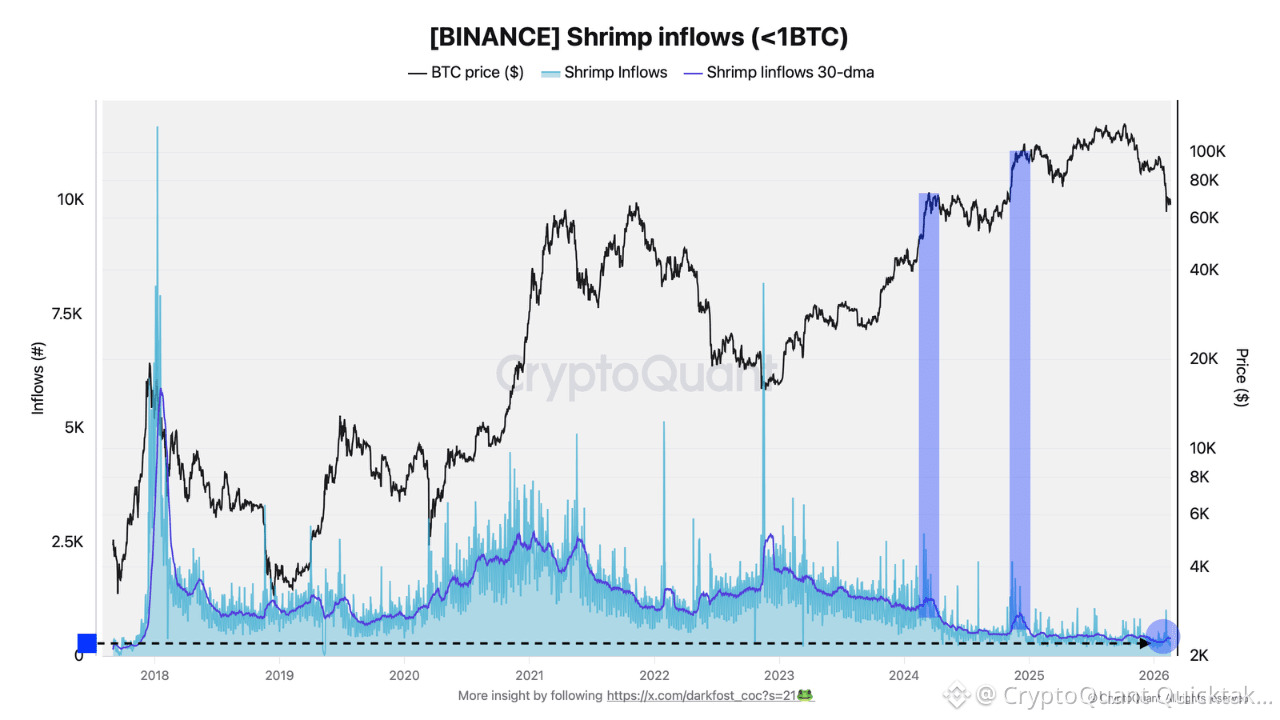

The absence of retail investors, often referred to as shrimps, has been widely discussed throughout this cycle. This group represents the smallest BTC holders, approximated here through all transactions below 1 BTC.

The monthly average of inflows to Binance from this cohort has now reached an unprecedented level of inactivity, not seen since 2017. It currently stands at around 384 BTC, a stark contrast to January 2021 levels, when nearly 2700 BTC were being sent to the platform.

Two periods of modest activity can still be identified around the March 2024 highs, with roughly 1250 BTC per month, and again in December 2024 at around 900 BTC. These figures nonetheless remain particularly low compared to previous cycles. A daily spike in panic-driven inflows was also observed as BTC approached the $60,000 level, suggesting isolated capitulation events.

Since the end of the bear market, retail inflows have declined significantly, whereas in previous cycles they tended to increase progressively into the market top. This contraction accelerated markedly following the launch of spot Bitcoin ETFs in early 2024.

It is plausible that part of this investor base has shifted toward these vehicles, which offer exposure to BTC’s volatility without the need for direct custody or security management.

On the other hand, seeing these inflows remain this low is also a sign of weak selling pressure, which is a positive signal.

We are therefore far from witnessing a broad retail return to exchanges. This cycle appears instead to be defined by a disintermediation of on-chain retail activity in favor of more traditional financial exposure through alternative instruments.

As such, the apparent absence of retail participation on exchanges may not necessarily reflect a lack of interest in Bitcoin, but rather an evolution in how these participants choose to access the market.

Written by Darkfost