Uncle San will explain the reasons for the recent consolidation to everyone.

Currently, the market is exhibiting a significant macro event dampening effect: after the two major announcements of the Federal Reserve cutting interest rates as expected and the rising expectations of the Bank of Japan raising interest rates, $BTC and $ETH did not show the traditional rise and fall response, but instead fell into a range-bound oscillation pattern.

The core issue is not that the market is behaving unusually, but that market expectations have been sufficiently digested in advance. Information such as the Federal Reserve's interest rate cut path and Japan's monetary policy shift has been continuously released through various forward guidance and market expectation surveys prior to formal implementation, completing multiple rounds of pricing before the events occurred. This has resulted in a market that shows characteristics of not rising on good news and not falling on bad news when the events materialize:

When good news is realized, expectations are fulfilled, early layout capital takes profits, lacking new buying support.

When bearish news is released, previous panic selling has been completed, and the market forms liquidity support.

Ultimately, the market falls into a state of range oscillation + low volatility equilibrium, where price fluctuations only reflect short-term capital games, rather than trend directions.

Core driving logic: Capital support determines the trend, rather than the event itself.

The essence of market fluctuations is not driven by a single macro event, but depends on the capital support capacity and retention willingness of incremental capital. This core logic can be broken down into three key questions:

After the macro easing is implemented, is there a sustainable long-term allocation of incremental capital entering the market?

Is the current market's trading subject mainly short-term speculative capital or long-term value investors?

After the event is realized, does it form an effective chain of capital support to sustain the market?

From the current market characteristics, the answer tends to be negative:

Incremental capital is mainly composed of short-term arbitrage funds, with insufficient willingness for long-term allocation capital to enter.

Market trading is concentrated on event-driven speculation, lacking deep support from fundamentals or technical aspects.

After the event occurs, previous profit-taking capital exits, and new buying support is weak, making it difficult for the market to form a trend breakthrough.

This is also the core reason for the current market appearing strong yet repeatedly under pressure, and appearing weak yet not breaking down. The capital game shows a short-term balance, lacking the core driving force to break the balance.

Potential traps of event-driven trading.

The core risk of the current market does not come from macro bearishness or technical breakdowns, but from investors' excessive reactions to already digested expectations.

Some investors are still trading based on news, ignoring the market rule of early pricing of expectations.

Lack of judgment on core indicators such as capital flow and support/resistance levels, blindly chasing highs and lows.

Short-term emotional fluctuations dominate trading decisions, leading to a vicious cycle of frequent high buying and low selling.

This trading model is essentially ineffective trading. In a market environment where expectations have been digested, a single event is unlikely to change the capital equilibrium pattern, and may instead easily become a tool for major capital to harvest short-term speculators.

The essence of oscillation: Waiting to break the equilibrium.

The core logic of the current market's fluctuations is waiting for unexpected variables that have not been priced in, which must meet the characteristics of being unpredictable and having far-reaching impacts, specifically including:

Changes in the structure of incremental capital: Large-scale entry of long-term allocation capital (such as institutional funds, corporate treasury).

Clarification of macro risks: The Federal Reserve's subsequent interest rate cut rhythm is clear, and market feedback after the Bank of Japan's monetary policy implementation.

Market sentiment extreme breakthrough: The fear index or greed index forms a trend reversal after reaching historical extremes.

Key technical breakthrough: BTC and ETH break the current oscillation range, forming a trend signal of volume and price resonance.

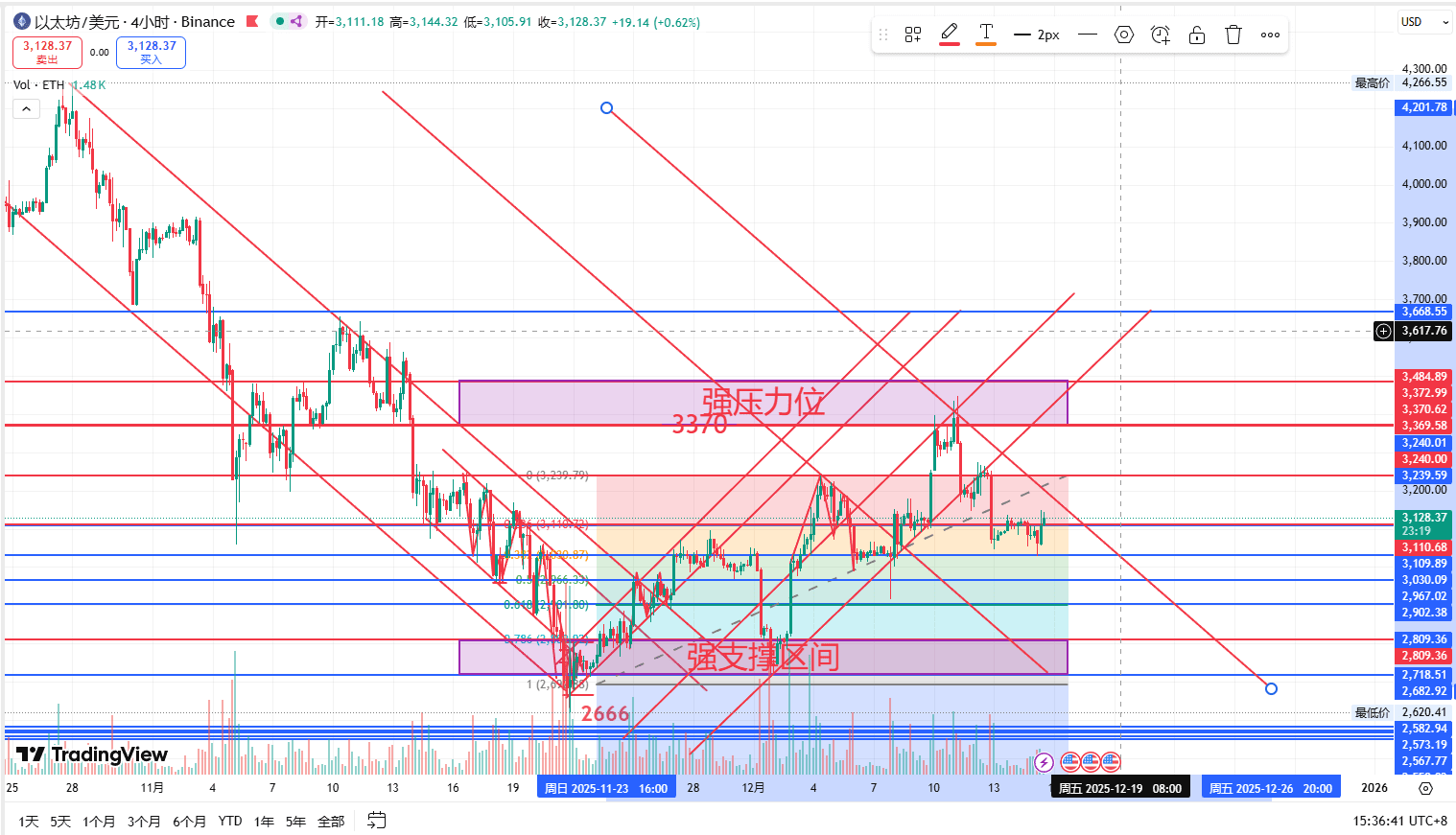

Before new variables appear, the market will maintain a pattern of high resistance + strong support in range oscillation.

The upper side is suppressed by the previous trapped positions and profit-taking positions, with limited upward space.

Support from liquidity at the bottom and long-term moving averages keeps the depth of the pullback controllable.

Volatility gradually converges, with the market mainly consuming emotions + clearing floating positions, testing investors' patience.

Focus on the long-term cycle, avoiding short-term emotional speculation.

In light of the current market environment, it is recommended that investors adopt a strategy framework of cycle allocation + signal confirmation.

Clarify investment positioning: Distinguish between short-term speculation and long-term allocation, avoid replacing long-term cycle judgment with short-term emotional trading.

Abandon event-driven trading: After macro events are implemented, avoid blindly following the trend, and wait for the resonance signals between technical and capital aspects.

Focus on key indicators: Key tracking of incremental capital flow (such as USDC/USDT issuance data), the relationship between core support and resistance levels in volume and price, and the resonance of multi-cycle technical indicators.

Strictly control position risk: In a fluctuating market, the position of a single trading variety should not be too high, set strict stop losses to avoid being caught in short-term fluctuations.

Patiently waiting for direction: The longer the oscillation cycle, the stronger the subsequent trending market is likely to be. In the current stage, waiting for signals is more cost-effective than active trading.

Oscillation is the prelude to trends, new variables set the direction.

The range fluctuations in the current crypto market are essentially a process of capital rebalancing after digesting expectations. In the short term, the market lacks the core driving force to break the balance, and volatility may continue to run at low levels; in the medium to long term, as the macro environment clarifies, incremental capital enters or technical breakthroughs occur, the market will welcome a trend direction choice.

Everyone needs to abandon emotion-driven trading, focus on long-term cycles and core variables, maintain patience before direction is clear, and use signal confirmation + position control to deal with oscillation risks, so that core opportunities can be grasped in subsequent trend markets.