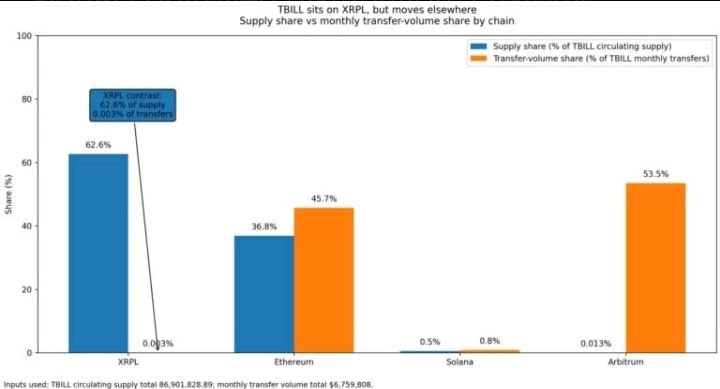

Tokenized US Treasuries are approaching $11B, and the real chain war has shifted from issuance to distribution, usage, and financial utility. Right now, XRP Ledger (XRPL) holds around 62–63% of OpenEden’s TBILL token supply, yet almost none of the trading volume.

OpenEden’s TBILL vault token, backed 1:1 by short-dated US Treasuries, shows a clear imbalance. Over $54M in supply sits on XRPL versus $32M on Ethereum, but monthly transfer volume is just $200 on XRPL compared to millions on Ethereum and Arbitrum. That’s roughly 0.003% of activity happening on XRPL. Issued and held here, moved and used there.

At the same time, Aviva Investors has partnered with Ripple to tokenize traditional fund structures on XRPL, signaling a push toward large-scale production of tokenized funds and real-world assets (RWA). The narrative is regulated distribution, built-in compliance tools, near-instant settlement, and stablecoins as the cash leg for subscriptions and redemptions.

But liquidity gravity matters. Ethereum and layer 2s dominate composable finance, collateral workflows, and institutional market maker routing. Integrations like BlackRock’s BUIDL becoming tradable through UniswapX reinforce Ethereum’s lead in settlement and collateral depth.

The key question: Is XRP becoming a real RWA venue, or just another issuance endpoint while trading and collateral remain on $ETH ?

The next 30–90 days are critical. Watch TBILL transfer share, $XRP stablecoin transfer volume, distributed asset value trends, and any live tokenized fund launch from Aviva. If usage rises with balances, XRPL could gain venue status. If not, this remains a supply skew narrative while real treasury liquidity flows elsewhere.