior? This is not a problem that you can solve on paper it is only evident at scale.

The OP Stack has today given a 7 day finalization window to DuskEVM. It is not merely a technical fact, but it has a direct impact on economics. Capital is at risk until finality is achieved, liquidity is less malleable and some uses are more difficult to maintain.

This would involve designing applications that take into consideration delayed certainty by the builders. More guards, more precautions, more capital locked up. Dusk has been candid that this is not permanent but it seeks to rectify it but until that time it is cost of time that is real. Quick finality is not just convenient, but it saves money.

What success would be as an asset of DUSK.

What success would be as an asset of DUSK.

Technically, when Dusk succeeds, then DUSK ceases to be a speculative token, and it turns into an asset productive asset. It is mortgaged in order to settle, invested in order to execute, and required by applications which require personal, conforming infrastructure.

In case no adoption comes at least not in the case of regulated or institutional user the reverse occurs. The system is still technically impressive, yet it is not utilized, and the token cannot make a case of itself. This renders adoption as the key risk factor, compared to technology.

The point is that Dusk is not constructing a vibe chain, it is constructing finance rails.

Dusk Network is not hype cycle and meme culture friendly. It is privacy-friendly, auditable, and predictable-settlement friendly - the latter is important where real financial assets are concerned.

Such an ambition adds complexity, extended schedules and increased expectations. However, should it succeed, it will be rewarded with the sort of thing that most blockchains never attain: mundane, undramatic infrastructure that can be entrusted with serious value. And in finance, it is just what you want to be boring.