Analyzing exchange reserves can provide valuable insights into investor behavior for a given asset.

When a sharp increase in an asset’s reserves on an exchange is observed, it generally reflects investors’ willingness to transfer their funds onto these platforms, most often with the intention of selling. This type of dynamic tends to signal potential short term selling pressure, as assets become immediately liquid once deposited on an exchange.

Conversely, a decline in reserves held on trading platforms sends a very different signal. It suggests that investors are withdrawing their assets from exchanges, reflecting an accumulation trend and a stronger long term conviction, as funds are moved into private custody solutions rather than kept in a trading environment.

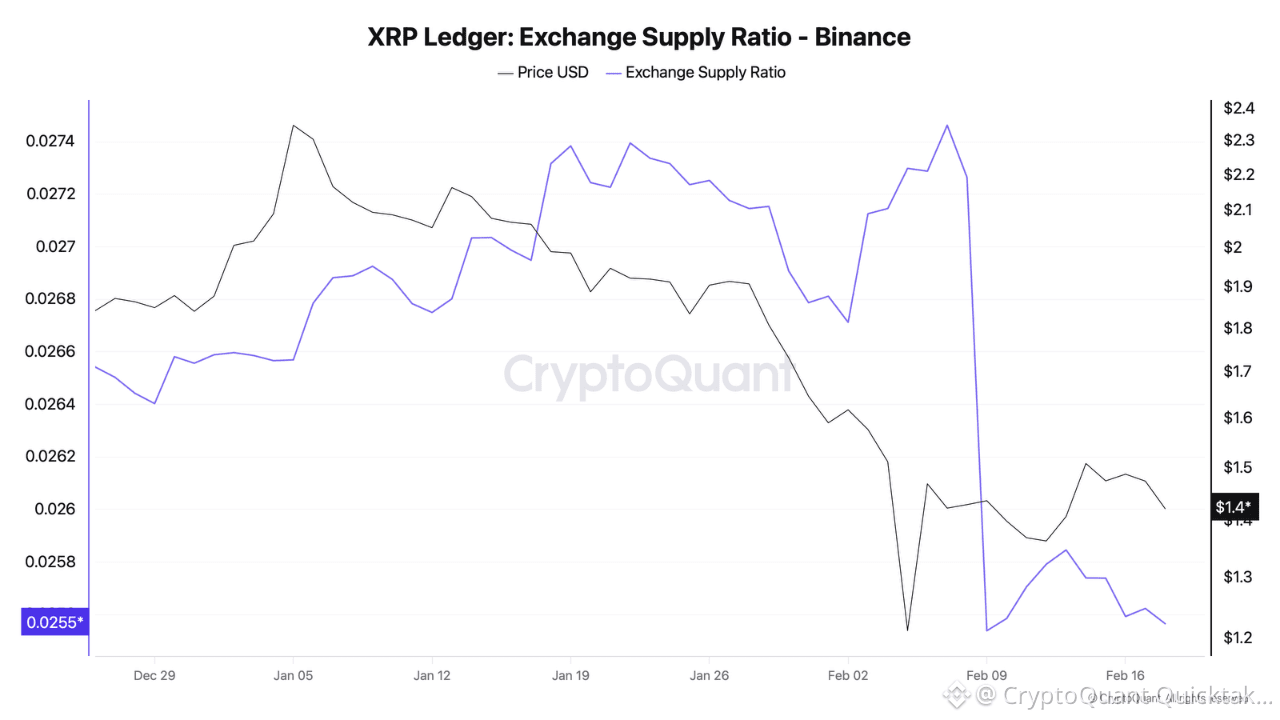

This is precisely the trend currently observed in the XRP supply ratio on Binance. This indicator simply measures the proportion of the asset’s total supply held by a given exchange.

Over the past ten days, the XRP supply ratio on Binance has recorded a notable decline, dropping from 0.027 to 0.025. During this period, approximately 200 million XRP have left the platform.

While some of these movements may occasionally result from internal reallocations by the exchange itself, platforms such as Binance regularly publish their custody addresses, making it possible to distinguish organic user driven flows from internal operational adjustments with reasonable accuracy.

This dynamic therefore suggests that some investors consider current price levels to be attractive from an accumulation standpoint. It is worth noting that the asset has undergone a correction of around 40% since the beginning of the year, which may further strengthen the interest of investors adopting a longer term strategy.

As a result, these investors appear to be positioning for the long term by withdrawing their XRP from exchanges in order to store them in private wallets.

Written by Darkfost