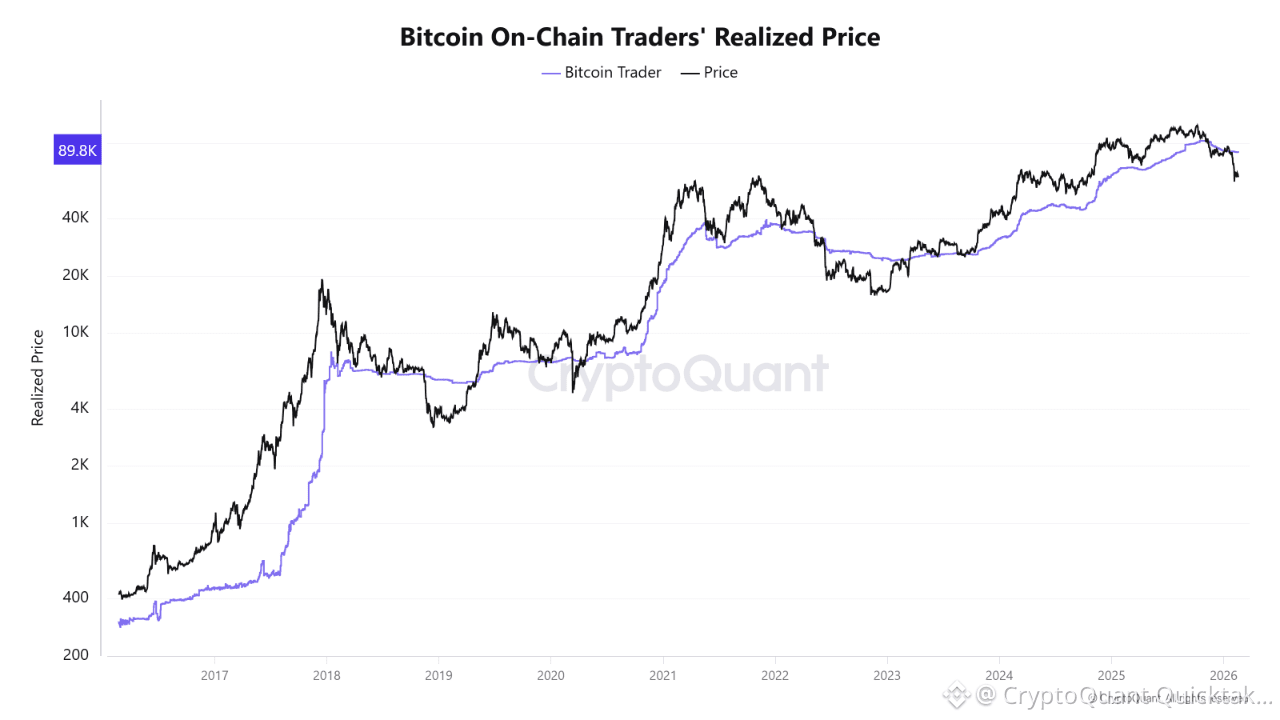

There is a specific group of Bitcoin participants whose average cost basis has acted as a structural dividing line between bull and bear markets across every cycle in on-chain history. These are mid-weight traders — wallets holding between 10 and 10,000 BTC with coins last moved within the past one to three months. Active enough to reflect real market sentiment. Sizeable enough to move it. Their realized price is now sitting at approximately $89,822, and Bitcoin hasn't traded above it since mid-January 2026.

The 2021 cycle shows exactly why this level matters. When BTC set its first ATH near $67,551 in November 2021, this cohort's realized price was around $33,700. Crucially, price never fell below that level during the mid-cycle consolidation — which is precisely why the market held constructive sentiment through late 2021 and early 2022. These traders remained in profit, conviction held, and the structure stayed intact. The realized price acted as a floor. The true bear market only confirmed itself in June 2022 when BTC crashed roughly 30% below their cost basis, reaching as low as $18,945.

The current situation has broken that pattern at a much earlier stage. This same cohort's realized price peaked near $94,000 in late 2025. Price slipped below it in mid-December 2025 and has not recovered. As of February 18, 2026, BTC trades near $66,424 — roughly 26% below what these active, mid-size traders paid on average. Every day that gap holds, this group sits in unrealized loss, and historically that is the condition that prolongs bear markets rather than resolves them.

The comparisons circulating right now to mid-2021's correction ignore this entirely. In 2021, these traders were never underwater. Today they are — by a wide margin. Until Bitcoin reclaims and holds above $89,800, the on-chain structure has not repaired. That is the level to watch, not price

Written by Crazzyblockk