Today's Bitcoin has fallen back below 90,000, which is a rebound upward and a correction downward. This rise and fall is a normal phenomenon. A drop occurring during a rise and a rise occurring during a drop both belong to a consolidation phenomenon. Overall, this kind of market is considered a period of consolidation, which is normal.

The detailed judgment of the market trends is actually not difficult, but currently, the hardest part is grasping the overall trend. If you cannot grasp this overall trend, do not act lightly. It’s still that saying: be patient and continuously enhance your own self-control.

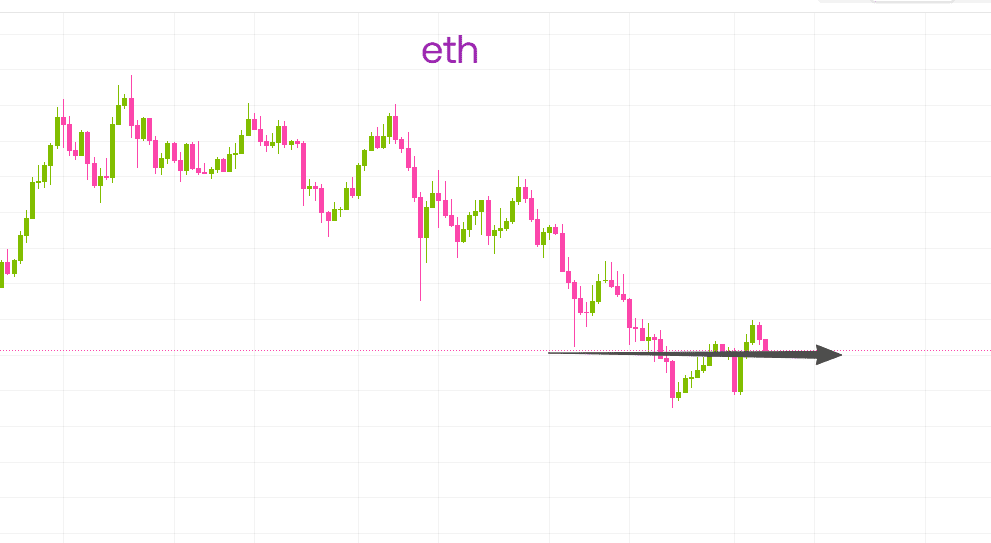

For Ethereum, it is still above 3000. There might be a short-term pullback, but the price remains above the large bullish candle, and the overall support has not broken. The key defense line is also intact, so support is effective. Currently, it is still a rebound during a downtrend, with no signs of reversal. Not taking action is the best action.

Yesterday, there was a wave of upward assaults online with Luna, and the overall fluctuation has already exceeded 50%. However, for this type of asset, it's better to wait and see, as certainty is more important‼️

For altcoins, there is still a contradictory phenomenon, a conflict between large caps and small caps, which has resulted in the market not showing a tendency to converge; there is no stable upward trend, but there has been a stable downward trend, which can be seen as a change. Overall, it is still a beneficial phenomenon for the market. What is worth complaining about is that when the market drops, every coin drops; it's not like the stock market. In the stock market, while most stocks are falling, there are always a few that rise; as long as you seize that opportunity, you can still operate.

However, for certain altcoins, it is better to minimize operations. Especially when the market is unstable, they tend to show excessive volatility with dramatic rises and falls or are eager to harvest and profit. In the following weeks, you may face significant losses if the downtrend continues. Therefore, try to reduce the frequency of strikes.

Then let's talk about something at the end. For the current market, the highest state is actually to achieve non-action. This is a very key point. Non-action means not predicting market trends; do not strike until the conditions you meet are present. This is what is known as non-action. So what is action? In ancient Greece, there was a figure named Sisyphus, who pushed a large boulder up a hill every day, only for it to roll back down every evening, and as soon as the sun rose, it would roll back down again. That is action. Action will only bring more suffering, living in that cycle, unable to break out of that period. What I am sharing with you relates to action.

If I don't mention it, then this thing is non-action. But once I mention it, it has already become action. There is a saying on Wall Street: those who go long can make money, and those who short can also make money. Only the small investors who are overly optimistic do not make money. Those who are like half-filled bottles cannot make money either. Since what I have stated is action, let's focus on being bullish.

Because now, under such complex circumstances, what you see is only a graphical representation, which can be misleading. For those of us involved in this, if you just keep referring to the graphics to judge the ups and downs of the market, you can only be a novice who hasn't even entered the door. Once you enter, you must abandon this graphical approach. If you don't abandon the graphics, you can easily be misled, just like getting trapped in a magical trick, slowly getting absorbed until you are enchanted; that is the essence. Therefore, what you need to do is to discard these so-called images. They themselves are a form of language, and this language can sometimes be deceptive.

Especially in the current market, it is different from the past. Major players are involved; it's not like what you see, where it just falls. Therefore, we must remain bullish.

In a down market, there isn't much support, and how can you proceed? It gives many people a commonality and they buy in cheaply, which is meaningless. There must be someone to take over this asset; it is no longer the Bitcoin of the past; it is Bitcoin on a global scale, undergoing a transformation. Now, when you look at the price, it seems high. In the future, if it rises to 200,000 or 300,000 dollars, it will only make you feel unattainable. But please globalize your career; do not confine yourself to a corner.

I can choose not to strike, but I cannot be bearish. The current situation is so low, and there may still be an infinite bottom. The major player may seem like it has fallen from a high altitude, and it might still drop, but it just happens to be at the stop-loss point and has stabilized. So there is no need to blindly look for declines.

In the end, the same saying applies: you may not participate, but you cannot be bearish, because the poor cannot ride the coattails of economic recessions. You can ride the convenience of prosperity, but you will never be able to achieve wealth in a downturn.

What you need to do is to control your hands. No rabbit means no hawk; if it doesn’t come out, I won’t strike. If it doesn’t reach my ambush point, and the prey doesn’t come up, I won’t strike. It’s that simple. First, let yourself survive, then consider the issue of basic needs, and then think about realizing your dreams.