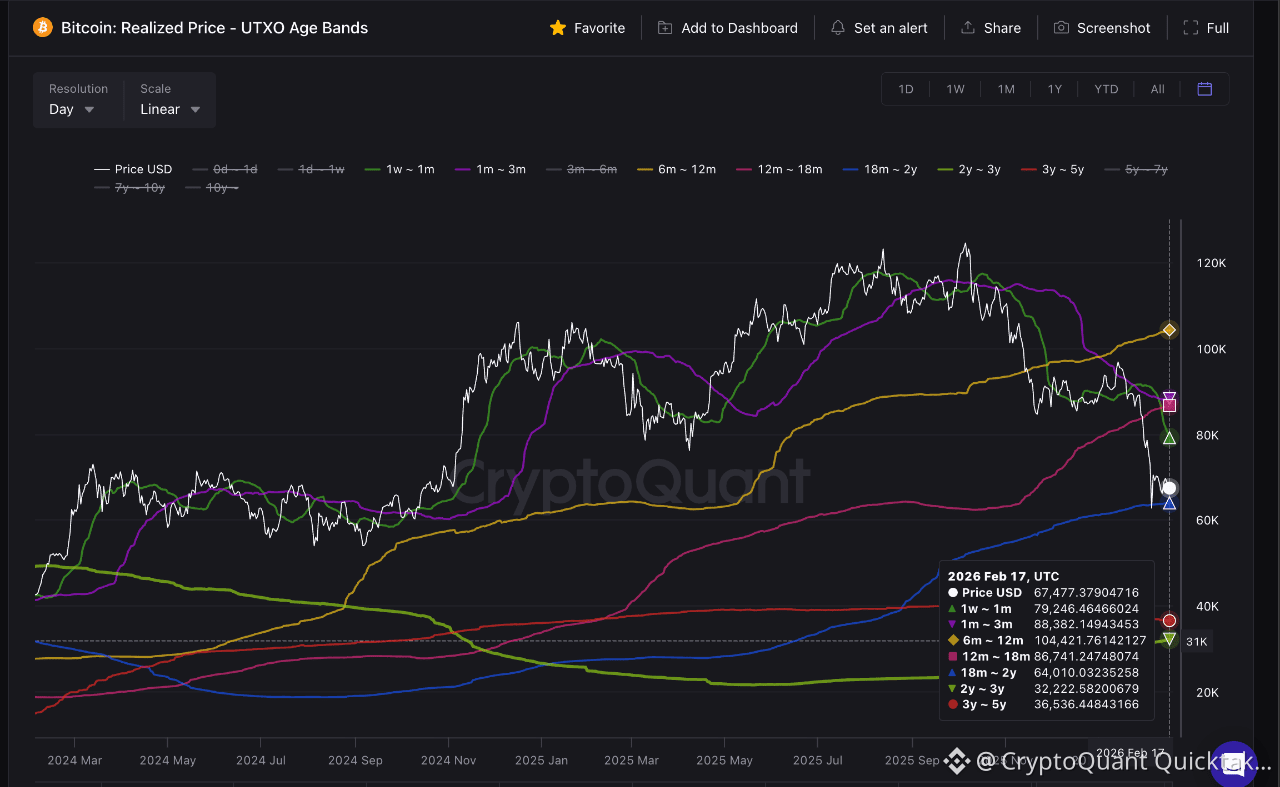

Realized Price – UTXO Age Bands reflects the average cost basis of different holder cohorts, allowing us to assess which segments of the market are currently under stress. This metric helps identify where selling pressure is coming from and whether the broader market structure remains intact.

At present, price has moved below the short-term holder realized price bands (1w–1m and 1m–3m). This indicates that short-term participants are largely underwater, and the recent downside is primarily driven by distribution from this cohort. This structure also explains why relief rallies remain capped, as price tends to face supply when it approaches short-term holders’ cost basis, where break-even exits and stop-losses cluster.

However, price has not yet established sustained acceptance below the longer-term realized price bands (6m+). This suggests the current move is better characterized as a reset / mini bear phase rather than a full-scale capitulation. Without reclaiming short-term realized price bands, trend recovery remains limited, while the preservation of long-term cost bases implies that structural downside risk is still contained.

Written by tugbachain