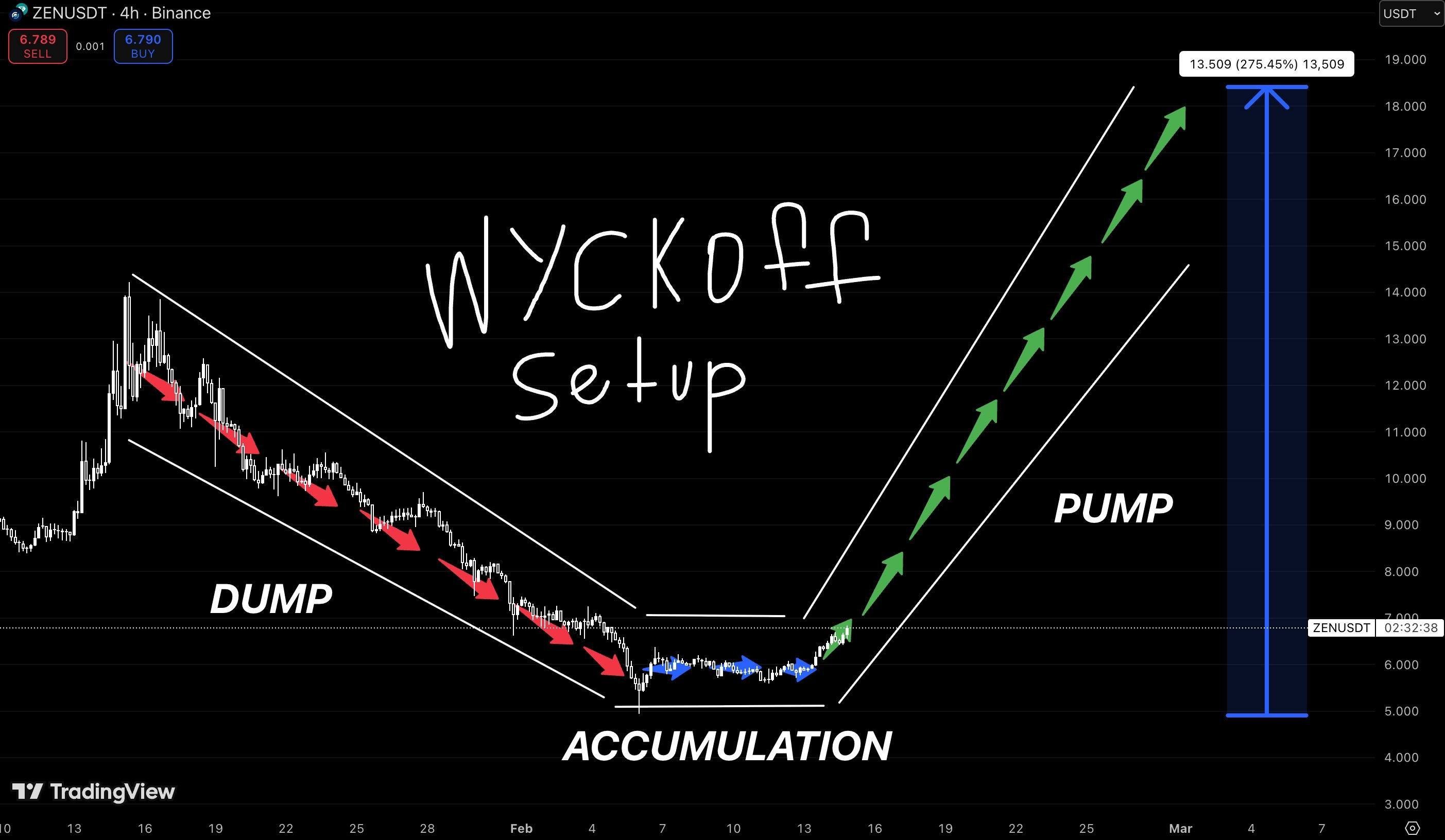

Classic structure

First phase - aggressive markdown inside a clean descending channel. Lower highs, controlled sell pressure, no real bid stepping in

Then the shift

Price compresses at the bottom of the range around $5.8–6.2. Volatility contracts. Sellers stop pushing. That flat base isn’t random - it’s absorption. Supply gets chewed through while everyone calls it dead

Now we’re seeing early expansion out of accumulation. Higher lows forming. Momentum flipping. Structure breaking the local range ceiling

If this Wyckoff transition plays out fully:

- Phase C spring already in

- Phase D markup begins

- Channel reclaim = fuel

Measured move from the base projects toward $13–18 - roughly 2.5–3x from the range lows

The key is simple: as long as the accumulation low holds, bias remains expansion

Compression → expansion.

That’s the game