Ripple CEO Brad Garlinghouse recently suggested there is a 90% chance the CLARITY Act will pass by the end of April. The Digital Asset Market Clarity Act aims to clarify the regulatory boundary between the SEC and CFTC, establish registration frameworks for exchanges and brokers, formalize custody and asset segregation rules, and codify AML/KYC standards. It seeks to reduce long-standing ambiguity around who regulates the U.S. crypto spot market and under what rules.

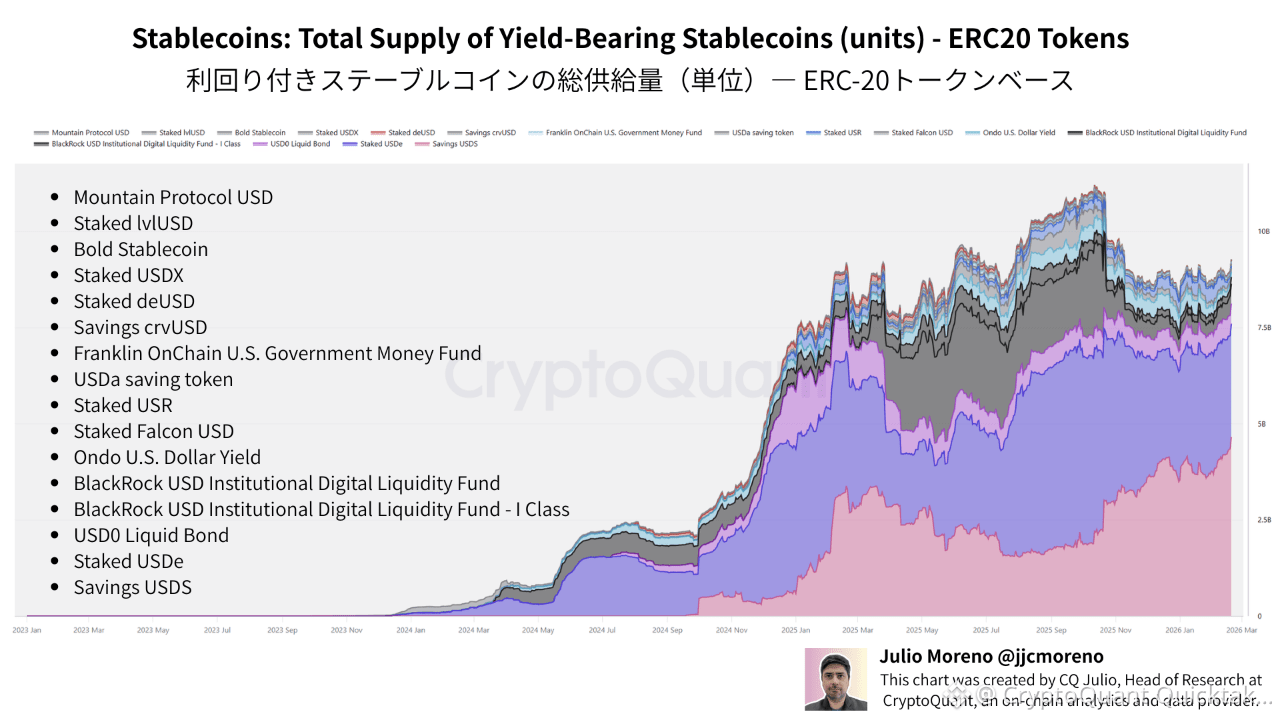

The main delay stems from the Senate Banking Committee postponing markup of H.R.3633. The core dispute centers on stablecoin yield. While the GENIUS Act bans issuers from paying interest, banks argue that exchange-based rewards create de facto yield products that could drain deposits from traditional banking. As the chart shows, the total supply of yield-bearing stablecoins has expanded sharply since late 2024, reaching multi-billion levels in 2025, underscoring how rapidly this segment is growing within the on-chain economy.

This growth has intensified political and financial tensions. Crypto firms seek to distinguish between issuer-paid interest and user-facing rewards, while banks push for tighter restrictions to prevent deposit outflows. Until compromise language is codified, Senate momentum remains fragile.

Meanwhile, the Senate Agriculture Committee has advanced separate CFTC-focused text, meaning multiple legislative packages must eventually be reconciled. Combined with bipartisan vote requirements, state preemption concerns, and unresolved DeFi provisions, the legislative path remains complex.

If enacted, the Act could compress regulatory risk premiums in the short term and reshape market structure over the long term. However, clarity will arrive in stages — first through headlines, then rulemaking, and finally enforcement. Until then, uncertainty remains embedded in the system.

Written by XWIN Research Japan