Uncle San is coming today to conduct an in-depth analysis of the $ETH market.

Core event review: The essence of the extreme volatility of ETH overnight, dominated by the main force's leverage cleansing.

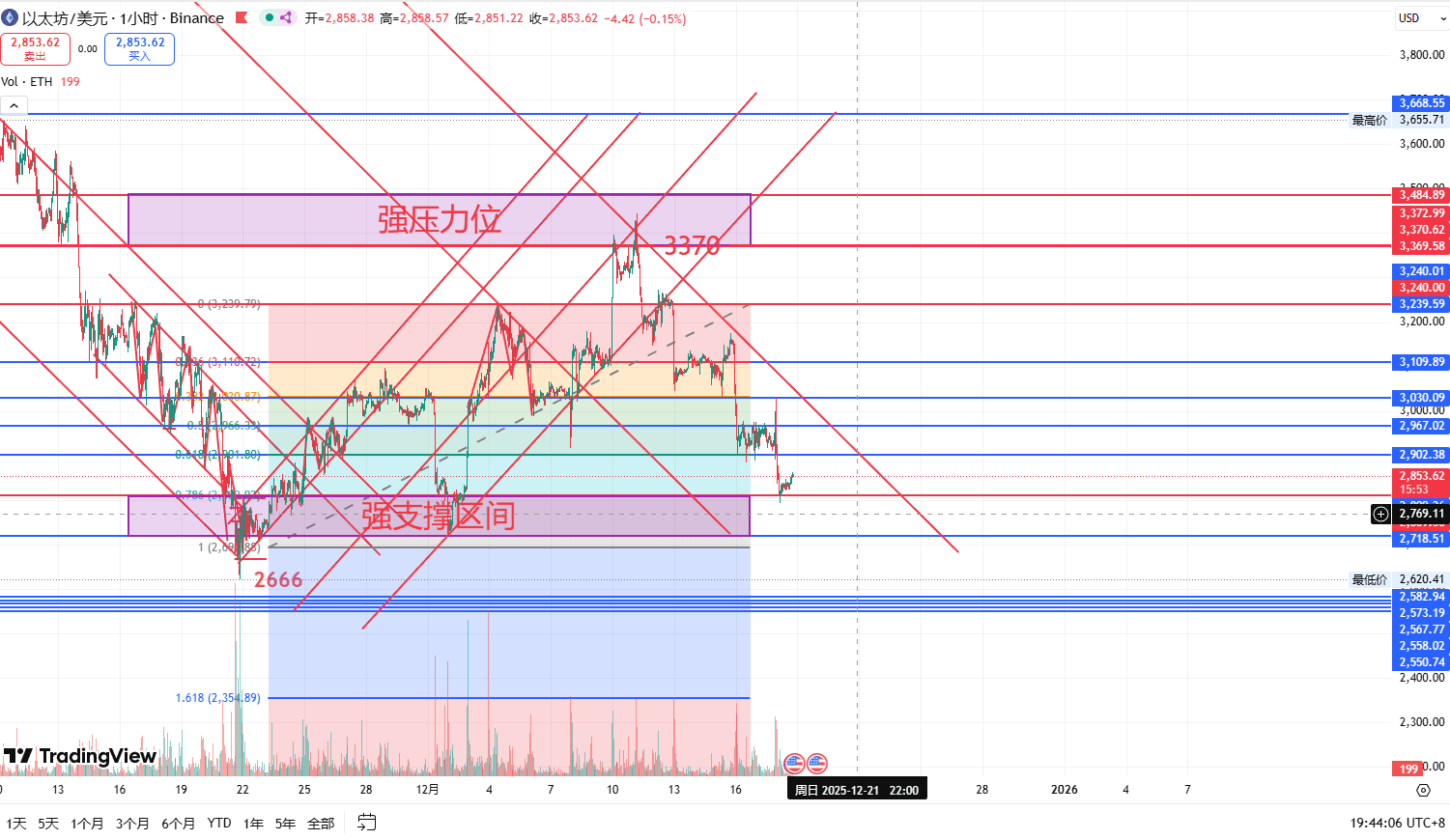

Extreme volatility reappeared in the crypto market overnight, with ETH performing a pin bar pattern: after the US stock market opened, it first dipped to 2880, then quickly surged violently to 3030, and finally fell back to around 2800. Such movements are not the result of natural supply and demand games in the market, but rather a strategy of double killing implemented by the main force through price manipulation.

From a trading logic perspective, the core purpose of volatility is to cleanse leveraged positions across the market: creating false breakout signals during periods of relatively thin liquidity, attracting high-leverage long funds to enter; then triggering long position liquidations through reverse smashing while using market panic to force low-position holders to cut losses, ultimately completing the collection of blood-stained chips. This process essentially exploits the market's greed and fear emotions to achieve indiscriminate cleansing of investors in different directions and holding states, rather than being a signal for the initiation of a trending market.

Core logic breakdown: The inevitability of the rebound bait under macro headwinds

The core logic of predicting higher shorts in advance lies in seeing through the nature of the bait behind the rebound. Currently, the macro level headwinds have become a foregone conclusion, and the global liquidity tightening trend remains unchanged. In this context, any rapid rise lacking sustained incremental buying support belongs to traps set by the main force to create liquidity.

Specifically, the overnight rise was not accompanied by sustained inflow of incremental funds and occurred during periods of thin liquidity, further confirming its falseness. The main force creates optimistic market expectations through such rises, attracting retail leverage funds to enter, which in fact accumulates selling pressure for subsequent declines. This is also the core logical basis for the effectiveness of the contrarian targeting strategy.

Key variable foresight: Dual scenario deduction of the US November CPI data

Currently, ETH is consolidating around 2800, and the market is in an extremely cautious wait-and-see state, primarily waiting for the release of the US November CPI data tonight at 21:30. This data is not an ordinary macro indicator release, but a key node that directly affects global capital flows. Its core impact lies not in the quality of the data itself, but in the market's interpretation and utilization direction of the data.

CPI data exceeds expectations (inflation rebound)

If data shows inflation rebound, it will directly confirm that inflation stickiness exceeds expectations, and the market's fantasy of the Federal Reserve's subsequent interest rate cuts will be completely shattered, further strengthening expectations for the Federal Reserve to maintain a tight policy. In this case, the crypto market will face panic selling, likely triggering a waterfall decline, with the 2800 support rendered meaningless, and the downward space completely opened.

CPI data below expectations (inflation cooling)

If data shows significant cooling of inflation, the market may welcome an emotional rebound in the short term. However, it is important to be wary that in the context of the historic rate hike by the Bank of Japan and global liquidity tightening, such rebounds driven by positive news lack sustainability and rather provide an excellent opportunity for the main force to distribute chips. For investors, this rebound will become a secondary high short opportunity with an excellent risk-reward ratio, rather than a signal for trend reversal.

Core views and trading strategies

Core view: The trend remains bearish, reject blind long and short

The core logic of the current bearish trend for ETH has not changed, but before the data release tonight, both blind shorting and aggressive longing carry extremely high risks. The real trend battle begins with the market's immediate choice after the data release—whether it directly breaks down support or first rallies and then plunges will determine the wealth distribution pattern of the market at year-end.

Trading Strategy: Waiting for signals, precise targeting

Firmly avoid blind bottom-fishing: Currently, the area around 2800 points is not the bottom, and the sideways consolidation is the silence before the storm; blind bottom-fishing may face significant volatility risk after data release;

Waiting for clear signals: abandon speculative trading before data release, focus on the clear directional choice of the market after data release, and wait for the trend to establish before positioning accordingly;

Seize the secondary high short opportunity: If positive data triggers a rebound, be wary of the risk of the main force distributing chips, and view the rebound as an opportunity for a secondary high short, strictly controlling positions and stop-losses;

做好风险防控:无论数据走向如何,均需提前设定严格的止损策略,避免被市场极端波动裹挟,确保资金安全。

The core profit logic of the market lies in insight into the essence of the market and control over emotions, rather than chasing short-term volatility. Tonight's US November CPI data will become the key variable to break the current balance, and the market will face a decisive choice for year-end direction. For investors, the most crucial thing is to remain calm and patient, waiting for clear signals after the data release, and precisely pulling the trigger once the trend is established, rather than being influenced by short-term fluctuations. The crypto market rewards not emotional followers but sharp hunters who can see the essence and maintain rationality.