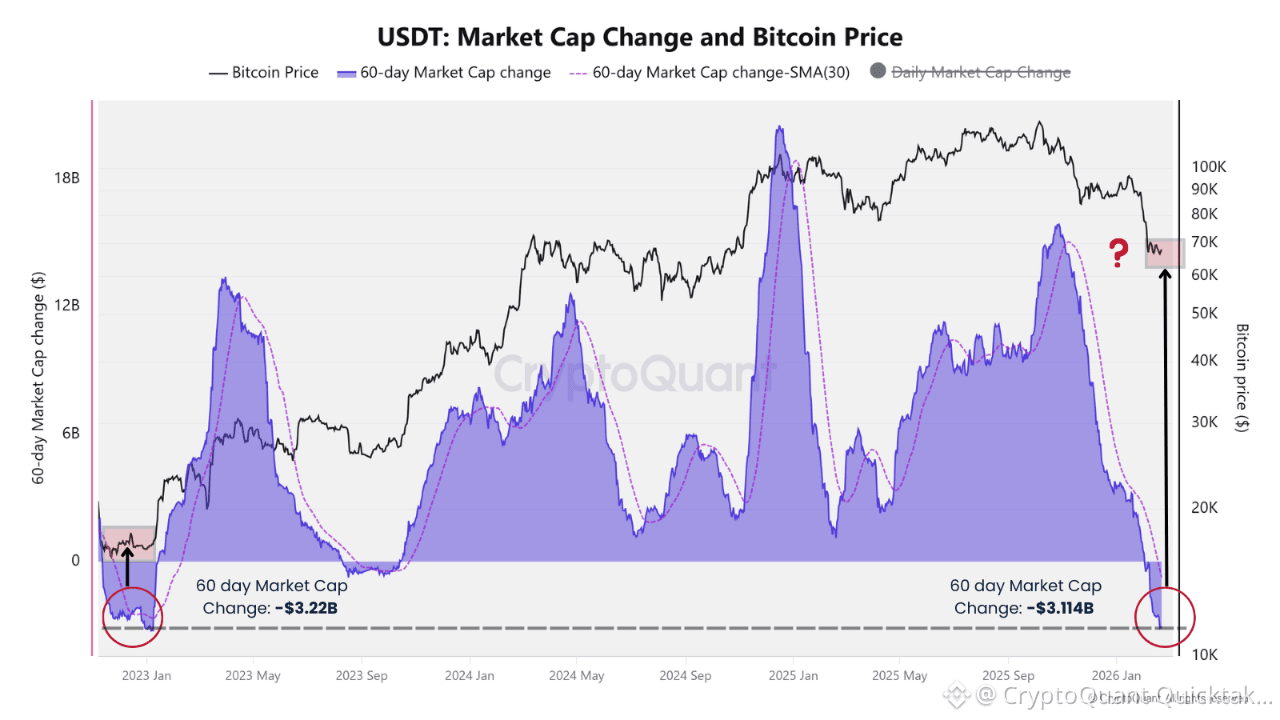

The 60-day Market Cap Change has dropped below -$3B, on only two occasions. The first occurred in late 2022, precisely as Bitcoin was carving its cycle bottom near $16K, a moment of maximum fear and forced selling. The second is happening now, in early 2026, with BTC trading near $65–70K after a prior all-time high run.

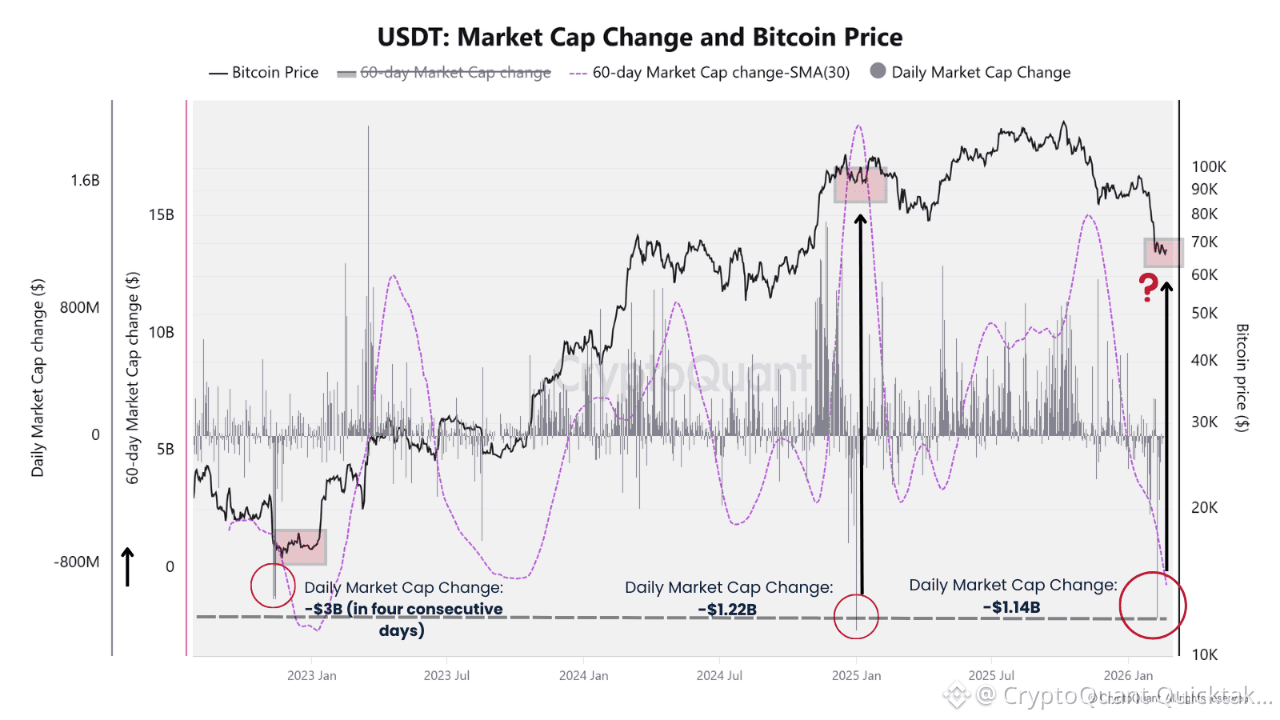

On a daily basis, USDT has printed three instances of -$1B+ single-day outflows. Each episode coincided either with local/macro bottoms or sharp volatility clusters in Bitcoin. USDT redemptions at this scale reflect institutional or large-holder exits from the ecosystem entirely, which tends to occur at or near exhaustion rather than at the beginning of sustained downtrends.

Stablecoins are the dry powder of crypto. When USDT supply expands, it signals fresh capital entering the ecosystem. When it contracts aggressively, it implies liquidity withdrawal, risk-off behavior, or forced redemptions.

For Bitcoin, a reflexive, liquidity-sensitive asset, this matters deeply.

The current 60-day contraction suggests sustained capital outflows, reflecting structural tightening in crypto-native liquidity.

However, context is key: in previous cycles, once forced deleveraging completed and USDT flows stabilized, Bitcoin transitioned into strong medium-term upside as liquidity conditions normalized.

Risk-reward now hinges on stabilization.

If USDT contraction persists, downside pressure may extend.

If flows flatten or reverse, the asymmetry shifts rapidly in favor of upside.

Extreme liquidity stress has historically marked opportunity, but only once selling exhaustion is confirmed.

Written by MorenoDV_