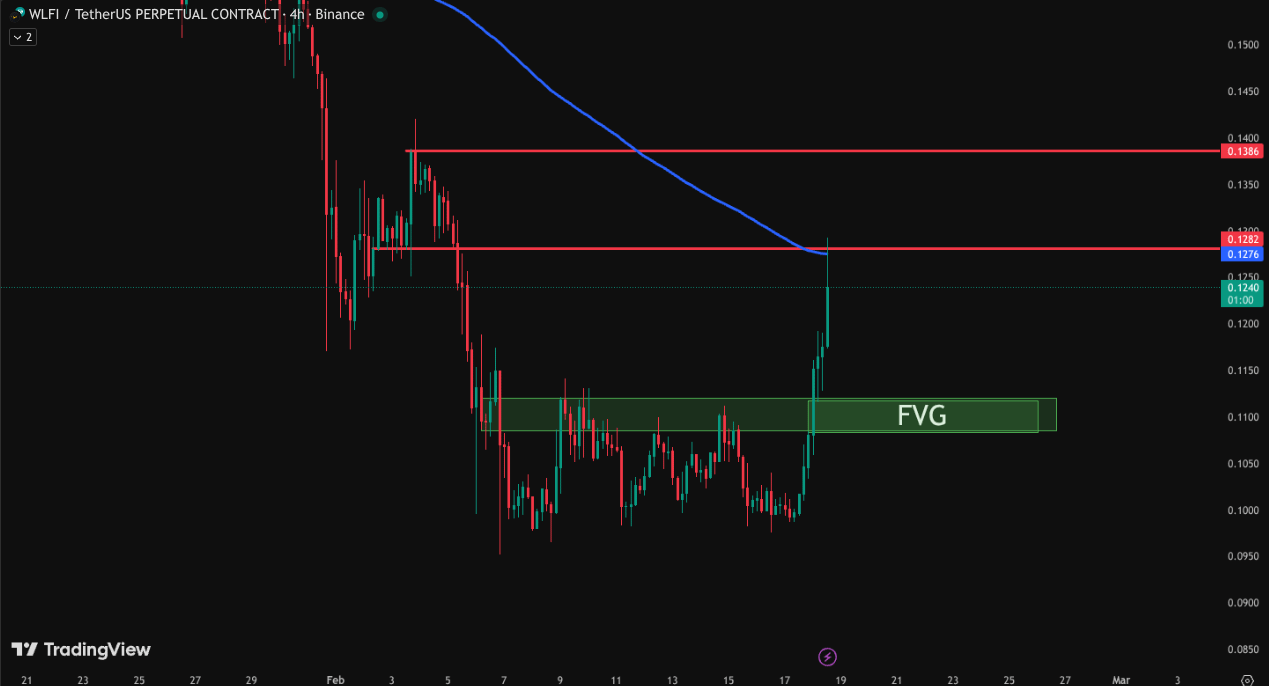

$WLFI has just delivered a technically significant move that traders should not ignore.

After breaking above a key Supply Zone, price successfully flipped that area into a Demand Zone — a classic market structure shift that signals bullish strength. This kind of supply-to-demand flip often confirms that sellers have been absorbed and buyers are now in control.

But here’s where it gets interesting…

📌 The Current Situation

After the breakout, WLFI rallied upward and tapped into a major resistance level.

At the same time, price touched the 200 EMA, creating a strong confluence zone.

And what happened?

A rejection candle formed with a clear upper wick, showing selling pressure exactly at resistance + 200 EMA confluence.

Now the big question:

👉 Is this just a temporary rejection before another breakout?

👉 Or are we about to see a deeper pullback before continuation?

🧠 Technical Breakdown

1️⃣ Supply → Demand Flip (Bullish Structure Shift)

When price breaks a supply zone and holds above it, that zone often becomes demand.

This indicates:

Buyers absorbed previous sell orders

Market sentiment shifted bullish

Smart money likely positioned earlier

If price holds above this flipped demand zone, continuation remains valid.

2️⃣ Resistance + 200 EMA Confluence

The 200 EMA is widely respected by institutions and swing traders.

When resistance aligns with the 200 EMA, it creates:

Liquidity grab potential

Rejection probability

High-volatility reaction zone

The rejection wick suggests sellers defended this area — but one candle is not confirmation of trend reversal.

🔍 Possible Scenarios

🟢 Scenario 1: Breakout Continuation

If price:

Consolidates tightly below resistance

Holds above flipped demand

Shows bullish volume increase

Then we may see a strong breakout above resistance + 200 EMA, leading to momentum expansion.

This would confirm:

✔ Rejection was weak

✔ Buyers are accumulating

✔ Breakout loading phase

🔴 Scenario 2: Deeper Pullback Before Continuation

If price:

Breaks back below flipped demand

Shows strong bearish momentum

Fails to reclaim 200 EMA

Then a correction toward lower support levels could occur before the next leg up.

This would likely be:

🔁 Healthy retracement

🧲 Liquidity sweep

📊 Reset before continuation

🎯 What I’m Watching

Volume reaction near 200 EMA

Structure on lower timeframes

Reaction at flipped demand zone

Liquidity sweep above resistance

No confirmation yet — market is at decision point.

⚠ Risk Reminder

Confluence increases probability — not certainty.

Always wait for confirmation and manage risk properly.